-

Bitcoin exchange deposits have hit a six-year low, marking the lowest level of BTC deposits in that time.

That being said, HODLERS are key in preventing a drop to the $55K support.

As a seasoned researcher with years of experience navigating the crypto market, I find the recent drop in Bitcoin exchange deposits highly intriguing. Having witnessed numerous bull and bear cycles, I can say that this low deposit level is reminiscent of a time when hodlers were confident in the long-term potential of BTC.

bitcoin’s (BTC) bullish momentum took a hit as the digital currency dipped back down to around $58,000 following a brief surge over the weekend that lifted it above $60,000. This decline is represented by three consecutive red candles on the chart.

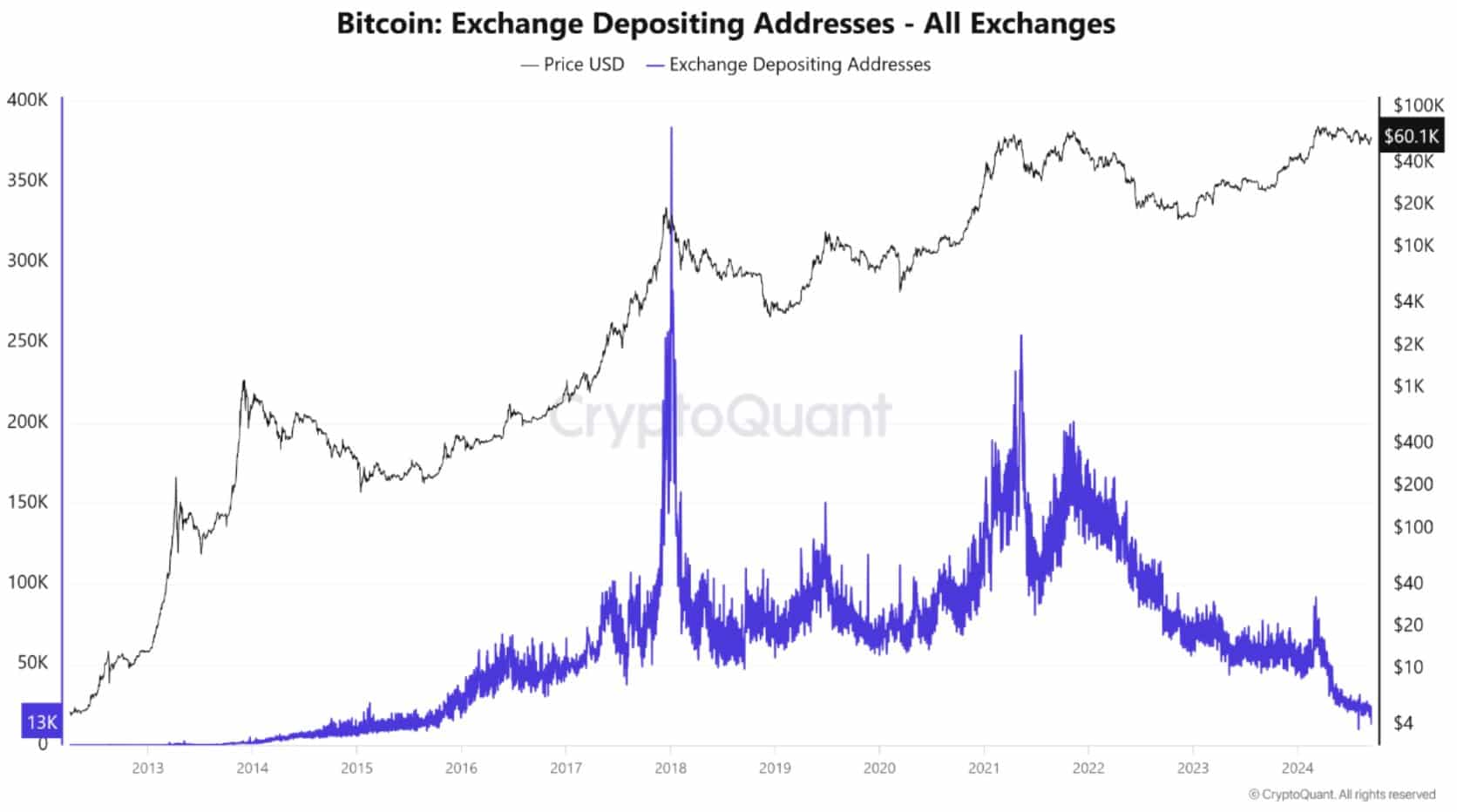

Although opinions among analysts vary as to whether $60K serves as support or resistance, a recent report from CryptoQuant indicates that the number of Bitcoin deposits into exchanges has dropped to a six-year minimum of 132,100, suggesting diminished pressure to sell.

Could this milestone help BTC avoid a drop to $55K?

Drop in BTC exchange hints at rising hodler dominance

1) The graph shows that there are less Bitcoin deposits being made into exchanges, which is usually a positive sign. Economically speaking, when the supply of Bitcoins decreases, it can cause the value of each token to increase due to scarcity.

While for investors, less BTC on exchanges suggests confidence in price recovery.

Source : CryptoQuant

Additionally, AMBCrypto’s examination reveals that increases in Bitcoin deposit exchanges tend to coincide with Bitcoin reaching peak price levels, suggesting profit-taking activities and often causing sharp drops. This pattern might hint at potential accumulation.

Over the past six years since the last spike, I’ve noticed that a decrease in deposits suggests greater control by long-term holders, as they seem to be holding onto their assets more tightly.

Put simply, the Bitcoin space is now dominated by hodlers confident in a price correction.

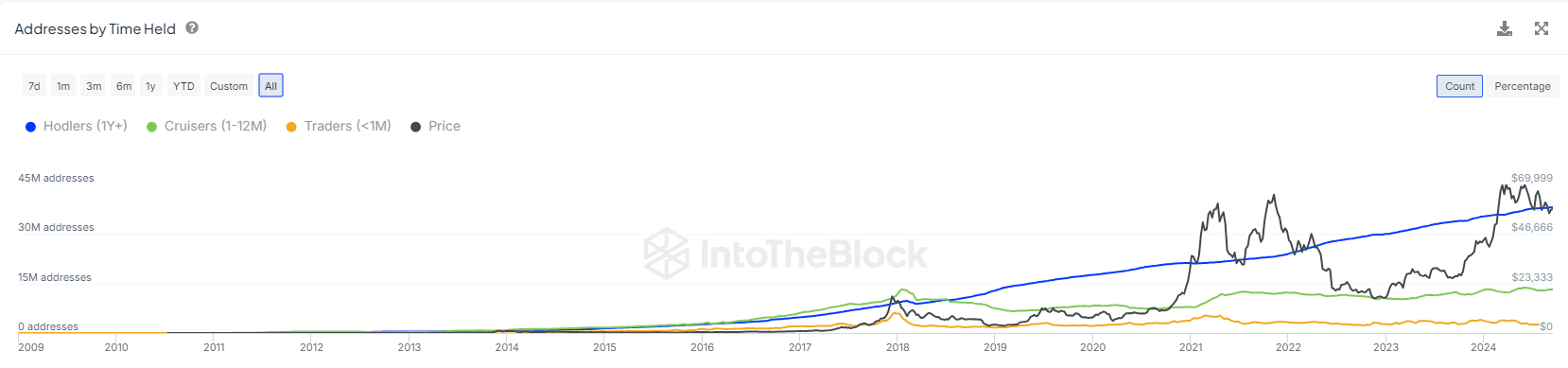

Source : IntoTheBlock

As expected, the hodler count has surged to 38 million, marking a staggering 375% increase from 8 million six years ago. Notably, hodlers holding BTC for over a year now represent 70.77% of total addresses.

It’s noteworthy that this figure surpasses the number recorded during the BTC peak in mid-March, which represented its all-time high.

In short, long-term holders are key to preventing a drop to $55K – but what are the odds?

The odds are intriguing

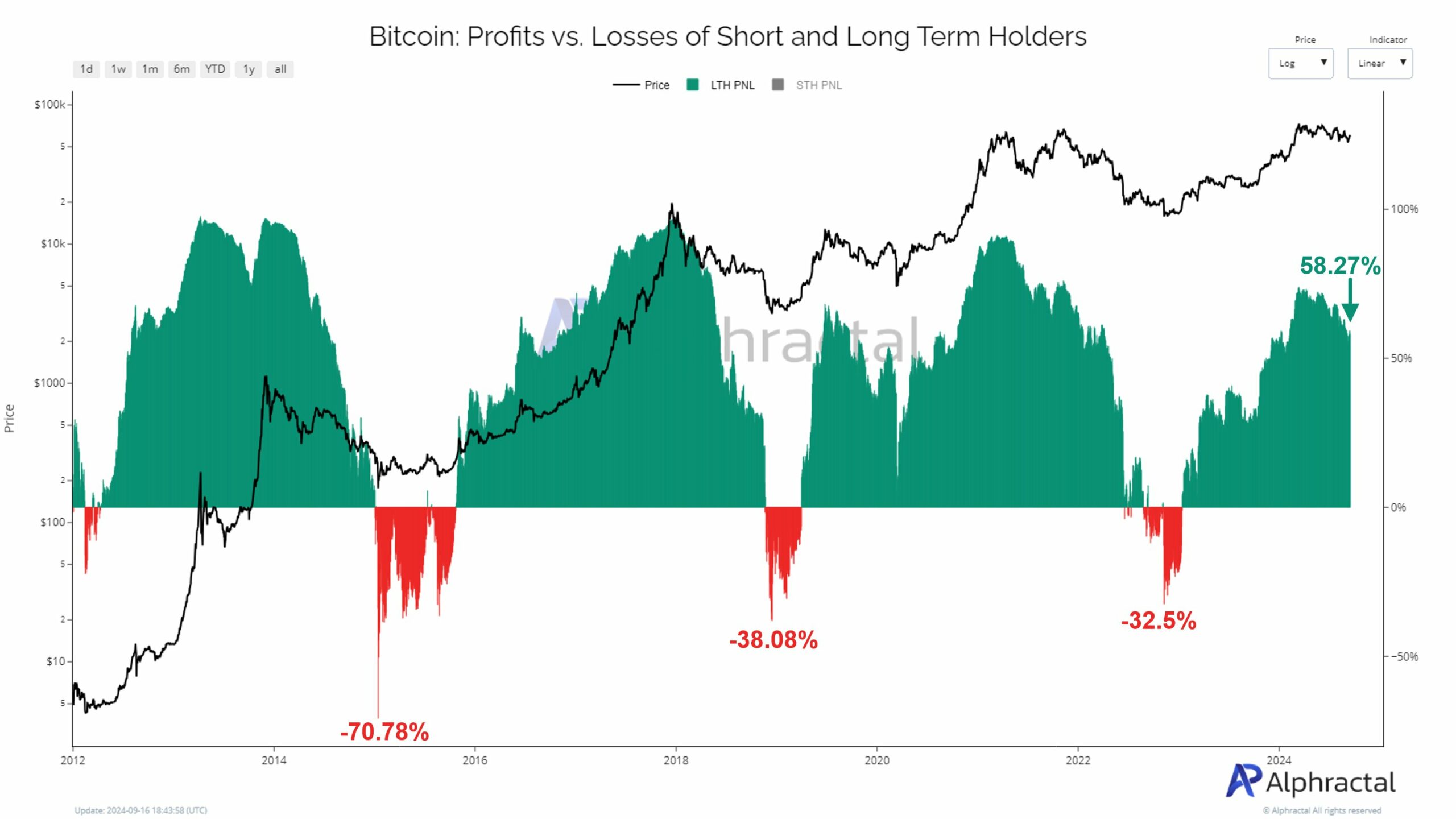

As an analyst, I’ve noticed that currently, approximately 58.27% of Long-Term Holdings (LTH) are in profit, which is a decrease from a peak of 74% on March 13, representing a decline of around 16%. Historically, such a drop in the profit margin after reaching peaks might be indicative of a possible bear market in the coming months.

Source : X

As a crypto investor, I’ve noticed that the long-term holdings (LTH) are still showing profits, but the narrowing profit margins might be hinting at a potential deceleration or a shift towards a bearish market trend.

Even though Bitcoin has been experiencing continuous losses since hitting $70K back in March, the steadfast support from long-term holders suggests they have faith that a corrective price movement might be on the horizon.

Should this pattern persist, it’s possible that LTH may choose not to sell, a conclusion suggested by the decline in Bitcoin deposits into exchanges.

Moreover, if the Federal Reserve decides to lower interest rates, Bitcoin might reach a fresh all-time high. This assumption holds if the decline in Bitcoin deposits on exchanges continues – will it persist?

Time will tell

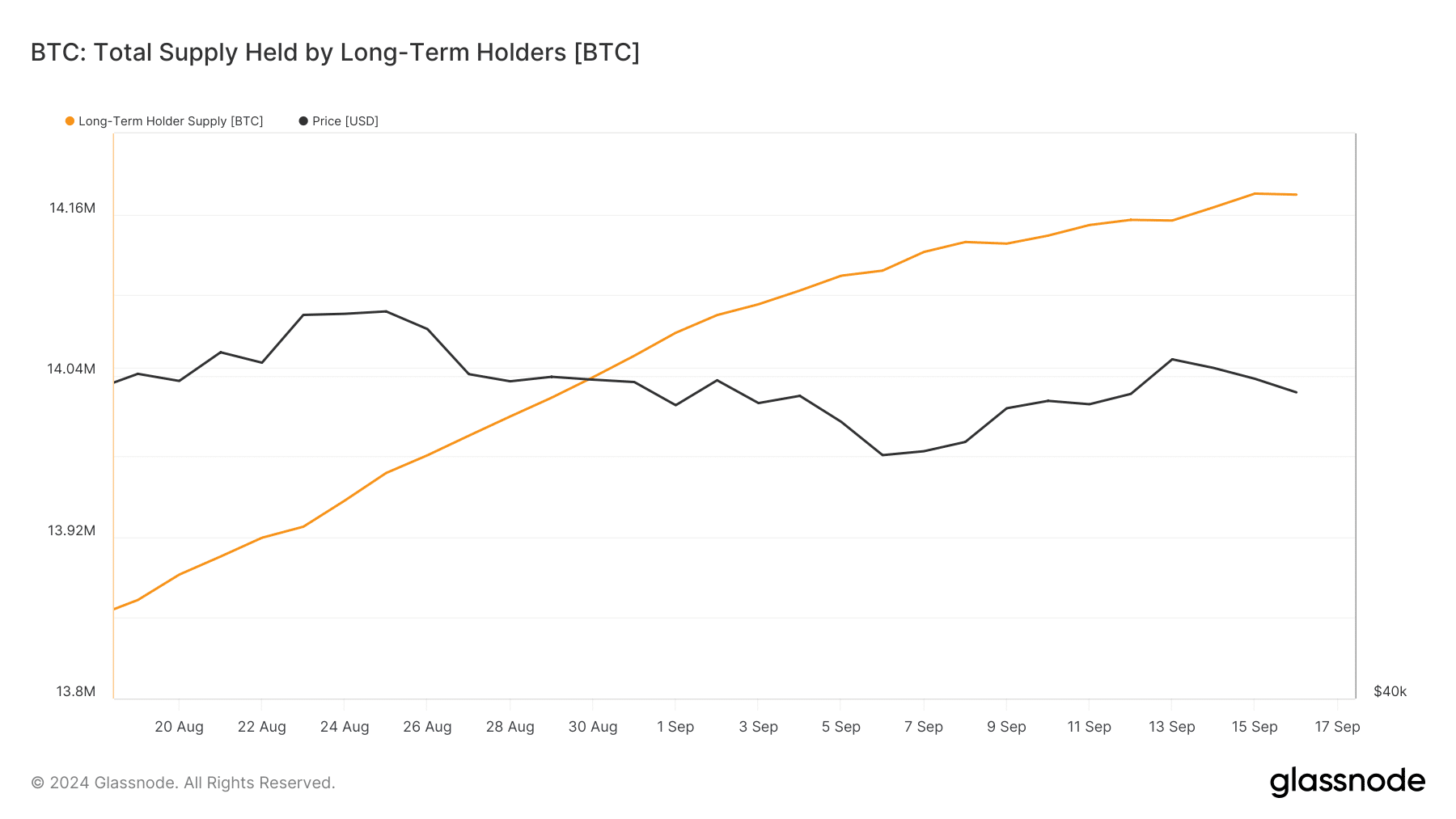

30 days prior, Large Token Holders (LTHs) made the initial sale of a substantial amount of their assets on September 16th, which aligns with Bitcoin’s dip to $58K.

Source : Glassnode

Previously discussed, Long-Term Holders (LTHs) should reinforce their holdings by abstaining from additional selling. Yet, this unusual dip in price is consistent with our earlier forecasts provided by AMBCrypto.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If Long-Term Holders (LTHs) manage to confirm that this occurrence is unusual, and Bitcoin deposit activities on exchanges stay minimal, then the pathway to a fresh All-Time High (ATH) might remain spacious.

If large holders (LTHs) persistently sell their cryptocurrency, the current support level of $55K might weaken, making the future less predictable and potentially more volatile.

Read More

2024-09-18 02:16