As a seasoned analyst with over two decades of market experience under my belt, I find myself increasingly intrigued by the current state of Bitcoin (BTC). The decline in exchange inflows and the surge in liquidity from China suggest that we might be on the cusp of a significant breakout.

Investors, both individual and institutional, are finding themselves increasingly intrigued by Bitcoin [BTC], viewing it as a potential long-term asset for preserving value in the same vein as traditional financial holdings.

In contrast to past periods when Bitcoin was often bought and sold for quick gains, a significant amount of it is currently being kept in offline wallets, indicating a high level of investor trust.

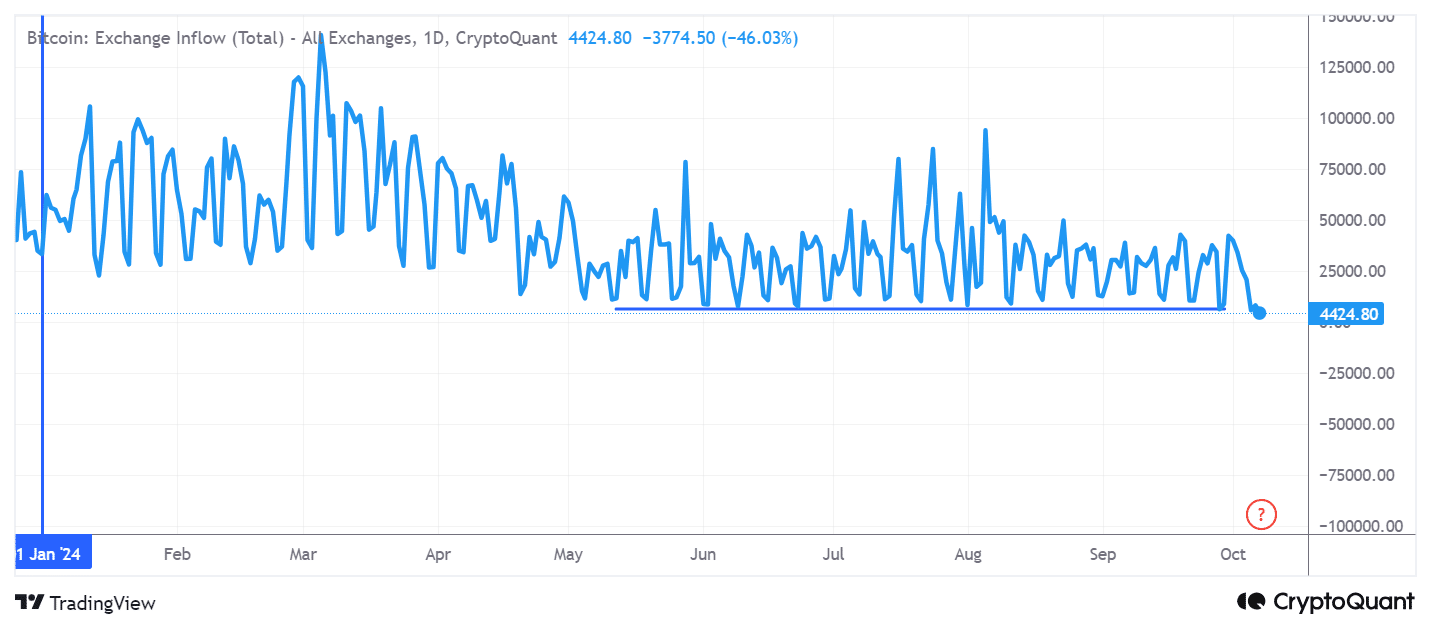

To start off the fourth quarter, Bitcoin inflows into exchanges have reached their minimums for the year. This suggests that investors and institutions expect long-term profits from BTC, as its market capitalization persistently expands due to growing acceptance among a broad user base.

China liquidity stimulus

Chinese equities are surpassing international market performances, mainly because of a substantial injection of liquidity from the government’s stimulus plan.

The increase in available funds is influencing risky investments such as Bitcoin, which typically follows a close relationship with the stock market’s performance in China.

After the significant stimulus package by the People’s Bank of China, similar to the one implemented post-pandemic in late September, the value of Chinese internet stocks has skyrocketed by approximately $2 trillion.

Multiple investors interpret the rise in Chinese shares as possibly indicating a comparable uptrend in Bitcoin. This observation supports the reason behind the decrease in Bitcoin’s exchange inflows, suggesting potential price increases ahead.

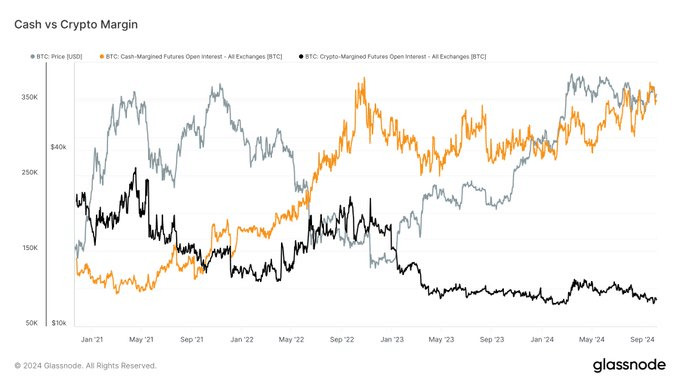

Last week witnessed a significant disparity between the open interest for cryptocurrency-backed and cash-settled Bitcoin futures contracts, which is worth noting alongside the liquidity boost.

Instead of holding Bitcoin for leveraged trades, an increasing number of traders prefer to use traditional cash now. This change is advantageous because cash margins help decrease market fluctuations and the possibility of compulsory liquidation, thereby fostering a more secure trading atmosphere.

At present, individual investors are persistently pursuing substantial returns through high-leverage trading, which fuels the market’s fluctuations.

The gap between institutional wariness and retail excitement underscores the evolution of the Bitcoin market. More and more, it’s institutional involvement that fuels long-term, steady market expansion.

Can BTC reach $77K?

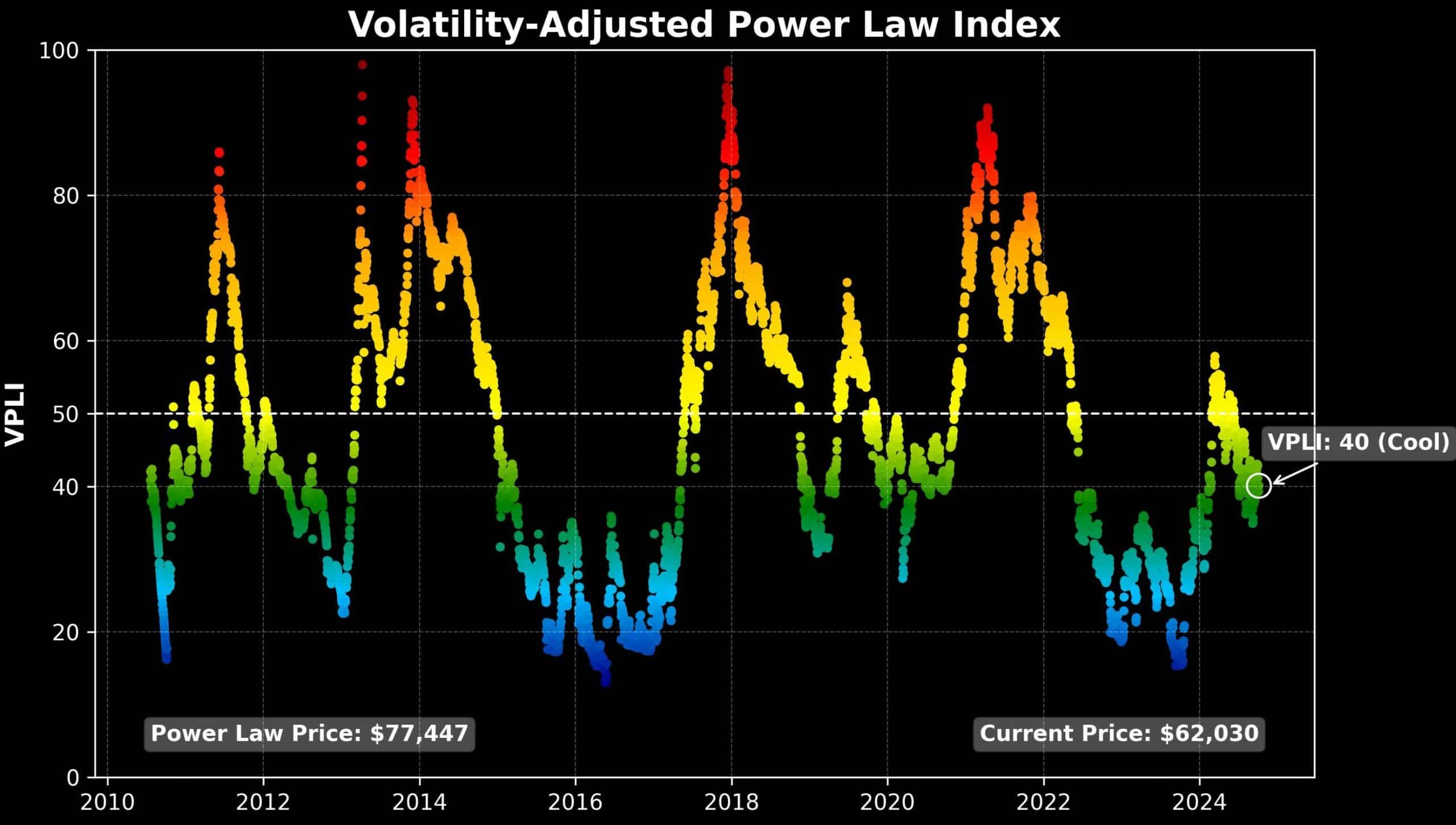

The Volatility Adjusted Power Law Index indicates that a reasonable price for Bitcoin is currently around $77,000, taking into account long-term growth and market volatility. Even though the price has been stabilizing near $60,000 recently, the estimated fair price has increased from $70,000 to $77,000 over the past month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The enhanced liquidity coming from China’s stimulus package and the decreased turbulence in the futures market imply that Bitcoin could be poised for a significant surge. In other words, it seems Bitcoin is gearing up for an upward spike, potentially reaching $77K as we move further into Q4.

As the worldwide liquidity increases, it becomes increasingly plausible that Bitcoin could reach $77K. This is particularly likely if strong economic circumstances and institutional backing contribute to its expansion.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-08 12:39