-

BTC LTHs are torn between selling and holding amidst price volatility.

Bitcoin remained below $60,000 at press time.

As a seasoned researcher with years of experience navigating the tumultuous waters of cryptocurrency markets, I can confidently say that watching Bitcoin’s price action is like riding a roller coaster without a seatbelt. The current situation, characterized by the tug-of-war between selling and holding among long-term holders (LTHs), is reminiscent of a game of cat and mouse.

As a researcher, I’ve noticed an uptick in Bitcoin’s [BTC] volatility lately. Its price seems to be finding it challenging to hold within the significant $60,000 price range.

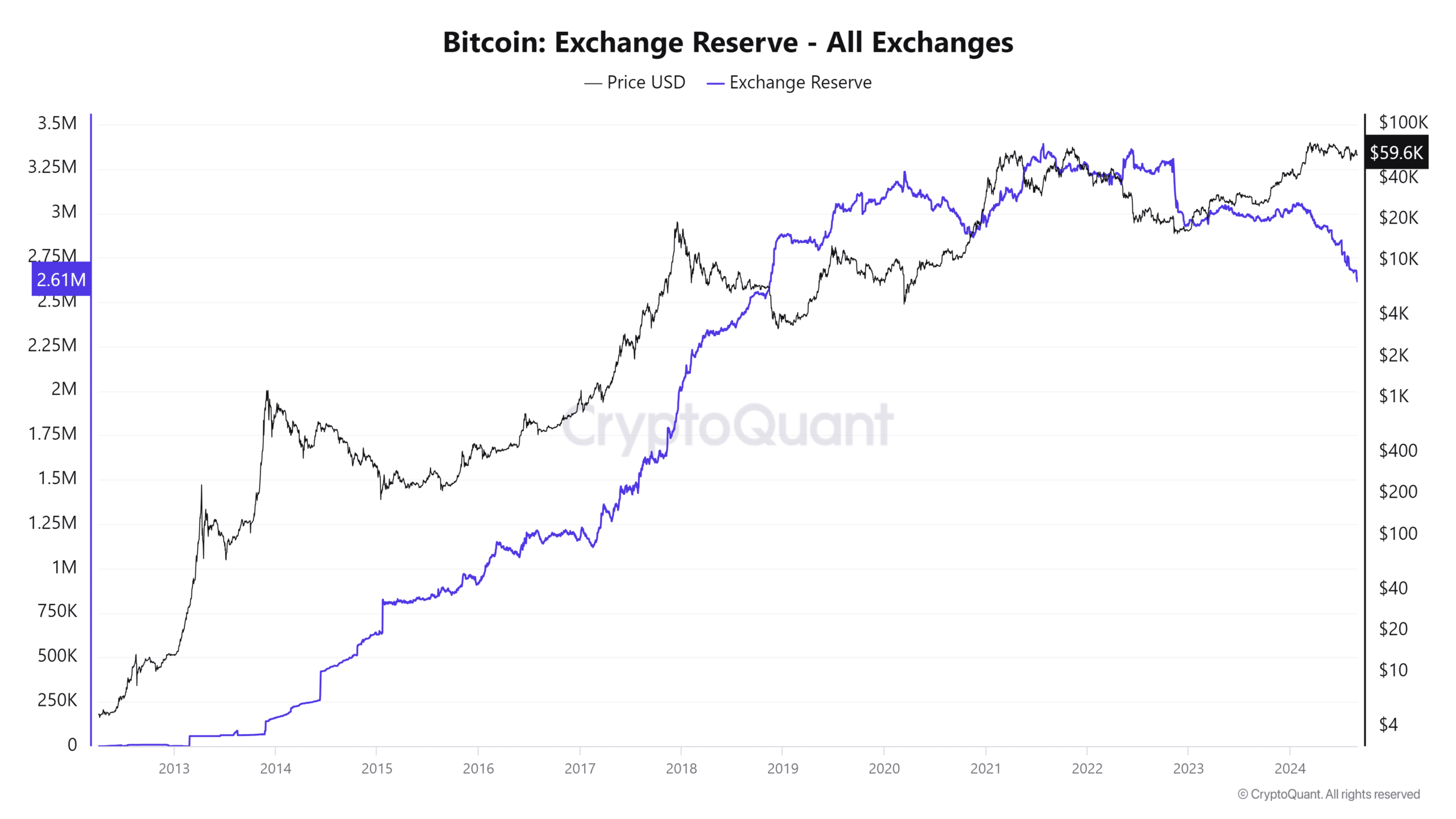

In spite of the volatile price changes, it’s clear that a significant pattern is arising: The amount of Bitcoin stored in exchanges is decreasing sharply. This drop in exchange-held Bitcoins suggests that large-scale investors, commonly known as “whales,” are becoming less inclined to offload their Bitcoins.

Bitcoin exchange reserves hit another low

According to AMBCrypto’s examination, the levels of Bitcoin stored on exchanges have reached another record low, marking an ongoing, substantial decrease that started at the beginning of the year.

Based on data from a chart on CryptoQuant, it appears that the Bitcoin reserves have decreased to around 2.6 million coins. This is a drop from the roughly 3 million Bitcoin reserves reported in January.

As a researcher, I’ve observed a decrease in exchange reserves, which implies a shrinkage in the liquidity pool that these exchanges can offer.

Less liquidity could mean good news for Bitcoin’s value, since it might show that less people are keen on selling their Bitcoins. This decrease in supply for sale eases the market pressure to buy.

Additionally, it appears that the persistent drop in Bitcoin’s reserve stocks is primarily influenced by long-term investors (HODLers), demonstrating their firm confidence in Bitcoin’s potential worth and preference for avoiding short-term trades.

Over time, if long-term investors gain more control, the market might experience increased stability and reduced vulnerability to significant mass sell-offs due to panic.

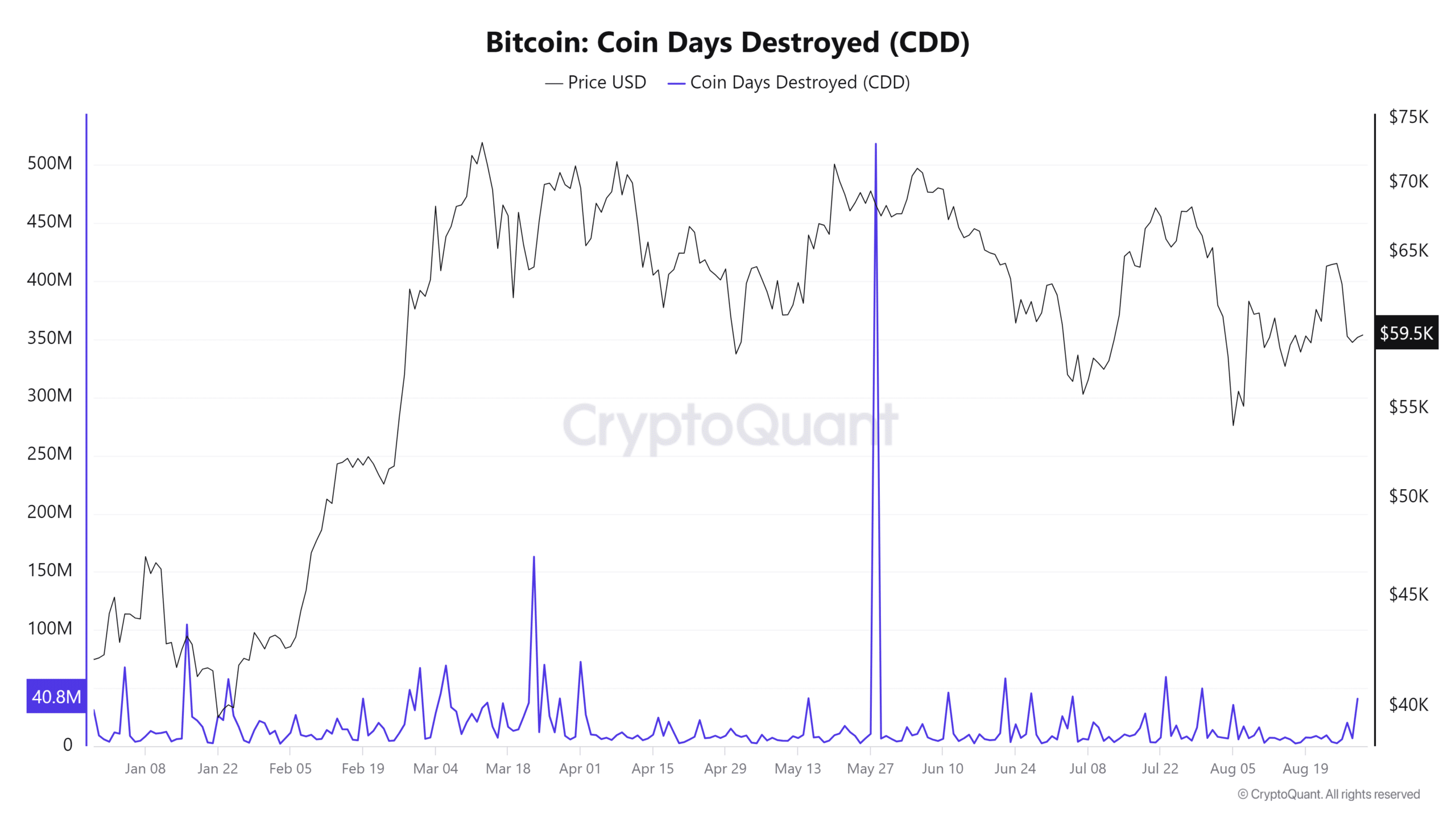

Comparing CDD with Bitcoin exchange reserves

A current examination of the Coin Day Destroyed (CDD) metric for Bitcoin, coupled with data on Bitcoin exchange reserves, indicates a noticeable discrepancy. Lately, there’s been a small surge in the CDD metric.

Instead of the previous consistent pattern suggesting long-term holders weren’t frequently using their cryptocurrencies, there appears to be a shift in this behavior now.

The CDD measure follows the migration of Bitcoins that are older and possess “holding periods” as they remain stationary in a wallet without transaction. Every day a Bitcoin remains idle in a wallet, it accrues an additional “holding period,” also known as a “coin day.”

As I delve into the world of Bitcoin analysis, I’ve come across a fascinating concept known as “Coin Days Destroyed” (CDD). In simpler terms, whenever Bitcoins that have been dormant for a certain period are spent, these accumulated ‘dormancy periods,’ or ‘coin days’, cease to exist. This is why they refer to it as “Coin Day Destruction.”

Lately, the rise in CDD indicates that the latest fluctuations in Bitcoin’s value might have motivated some long-term investors to dispose of or transfer their Bitcoins, thereby disrupting the prior pattern of holding.

As an analyst, I find myself pondering over this shift in the market. It might be a reaction to the prevailing uncertainties or a calculated move by certain stakeholders to leverage price fluctuations for their benefit.

BTC remains volatile

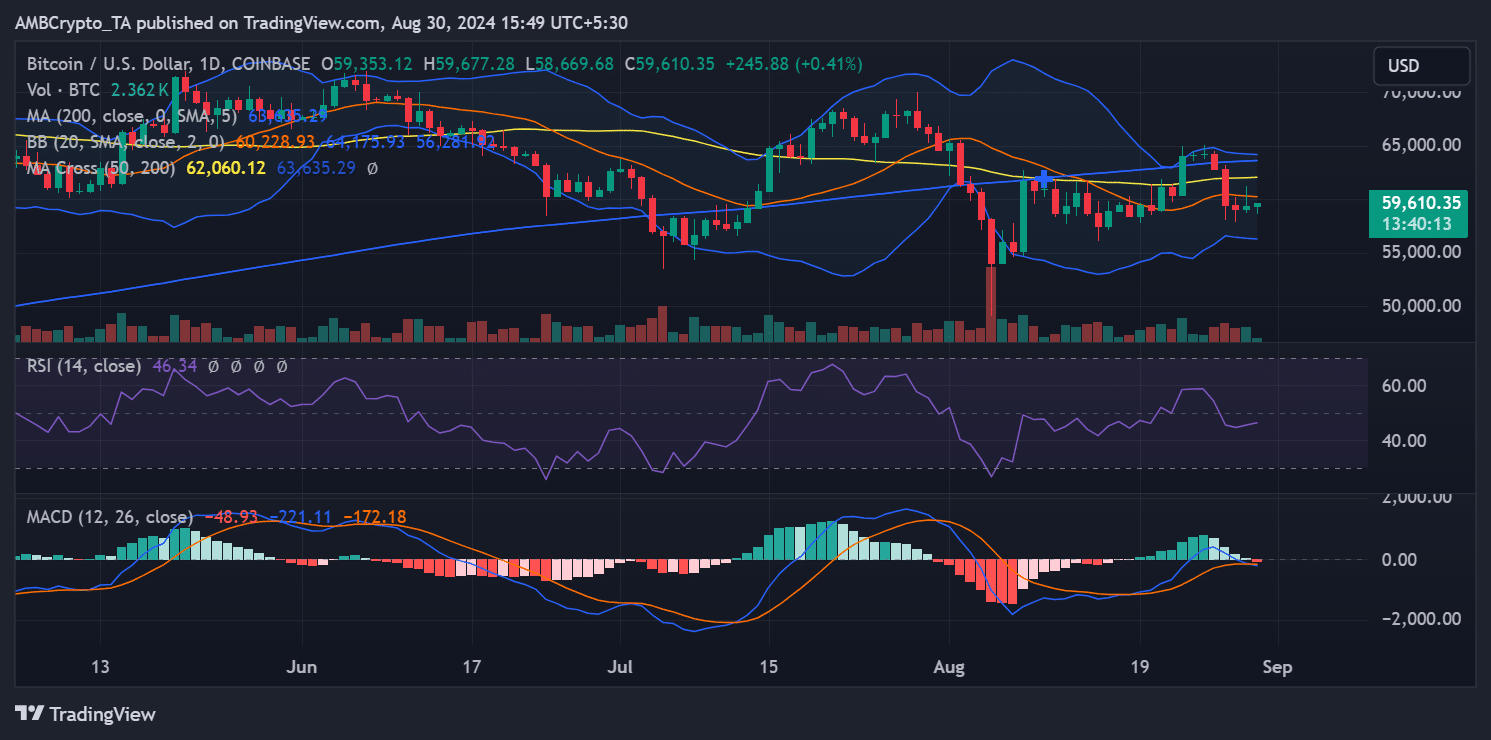

Based on a recent examination of Bitcoin’s daily pricing pattern, it appears that Bitcoin reached nearly $61,000 during the preceding trading day. Regrettably, it failed to maintain this peak and ended up closing the session at approximately $59,264 instead.

Over the past few days, Bitcoin’s pattern of momentarily spiking and then decreasing has been quite common, which has led to heightened market fluctuations.

The level of Bitcoin’s price fluctuations can be more clearly demonstrated through the movements of its Bollinger Bands, a technical tool used to gauge volatility in prices.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The flexibility or expandability of Bollinger Bands is linked to their broadening when there are larger price swings. A wider span between the bands indicates a higher degree of volatility, meaning that the price tends to move significantly up or down.

Currently, Bitcoin is being exchanged for approximately $59,597, showing a minimal rise of nearly 1% in value. The fluctuating trends, evident from the Bollinger Bands, indicate that Bitcoin is undergoing substantial temporary fluctuations in its price.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-30 23:04