- USDT inflows signal strong demand for Bitcoin, driving price up.

- Stablecoins are integral to Bitcoin’s continued bullish momentum.

As a seasoned researcher with years of experience navigating the dynamic world of cryptocurrencies, I find the current surge in USDT inflows to centralized exchanges truly fascinating. The consistent $40 million daily deposits of Tether have become a beacon of investor sentiment, indicating strong demand for Bitcoin and other digital assets.

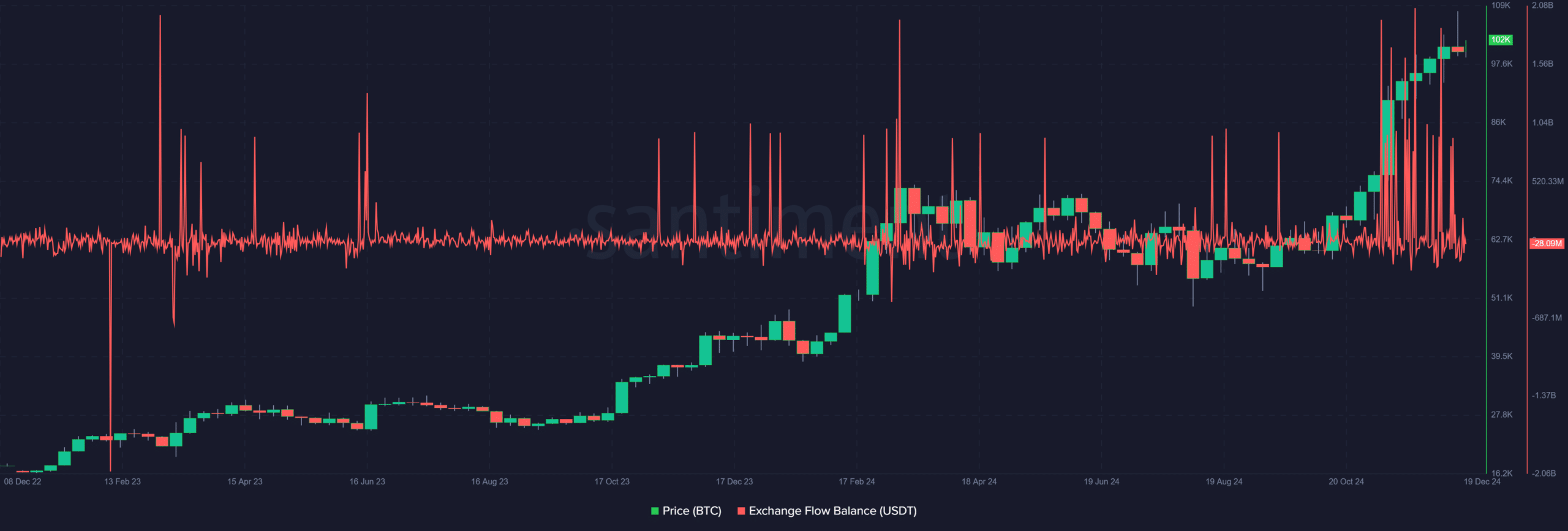

As a researcher delving into the world of digital currencies, I’ve noticed an intriguing pattern emerging from recent on-chain analysis: Tether (USDT) inflows to centralized exchanges are surging, averaging around $40 million daily. This trend could indicate that stablecoins might be fueling Bitcoin’s continuous ascent, as the cryptocurrency just reached an unprecedented high of $108,000.

From my perspective as a researcher, the substantial increase in USDT deposits suggests that major investors are strategically preparing for additional profits. Given that stablecoins function as a bridge to various other assets, this surge might indicate a strong belief in Bitcoin’s potential for further expansion and growth.

Significance of USDT inflows and their impact

As an analyst, I’ve noticed that the consistent flow of USDT (Tether) into centralized exchanges serves as a significant barometer for investor sentiment.

Instead of most investments, deposits in stablecoins usually indicate readiness for trading instead of immediate selling off. Investors often employ USDT as a liquidity conduit to buy fluctuating assets such as Bitcoin when the market situation is advantageous.

Approximately $40 million worth of the digital currency USDT is being transferred to exchanges each day, indicating a growing desire among investors for cryptocurrency involvement. This rise underscores both institutional and individual interest in Bitcoin’s price climb, hinting that stablecoins are vital in maintaining market dynamism.

During periods of intense market action, I find it striking how this pattern emphasizes investors’ eagerness to fuel additional upward trends.

Effect of stablecoin flows on Bitcoin’s price

The movement of stablecoins like Tether, specifically, has a direct impact on Bitcoin’s price fluctuations because it boosts the demand to buy. When substantial amounts of USDT are transferred into trading platforms, these deposits frequently signal an increase in trading volume, which subsequently pushes up the price of Bitcoin.

The trend matches the latest record-breaking peak of Bitcoin at around $108,000, driven by substantial increases in USDT deposits.

Instead of conventional investments, stablecoins offer swift access to markets, intensifying the effect of significant trends. The steady influx of around $40 million per day indicates a robust appetite for Bitcoin, contributing to its persistent bullish trend.

As I consistently add more stablecoins like USDT to my portfolio, I can’t help but feel optimistic about potential price surges, as these inflows seem to be a key driver shaping the broader market movements. In other words, it appears that USDT is playing a pivotal role in setting the direction of crypto trends.

Looking ahead

2025 is expected to see substantial expansion and development in the stablecoin sector. Experts foresee that the cumulative market value of prominent stablecoins such as USDT and USDC might not only double but possibly triple, signifying their transition from specialized financial instruments into widely accepted assets.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This growth is expected to originate from stricter guidelines, wider acceptance, and a surge in regional currency-tied stablecoins, potentially competing with existing dollar-linked alternatives and asserting their influence.

Furthermore, incorporating stablecoins within conventional banking structures could significantly boost financial services, offering quicker and more accessible solutions on a global scale.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-20 11:04