- BTC price could hit $103K, driven by liquidity sweep.

- A likely uptick in global longs could mark a potential BTC reversal and bull trap.

As a seasoned researcher with years of experience in the cryptocurrency market, I find the current Bitcoin [BTC] price trend intriguing. The potential $103K liquidity sweep predicted by CrypNuevo aligns with my own analysis of recent trends and market behavior. However, it’s important to remember that the crypto market can be unpredictable, like a wild roller coaster ride on a stormy day.

Over the recent days, the value of Bitcoin [BTC] has remained over $100K, yet its future trajectory might be influenced significantly by the Fed’s decision regarding interest rate cuts.

As a researcher examining recent economic data, I find myself reflecting on the latest U.S. inflation and employment figures that were released last week. These statistics have influenced market expectations, suggesting a high likelihood of another 25 basis points interest rate reduction during the upcoming Federal Reserve meeting scheduled for December 18th. In essence, the market is pricing in a 96% chance of this adjustment.

Next BTC moves

What’s predicted for Bitcoin’s direction by trader CrypNuevo? Based on current trends, he suggests a potential liquidity hunt around the price range of $103K to $104K. This is part of his recent analysis on BTC.

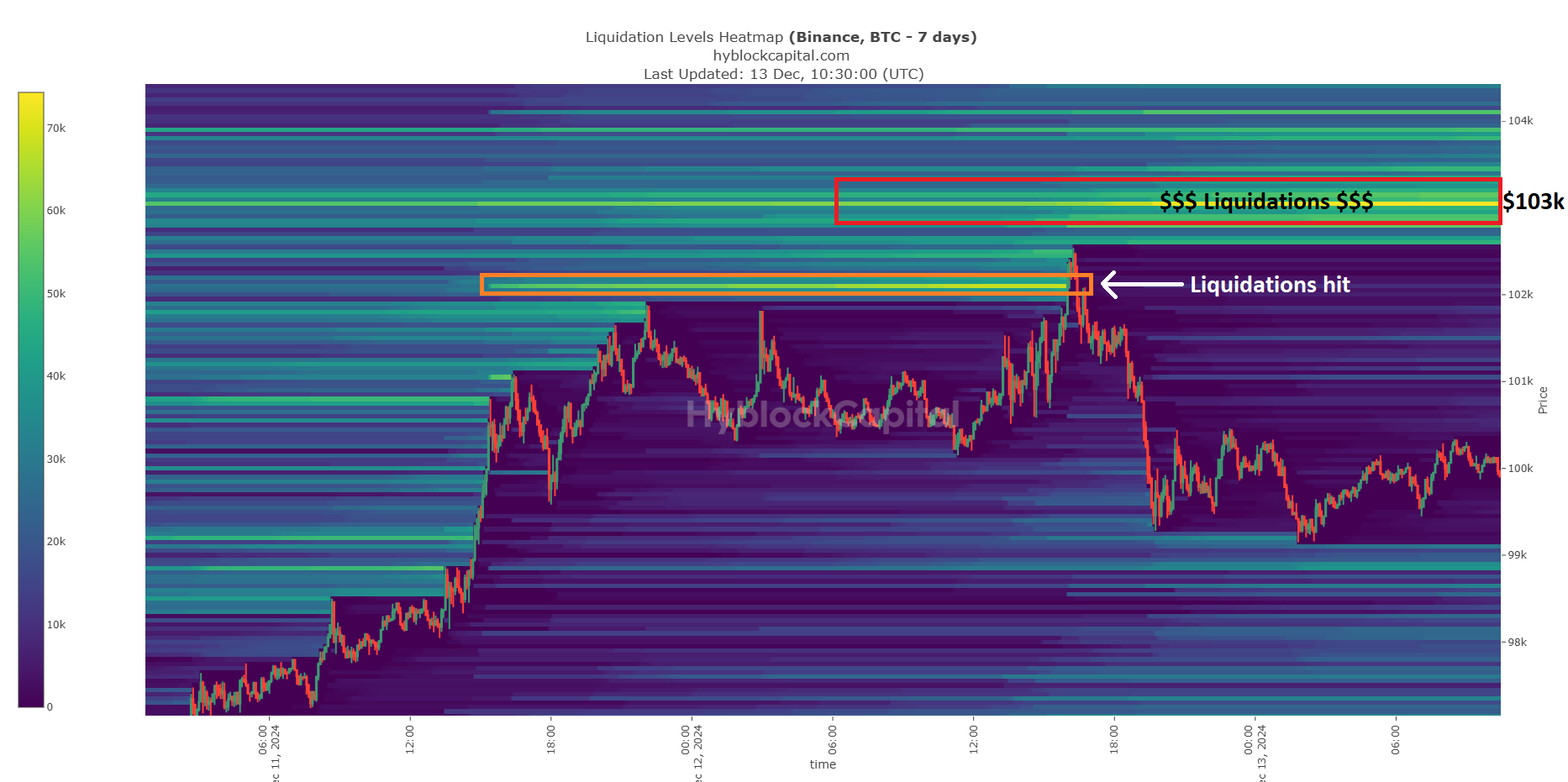

There have been numerous quick sell-offs at the price point of $103,000. This could be an opportune moment to track them down…Notice that they’ve been systematically focusing on these liquidation groups over the last few days.

Currently, significant short positions were being held between $103,000 and $104,000, supporting the prediction made by CrypNuevo.

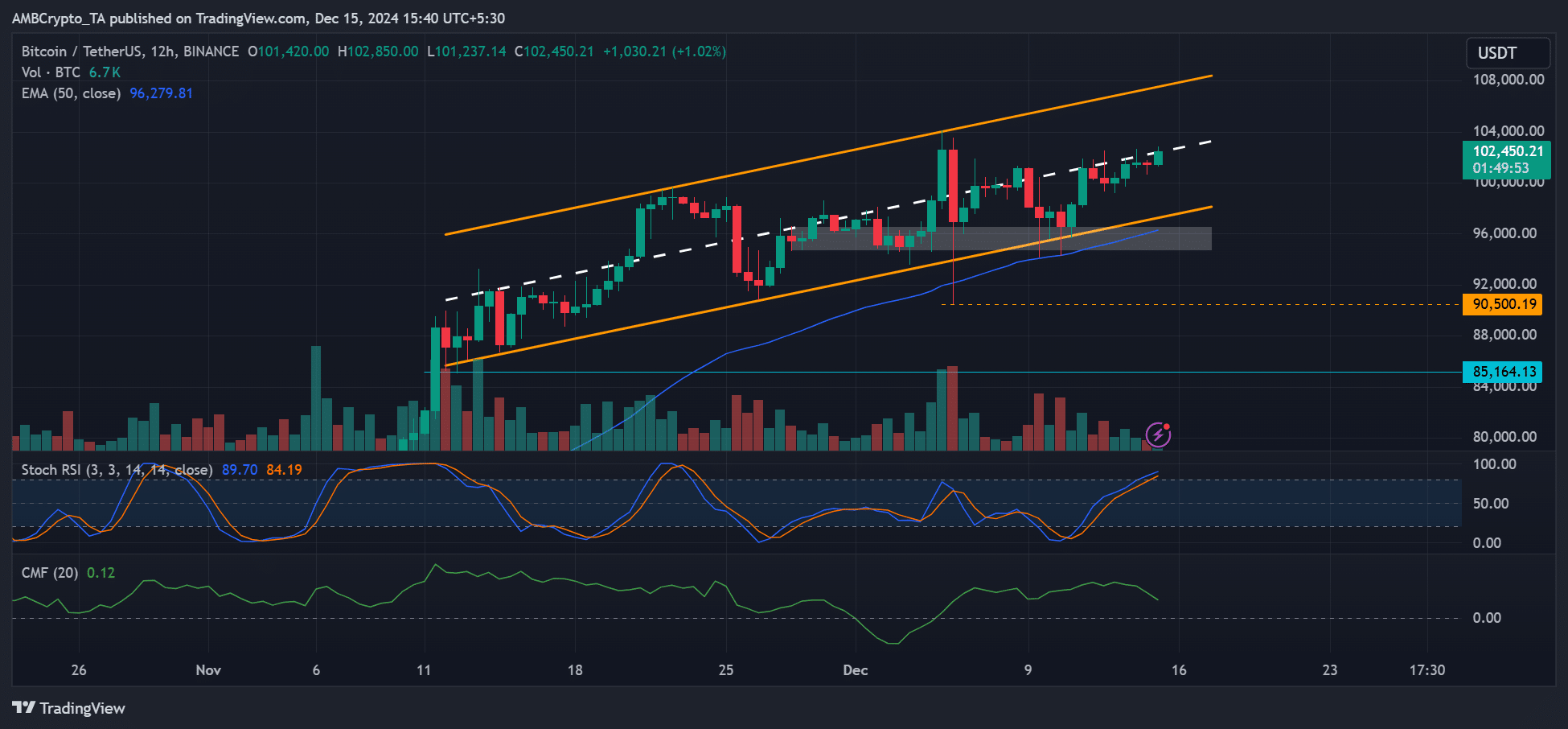

On the 12-hour timeframe, Bitcoin has been closely confined within its rising channel’s central zone. The potential targets at $103K and $104K were situated approximately 2% away from this central zone.

Instead of reaching a potential peak of $107K, which is 5% above the middle point, there may be less trading activity due to lower liquidity. The $103K level could potentially exert more influence on price movements instead.

As a crypto investor, I’ve been closely watching the market trends, and if the current predictions hold true, Bitcoin might surge towards the $103K-$104K mark due to the anticipated liquidity sweep. However, it’s important to note that such a rise could be followed by a subsequent dip lower.

The bottom end of the channel has prevented past reversals, and a possible correction might soften around $97,000. Subsequently, Bitcoin may persist in its sideways trend.

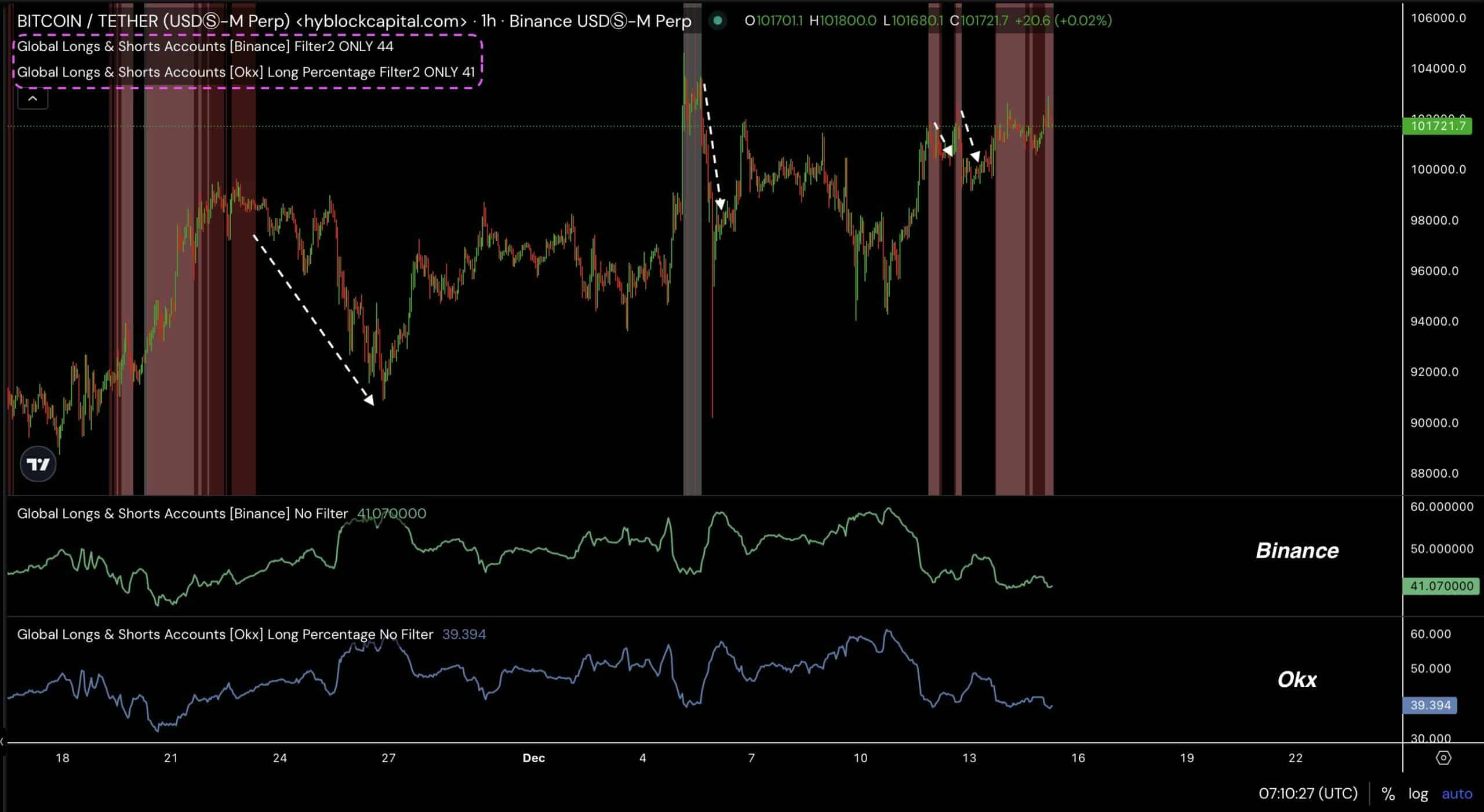

According to Hyblock’s global longs indicator, it seems plausible that Bitcoin may slide towards its lower range following its touch of $103K. This oscillator tends to increase whenever Bitcoin experiences a decline, while it decreases when Bitcoin surges.

Currently, the indicator appears to be nearing its lowest point and may potentially turn around, indicating a probable Bitcoin pullback and possible bull trap scenario.

Read Bitcoin [BTC] Price Prediction 2024-2025

As I delve into my analysis, it appears that Bitcoin (BTC) might briefly surge beyond its mid-range towards the $103K-$104K zone to liquidate short positions. Subsequently, I anticipate a shift towards leveraged longs as the price approaches the lower end of the channel around $97K.

However, a breakout on either side would invalidate the above range-bound outlook.

Read More

2024-12-16 06:15