- Bitcoin struggled against $67,583 resistance; breaking this level could trigger a move toward $70,000.

- RSI and MACD show weakening momentum, while rising active addresses suggest potential bullish activity.

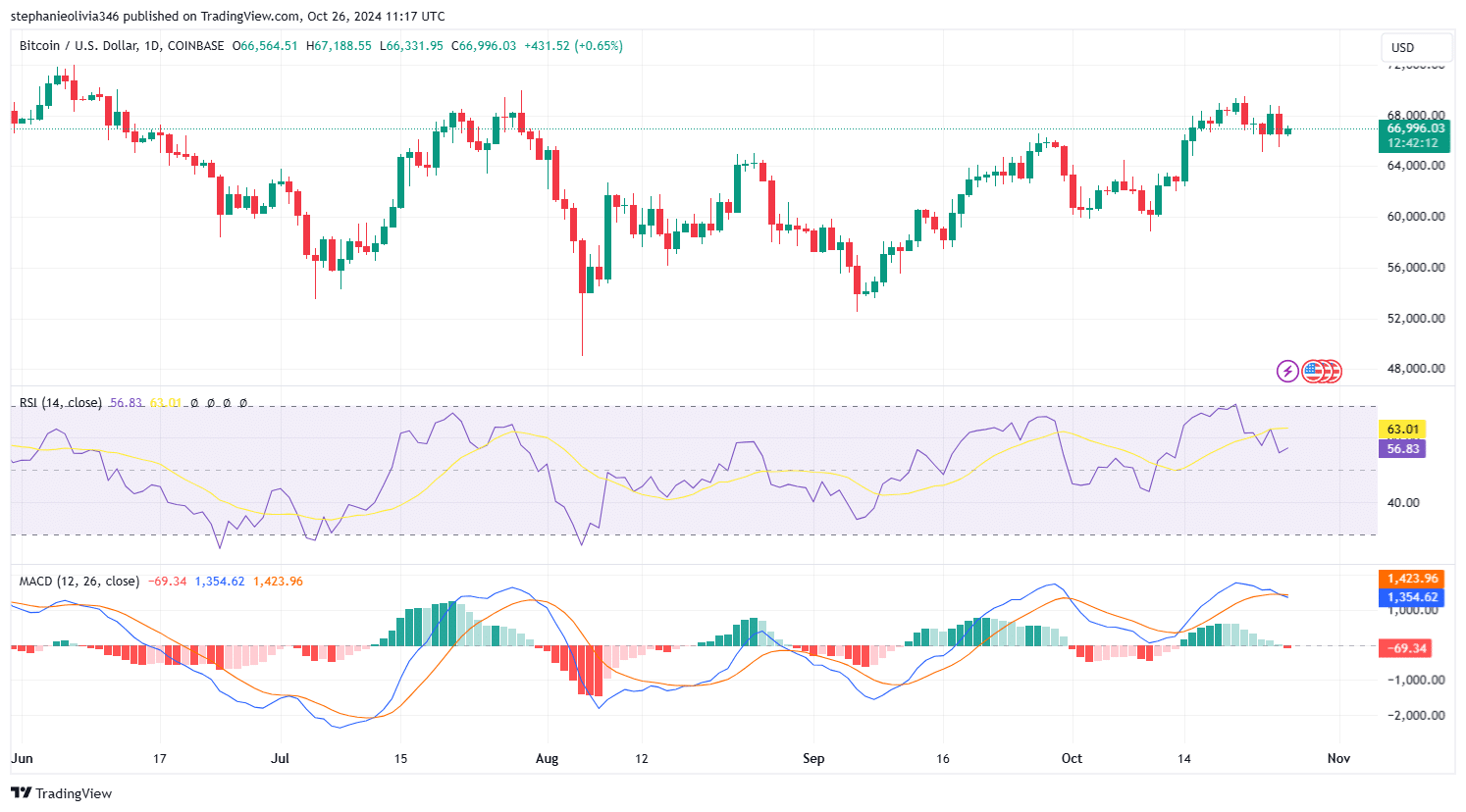

As a seasoned researcher who has observed the cryptocurrency market’s ups and downs for years, I find myself at a crossroads with Bitcoin’s current position. On one hand, the technical analysis points to a challenging resistance level near $67,583.25 that has repeatedly thwarted bullish attempts in the past. The weakening momentum shown by RSI and MACD adds another layer of uncertainty. However, the rising active addresses suggest potential bullish activity that could help push Bitcoin towards its next target of $70,000.

Bitcoin (BTC) dipped below $67,000 to hit an intraday low of $65,700 following a loss of its overnight gains. At the moment of publishing, it was trading at $66,972.95, showing a 1.22% drop in the last 24 hours and a 2.01% decrease over the past week.

Regardless of a temporary drop, Bitcoin’s total market value stands firm at approximately $1.32 trillion, with around 20 million coins in circulation. Over the past day, the trading activity has been significant, reaching an impressive volume of $46.32 billion, indicating sustained curiosity among traders.

In simpler terms, the price movement of Bitcoin is confined within a downward sloping pattern known as a ‘descending channel’. This pattern consists of progressively lower peaks (highs) and troughs (lows), suggesting that the market may be headed towards a bearish outcome.

Above the channel’s peak, approximately $69,000, has consistently served as a significant barrier for price increase, causing the prices to drop following every effort to surpass it.

According to the graph, recent refusals have shown similar trends, implying that this resistance continues to be a significant hurdle for future progress.

Support and resistance levels

Currently, Bitcoin’s resistance level is approximately between $67,583.25 and $69,000. This range has repeatedly thwarted any bullish advancements.

Should Bitcoin surpass its current ceiling, it might initiate a prolonged ascent towards approximately $70,000.

If you don’t manage to advance past this stage, there’s a possibility that Bitcoin might slide down again inside the falling trendline.

The important level for immediate Bitcoin support is approximately $66,423.76, as indicated by the chart. If this support gets broken, there’s a possibility that the price could fall towards the lower limit of the channel, which falls between $60,000 and $62,000.

RSI and MACD analysis

As of the time this article was released, the Relative Strength Index (RSI) stood at 56.75, falling slightly below its signal line at 63.00. This suggests that the bullish trend may be losing strength and moving towards a more balanced or neutral phase.

In October, the Relative Strength Index (RSI) surpassed 70, suggesting that the market was overbought. This was followed by a decline, which could be seen as a correction. However, the present RSI value suggests there might still be potential for further price increases.

Maintaining above the 50 mark is important for bullish momentum to sustain.

In simpler terms, the MACD line is still higher than the signal line, indicating a persistent upward trend. Yet, the histogram bars are getting smaller, which could mean that the strength of this trend might be gradually weakening.

When the Moving Average Convergence Divergence (MACD) line drops beneath the signaling line, it could potentially suggest a brief downtrend or a phase of stability.

On-chain activity

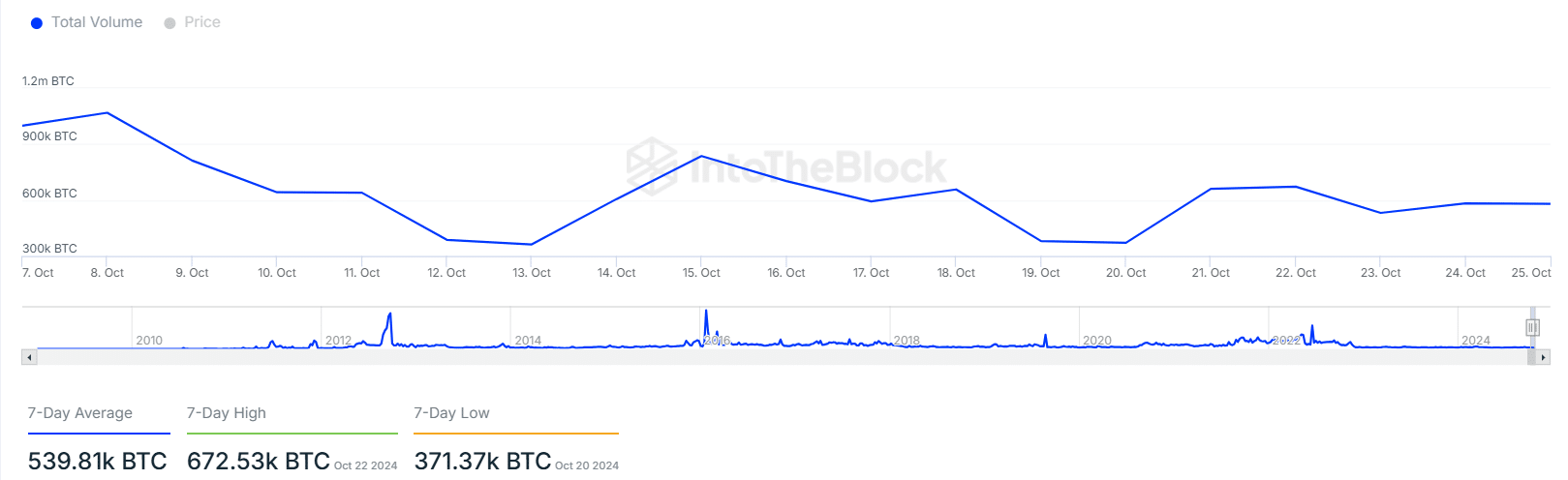

As reported by IntoTheBlock, there’s been a 5.20% rise in active Bitcoin addresses over the past week, indicating a growth in user interaction with the cryptocurrency.

Instead of the new user growth slowing down, it appears that established users are contributing more to the network’s activity, as there was a decrease of 6.50% in the creation of new addresses.

Currently, the average daily transaction volume of Bitcoin is approximately 539,810 Bitcoins, reaching a high of 672,530 Bitcoins on October 22nd and dipping to a low of 371,370 Bitcoins on October 20th.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The fluctuating volume reflects shifting market activity, with the recent spike indicating rising engagement.

The consistent fluctuations in transaction activity hint at evolving trends in Bitcoin trading, possibly influencing its price swings over the next few days.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-10-27 00:08