- Bitcoin shed a lot of its recent gains during the week preceding Election Night in the U.S

- Historical patterns pointed to an upcoming bull rally on the charts

As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous market fluctuations and cycles. The recent downward trend in Bitcoin, despite its close approach to the all-time high, is not unfamiliar territory for me.

Following repeated approaches towards its record-breaking peak of $73,600, Bitcoin [BTC] experienced an unexpected dip. Specifically, it dropped to a minimum of $67,459 on the 3rd of November.

However, does this decline mean the bear market is back or is it simply a short-term correction?

Why is Bitcoin down?

As an analyst examining the situation, I delved into Bitcoin’s past trends to shed light on the current price drop. Notably, in 2016, the digital currency experienced a 10% plunge merely days before a major event, which could suggest that the recent dip might be a similar occurrence.

In 2020, Bitcoin’s worth fell by approximately 6.2%. Interestingly, Bitcoin’s recent trend appears to resemble past patterns, as it has lost more than 8% of its value since reaching its peak.

Election-driven uncertainty

Quinten Francois, a co-founder of WeRate, echoed a comparable viewpoint, stating that the volatile pre-election phase has a significant influence on investor attitudes. In simpler terms, he expressed this idea on platform X.

As a researcher studying financial markets, I can express that these markets tend to be wary of unpredictability. Currently, as we approach election week, there’s an abundance of uncertainty looming. This could potentially explain the recent dip in the value of Bitcoin ($BTC).

The Founder of CryptoSea, famously known as Crypto Rover, supported this perspective by stating,

“Bitcoin always dumps right before the U.S. elections.”

Currently, I’m excited to share that the cryptocurrency I’ve invested in has bounced back and is now trading at around $69,000 on the charts – not far from my goal!

What’s next for Bitcoin?

Given that the unpredictability surrounding the upcoming elections appears to be the origin of the recent slump, one can’t help but wonder – What will happen to the leading cryptocurrency next?

Historically, following elections, we’ve observed a trend where stock markets start to rise significantly and continue this upward trend throughout the subsequent year.

In 2016, Bitcoin gained by approximately 60% two months after the election.

Additionally, an approximate gain of 150% was recorded after the presidential elections in 2020.

So, if history repeats itself, BTC could hit a new ATH in the upcoming months.

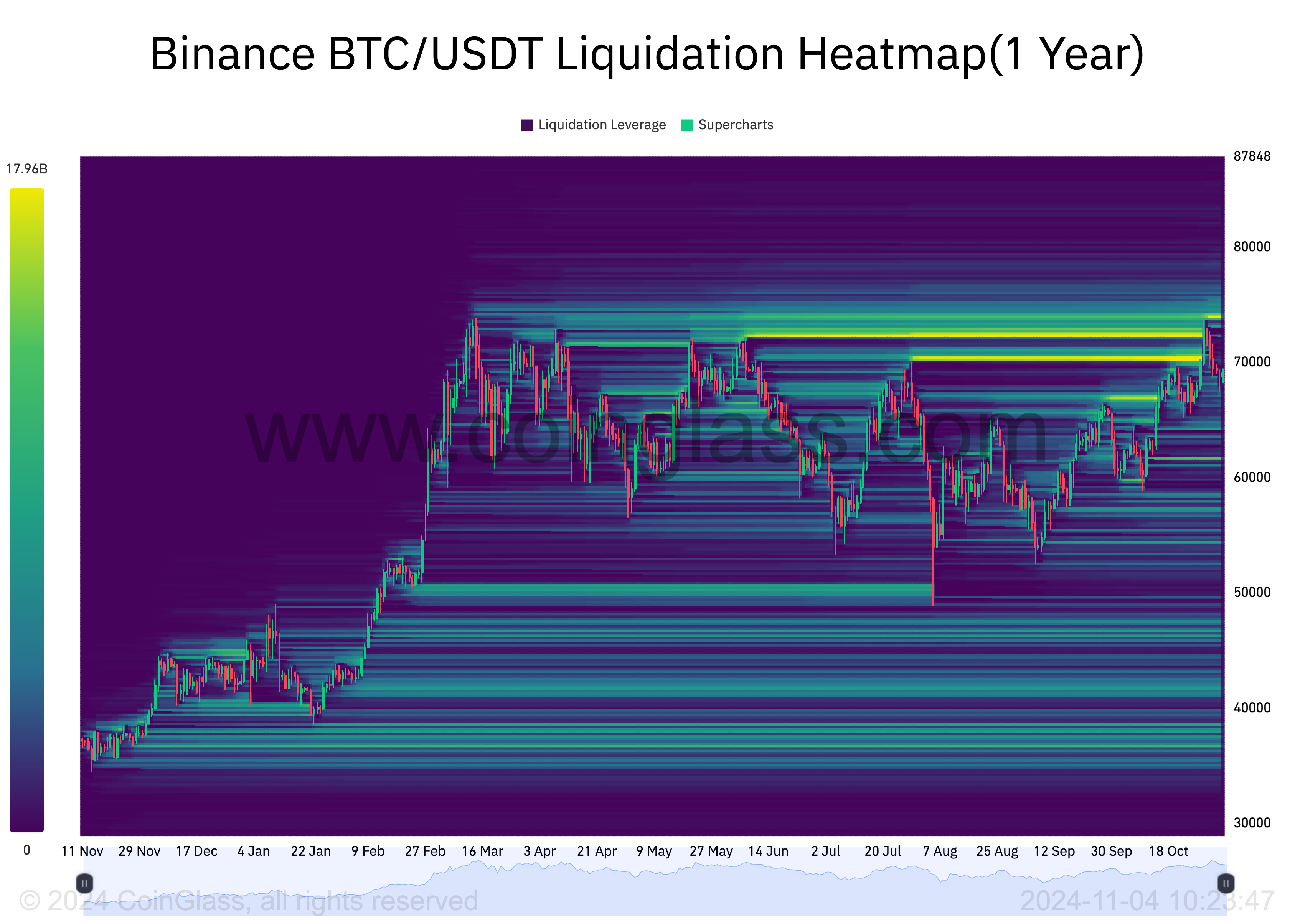

In summary, AMBCrypto’s examination of a 1-year liquidation heatmap provided by Coinglass seemed to hint at the possibility of even higher prices in the future.

A strong cluster of liquidity was formed around $74,000. This magnetic zone could attract the price, marking a new ATH for the king coin.

Altcoin outlook – Trump vs. Harris victory

Regardless of who wins the election, it appears that Bitcoin is poised for a rise in value. However, the future prospects for alternative cryptocurrencies may differ. Earlier reports suggested that a Donald Trump presidency might create a more advantageous climate for altcoins.

Due to a potential loosening of cryptocurrency regulations under the Republican government, and with clearer rules from the Securities and Exchange Commission (SEC) about which altcoins are considered securities, there may be significant increases or “bull runs” in the value of these digital assets.

Additionally, AMBCrypto points out that following elections, some Bitcoin investors might be redistributing their profits, potentially boosting the value of certain alternative cryptocurrencies. However, it’s currently unclear if this situation will lead to a sustained period of growth for altcoins, often referred to as an “altcoin season.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Solo Leveling Season 3: What You NEED to Know!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

2024-11-04 14:16