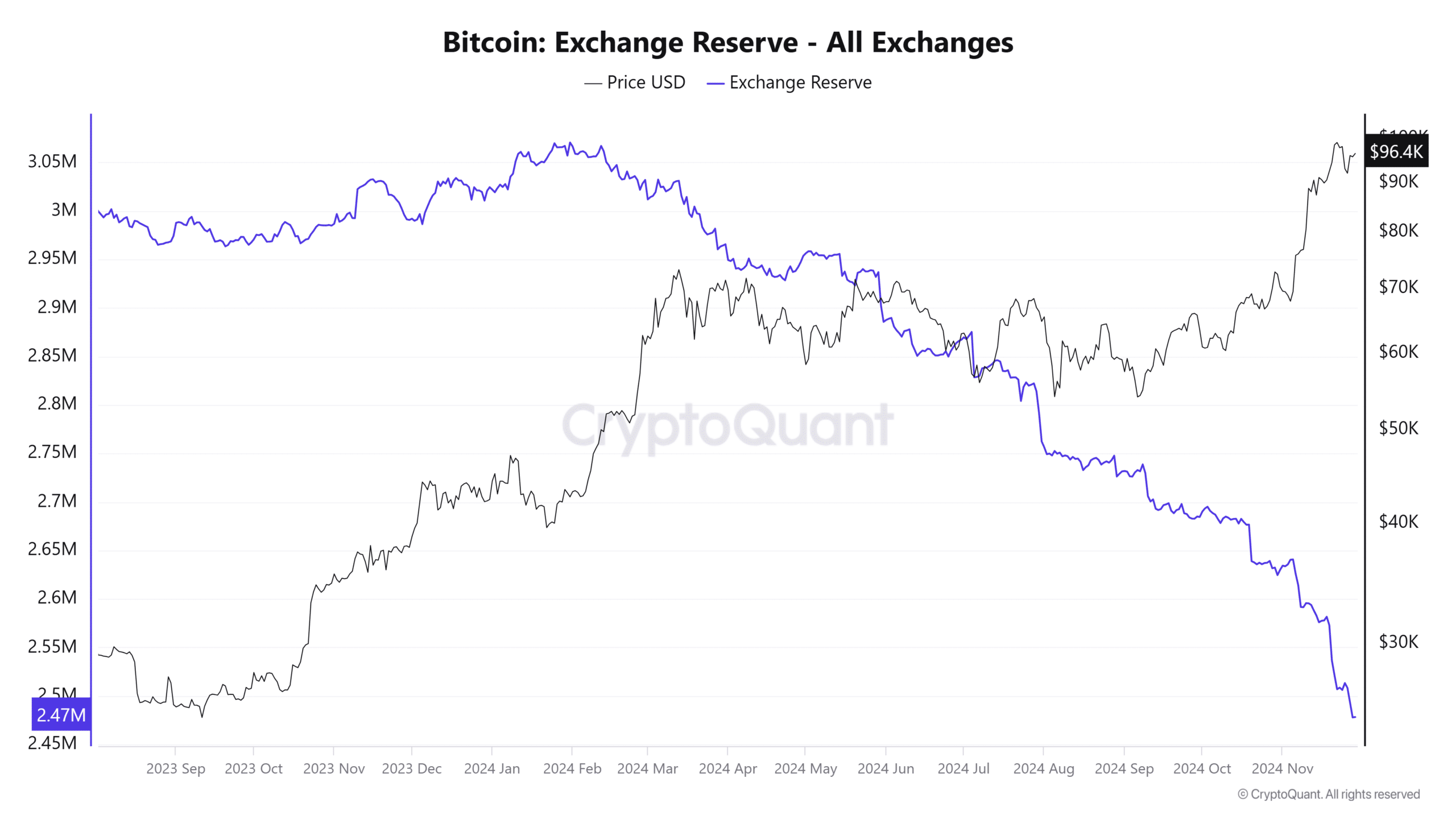

- BTC’s rally comes as its exchange reserve continues to decline.

- Sentiment suggests BTC might drop further until it finds a critical point for a rebound.

As an analyst with over two decades of market analysis under my belt, I find myself cautiously optimistic about Bitcoin’s current market situation. The recent rally has been impressive, but the minimal 24-hour gain and the decline in exchange reserve suggest that we might be approaching a critical point.

Despite an impressive surge in value last month that propelled Bitcoin [BTC] to a fresh record high, boasting a 33.14% rise, its current market performance seems less than anticipated.

Right now, the increase over a 24-hour period is relatively small at 0.78%. This suggests that there’s more buying happening than selling, but it’s important to note that this upward trend isn’t yet certain, according to AMBCrypto’s report.

BTC supply on exchanges drops further

According to CryptoQuant’s recent data, there’s been a persistent drop in the amount of Bitcoin held on crypto exchanges. Over the last day, the Exchange Reserve has decreased by approximately 0.61%, and over the past week, it’s dropped by around 1.53%.

A decrease in Bitcoin’s exchange reserve often signals less Bitcoin available for trading on exchanges. This situation frequently contributes to price rises as a result of the perceived scarcity.

The drop-off has contributed to Bitcoin’s recent increases as shown on the daily graph. Nonetheless, whether this surge will endure is questionable, as highlighted by AMBCrypto in pointing out crucial aspects worth monitoring.

Selling pressure builds as BTC hits supply zone

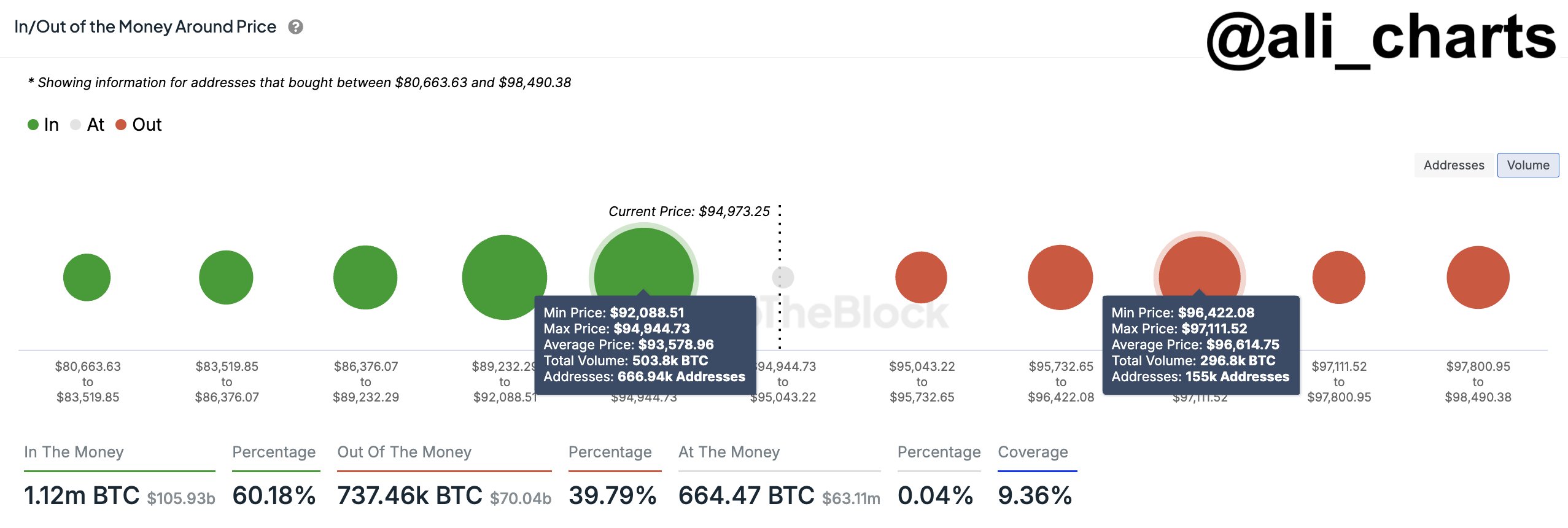

As per analyst Ali’s assessment, Bitcoin (BTC) has reached a crucial point. It has moved into a region where there is a high concentration of sellers at approximately $96,614.75. At this price level, there is a substantial amount of selling pressure, with orders to sell around 296,800 BTC.

As an analyst, I’d like to emphasize the strategic significance of the $93,578.96 demand zone should Bitcoin (BTC) experience a dip. This area is particularly interesting because it gathers a substantial concentration of buy orders totaling approximately 503,800 BTC from around 666.94 addresses.

He stated:

“Staying above this support level is a must to prevent these holders from selling.”

As an analyst, I find that the influx of buy orders at this point indicates potential stability. However, whether we maintain this position hinges significantly on the magnitude and persistence of any selling pressure.

Additionally, AMBCrypto pointed out a potential red flag, as there was a significant increase in Bitcoin transfers into exchange platforms – approximately 2,678 Bitcoins were moved within the past day. This trend strengthens the speculation that Bitcoin’s price may experience a downward shift.

Retail participation weakens

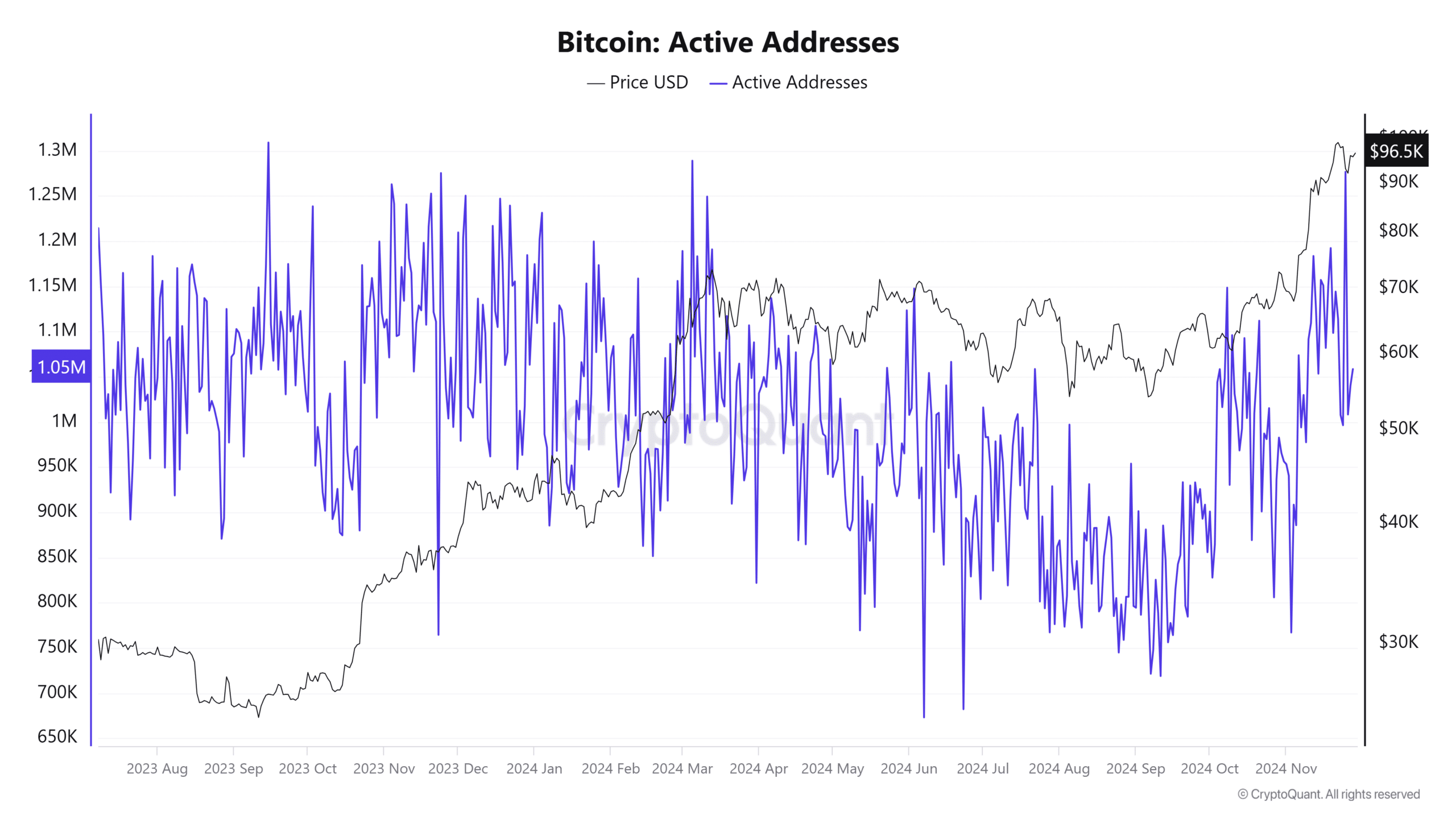

Investors who have a significant impact on the fluctuations of asset prices are displaying decreased enthusiasm, as there’s been a notable drop of approximately 35,03% in the number of actively involved parties.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A decrease in actively used Bitcoin addresses often indicates less purchasing activity, potentially leading to a price drop that might approach the previously mentioned demand level.

If the present buying interest and location activity within the demand zone continue at their current pace, it’s still feasible that the price could change direction from that level.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-29 21:11