- Bitcoin’s trading volume on Binance has sharply declined, increasing market vulnerability.

- Retail interest remains inconsistent, signaling uncertain short-term market sentiment.

As a seasoned market analyst with over two decades of experience under my belt, I’ve witnessed numerous market cycles and their unique ebbs and flows. The recent performance of Bitcoin on Binance is reminiscent of a roller coaster ride, albeit one that leaves you with a lingering sense of uncertainty.

The sharp decline in trading volume is concerning, as it not only indicates reduced liquidity but also creates an environment where even minor fluctuations can lead to significant price swings. This vulnerability necessitates caution from traders, especially those who tend to act on impulse.

However, the mixed signals from retail activity are what truly piques my interest. On one hand, we see a decrease in Open Interest, suggesting reduced speculative activity. Yet, on the other, the increase in Open Interest volume implies that those still participating are taking larger positions, perhaps signaling confidence in future price movements.

It’s like watching a game of cat and mouse, where the market is the cat, and we as traders are the mice. The key is to avoid getting caught unawares and instead learn to dance gracefully with the market, adapting our strategies accordingly.

As for my prediction, I’d say Bitcoin will likely tango its way through a series of ups and downs in the coming months. But remember, the markets are like a good joke—they’re always better when you don’t see them coming! So buckle up and enjoy the ride!

Following a short spell of hopefulness in early December, Bitcoin [BTC] has struggled to keep up its pace, dipping under the $100,000 threshold and showing little movement lately.

Over the past fortnight, the value of this virtual currency has experienced minimal growth, currently sitting at approximately $92,790. This represents a decline of about 13.2%.

Currently, the value of a single Bitcoin is 14.2% lower than its peak price of $108,135, which was reached in December and was recorded when the news was published.

The subpar showings in this area have sparked worries amongst market players, as both transaction activity and public enthusiasm appear to be dropping significantly.

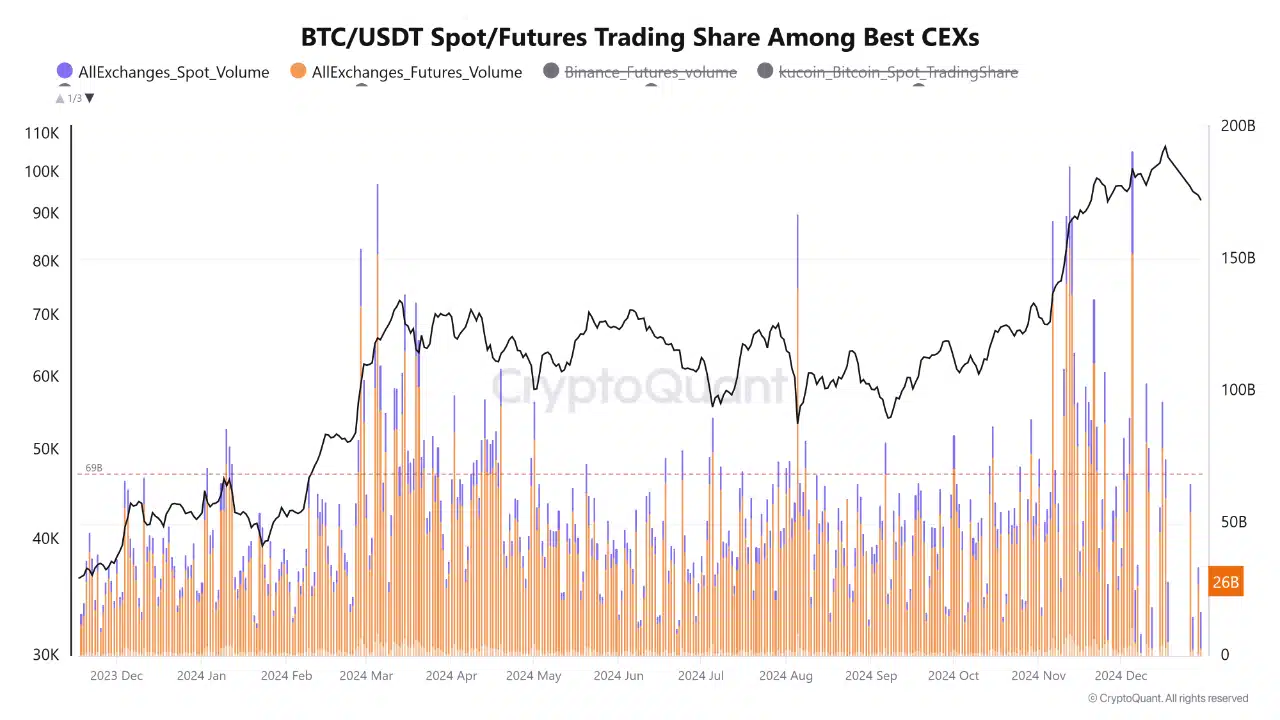

One important reason for the muted results could be the steep decline in the number of Bitcoin transactions happening on Binance, which is currently the most prominent cryptocurrency trading platform globally.

Over the past week, trading activity on both spot and Futures BTC/USDT pairs has sharply declined.

Essential for ensuring smooth trading, centralized markets provide the necessary liquidity and balance supply and demand levels.

Due to less trading on Binance, the market has become more susceptible because the decreased buying interest makes it challenging to balance out the selling force.

In this state, small changes in purchase or sale actions can lead to significant price volatility, meaning prices may change dramatically.

Experts advise investors to proceed with care and resist making hasty choices because the current market mood is still unstable.

Mixed signals from retail activity

Besides just looking at trading volume, there are several other crucial Bitcoin measures that offer a more comprehensive understanding of its present market situation.

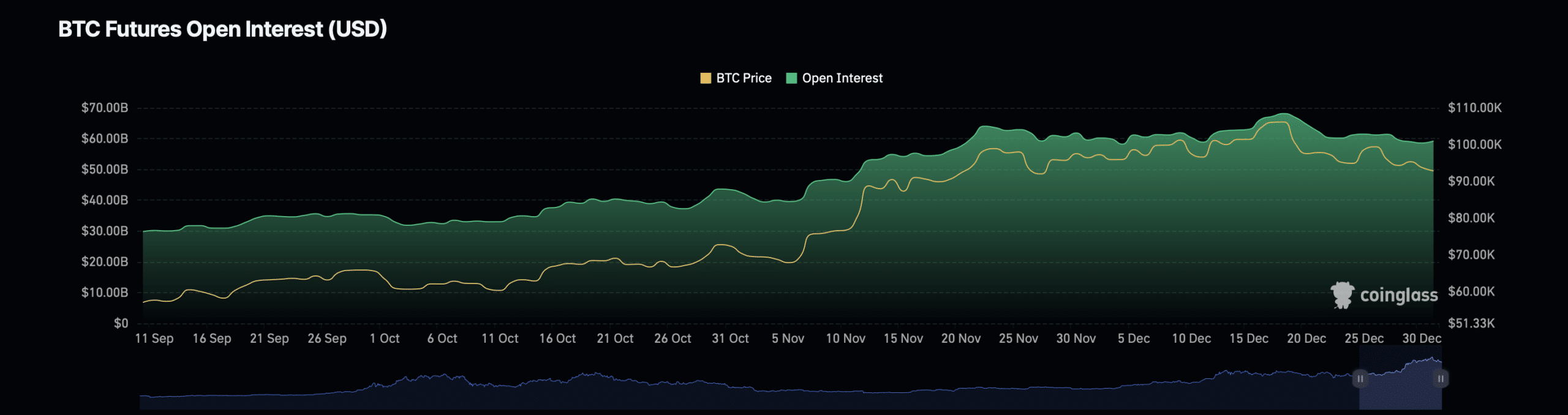

As a crypto investor, I’ve noticed from the data provided by Coinglass that the Open Interest for Bitcoin has dipped by around 2.58%, bringing it down to roughly $57.66 billion. This figure represents the current value of all outstanding futures contracts related to Bitcoin.

This decrease suggests that futures traders’ enthusiasm is dwindling, usually taken as a symbol of lessened speculative action.

On the other hand, the value of Bitcoin’s Open Interest has significantly increased by 71.7%, reaching a staggering $109.92 billion.

This increase indicates that although fewer individuals are engaging in trading, those who continue to participate are adopting more substantial stakes, possibly signaling a level of faith in forthcoming price fluctuations.

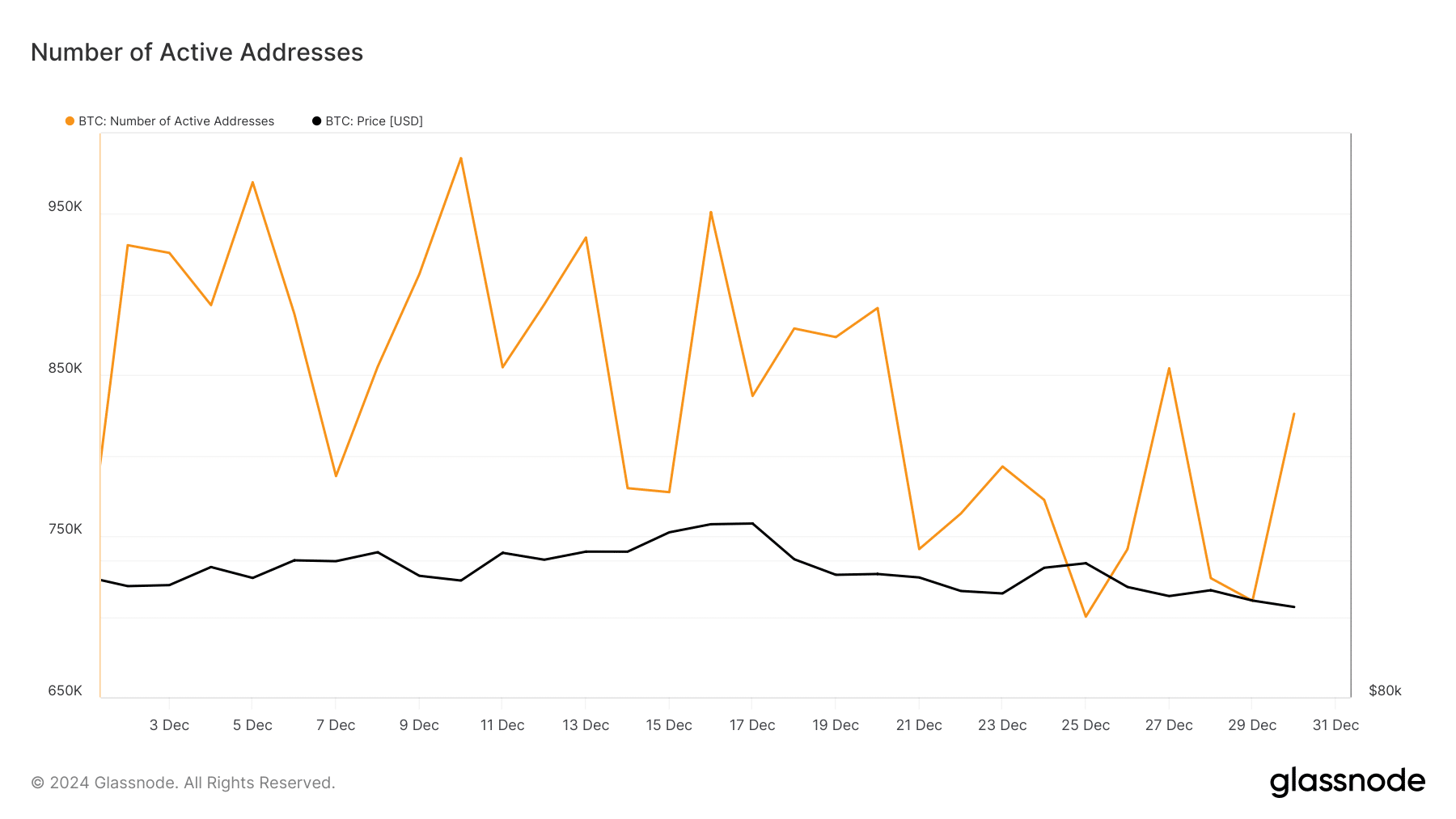

Looking ahead, the number of active Bitcoin addresses provides a glimpse into the level of retail involvement and on-chain action. Each active address represents a distinct Bitcoin address participating in transactions during a specific day.

In early December, the number of active cryptocurrency addresses dropped to a minimum of 787,000, but by the 10th, it had bounced back to approximately 984,000.

Initially, the activity level fell to 700,000 on December 25th, but then showed a slight increase, reaching 826,000 by December 30th.

The number of active participants dropped to 700,000 on December 25th and then rose slightly to 826,000 by the end of the month on December 30th.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This pattern shows a fluctuating retail engagement, characterized by brief peaks of enthusiasm that are quickly followed by significant drops.

These ups and downs indicate that the retail drive behind Bitcoin hasn’t been consistently strong, an element that plays a vital role in pushing its price upward during bullish market phases.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-12-31 15:04