-

BTC failed to rally despite a dovish FOMC meeting on 31st July.

July Jobs report on Friday could add volatility and set the next BTC price direction.

As a seasoned researcher with over two decades of experience in financial markets, I’ve seen my fair share of market anomalies and unexpected turns. The latest Bitcoin [BTC] price action following the dovish FOMC meeting is no exception.

🌪️ Storm Brewing: EUR/USD Forecast Turns Chaotic Under Trump!

Discover why the next days could be critical for forex traders!

View Urgent ForecastAfter the dovish FOMC meeting on August 1st, Bitcoin (BTC) broke away from U.S. stock market trends and dropped below $65k, whereas stocks reached new record highs.

At the latest gathering, the Fed maintained its current interest rates, as anticipated. However, Chair Jerome Powell hinted towards a potential interest rate reduction in September.

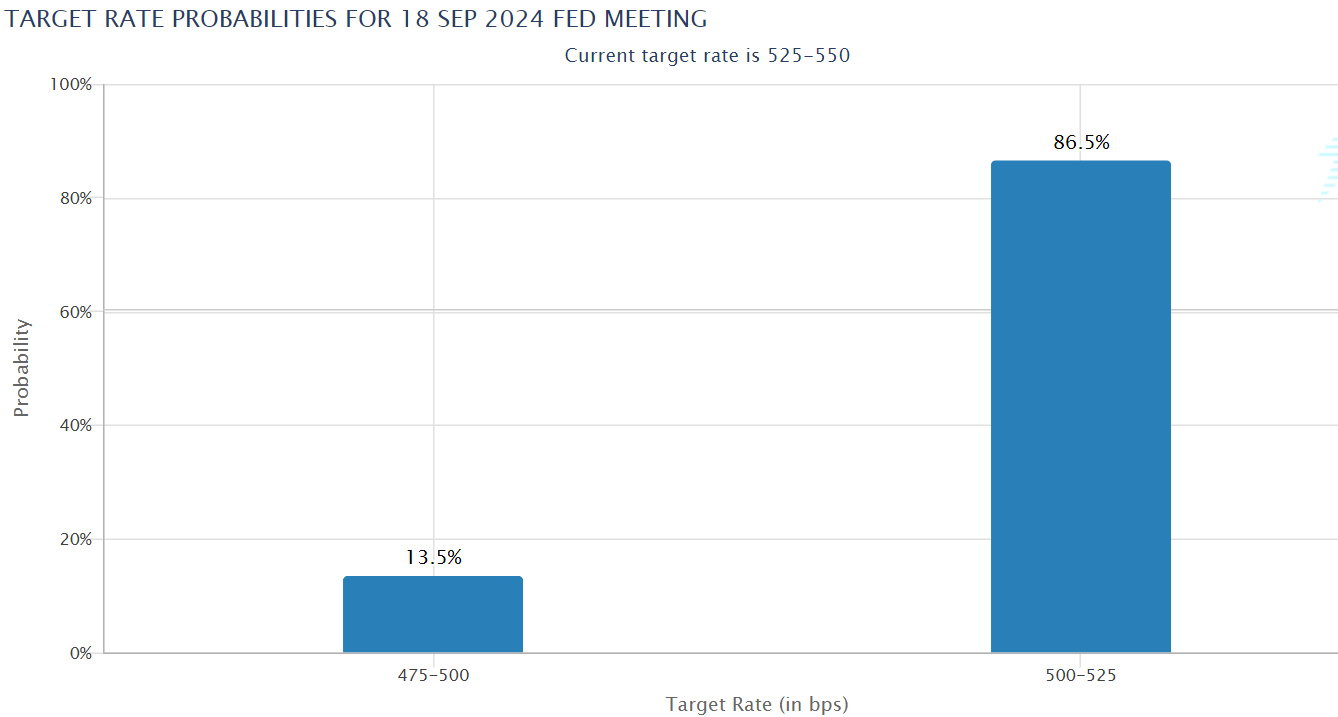

Currently, based on recent market trends, I’m seeing a strong indication that there’s approximately an 86.5% likelihood of a potential interest rate cut in September. This optimistic outlook, stemming from the interest rate traders, has been positively influencing the performance of US stocks.

So, why didn’t Bitcoin follow the US equities rally, given the Fed’s dovish announcement?

Galaxy’s Mike Novogratz blames US government

Mike Novogratz of Galaxy Digital expressed concern that U.S. politics could pose a potential risk to the market. He suggested that, for political purposes, the U.S. government might decide to sell Bitcoin following President Trump’s announcement about establishing a strategic reserve.

‘It seems as though there’s pressure on Bitcoin, and I can’t say for certain, but it might be the U.S. Marshals’ Office. They’re connected to the Department of Justice… I just hope they wouldn’t be offloading it.’

Last week’s transfer of $2 billion worth of Bitcoin by the U.S. government has led QCP Capital to echo similar warnings about market behavior.

The transfer of approximately $30,000 worth of Bitcoin from the U.S. government related to the Silk Road case has caused a degree of apprehension or doubt in the cryptocurrency trading environment.

After failing to surpass the $70k ceiling, QCP Capital anticipates that Bitcoin may continue within a certain price range.

As a seasoned financial analyst with years of experience in the market, I believe that the upcoming US July 2024 Jobs report could be a significant market mover. Based on my past observations and trends, I have noticed that employment data plays a crucial role in determining the direction of the economy. The jobs report, set to be released on August 2nd, will provide valuable insights into the current state of the labor market and may influence investor sentiment and trading decisions. Therefore, I urge fellow investors to closely monitor this report and its potential impact on the market.

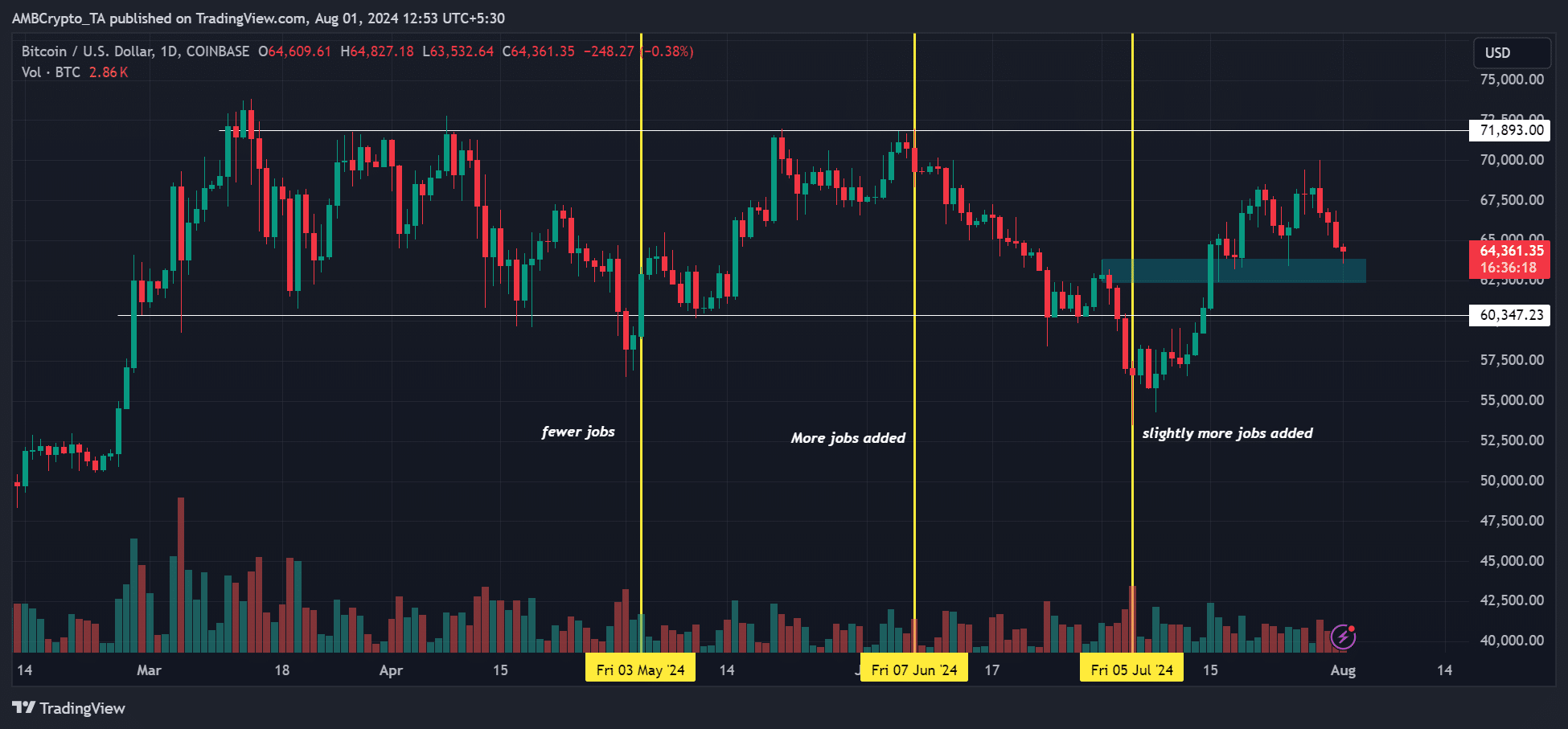

According to historical employment data, instances where fewer jobs were added seemed to boost Bitcoin (BTC), because this trend suggested a weakening U.S. job market and increased the likelihood of the Federal Reserve lowering interest rates.

In the job report published on May 3rd (April’s), which was unexpectedly favorable, Bitcoin surged approximately 6% in response.

Nevertheless, the job reports published in June and July, which indicated an enhancement in the U.S. labor market, led to a decline in BTC prices instead.

On Friday, a less robust Jobs report might spur Bitcoin’s recovery from recent setbacks. Conversely, a stronger Jobs report with increased job growth may exacerbate its downward trend and push it closer to its lower price range.

Quinn Thompson of the crypto hedge fund Lekker Capital shared the same outlook. While acknowledging how crucial Friday could be for markets, he maintained a positive outlook for H2 2024.

1. I’m optimistic about the mid-term (second half of 2024) economic viewpoint… Tomorrow’s FOMC meeting and Friday’s Non-Farm Payrolls are shaping up to be among the most crucial events this week.

At the moment of reporting, Bitcoin was trading under $65,000. A rebound from its temporary support around $65,000 (indicated in cyan) might occur only if the upcoming Job’s report aligns with the optimistic outlook for bulls.

Indeed, the broader economic landscape and U.S. political developments continue to impact Bitcoin prices significantly. Keeping a keen eye on these aspects can prove beneficial for effective risk management.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-01 12:09