- Bitcoin’s fall below $59,000 has triggered significant market liquidations, particularly impacting altcoins.

- Analysts advise caution, suggesting a pause in accumulating altcoins due to current market uncertainties and weak signals.

As a researcher with extensive experience in the cryptocurrency market, I’ve witnessed firsthand how Bitcoin’s [BTC] fall below $59,000 has triggered significant market liquidations and impacted altcoins severely. The recent 4.7% drop in the global cryptocurrency market was driven by this sharp decline in Bitcoin’s price, which has raised concerns about the sustained health of the bull market.

Within the span of just 24 hours, there was a notable and steep 4.7% decrease in the collective value of cryptocurrencies around the world. This decline can be attributed to a substantial drop in Bitcoin’s [BTC] price which dipped below the crucial threshold of $59,000.

This decline has rippled through the market, impacting altcoins severely.

The value of Bitcoin has been finding it difficult to hold its ground, leading to a significant decrease in the total market capitalization of altcoins. This figure stood at a hefty $1.03 trillion at the start of this month but has since dropped to $953 billion as of the latest report.

The dip in Bitcoin’s value beneath $59,000 signifies a pivotal moment for the cryptocurrency industry. This downturn mirrors growing apprehension and incites significant selling actions.

The declining pattern raises concerns about the longevity of the bull market for Bitcoin, as it repeatedly challenges its support thresholds – a sign of possible market instability.

Analysts on “The Ran Show” by Crypto Banter discussed Bitcoin’s vulnerable state near the bottom of its price range, implying that continuous probing of these levels could be a sign of an upcoming market transition.

Steer clear from altcoins

Amidst the volatile market landscape, it is recommended that traders practice discretion, especially when dealing with altcoins.

Based on current trends and market information, it appears that altcoins may experience a pause or decrease in value due to Bitcoin’s extended price fluctuations.

An expert from Crypto Banter observed that although altcoins usually experience recoveries, the present market situation does not seem to encourage quick rebound.

As an analyst, I’ve observed that Pendle (PENDLE), much like other altcoins, has undergone a significant drop in value. Contrary to assumptions that this decline was caused by internal protocol issues, my analysis indicates otherwise. Instead, it appears that external market pressures have been the primary drivers of this volatility. This insight underscores the inherent risks associated with altcoin investments during uncertain economic conditions.

The analyst recommends concentrating on reliable on-chain information and not letting transient social media fads unduly influence your perspective.

As a cryptocurrency analyst, I’ve taken note of FTX’s latest action and expressed optimism about its potential to restore more funds to affected users than originally anticipated. This development could be a promising sign for improving market liquidity, which may provide the foundation for a market recovery.

An analyst emphasized the enduring worth of Bitcoin based on its market capitalization expansion when contrasted with significant financial corporations and conventional assets such as gold, acknowledging its potential value in the long run despite any short-term price fluctuations.

Solana: A case study in volatility

It’s worth considering a closer look at Solana (SOL), the third-largest altcoin, as an illustrative example of how the broader market downturn affects altcoins.

Over the past 24 hours, Solana’s price has taken a hit, dropping by 7.3% and currently standing at $134.83. This decline occurred after a momentary uptick driven by anticipation surrounding prospective ETFs.

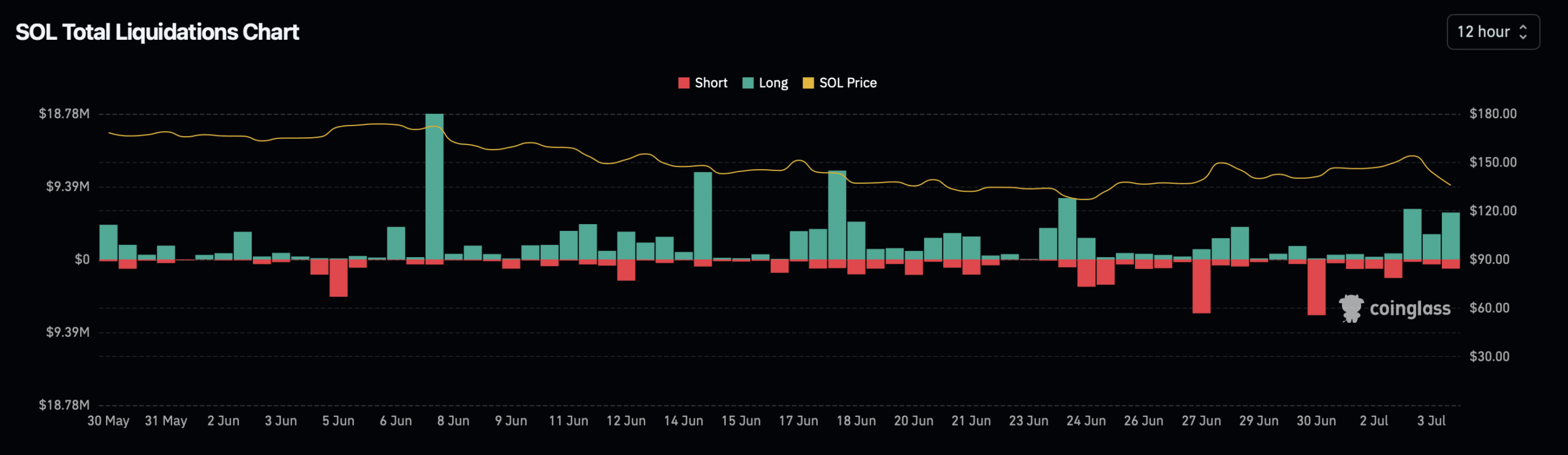

The reduction in Solana’s worth has led to substantial consequences for traders. As reported by Coinglass, approximately 106,449 traders have experienced a total of $289.26 million in liquidations over the past day.

As a researcher studying the recent market events, I discovered that around 12.55 million dollars worth of Solana-linked positions were liquidated. The majority of these liquidations came from long positions, accounting for approximately 10.76 million dollars. In contrast, short position liquidations amounted to only 1.80 million dollars.

Read Bitcoin’s [BTC] Price Prediction 2024-25

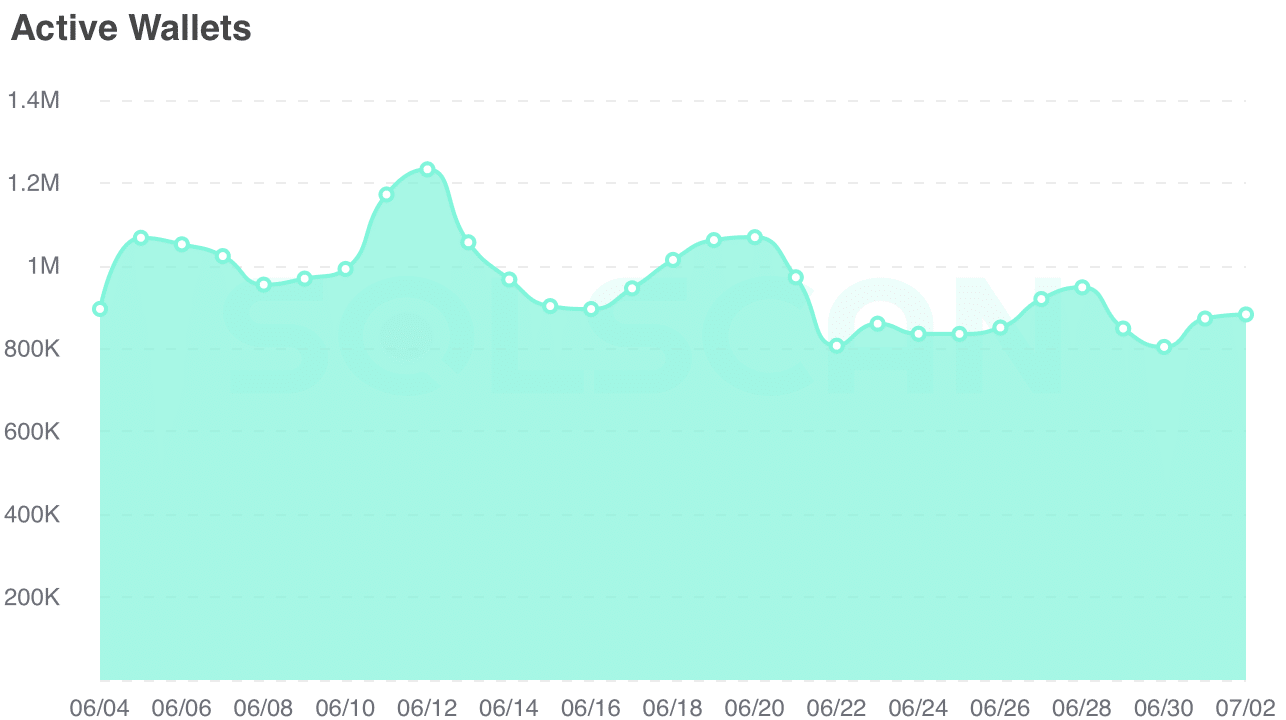

It seems that the economic downturn is leading to less activity on Solana’s blockchain, as evidenced by Am BCrypto’s analysis of Solscan which shows a significant decrease in the number of active addresses.

Last month, there were more than 1.2 million active addresses. However, as of now, that number has decreased to approximately 882,000, indicating a decline in user engagement during the present market situation.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-05 00:08