-

A look at how Bitcoin is faring in an extreme fear environment.

Why liquidations may have played a role in pushing BTC below $60k.

As a seasoned crypto investor with battle scars from numerous market cycles, I find myself once again standing at the precipice of uncertainty. The latest pullback of Bitcoin below $60k is a stark reminder that this market is as unpredictable as it is lucrative.

Bitcoin’s price has dipped again, falling short of the $60,000 mark, following a temporary surge last week. This latest move occurs only a few days since the market began showing signs of renewed hope for an upturn.

In the past day, the shift in Bitcoin’s price trend mirrors a change in overall investor feelings, as the Bitcoin/cryptocurrency fear and greed index moved from “fear” to “extreme fear.”

This has subsequently resulted in the flow of liquidity from the cryptocurrency.

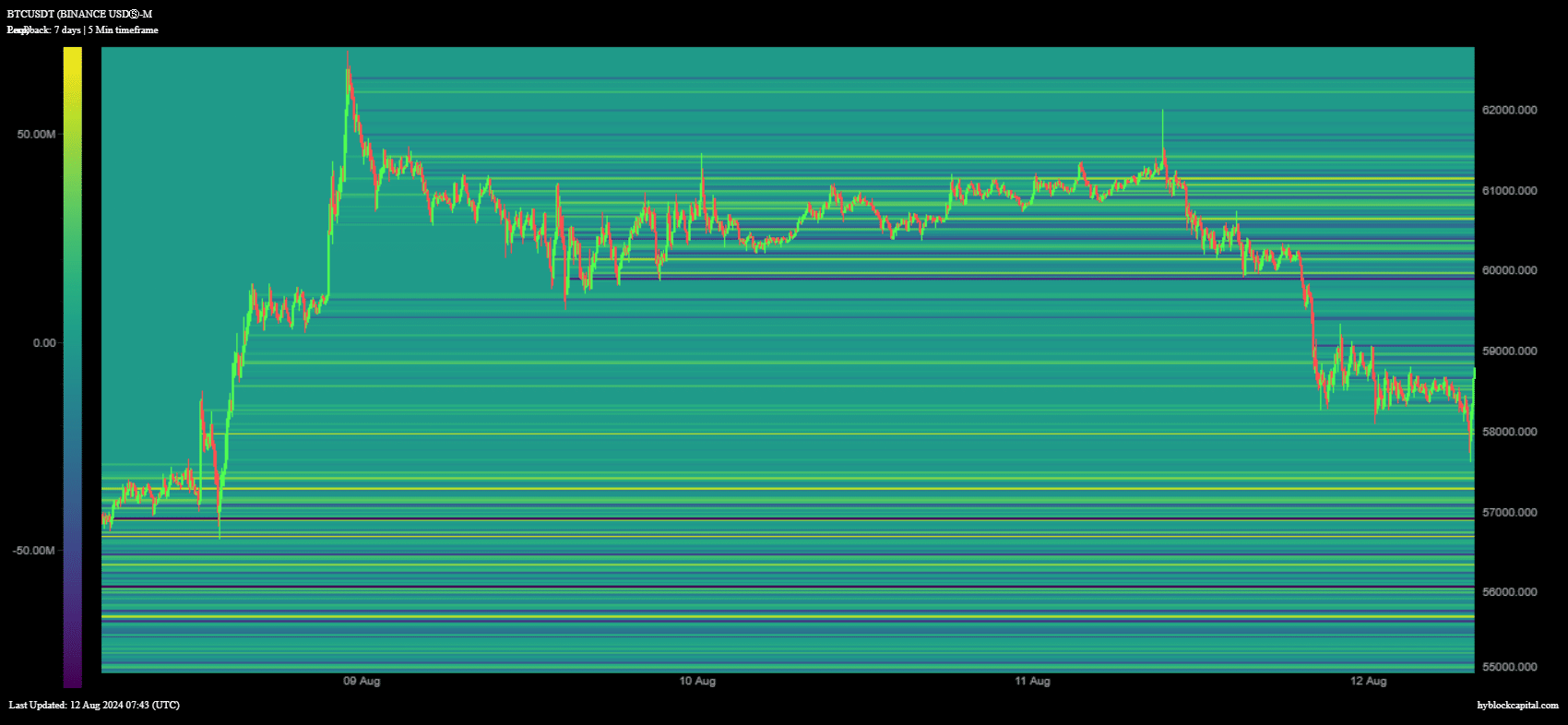

From my personal perspective as a seasoned trader with over two decades of experience in the market, the recent market crash and subsequent BTC rally have once again demonstrated the unpredictable nature of this volatile industry. Last week’s tumultuous events serve as a stark reminder that even the most optimistic predictions can be swiftly upended by unexpected turns. The short-lived surge of BTC to $62,754 during Thursday’s trading session was an exhilarating ride for many investors, but the subsequent drop to $58,172, a 7.58% decline from its weekly high, has left some questioning whether the market has truly recovered.

In simpler terms, the recent pullback in Bitcoin’s price happened around the average level on the Relative Strength Index (RSI). This is significant because it suggests that Bitcoin traders are becoming more focused on short-term profit-making. Given the current period of increased market volatility and uncertainty, this focus makes sense.

Over the past while, there’s been a significant rise in worries regarding the health of international financial markets following the unraveling of the Japanese Yen carry trade strategy.

Some experts are concerned that further financial consequences could occur, as there is growing apprehension about the possibility of an upcoming economic downturn.

More fuel for the bears?

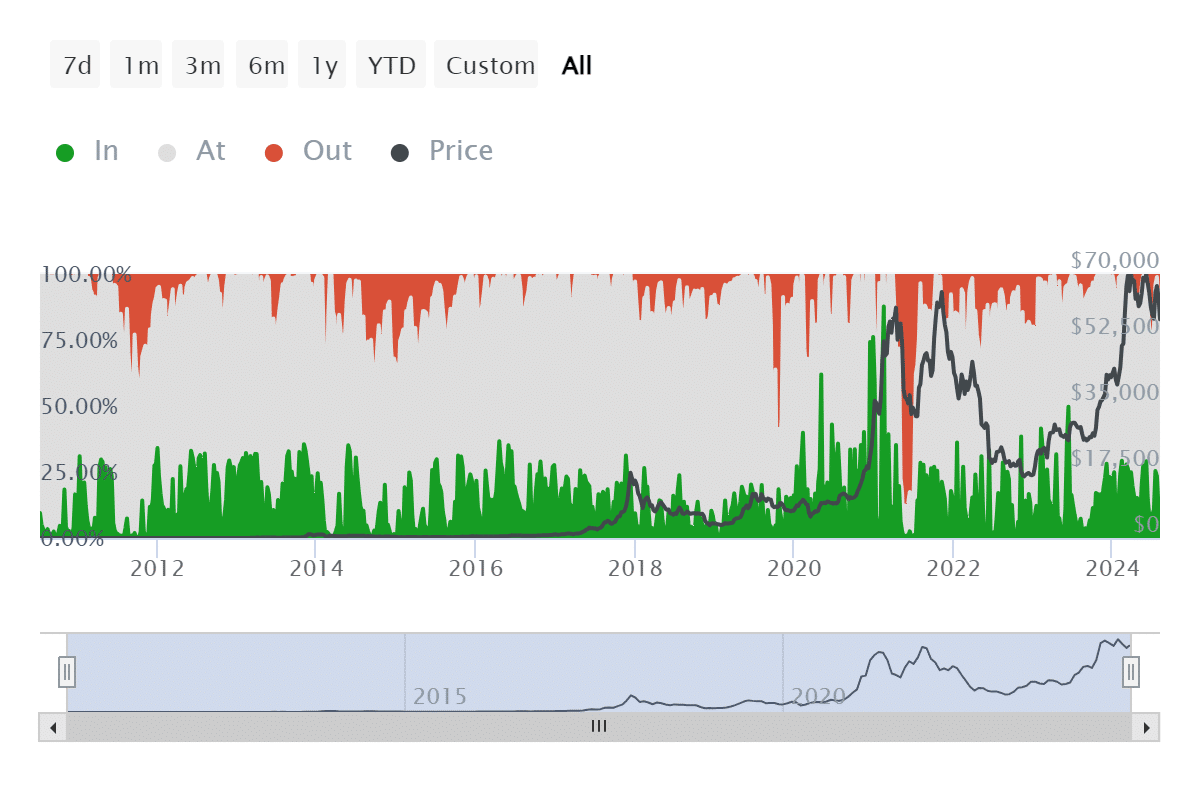

Examining Bitcoin’s liquidity, we found that it might be vulnerable to forced sales due to high exposure to liquidations. Our analysis showed that about 20.3% of addresses were underwater during the peak, which translates to approximately 10.84 million addresses at the time of the recent dip on August 5th.

The number of addresses out of the money as of 11th August was 7.14 million (13.38%).

Approximately 3.7 million addresses contributed liquidity to Bitcoin as it neared its lowest points. Simultaneously, the recent excitement surrounding Bitcoin might have fueled further enthusiasm and a growing desire for increased borrowing.

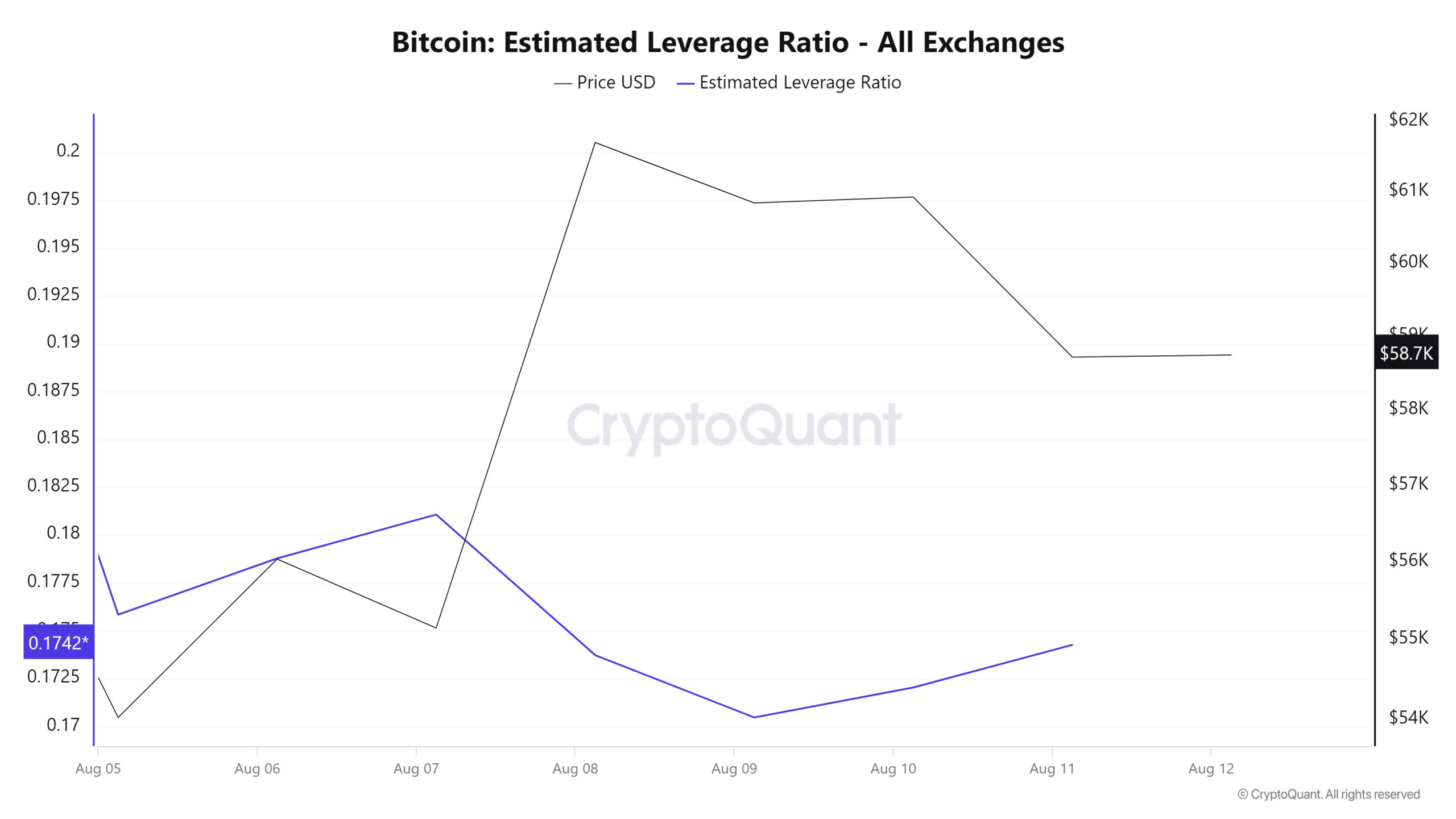

BTC’s estimated leverage ratio registered an uptick between 9th and 11th August.

Optimistic outlooks and high levels of borrowing might be fostering conditions ripe for additional sell-offs or liquidations. The value of BTC long positions reached a high of $53.92 million on August 11th, approximately within the $61,129 price bracket.

This was just before a strong bearish move that pushed the price below $60,000.

It seems that the closing of highly leveraged Bitcoin long positions could have significantly impacted Bitcoin’s price movements over the past two days.

Although the recent decline in Bitcoin’s price beneath $60,000 might be influenced by ongoing liquidations, it’s clear that the market could experience further drops if investor confidence stays low.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-08-12 21:12