-

BTC has surged by 9.92% over the past seven days, but fell again at press time.

Despite the surge, BTC remains in a bearish market especially with declining transaction volume.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I must say that the recent surge in Bitcoin’s price over the past seven days has been intriguing, but it hasn’t entirely changed my outlook on the market. The declining transaction volume and other indicators suggest that we are still in a bearish market.

Over the last week, Bitcoin [BTC] has made a recovery returning to the $60k level temporarily.

After touching its lowest points a week back, Bitcoin has been striving to keep its upward trend, but unfortunately, it dipped below $60k once more. On the positive side, the current market climate is sparking discussions among analysts.

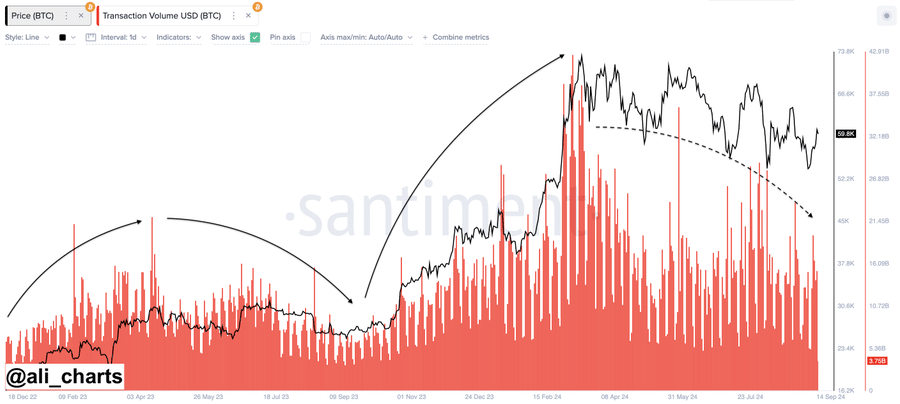

Crypto expert Ali Martinez proposed that the full reversal of the current trend might not have occurred yet, based on the transaction activity within the Bitcoin network.

Prevailing market sentiment

According to Martinez’s examination, the decrease in trading activity indicates that a change in direction (i.e., trend reversal) might not have taken place yet.

Based on this study, Bitcoin transaction volume usually rises during bull markets (uptrends) and falls during bear markets (downtrends). Since we’re currently experiencing a decrease in trading volume, it suggests that the market may still be in a downtrend.

During a rising price trend, the number of trades tends to grow as more investors become active in buying and selling, leading to a surge in overall market action due to increased buying and selling activity.

In other words, when a trend is rising, an increase in trading volume often indicates that more investors are participating, suggesting a strong market momentum.

As the market trend declines, trading volume tends to decrease. Lower volumes often indicate that there are fewer active traders. This implies that the negative market outlook, or bearish sentiment, remains dominant.

According to Martinez’s observations, the daily trading volume of Bitcoin has dropped by approximately 58.66%. This finding suggests that, from this perspective, Bitcoin is currently experiencing a downward trend or bear market.

What BTC charts suggest

According to Martinez’s observations, despite Bitcoin attempting to surge ahead, it appears that bearish sentiments continue to control the market. This suggests that the present market scenario might lead to a potential drop in Bitcoin’s price.

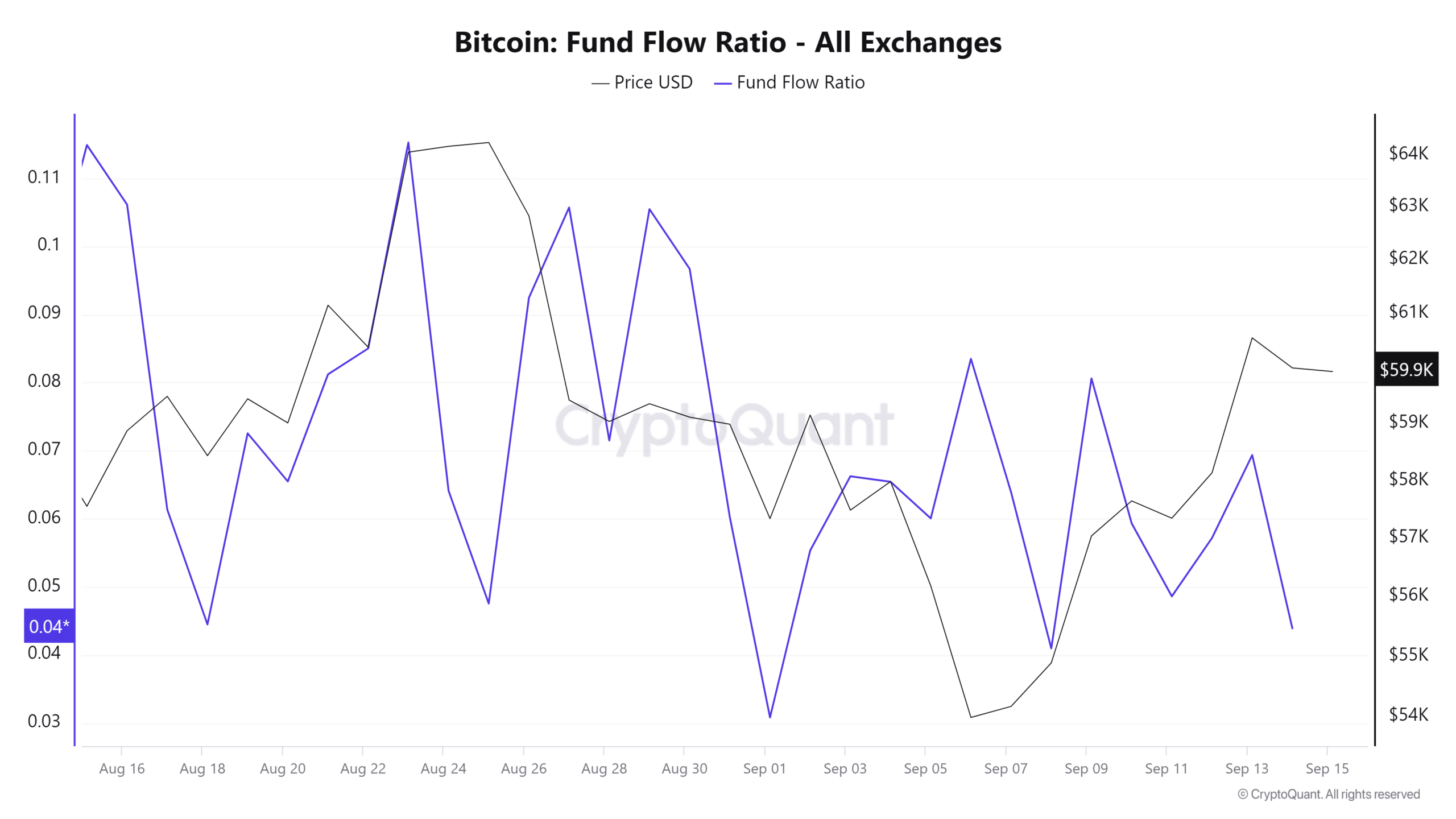

The amount of money moving into Bitcoin investments has decreased significantly in the last week. This suggests that fewer people are purchasing Bitcoin than those who are selling it, indicating that there is less interest among investors in putting their funds into this market at the moment.

In simple terms, the current market mood is pessimistic because investors are selling off their investments, which is causing prices to drop.

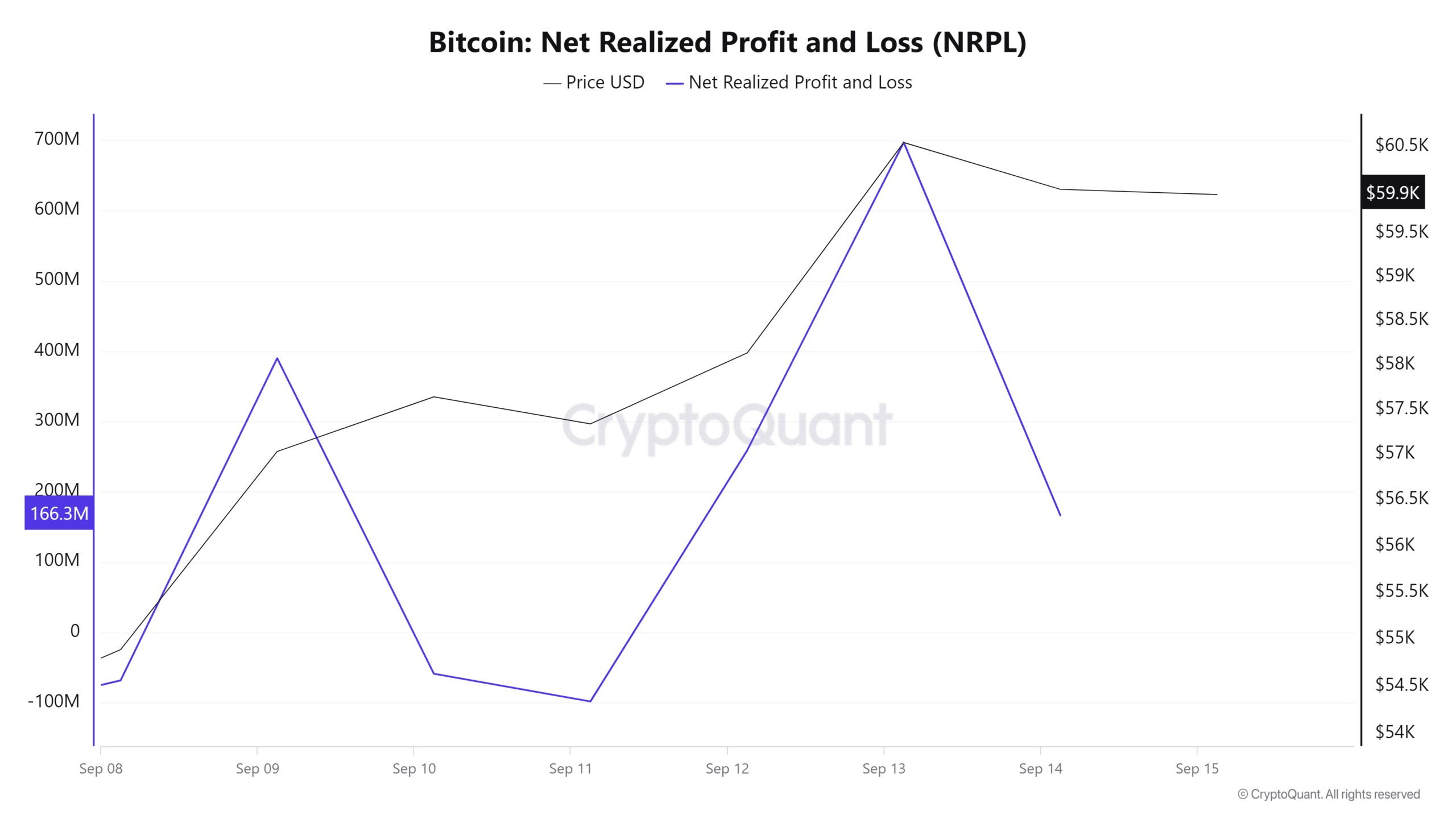

Furthermore, Bitcoin’s net realized profit/loss (NRPL) has dropped off slightly over the last two days following a surge in the preceding period. A decrease in NRPL suggests that investors may be offloading their Bitcoins at a loss.

This implies that the interest in buying Bitcoin (BTC) has decreased, either because fewer people are prepared to buy it at elevated prices, or there’s been a drop-off in overall trading volume.

To summarize, over the past week, Bitcoin’s Price-Daily Active Addresses (DAA) disparity persists. When DAA shows a negative divergence, it indicates that Bitcoin prices increase while the number of daily active addresses decreases.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

It seems that although prices are increasing, the actual usage of the network isn’t following suit at the same pace. This could be seen as negative or “bearish,” because the price surge might just be driven by speculation rather than genuine growth in demand.

In simpler terms, according to Martinez’s observations, Bitcoin is currently experiencing a downward trend. If the current pessimistic market feelings persist, there’s a possibility that Bitcoin could dip to around $57,342.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-16 10:16