- Bitcoin has dropped over 25% in the last four days.

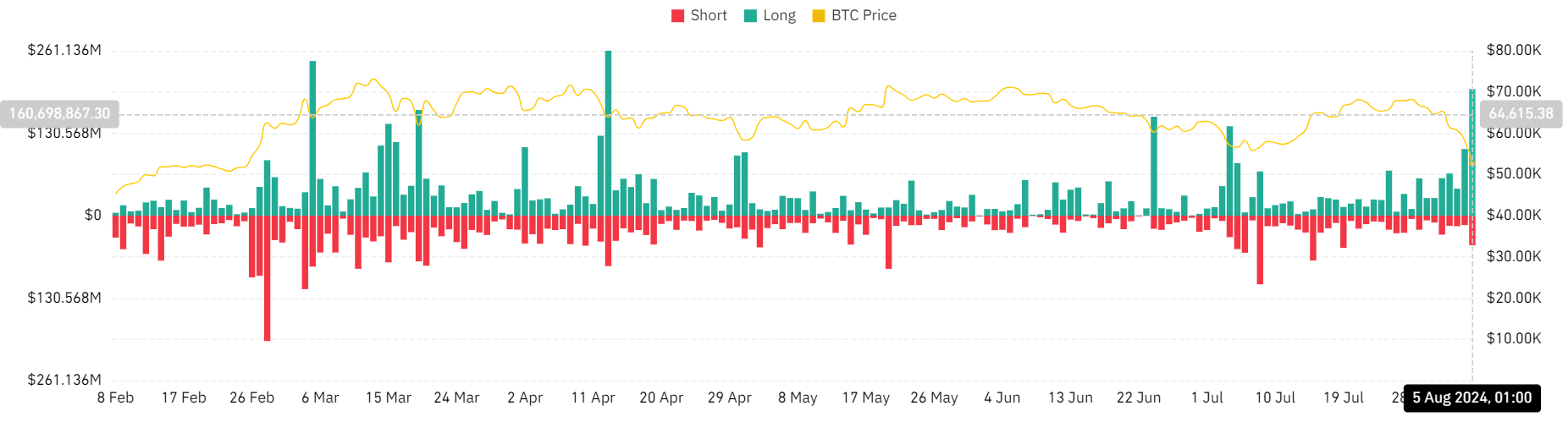

- The liquidation volume rose to the highest since April.

As a seasoned crypto investor with battle scars from numerous market fluctuations, I’ve learned to brace myself for the rollercoaster ride that is Bitcoin [BTC]. The recent 9% drop within 24 hours has certainly given me whiplash, but I’m not one to panic just yet.

Over the past day, Bitcoin’s [BTC] value has noticeably dropped, falling below the $60,000 threshold. With the ongoing trend and the market’s instability, there’s a possibility that we might witness a continued slide down to around $40,000.

Bitcoin drops 9% in 24 hours

According to AMBCrypto’s examination, Bitcoin’s price pattern showed a substantial decrease of more than 9% in the past day.

During this timeframe, the value of a Bitcoin was roughly around $52,900, experiencing a drop that fluctuated between 8% and 9%.

It’s clear from using the price range tool that Bitcoin has significantly dropped in value since its peak around August 2nd, with a decline of more than 24% overall.

Bitcoin to $49,000

As a crypto investor, I found utilizing the Fibonacci retracement indicator to scrutinize Bitcoin’s price trend immensely beneficial. This tool helped me predict possible future fluctuations in its value.

Significantly, if Bitcoin’s price sustains above the 23.6% Fibonacci resistance level, it may attempt to reach even higher Fibonacci levels.

The chart showed it could specifically test the 38.2% level at approximately $56,847.56 or even the 50% level at about $59,127.13.

If the decline continues, the next significant support level, as suggested by Fibonacci retracement analysis, is expected at the 0% mark, approximately $49,467.88.

Furthermore, the analysis of the Relative Strength Index (RSI) revealed that the asset was overbought. Often, this suggests an upcoming price correction or rebound, since potential investors may view this as a favorable moment to join the market.

During severe market drops, it’s important to remember that the Relative Strength Index (RSI) might stay in the oversold territory for a prolonged time.

Furthermore, the Moving Average Convergence Divergence (MACD) – a momentum indicator – also indicates a downward momentum trend.

It appears likely that the current downward trend could continue for a while in the near future, considering the price has already dropped beneath the 23.6% Fibonacci support level.

Given the current circumstances – a pessimistic Movement Average Convergence Divergence (MACD), an overbought Relative Strength Index (RSI), and Bitcoin’s alignment with significant Fibonacci levels – it seems that the near-term Bitcoin trend may lean towards bearishness.

Liquidation hits highest point in months

On Coinglass, an examination of Bitcoin’s liquidation volume showed a substantial surge, reaching its peak level since April.

On the last day of trading, August 4th, the accumulated Bitcoin liquidation volume surpassed $246 million.

Upon a detailed look at the data, it turned out that the majority of the liquidations involved long positions, amounting to approximately $200 million. Conversely, short liquidations represented around $46 million in value.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The significant surge in liquidated trades, notably in long positions, can be attributed to the sudden price change that took many traders by surprise.

It seems this event might have caused some automatic selling due to stop-loss conditions being met, or it led to the closing of leveraged positions. The frequent closure of long positions suggests that numerous traders were hopeful about Bitcoin’s price rise, expecting it to increase more than what actually happened.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-08-05 20:08