- Institutional interest in Bitcoin has remained unchanged even as retail sales persisted.

- Bitcoin whales have continued steady accumulation in the face of price dips below $60K support.

As a researcher with a background in cryptocurrencies and market analysis, I’ve closely followed Bitcoin’s (BTC) recent price action and underlying trends. The latest decline below $58,000 to a nine-week low was met with several factors contributing to the sell-side pressure.

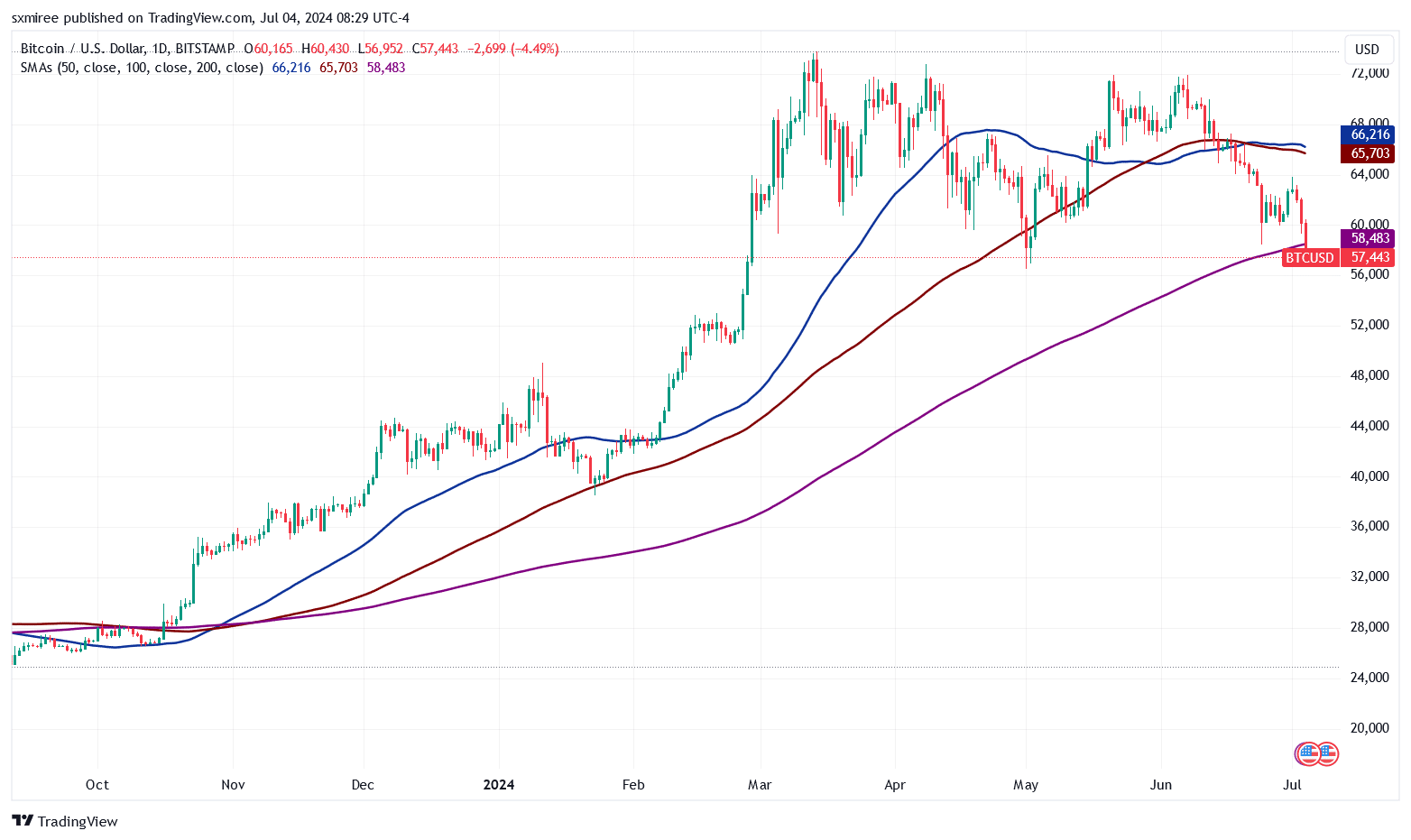

I’ve observed a downward trend in Bitcoin (BTC) for the past three consecutive days, including the 4th of July. This resulted in a large red candlestick on the BTC/USDT daily chart as the price plunged below the $58,000 mark.

Bitcoin reached a nine-week low and slipped beneath the 200-day simple moving average (SMA) for the initial time since October, marking a significant drop in its value.

Recent setbacks can be attributed to ambiguity in the direction of spot markets, hawkish remarks made by Federal Reserve Chair Jerome Powell, and persistent selling pressure driven by various reasons.

German government selling BTC

The German government’s persistent sale of Bitcoins has added greater pressure on the market supply side.

According to Arkham Intelligence’s on-chain analysis, I came across a transaction on the first of July where the German government transferred 1,500 Bitcoins from their wallet.

On the 2nd of July, the wallet transferred an additional 832.7 BTC across four distinct transactions. Subsequently, on the 4th of July, it processed a transaction moving 3,000 BTC.

Large holders are still taking up more coins

As a crypto investor, I’ve noticed something intriguing. Despite the unpredictable price fluctuations in the market, deep- pocketed investors continue to purchase larger amounts of the primary cryptocurrency.

As a crypto investor, I’ve been keeping a close eye on market intelligence platforms like Santiment. Recently, they reported an interesting finding: wallets holding a minimum of 10 Bitcoin (BTC) have collectively increased their holdings by 1.07% over the past six months, reaching a new record of 16.17 million BTC in total.

Large USDT and USDC hoarders’ financial fluctuations could be linked to the actions of substantial Bitcoin investors.

Approximately one-third (30.3%) of the total Tether (USDT) in circulation is stored in wallets that contain between 100,000 and 1 million USDT. Similarly, around one-third (34.2%) of the USD Coin (USDC) in existence is held in wallets with a balance between 100,000 and 1 million USDC.

Santiment pointed out that there had been a decrease of 5.37% and 1.99% over the past six months in these particular figures.

Bitcoin whales have notably been active in accumulating during dips below $60,000.

According to IntoTheBlock’s data analysis, the accumulation of over 55,000 Bitcoins by Bitcoin whales owning over 0.1% of the total supply within the last thirty days has been recorded as a net inflow.

Institutional interest

Despite Bitcoin showing signs of instability, publicly traded companies have persisted in increasing their holdings of the cryptocurrency.

According to BitcoinTreasuries.net, a total of 321,802 Bitcoins were collectively owned by publicly traded companies worldwide by the 4th of July. With the largest holding at 226,331 Bitcoins, MicroStrategy topped this list.

Japan-based Metaplanet, this week, announced the addition of 20.2 BTC to its treasury holdings.

Over the past quarter, the investment firm has acquired Bitcoin on three different occasions: April 23rd, May 10th, and June 10th. This most recent purchase represents the firm’s fourth transaction, increasing its Bitcoins in possession to a total of 161.27 units.

I’ve observed that El Salvador has maintained its daily purchase of one Bitcoin. In the month of March, President Nayib Bukele moved a substantial portion of the country’s Bitcoin holdings into a cold wallet, which is securely stored in a physical vault.

BitInfoCharts data shows this wallet held 5,600 BTC, worth over $400 million, at press time.

Bitcoin price action

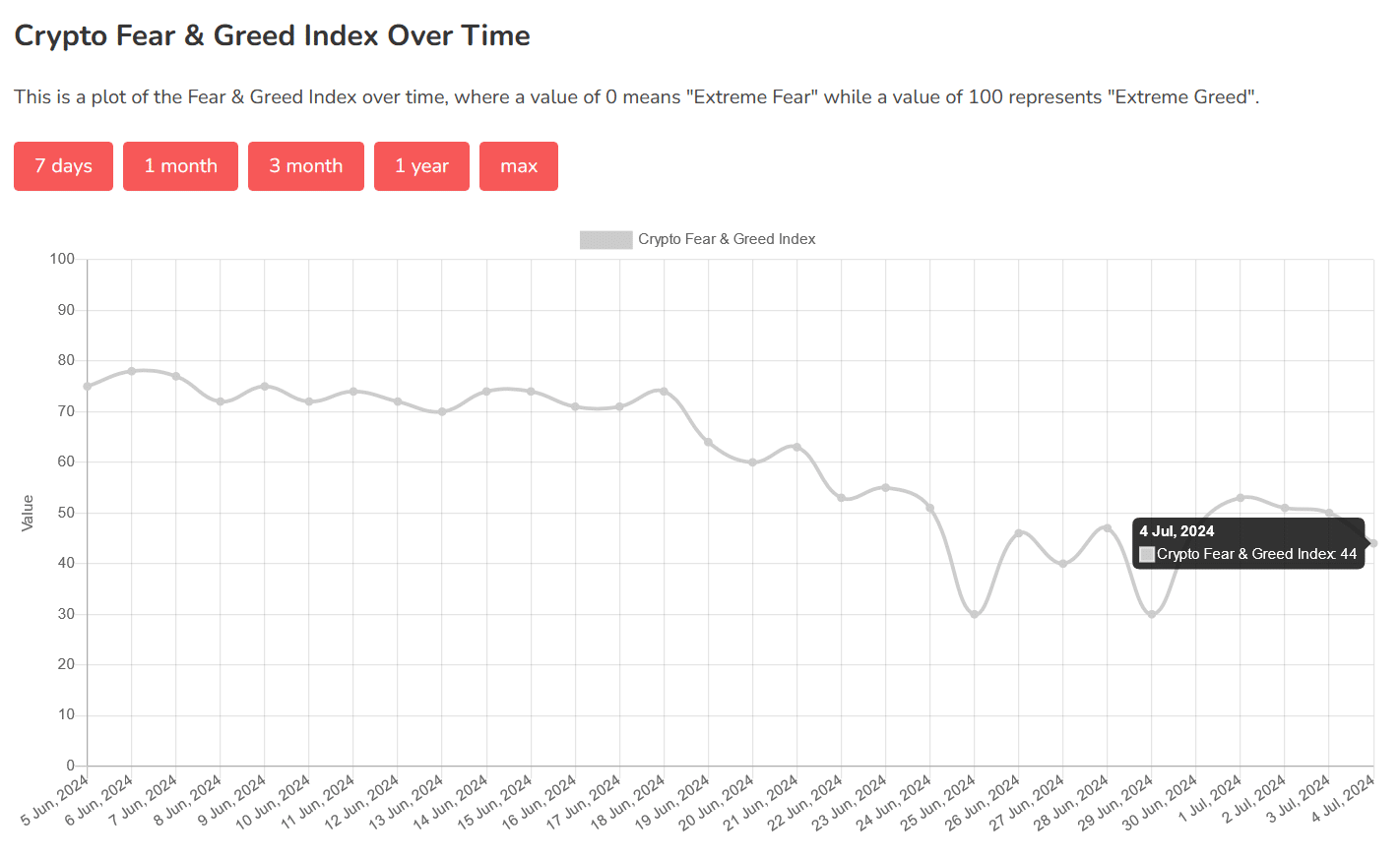

As a crypto investor, I’ve noticed that the critical support moving average was tested for the first time in ten months, which has heightened market concerns about a potential market top. According to Alternative.me’s Crypto Fear and Greed Index tracker, there has been a significant decrease of nine points since July 1st, leaving the index at 44 as I write this.

The current price of Bitcoin was at $57,580, representing a decrease of 16.51% over the past thirty days and a nearly 22% drop from its peak of around $73,700 reached in March.

Read Bitcoin’s [BTC] Price Prediction 2024-25

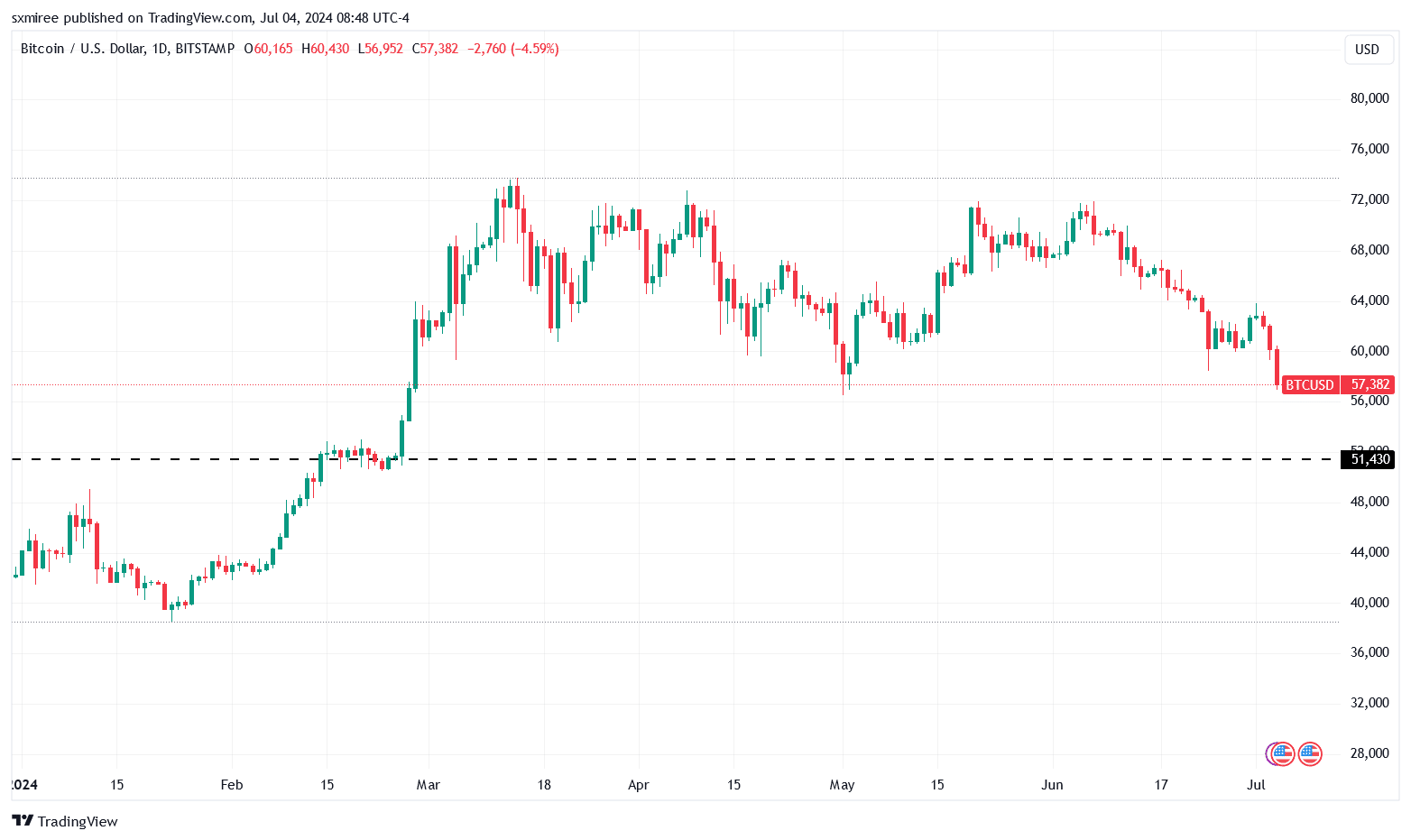

Looking closely at the Year-to-Date (YTD) chart, a potential drop beneath current prices might initiate a 12% downtrend reaching approximately $51,500 – a level where it stabilized in February.

If Bitcoin’s price is to experience a significant increase, it first needs to climb out of the descending trend that began in mid-June.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-05 07:04