- Bitcoin grips moderate fear; if it persists, short-term holders may sell to break even.

- Their exit could signal a price bottom.

As a seasoned crypto investor with battle scars from numerous market cycles, I can’t help but feel a sense of deja vu as Bitcoin once again approaches a crucial resistance level. The $60K mark has proven to be a formidable hurdle, and it seems that short-term holders are starting to throw in the towel, driven by fear rather than greed.

After a prolonged period of holding steady, Bitcoin [BTC] bulls managed to push the price over $60,000. Yet, this upward trend did not last as BTC subsequently slipped back under its support level and currently trades around $59,800.

As a result, the overall feeling towards the market is now dominated by fear again, as both optimistic buyers (bulls) and pessimistic sellers (bears) are competing intensely over important support points.

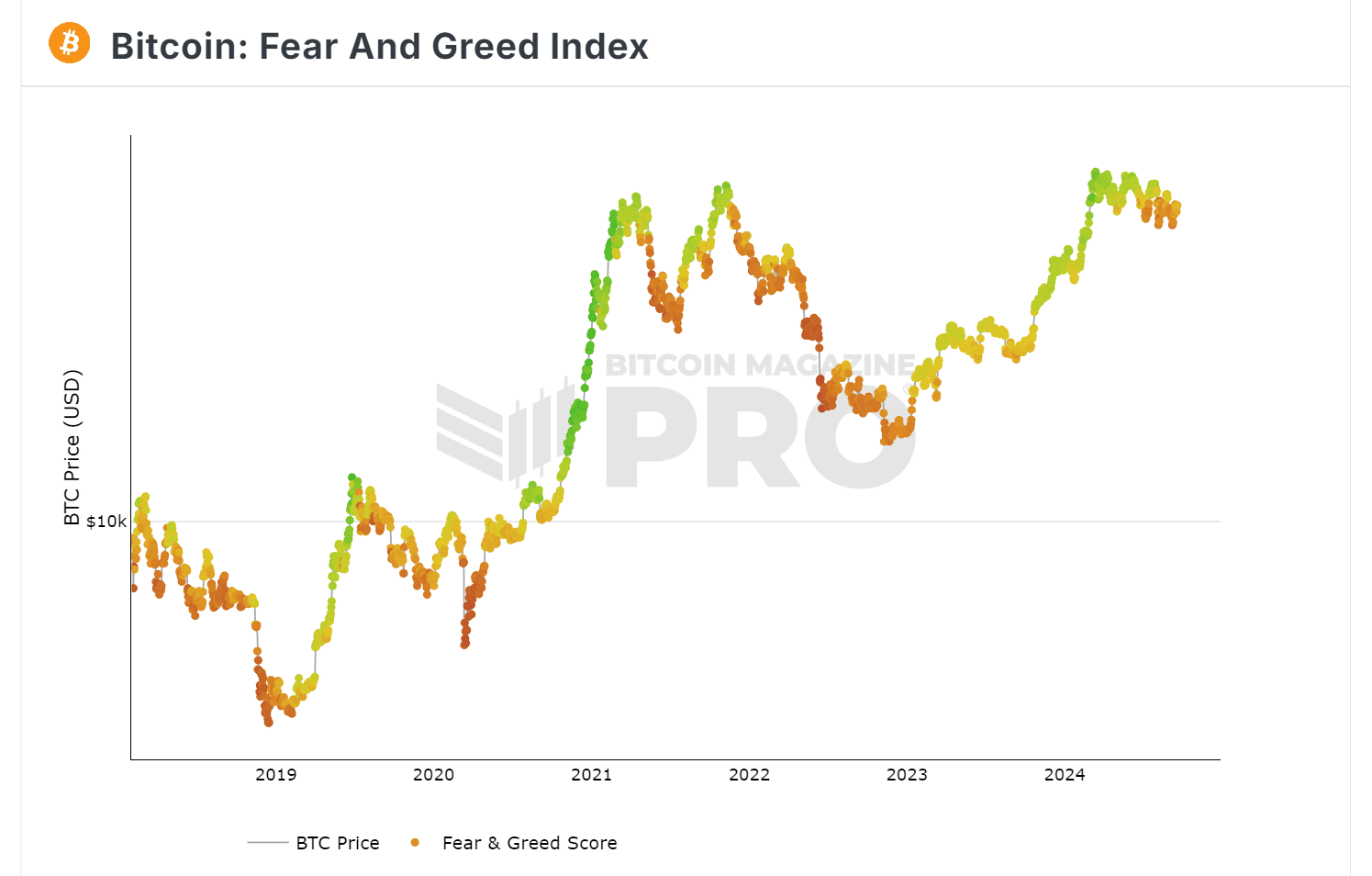

Bitcoin Fear and Greed shows high fear

Historically, when an index falls below 20, it usually indicates intense fear and is often associated with price lows. At such times, many novice investors flock to the market in search of affordable BTC, while short-term investors typically sell off to realize their profits.

At present, there’s a hint of apprehension among Bitcoin investors due to the market showing a level of ‘moderate fear’. If this pattern persists, it might boost the chances of reaching a price floor.

In simpler terms, when fear lingers among short-term traders, they may choose to offload their assets, causing a drop in prices. However, after a low point has been established, a decline could entice investors to purchase at lower costs, thereby initiating an upward trend.

Thus, tracking such market behavior (STH activity) could yield valuable information. If anxiety triggers mass sell-offs, the price of Bitcoin may reach its lowest point.

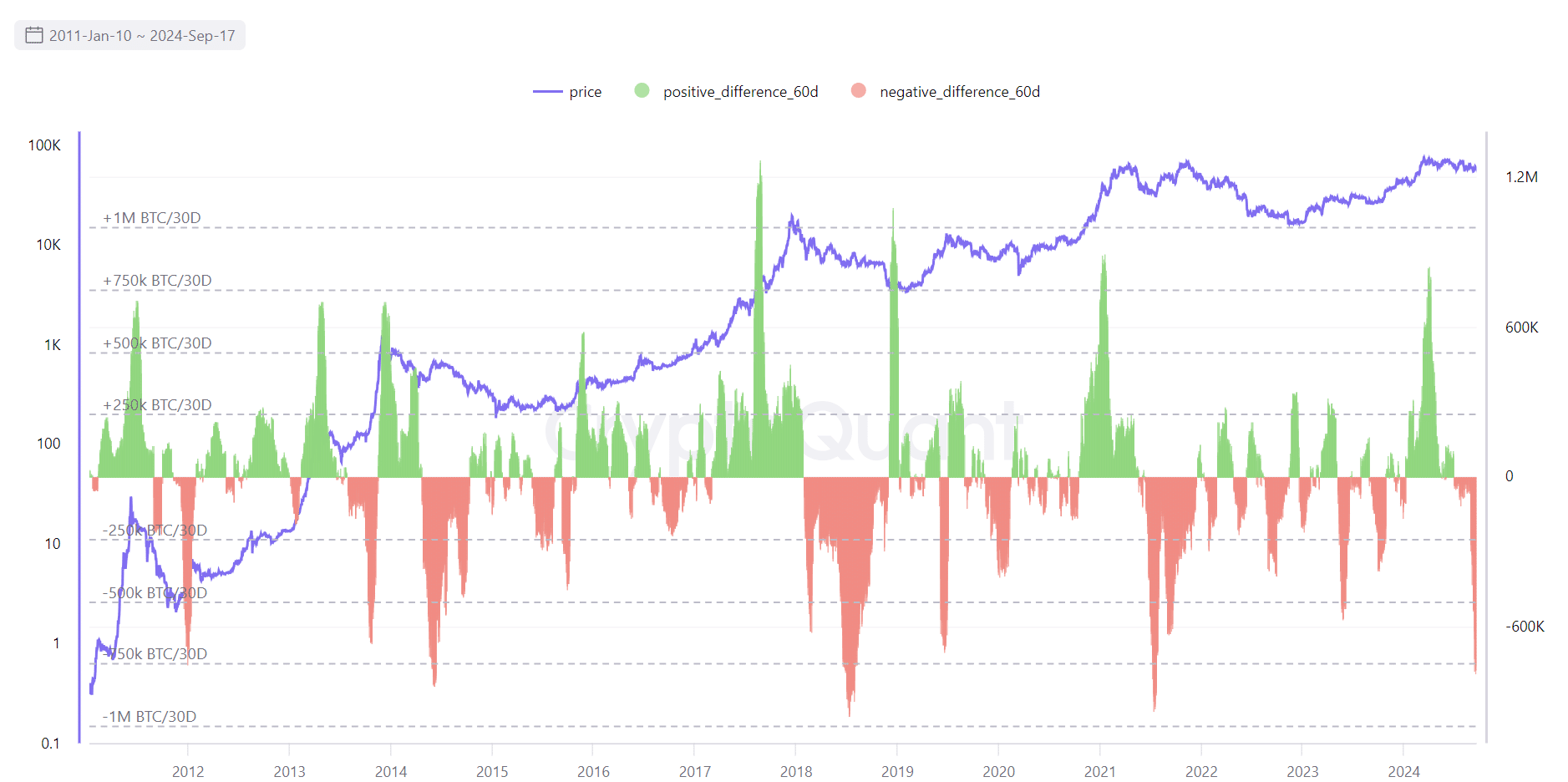

STH exit poses a real threat

Based on AMBCrypto’s interpretation of the graph, an increase in the negative net position of STH typically indicates a market peak, which is likely to be followed by a downward trend.

Essentially, a Short Tether (STH) event usually takes place as Bitcoin (BTC) approaches significant resistance levels. Once this happens, the subsequent drop in price is often due to these entities choosing to sell their holdings prior to any potential price decrease.

Source : CryptoQuant

Unlike what many people think, if this trend continues, the $60K – $61K zone could potentially function as a barrier (resistance) instead of a support.

If bulls lose their grip, Bitcoin could potentially pull back to the $51K support level before experiencing a possible correction.

To verify this pattern, AMBCrypto investigated long-term investors. Should $60K mark the next low point, it could signify a good chance to purchase at a discount.

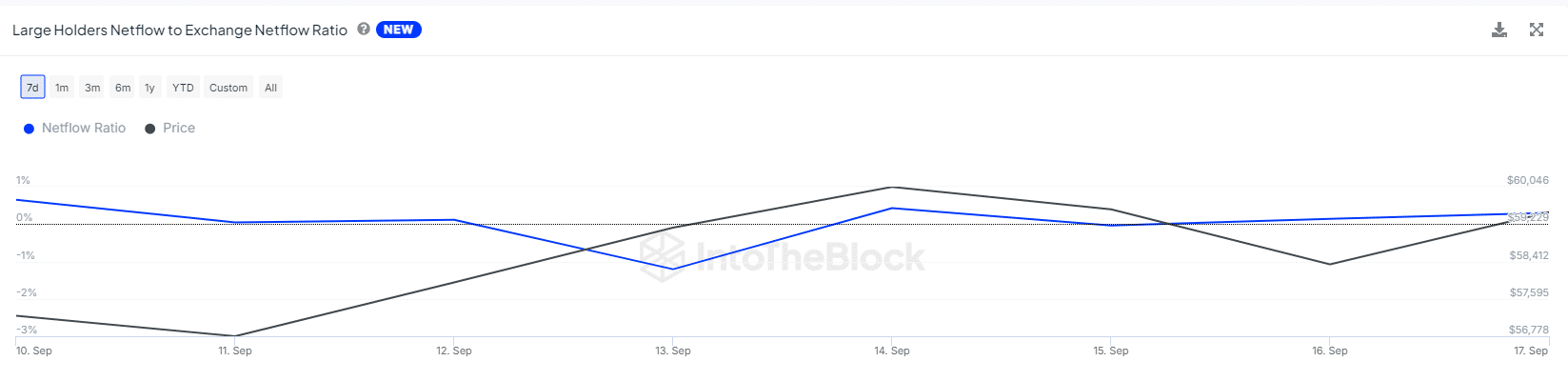

Large cohorts hold the key to the top

As Bitcoin reaches significant resistance points, short-term investors are modifying their portfolios. Meanwhile, long-term investors are selling off to preserve the $60,000 area as the potential new support level.

Today’s netflow ratio stands at 0.30%, which is double the figure recorded yesterday, suggesting a growing influence of major investors, as indicated in this post.

Source : IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024-25

Sixty thousand dollars is a crucial area of contest, where temporary investors consider it as a possible floor for the market, strengthened by increasing apprehension.

The firm foundation for a turnaround at $60,000 relies heavily on long-term investors, whose decisions might potentially contradict the theory suggesting a price floor.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-19 05:11