- The Bitcoin fear and greed index has shifted to a neutral score of 48, indicating balanced market sentiment.

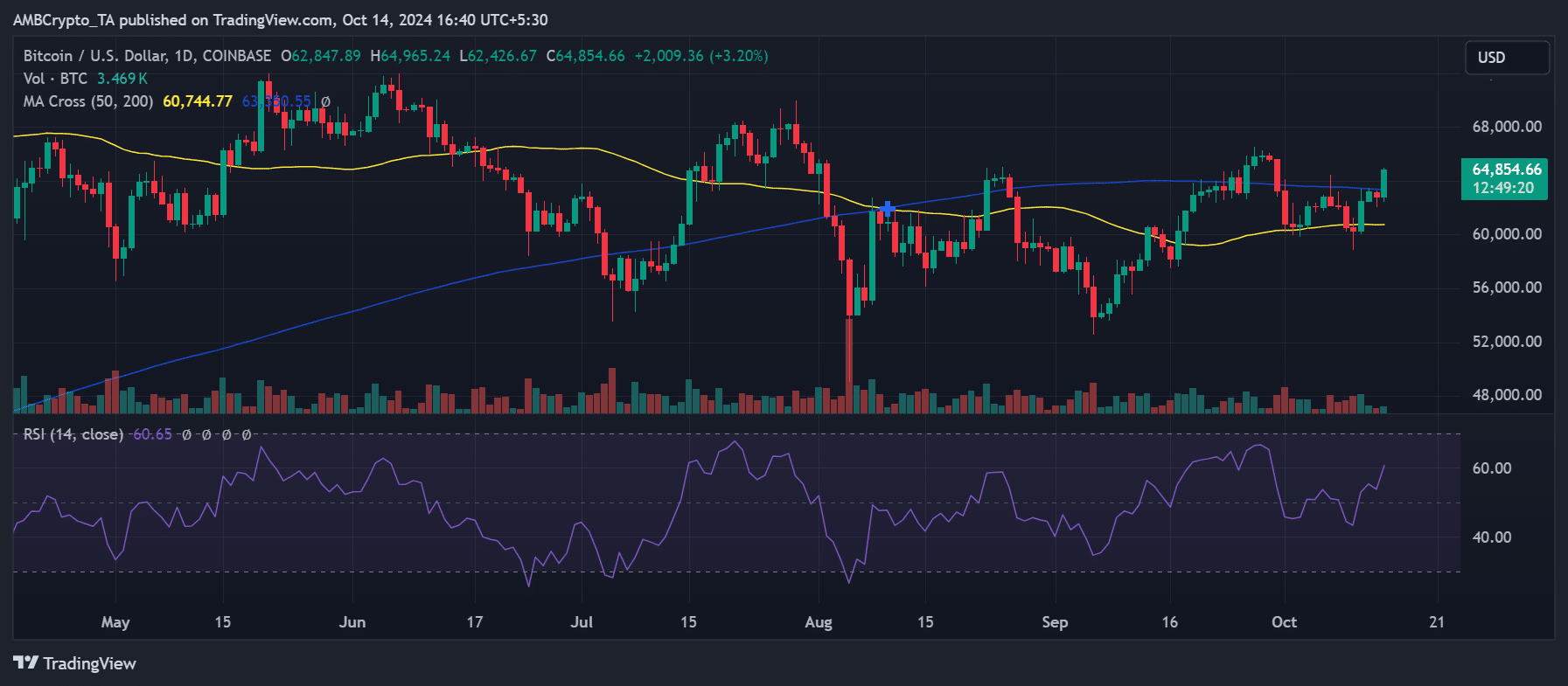

- Bitcoin has broken past its 200-day moving average, currently trading around $64,850 after a 3% increase.

Over the last several days, Bitcoin’s [BTC] journey has felt like a wild roller coaster ride due to its fluctuating price trends. Nevertheless, emerging information indicates that the market’s emotional state may be gradually becoming more steady.

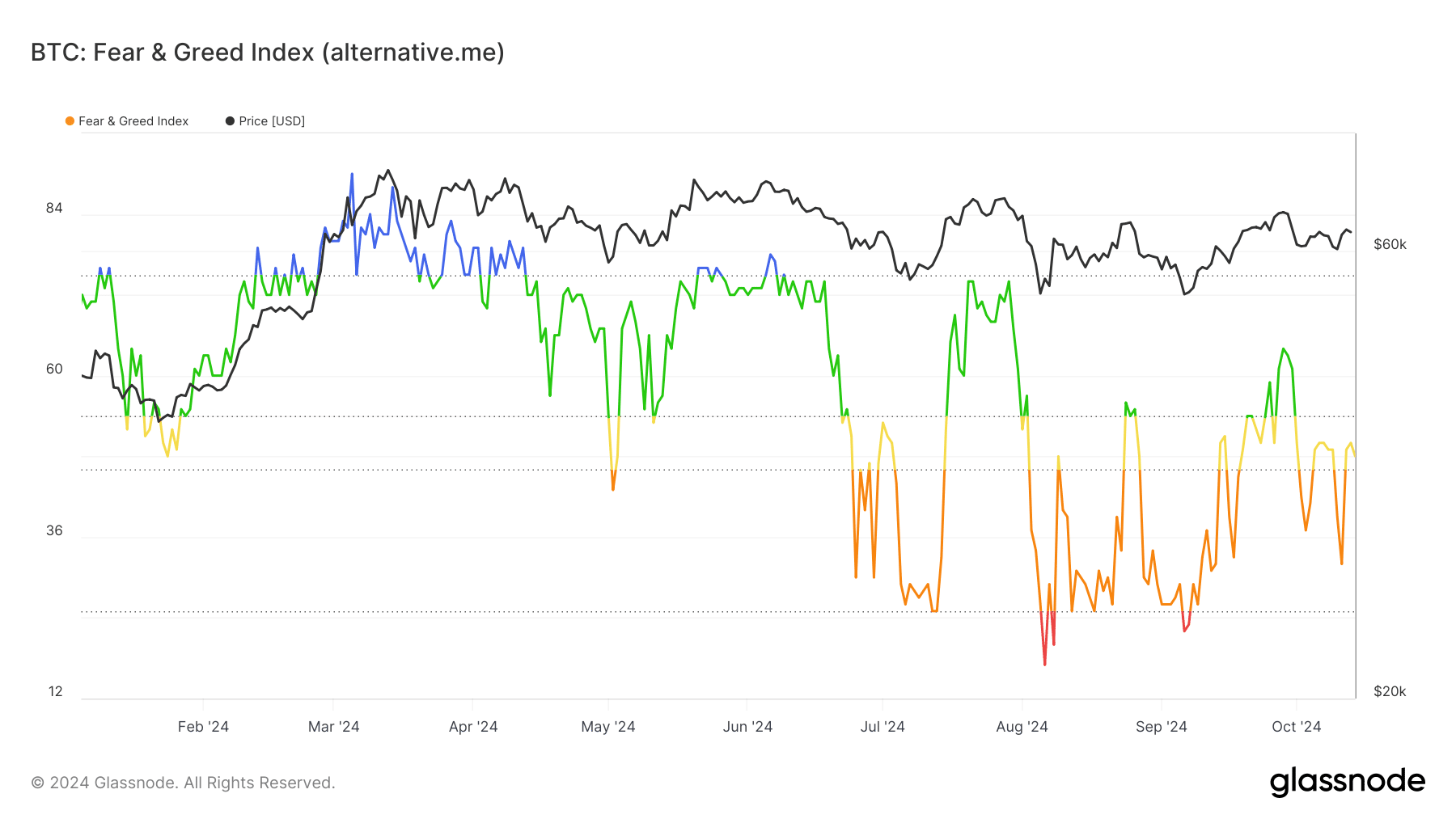

According to the Bitcoin Fear and Greed Index, the sentiments of traders have moved away from intense feelings of fear and greed, leaning towards a more balanced or neutral stance.

Bitcoin fear and greed index turns neutral

Based on reports from Glassnode, the Bitcoin Fear & Greed Index stood at 48 at the current moment, indicating a neutral attitude among investors. This represents a change from the intense fear and greed that ensued after the latest price volatility.

The index, which gauges market sentiment based on factors like volatility, volume, and social media trends, suggests that traders are adopting a wait-and-see approach after a period of intense market movements.

Last Monday, specifically on October 11th, the index experienced a decline to 32, mirroring a sense of apprehension among traders. Remarkably, this dip occurred concurrently with Bitcoin’s surge in value, reaching around $62,000.

Even though prices were on an uptrend, there was a general air of caution, probably as a response to previous drops in price.

BTC moves with fear and greed sentiment

As a cryptocurrency investor, I noticed from AMBCrypto’s analysis that the dip in the Bitcoin Fear and Greed Index on the 11th of October seemed to be a response to the recent price fluctuations of Bitcoin itself.

Previously, when prices hadn’t risen yet, Bitcoin experienced several decreases that lowered its worth approximately to $60,000. This value fell beneath the 50-day moving average (represented by the yellow line), which functioned as a significant level of support.

On October 11th, the market surprisingly made a comeback. This surge resulted in a 3% rise for Bitcoin, which bumped its value back up to around $62,500 and surpassed its 50-day moving average.

Despite this, the price remained under its 200-day moving average (blue line), a stronger resistance level.

As of this writing, Bitcoin is trading at approximately $64,850, gaining another 3%.

Recently, this positive trajectory enabled Bitcoin (BTC) to surpass its 200-day moving average, a barrier that previously hindered it at approximately $63,000.

The mix of these price fluctuations and the balanced feeling reflected on the Bitcoin Fear & Greed scale indicates that the market is exhibiting a careful level of optimism.

Active addresses remain stable

Regardless of the Bitcoin Fear & Greed Index suggesting a balanced outlook, the number of active Bitcoin users has remained strikingly consistent.

According to data provided by Santiment, approximately 3.5 million crypto wallets were actively used every day over a period of seven days, with little variation in the number.

Currently, around 3.52 million active wallets are interacting with the network, indicating consistent user involvement.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A consistent level of active addresses suggests continued engagement from long-term investors, potentially laying the groundwork for future price growth.

Regardless of changing opinions, the consistent level of network activity could indicate that Bitcoin’s long-term perspective is still optimistic.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-15 07:04