- Bitcoin showed strong bullish signals, with high dominance and investor confidence at an extreme level.

- Bullish trends showed signs of continuing, but volatility risks remained due to exchange behaviors.

As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself increasingly optimistic about Bitcoin’s current trajectory. The extreme greed level of 83 on the Fear and Greed Index speaks volumes about the market’s bullish sentiment, which is further validated by the surge in investor interest as evidenced by the NVT golden cross.

As an analyst, I’m observing a robustly bullish trend in Bitcoin [BTC], as evidenced by the Fear and Greed Index soaring to 83. This extreme greed level suggests that investors are brimming with confidence and their enthusiasm for the market is skyrocketing.

Currently, one Bitcoin is being exchanged for approximately $98,503.78, marking a 0.85% decrease over the past day. While this decline might indicate a robust bullish trend, it also stirs up doubts about whether Bitcoin can maintain its upward trajectory or encounter a market reversal instead.

Bitcoin fear and greed shows…

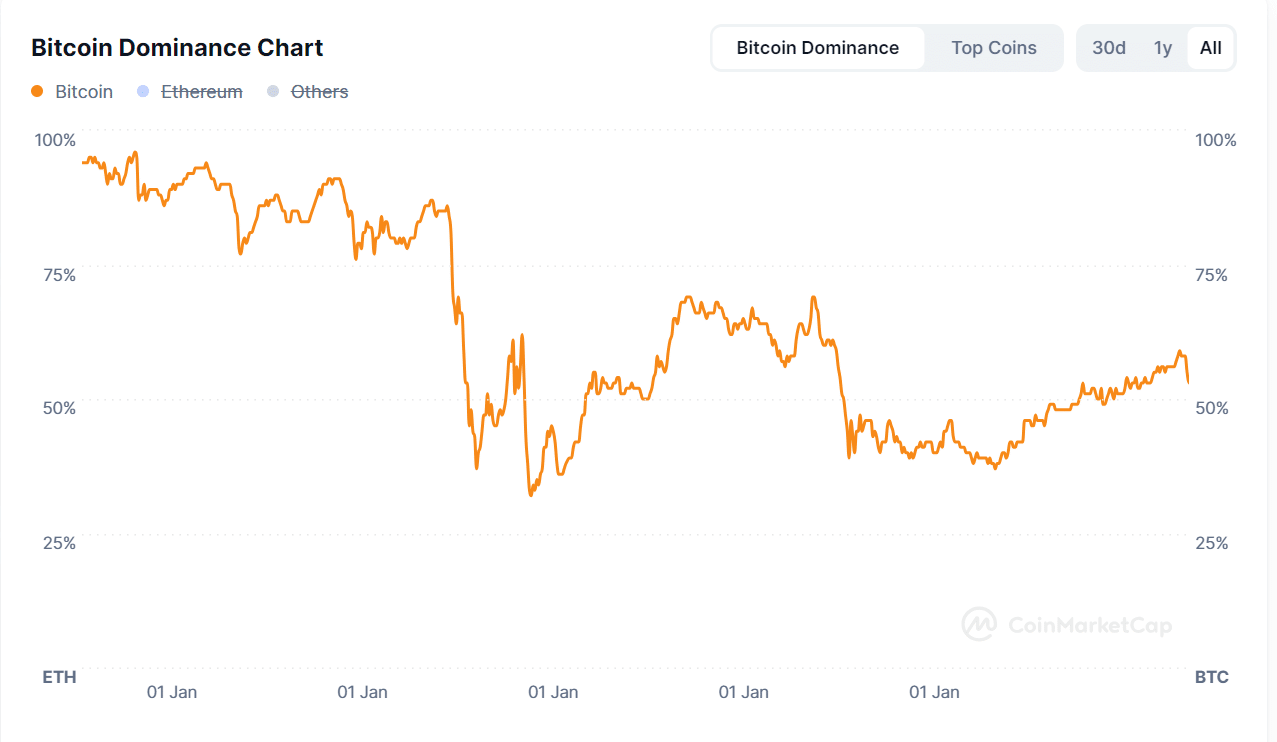

At the moment, Bitcoin’s control over the cryptocurrency market was approximately 54.5%. This shows how influential it is within the broader market. Interestingly, there was a decline of -3.5% in Bitcoin’s value on a daily basis, suggesting that there might be an increasing focus or interest in alternative cryptocurrencies (altcoins).

It seems as though other digital currencies may be growing in power, potentially affecting Bitcoin’s leading position in the near future.

Keeping a close eye on Bitcoin’s dominance can offer valuable insights about market trends and potential shifts in the power distribution among cryptocurrencies.

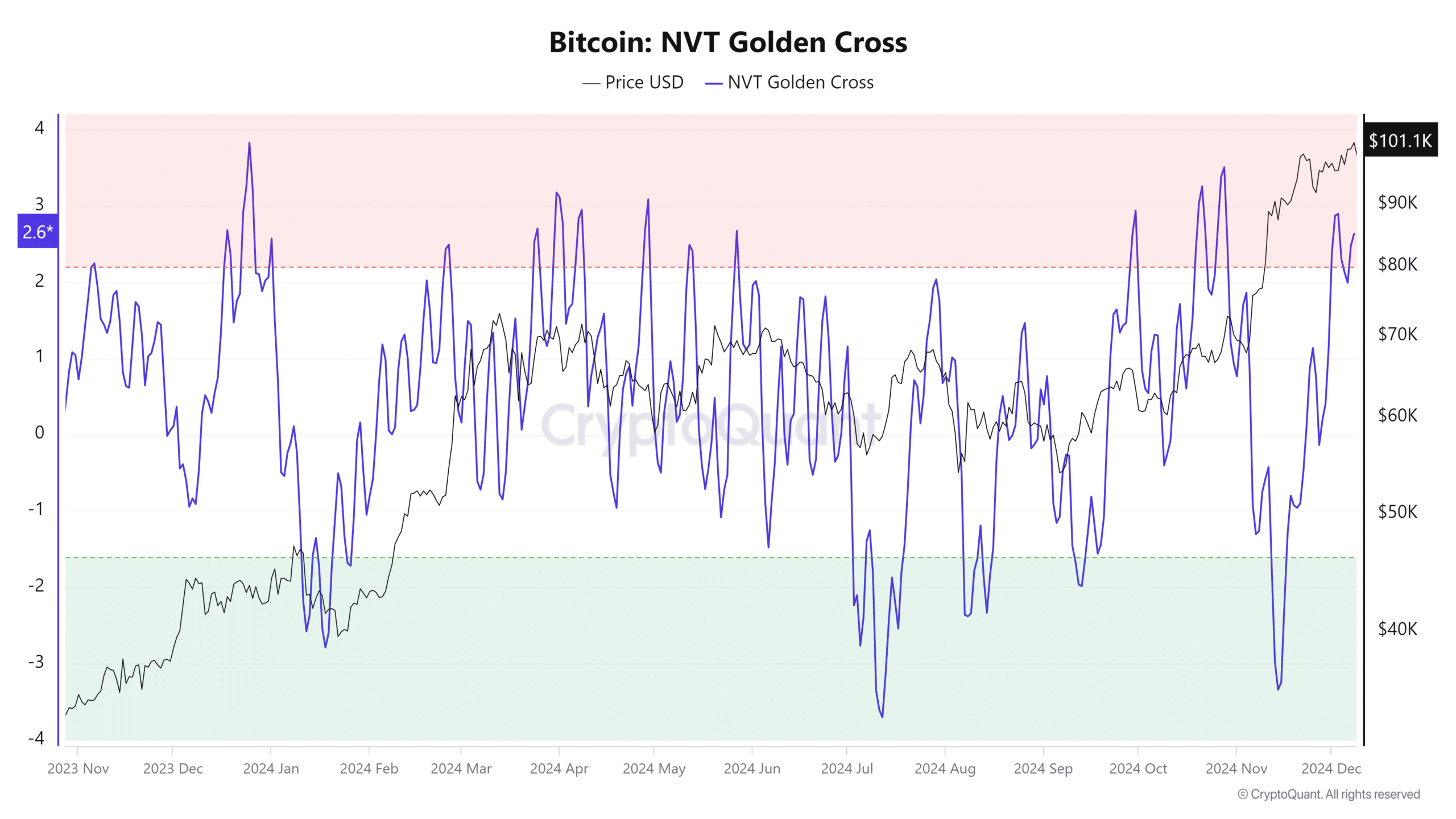

A surge in investor optimism

Bitcoin’s Network Value to Transactions (NVT) ratio saw a significant 7.84% daily spike, climbing up to 2.6. This increase suggests a rising level of investor attention on Bitcoin’s worth relative to its transaction activity.

Generally speaking, this kind of rise often signifies a positive, optimistic attitude among traders and a stronger belief in the market’s future. Furthermore, it implies that the Bitcoin network’s key performance indicators might draw in additional investors, potentially causing prices to climb higher.

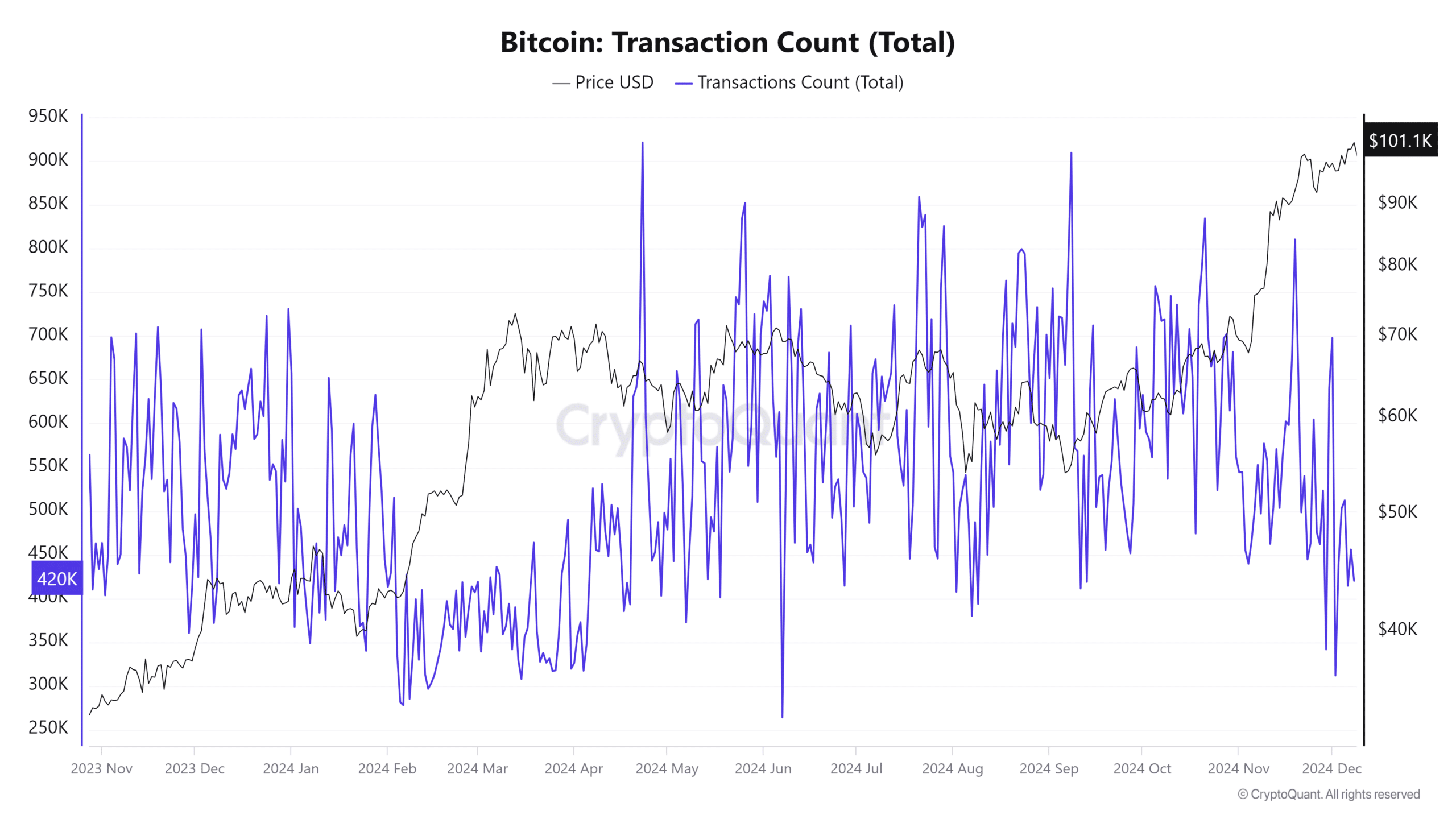

THIS boosts bullish sentiment

Bitcoin’s transaction count saw a daily increase of 0.94%, reaching 428.184k transactions. The rise in activity highlighted a more active BTC network and higher engagement among users.

Engaging in this action suggests increased investor enthusiasm and a greater chance of sustained optimistic market movements.

Consequently, a greater number of transactions boosted Bitcoin’s standing in the market, reinforcing its optimistic perspective.

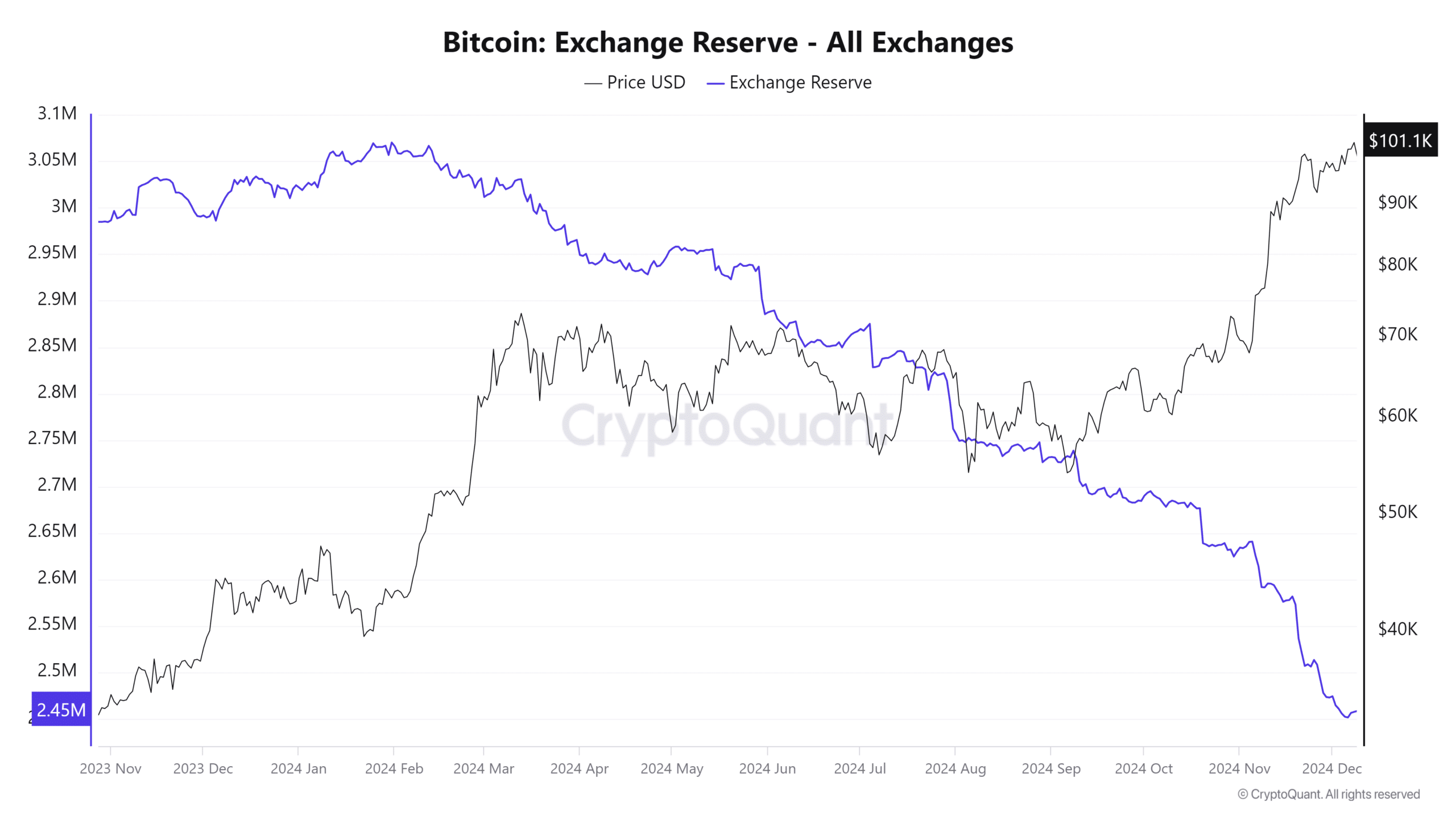

Investor confidence grows

Bitcoin exchange reserves dropped by 0.04% in 24 hours, now at 2.4573 million BTC at press time.

As a crypto investor, I’ve noticed a growing trend where BTC holders are transferring their assets away from exchanges. This could be to personal wallets for safekeeping or long-term storage. This action reduces the immediate selling pressure in the market, which in turn boosts optimism among bullish investors.

Bullish investors hold steady

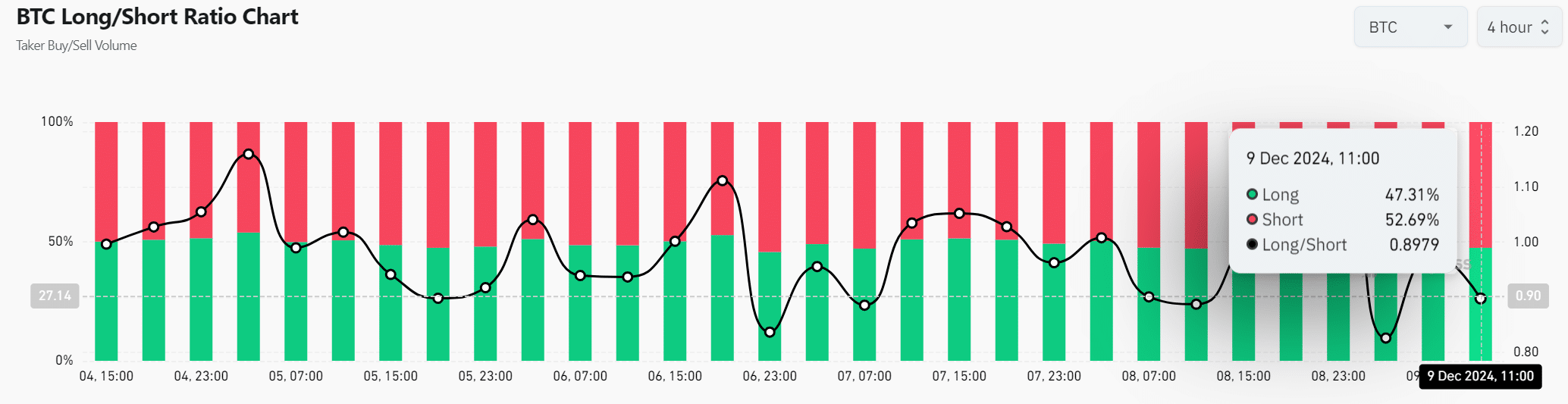

The proportion of Bitcoin being held long (bought) was approximately 47.31%, while the proportion being held short (sold) was around 52.69%. This means the Long/Short Ratio was 0.8979, suggesting that short sellers hold a slight advantage. However, the high level of long interest indicates a strong bullish outlook among investors.

Therefore, BTC remains resilient, with a positive outlook despite market fluctuations.

Bitcoin’s Fear and Greed Index at 83 suggests an extremely bullish market outlook.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite some positive growth and declines observed in areas like market share, transaction volume, and exchange holdings according to recent data, it’s still plausible that we could see a readjustment happening.

If the current trends persist, Bitcoin may keep rising, but it’s crucial for traders to stay alert for any sudden market fluctuations.

Read More

2024-12-10 05:11