- Bitcoin has a bullish structure but failed to follow through on the breakout.

- Fears of a local top due to social media buzz played out in the past four days.

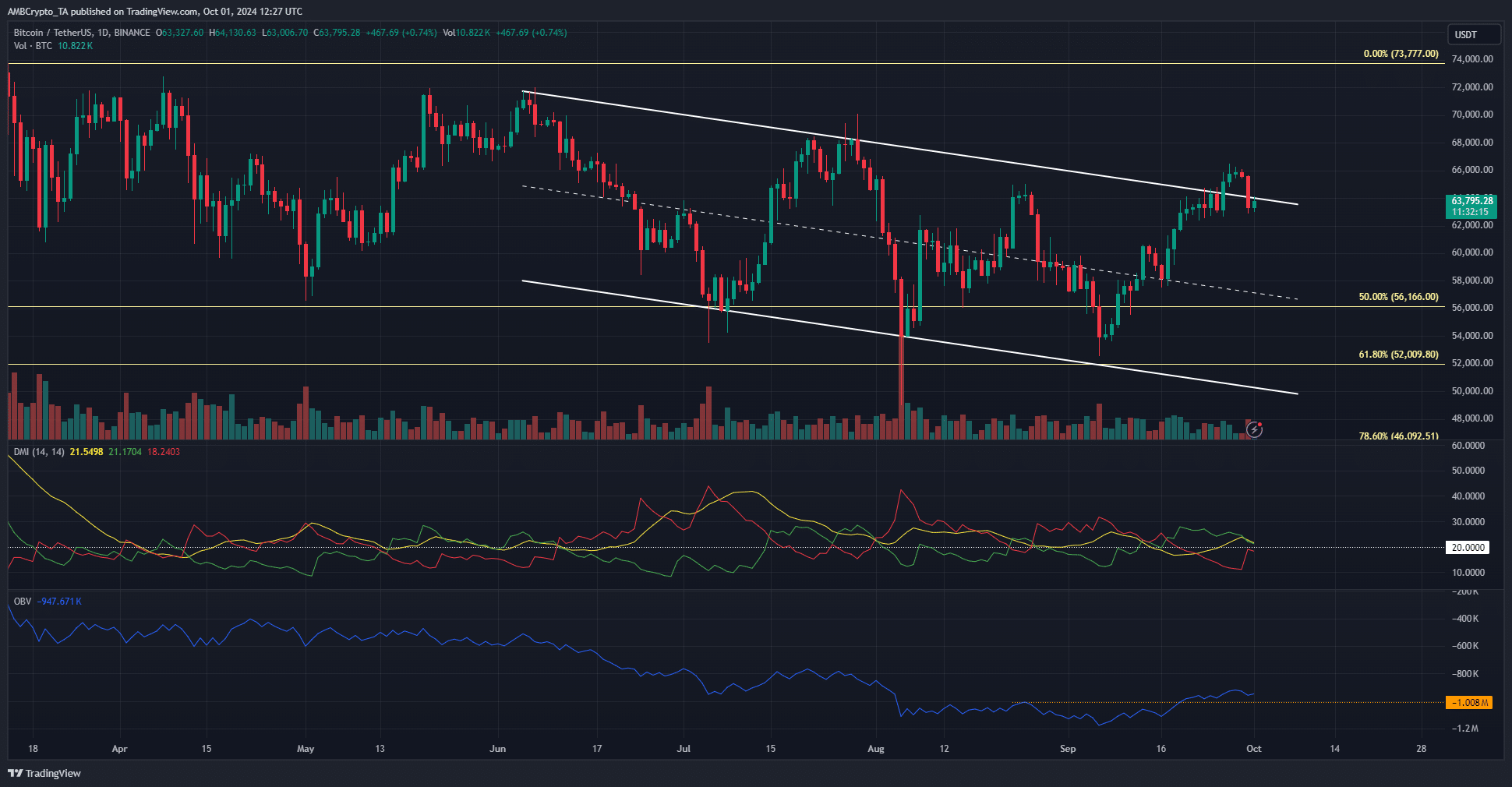

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen more than a few bullish breakouts fail to follow through. The recent Bitcoin [BTC] breakout from its descending channel is one such instance. While the technical structure was promising, the lack of conviction from buyers has led to a correction.

As a researcher, I’ve observed an intriguing development with Bitcoin [BTC]. Since July, it had been confined within a descending channel. Yet, this pattern was shattered as BTC surged to a local peak of $66.5k. However, following this high, the price trend shifted direction, marking a reversal in its upward momentum.

On X’s latest post, Santiment’s crypto market insights team pointed out a highly optimistic public sentiment. This could potentially lead to a market peak and possible mass sell-offs if Bitcoin prices were to further drop.

The near 5% price drop on Monday vindicated this idea. Is the market ready to recover, or was that the local top?

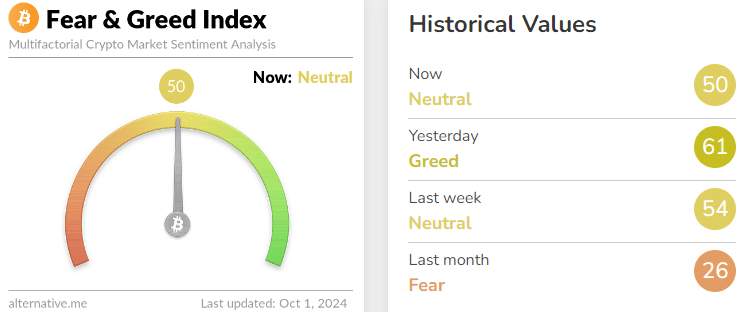

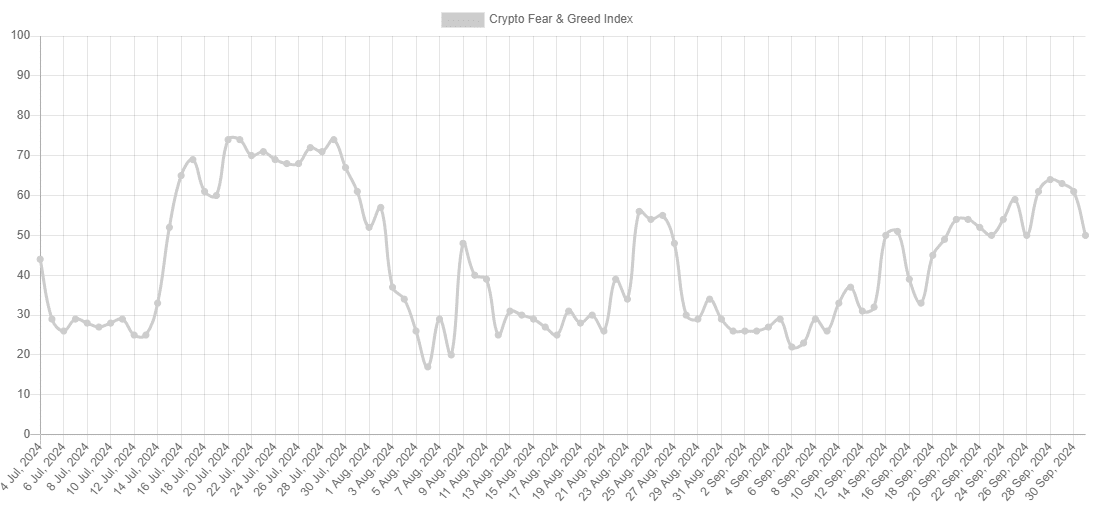

Bitcoin Fear and Greed Index

Examining the balance between fear and enthusiasm in market behavior indicates that investors should not feel alarmed. At present, the overall feeling is neutral, and it’s been either neutral or fearful for the past few weeks.

The score is calculated using different data points such as volatility, market volume, social media engagement, and the Bitcoin dominance trends and Google Trends scores.

Additionally, AMBCrypto examined the Bitcoin Fear and Greed Index’s ratings for the previous three months. During September, particularly in its second half, the index experienced a significant increase in its score.

This was still not enough to push the market into “greedy” territory.

The failed channel breakout

Since June, we’ve seen a pattern where prices reach successively lower peaks and troughs. On August 25th, the price peaked at $65k but fell below this level recently, which is a concerning sign because it also broke through the high points of the downward-sloping channel.

The brief surge in BTC didn’t persist for too long. In just four days, it experienced a 4.7% adjustment, dropping back within its range and under the resistance zone of $64k to $66k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Although the OBV (On-Balance Volume) has surpassed the local high from August, it hasn’t done so significantly. The absence of further price advance indicates that bulls were hesitant in their short-term commitment, preferring to secure their gains rather than pushing for more.

During the breakout, the DMI indicated a robust upward movement. Both the +DI and ADX remained above 20, though they have been trending downward. It’s probable that the price will find support around $60k to $61.5k next.

Read More

2024-10-02 06:15