- Bitcoin’s total fees have dropped to a three-month low.

- Due to this, miners’ revenue derived from fees has declined.

As an analyst with a background in blockchain and cryptocurrency research, I find the recent development in Bitcoin’s network fees and miner revenue quite intriguing. The three-month low in Bitcoin’s total fees has led to a significant decline in miners’ revenue derived from fees.

The cost of fees on the Bitcoin [BTC] network has reached a new low, mirroring the decreased usage of the main network for transactions.

This week, IntoTheBlock, a Bitcoin on-chain data provider, announced on their post (previously known as Twitter) that transaction fees on the Bitcoin network reached their lowest point in the past three months.

Last week, the network recorded transactions amounting to $12 million, marking a 45% decrease compared to the total from the preceding week.

State of the network

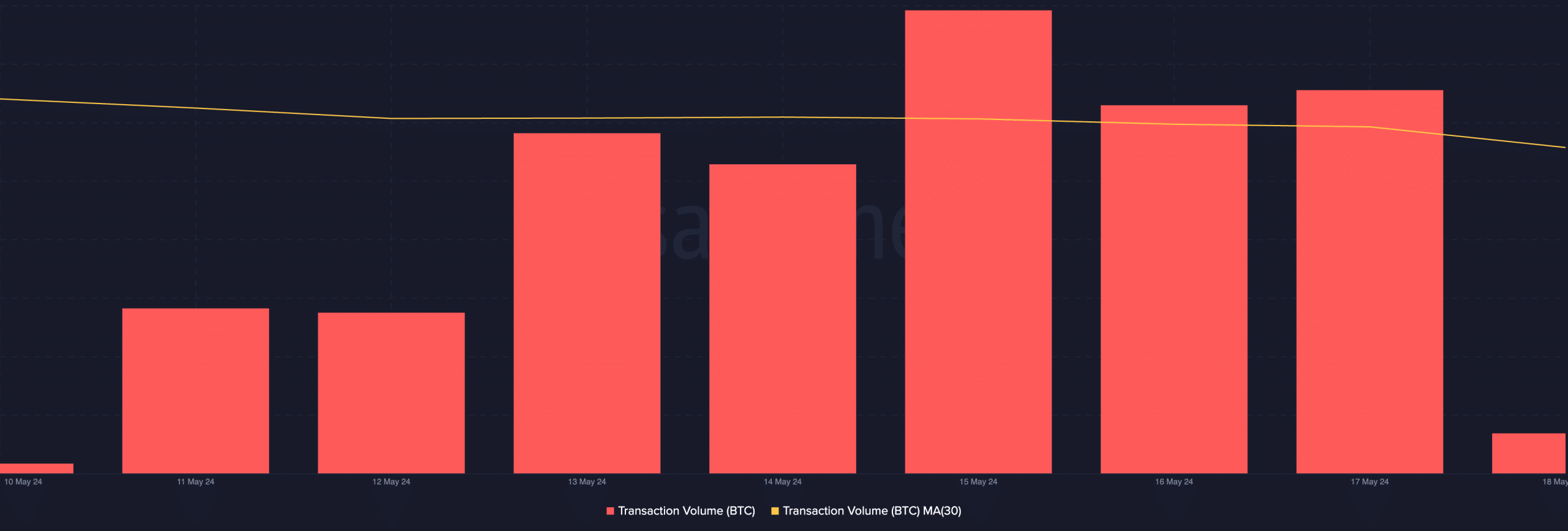

This week’s decline in the Bitcoin network’s fee is due to the decrease in its transaction volume.

Based on Santiment’s findings, I noticed that the total bitcoin (BTC) transferred in all network transactions declined consistently throughout the week.

Between the 11th and the 17th of May, Bitcoin’s transaction volume plummeted by 5%.

During the reviewed timeframe, the typical transaction fee on the network decreased by 17%, indicating a drop in demand that led to lower fees being charged on average. (Messari’s data suggests this decline.)

At press time, the average cost of executing a transaction on the Bitcoin network was $2.56.

The miners on Bitcoin’s network are the primary victims of its low network fees.

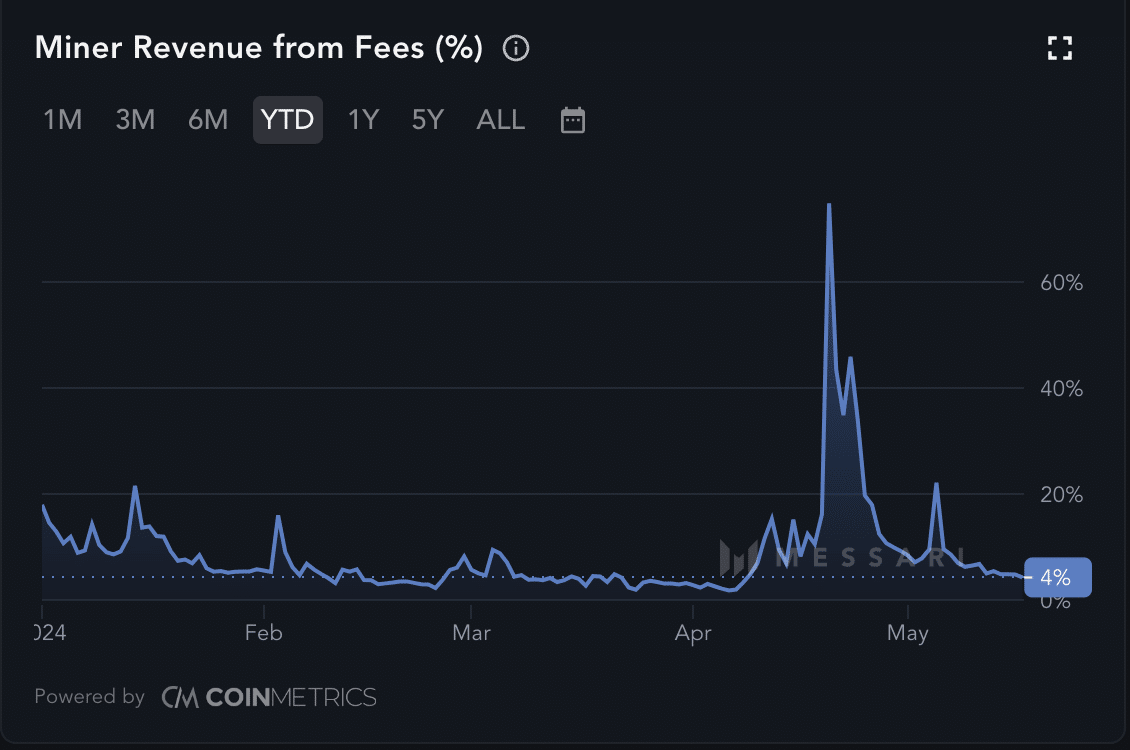

As a researcher studying mining revenues in the cryptocurrency market, I’ve observed an intriguing trend. Specifically, transaction fees contributed to miner revenue reached a peak of 75% on the 20th of April this year, following the halving event. However, since then, there has been a noticeable decrease in this percentage.

Based on current data from Messari, I’ve observed that just 4% of mining revenues in the market come from transaction fees generated by Bitcoin users as of now. This represents a significant drop, amounting to a 95% decline from the year-to-date peak.

Miners offload coins to prevent losses

Low revenue and BTC’s recent price troubles have forced some miners to sell their holdings.

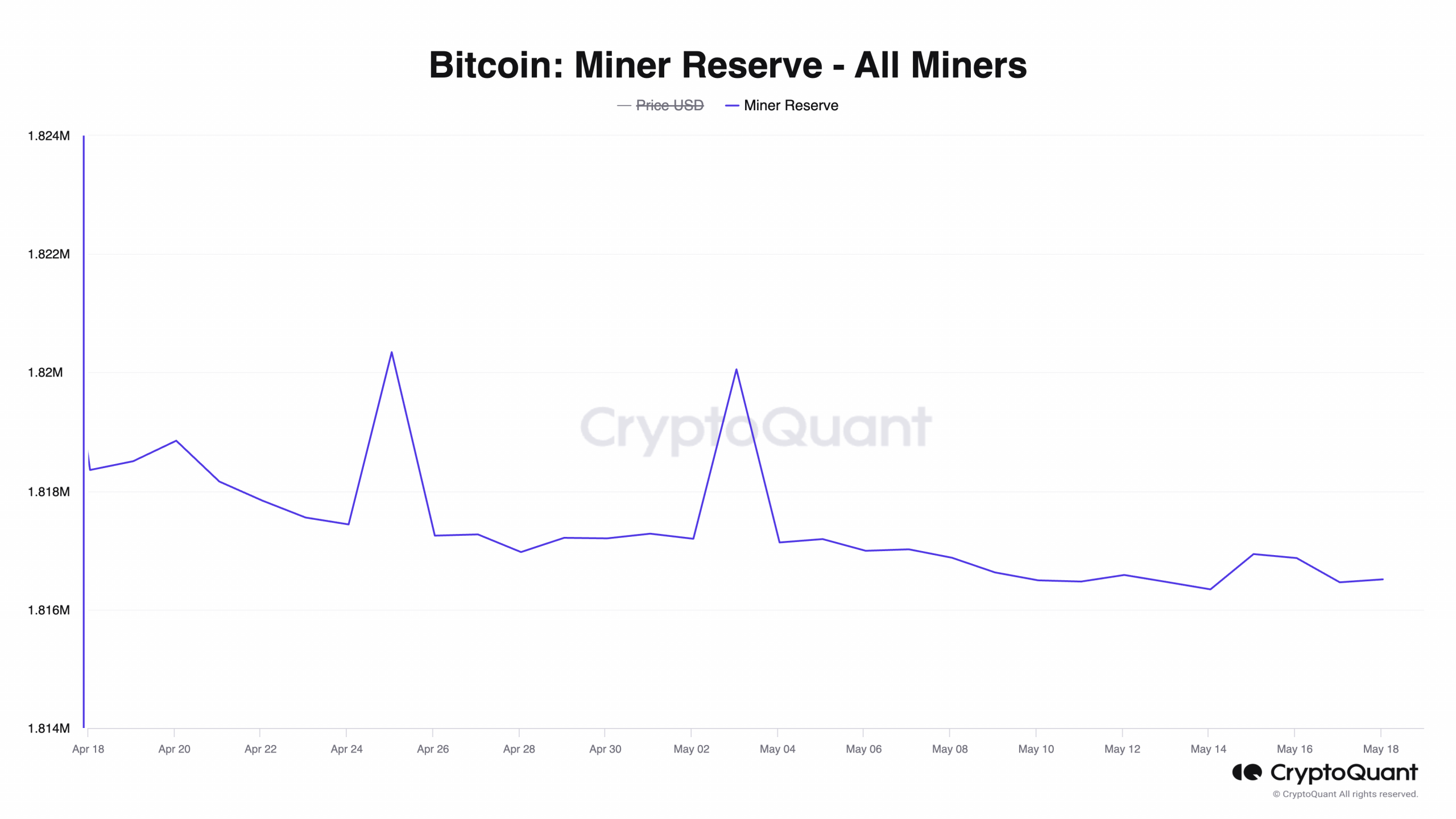

As a researcher examining the miner supply ratio of Bitcoin, I’ve discovered a decrease of 0.21% since the most recent halving event.

this indicator reflects the proportion of Bitcoins held by miners against the entire circulating supply. A decrease in this ratio signifies that miners are offloading a greater quantity of their newly-mined Bitcoins.

As a crypto investor, I frequently encounter situations where I consider selling a particular coin for various reasons. Sometimes, these decisions are driven by the high operational costs that are no longer sustainable for me. Other times, I may be tempted to take profits and secure gains from my investments. Lastly, if I’m uncertain about the future price of the coin or have doubts about its potential, selling might seem like the best option.

Miners selling Bitcoins from their holdings on the network has resulted in a decrease in the Bitcoin supply held by miners during a particular time frame, which is referred to as the Miner Reserve.

Based on information from CryptoQuant, Bitcoin’s miner reserves currently amount to approximately 1.81 million coins as of now. This represents a 1% decrease in comparison to the figure reported on the 25th of April.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-18 23:03