- Around 4.27% of Bitcoin’s supply was backing spot exchange-traded funds at press time.

- Analyst forecasts a market peak between November 2024 and February 2025.

As a seasoned researcher with over two decades of experience in financial markets, I can confidently say that the current state of Bitcoin is nothing short of intriguing. Having closely followed the cryptocurrency market since its inception, I’ve witnessed numerous ups and downs, but the growth of Bitcoin in 2024 has been particularly noteworthy.

Bitcoin (BTC) once again underscores its dominance as the top cryptocurrency. Following almost a month of holding steady and moving laterally, it surpassed previous records by breaking through the $80,000 mark.

In the past day, the value of the cryptocurrency increased by more than 5%. Moreover, in just the previous seven days, it surged by around 18%, as observed using data from CoinMarketCap, according to AMBCrypto.

Bullish environment for growth

The surge in Bitcoin can be attributed to overall optimism within the financial markets, significantly boosted by the Securities and Exchange Commission’s (SEC) approval of Bitcoin exchange-traded funds (ETFs) in January.

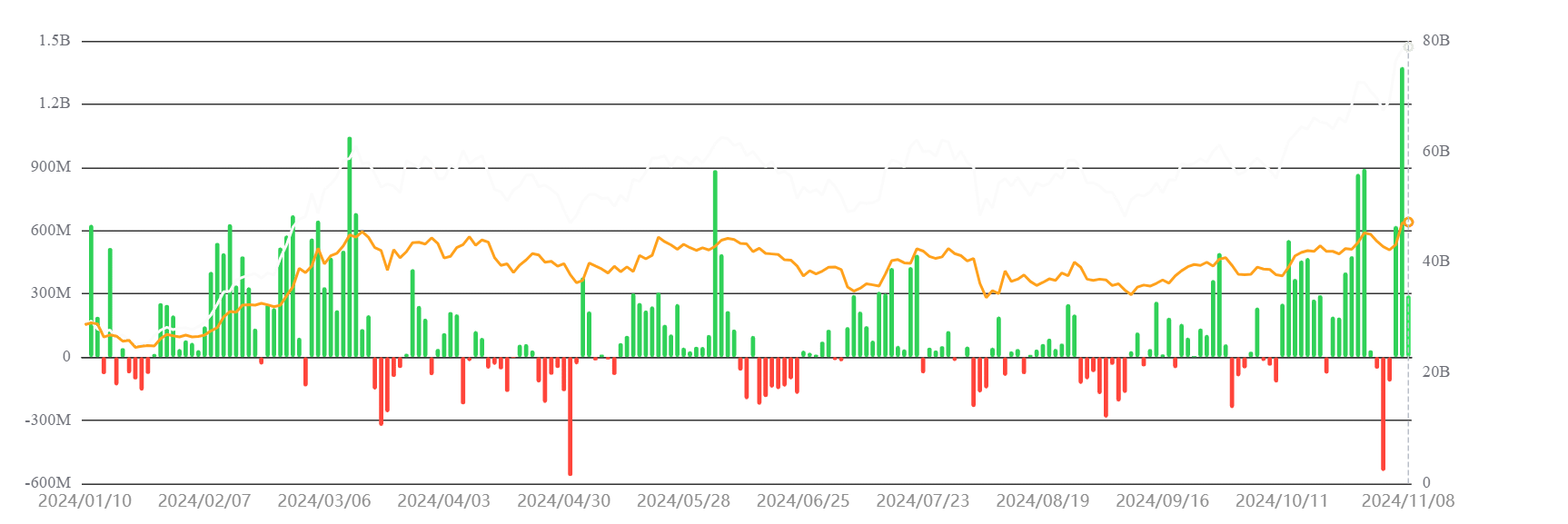

Approximately $26 billion in Bitcoin has flowed into these funds since their launch, as reported by AMBCrypto’s study using SoSo Value data.

Moreover, there’s been a significant increase in inflows into the Grayscale Bitcoin Trust (GBTC) after an early wave of outflows.

At present, the value being managed through Bitcoin spot ETFs amounts to approximately $79 billion, which represents around 5.21% of the overall Bitcoin supply.

There are other reasons outside of crypto that might explain Bitcoin’s performance.

Inflation has cooled significantly in the last few months. The job market has grown better too.

During the recent FOMC meeting, the U.S. Federal Reserve (Fed) chose a more accommodating stance, opting to keep interest rates unchanged.

It was widely agreed by investors and decision-makers that interest rates wouldn’t be adjusted during the upcoming meeting. However, there might be a potential reduction in rates later in the year if inflation remains under control.

This development enables individuals to begin investing in speculative assets such as stocks and cryptocurrencies, which carry a higher level of risk.

Bitcoin to get scarcer and dearer?

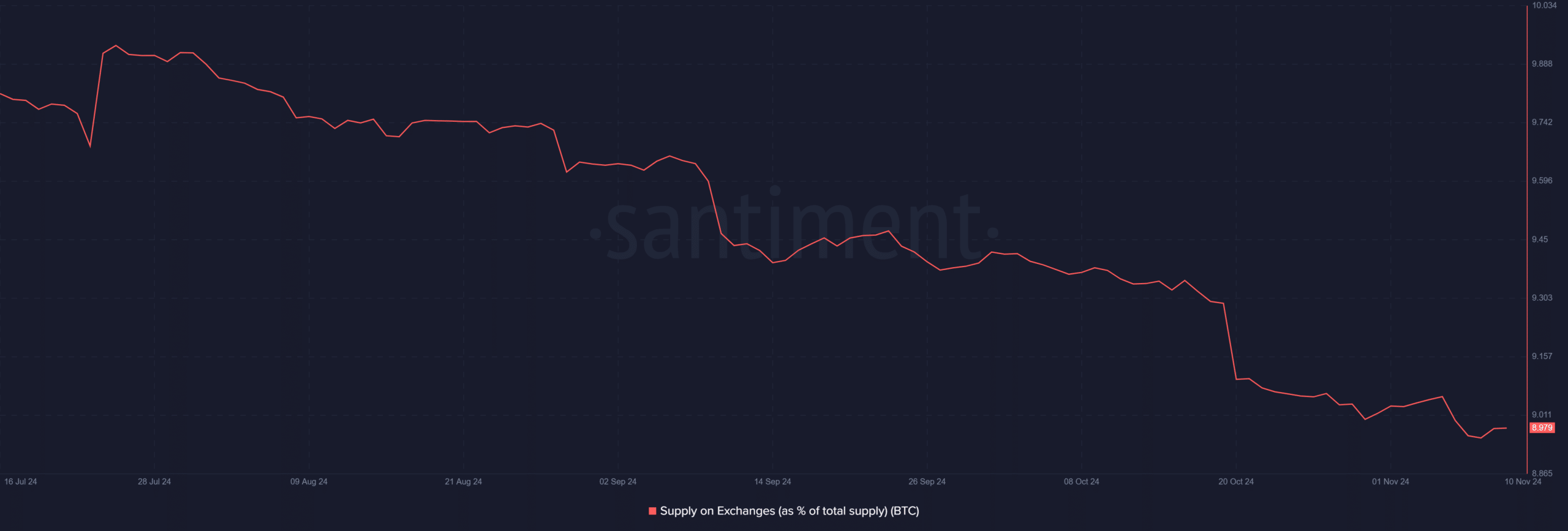

As more Bitcoins are held within Spot Exchange-Traded Funds (ETFs), there’s growing scarcity observed in the wider Bitcoin market.

According to an analysis by AMBCrypto using Santiment data, there has been a decrease in the volume of transactions on cryptocurrency exchanges.

To add to that, currently, roughly 9% of all Bitcoins in circulation are stored on exchanges, which is a decrease from approximately 12% at the beginning of 2024.

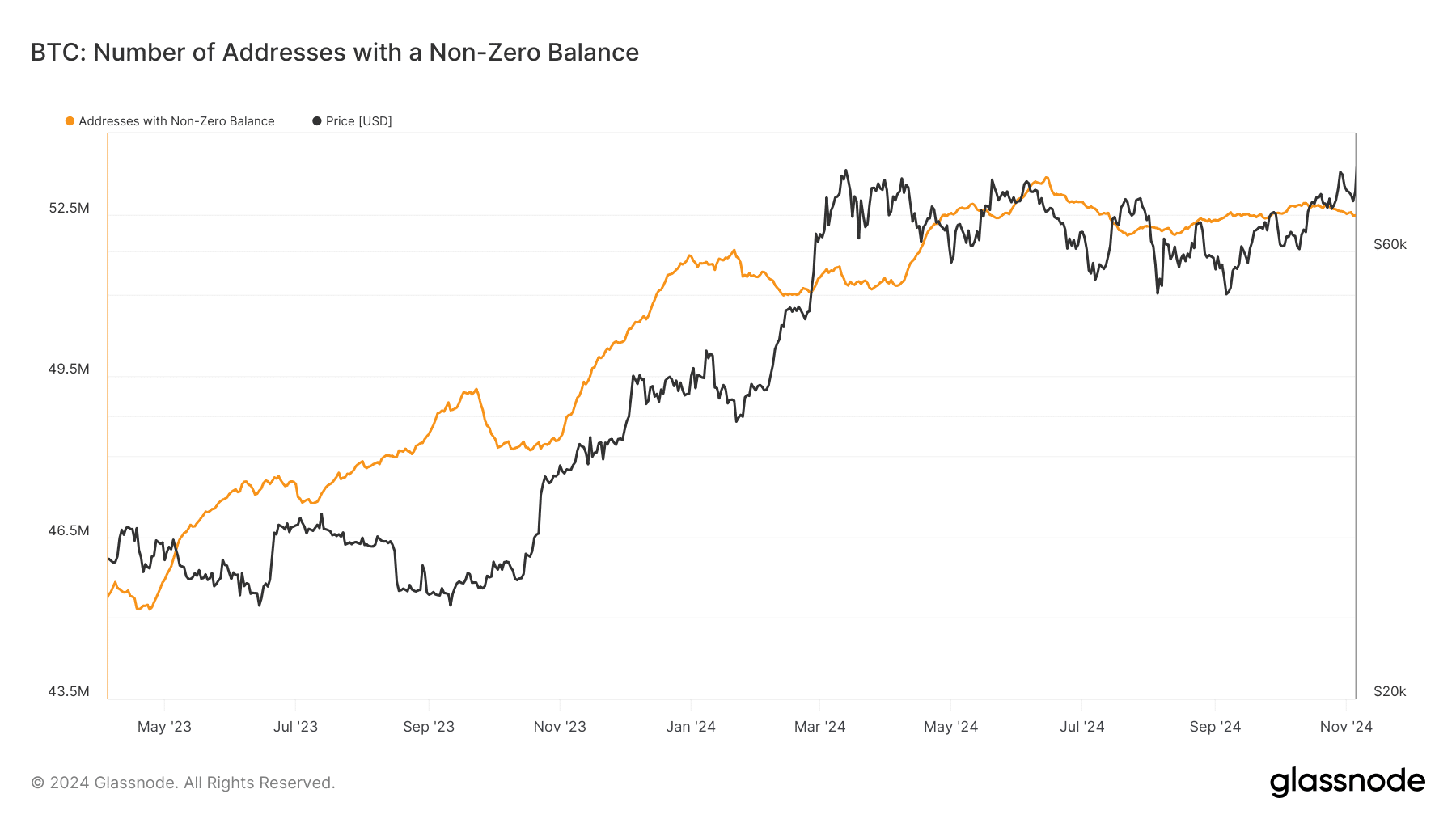

Furthermore, as supply dwindled, there was no decrease in demand. In contrast to previous bull markets, the Bitcoin surge in 2024 was fueled by a combination of retail and institutional enthusiasm.

As a crypto investor, I’ve noticed an interesting trend using Glassnode. AMBCrypto recently pointed out a significant surge in the number of ‘whale’ entities holding around 1,000 coins. This rise has been apparent since early 2024, and even more intriguingly, the number of addresses with any balance (small or large) has also increased during this period.

Rocket set for the moon?

In this optimistic outlook, a decrease in supply availability and an increase in demand interest could potentially drive Bitcoin prices to unprecedented peaks during this phase.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to technical analyst Ali Martinez’s previous forecast, the market peak is expected to occur some time within the range of November 2024 to February 2025.

It appears that starting at $80,000 is merely the beginning, given the impressive amount of fuel our rocket holds, which seems sufficient for a lunar journey.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-11 07:36