-

Bitfarms mined 189 BTC in June.

The mining firm now holds over 900 BTCs.

As an experienced financial analyst, I’ve closely monitored the developments in the cryptocurrency mining sector, and the latest news from Bitfarms has piqued my interest. The company reported a significant increase in Bitcoin production for June, mining 189 BTC compared to 156 BTC in May. This improvement resulted in approximately $8.8 million in sales revenue.

Bitfarms, a notable company in the crypto mining industry, released its June earnings report, revealing significant financial progress compared to previous periods.

Amidst a formidable corporate test, when an attempt was made to seize control of the company, this encouraging advancement transpired. The company admirably thwarted the takeover effort.

Bitfarms ups its earnings

As a cryptocurrency mining industry analyst, I’m here to share insights based on recent developments. Notably, Bitfarms, a key player in our sector, announced an uptick in their Bitcoin (BTC) production for the month of June. This information was disclosed through a press release that dropped on my desk on July 1st.

In June, the company effectively extracted 189 Bitcoins from the mining process, marking a significant increase compared to the 156 Bitcoins mined in May. From the profits generated in June, they sold off around 134 Bitcoins for roughly $8.8 million.

Currently, the company holds 905 Bitcoin in its treasury, valued at around $57 million.

Although Bitfarms showed strong results in June, an analysis based on previous years’ data uncovered a substantial decrease in efficiency. As of this point in 2023, the company had amassed 2,520 Bitcoins.

However, its earnings to date in 2024 have decreased to 1,557 BTC, marking a decline of over 50%.

The decrease in Bitcoin income for some in the sector isn’t just because of less productive mining; instead, it’s also attributed to the diminished BTC rewards given to miners, significantly impacting their total earnings.

How Bitfarms emerged from a hostile takeover

In June, there was notable corporate action in the cryptocurrency mining industry between Riot Platforms and Bitfarms. Specifically, Riot Platforms proposed a large-scale acquisition of Bitfarms valued at approximately $950 million.

Despite the sizeable offer, the acquisition attempt did not succeed in its entirety.

As an analyst, I’d rephrase it as follows: I discovered that Riot managed to acquire a significant 14.9% ownership in Bitfarms. Regrettably, their attempts to expand this stake beyond 15% were unsuccessful. Consequently, their influence on the company remains just below the threshold for substantial control.

In that identical timeframe, Riot Platforms pursued expanding its control over Bitfarms by proposing the replacement of three board members.

Riot’s broader strategy included this maneuver to have greater control over Bitfarms’ direction. Yet, encountering opposition, the attempt didn’t succeed.

In reaction to Riot’s hostile actions, Bitfarms strengthened its defense by bringing on a new board member.

It is plausible that this action was taken with the intent of fortifying their rule and warding off future power grabs.

Miner revenue continues to decline

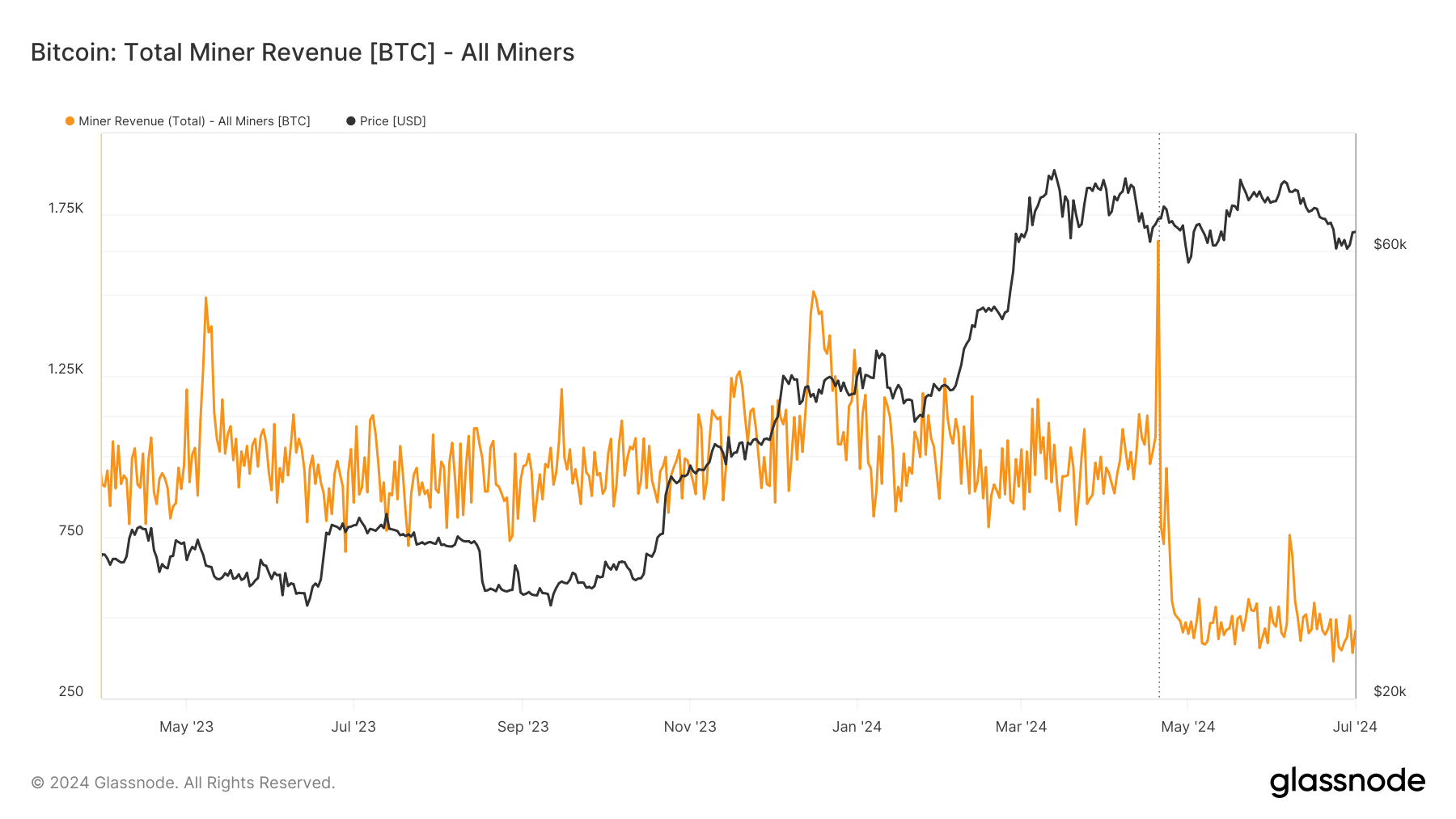

According to AMBCrypto’s interpretation of data from Glassnode, Bitcoin miner revenue has been on a downward trend since the halving event. The halving process reduces the reward given to miners for adding new blocks to the Bitcoin blockchain by half.

This event had a profound impact on the economics of Bitcoin mining.

As a researcher studying Bitcoin’s mining landscape, I observed that before the halving event, the daily revenue derived from mining operations fluctuated between approximately 900 and 1,000 Bitcoins. However, following the halving, this figure experienced a substantial decrease, with an average of around 400 to 500 Bitcoins being mined daily.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As of this writing, the daily revenue was around 456 BTC.

Based on the latest financial reports from Bitfarms, I’ve observed a declining revenue trend from cryptocurrency mining activities. It seems this situation is affecting miners industry-wide.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-03 06:17