-

Bitcoin’s short-term holders now hold their coins at a profit.

BTC’s future open interest has risen to a two-month high.

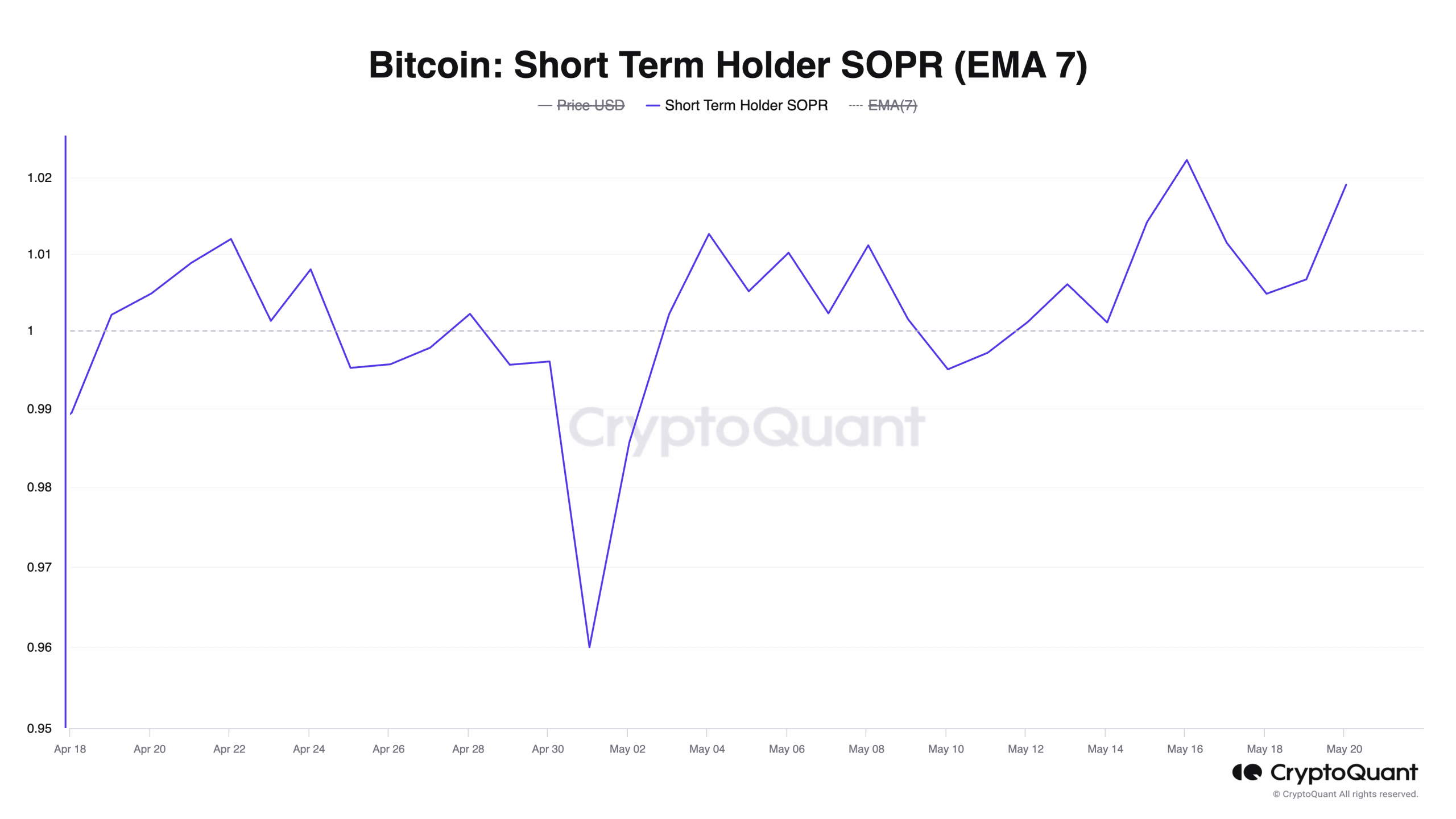

As an experienced analyst, I believe that Bitcoin’s (BTC) recent price rally is supported by the fact that short-term holders are now holding their coins at a profit. The Spent Output Profit Ratio (SOPR) for short-term holders has risen above 1, indicating bullish sentiment in the market. This dynamic could aid the sustainability of BTC’s current price rally by absorbing any profit-taking by sellers without the risk of a significant price drop.

As a researcher studying the Bitcoin market, I’ve observed an intriguing development regarding the Spent Output Profit Ratio (SOPR) for short-term holders (STH). The SOPR has surpassed the threshold of 1, indicating that these investors currently hold their coins having made a profit. This could potentially suggest optimism among short-term investors and a bullish sentiment towards Bitcoin prices.

As a cryptocurrency analyst, I recently observed an intriguing trend in the data. Using the pseudonym Phi Delta Analytics, I discovered that when the value of a specific metric surpasses 1, it typically indicates a surge in “optimistic market feelings.”

The STH-SOPR indicator for Bitcoin assesses if investors, who have owned the cryptocurrency for a half year to one and a half years, are realizing gains or incurring losses when they sell.

When the Short-Term Holder SOPR (SOPR) surpasses 1 as in this instance, it signifies on average, short-term coin sellers have made a profit. In contrast, if the STH-SOPR falls below 1, it implies these sellers experienced a loss.

Why the value above 1 is significant

According to CryptoQuant’s data, BTC’s STH-SOPR was 1.019 at press time.

Prior to reaching this stable level, the metric experienced a significant decline, bottoming out at the 1 mark without dipping further, according to Deltalytics’ analysis.

I analyzed the market situation and noticed that when that event occurred, the coin’s price reached a point where sellers weren’t incurring any losses or gains. Consequently, many market players chose to keep their coins rather than selling them. This indicated a decrease in selling pressure and was a favorable sign for the market.

The analyst pointed out that for Bitcoin (BTC), the STH-SOPR (Short-Term Holder Spent Output Proportion Ratio) needing to exceed 1 is a key indicator. Should this condition be met, any profit-taking actions by sellers would be absorbed by the market without triggering a substantial price decrease.

As a data analyst, I can share that based on our latest findings from Deltalytics, the ongoing price rally for Bitcoin (BTC) could be more sustainable than previously anticipated. Our analysis indicates this might hold true.

In a relatively calm market condition, this situation could cause Bitcoin’s value to increase.

BTC amid the recent price rally

In the last 24 hours, Bitcoin, which is currently the most prominent cryptocurrency, has gained significantly due to the market surge. The coin’s value was recorded at $71,212 when the press release was issued, representing a 6% price increase.

During the specified timeframe, there has been a notable surge in Bitcoin’s derivatives market with a substantial increase in trading volume. As per Coinglass’ statistics, this rise reached an impressive 112% over the last 24 hours.

The open interest for Bitcoin’s futures contracts was at its peak of $35 billion as I write this.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

2024-05-21 13:14