- Bitcoin’s active addresses confirmed strong FOMO as the digital asset hit new highs.

- Sell pressure intensified as mid-term HODLers engaged in profit-taking.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed numerous bull and bear cycles. The latest Bitcoin rally has been nothing short of spectacular, but it has also raised some concerns about potential profit-taking among mid-term HODLers.

Many experts have predicted that the value of Bitcoin (BTC) could significantly increase this year, reaching prices far beyond $100,000, based on their positive outlook for the cryptocurrency.

The recent upward trend seems to have sparked a sense of Fear Of Missing Out (FOMO), as indicated by the increase in the number of wallets containing Bitcoin.

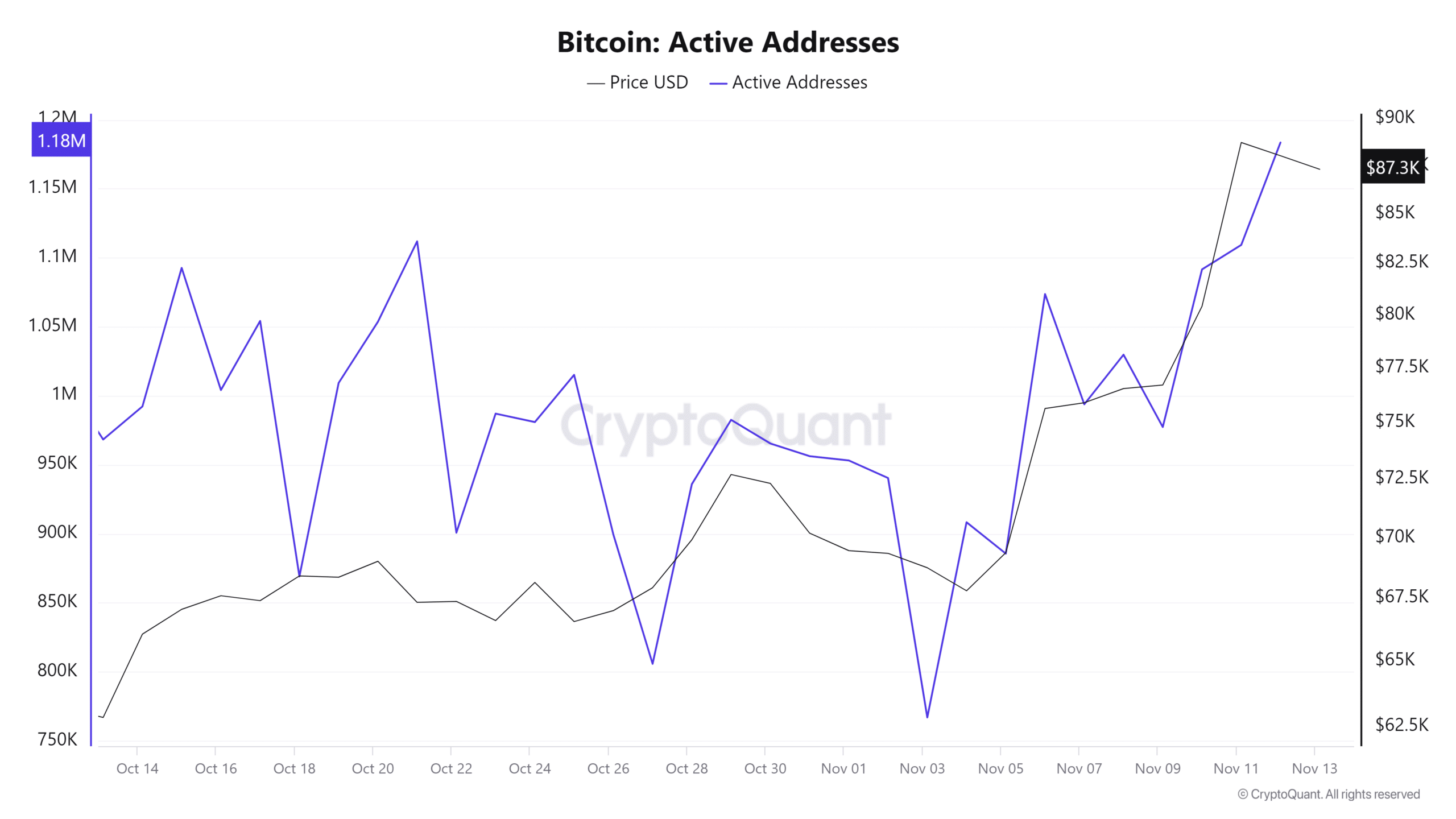

As per CryptoQuant’s analysis, the recent rise in Bitcoin’s price is marked by an increase in the number of active Bitcoin users.

This action showed not just assurance in the present market conditions, but also hinted at their eagerness to capitalize on the ongoing upward trend.

On November 3rd, there were only approximately 766,947 active addresses. However, by November 12th, that number had significantly increased to more than 1.18 million.

This outcome highlighted a directly proportional outcome with price.

During that time, the increase in the number of active Bitcoin addresses was mirrored by the significant investments into Bitcoin ETFs.

Is Bitcoin buying pressure decreasing?

As more people actively participate, there’s a growing bullish trend. However, recent evidence suggests that the urge to realize profits is becoming stronger.

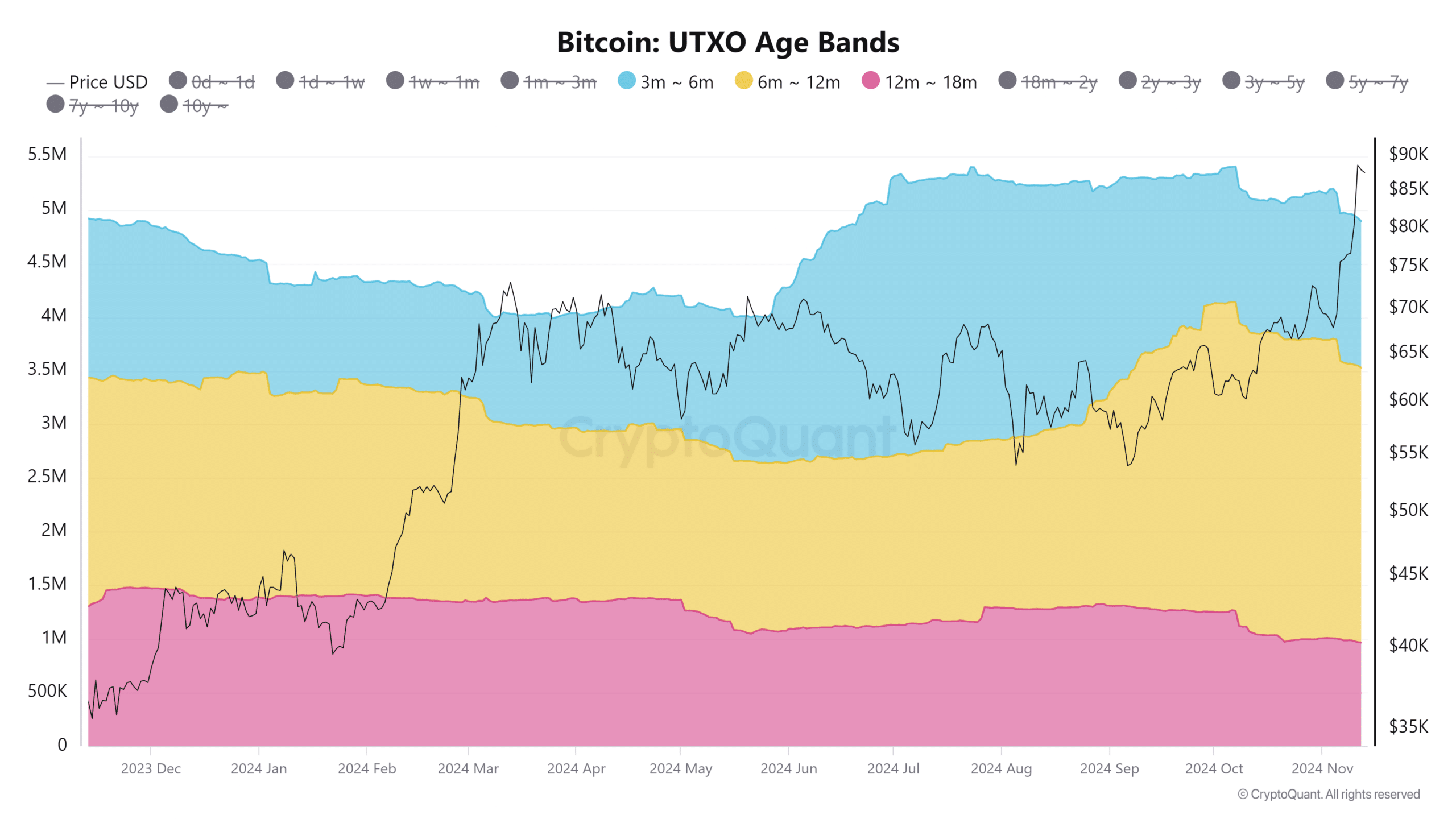

It’s particularly relevant to this group of Bitcoin holders who have possessed it for anywhere between 6 and 18 months, predominantly in the open market.

The data shows that by May 2023, buyers who had been holding onto their assets began to build up their stocks. Those who persisted until now have seen returns exceeding 200% over the past 18 months.

As per CryptoQuant’s analysis, it appears that many investors who are holding medium-term have typically bought around the $28,000 price point.

Approximately 230,000 Bitcoins were transferred from wallets that had been stored for 6 to 12 months between the 3rd and 12th of November. Additionally, around 41,500 Bitcoins shifted from wallets kept for 12 to 18 months during the same period.

Is this the end of the latest bullish wave?

As a researcher, I’ve noticed an increase in selling pressure coming from medium-term holders, which might signal that Bitcoin is primed for a substantial correction.

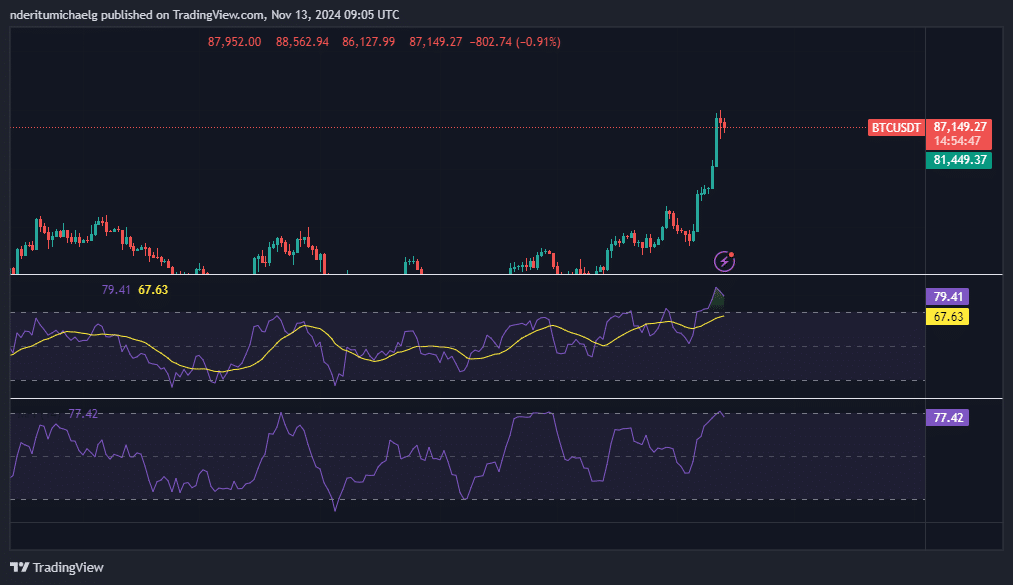

In more straightforward terms, it reached a high of $89,940 during the November 12th trading session, showing signs of bullish fatigue (indicating that buyers are running out of steam) and increased selling activity.

Bearish expectations have been rising based on the fact that the price was deeply overbought.

The increase in selling by mid-term investors indicates an uptick in profit-taking, and this could suggest that long-term investors are preparing for potential market corrections following Bitcoin’s recent surge.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite it being sensible to experience a pullback given the current market conditions, optimistic forecasts remain prevalent, particularly as we approach the year 2025.

Increased usage of active Bitcoin addresses implies that fear of missing out (FOMO) might keep the minimum price stable and stimulate further purchases, since many investors view Bitcoin as a compelling investment opportunity with prices below $100,000.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-14 00:08