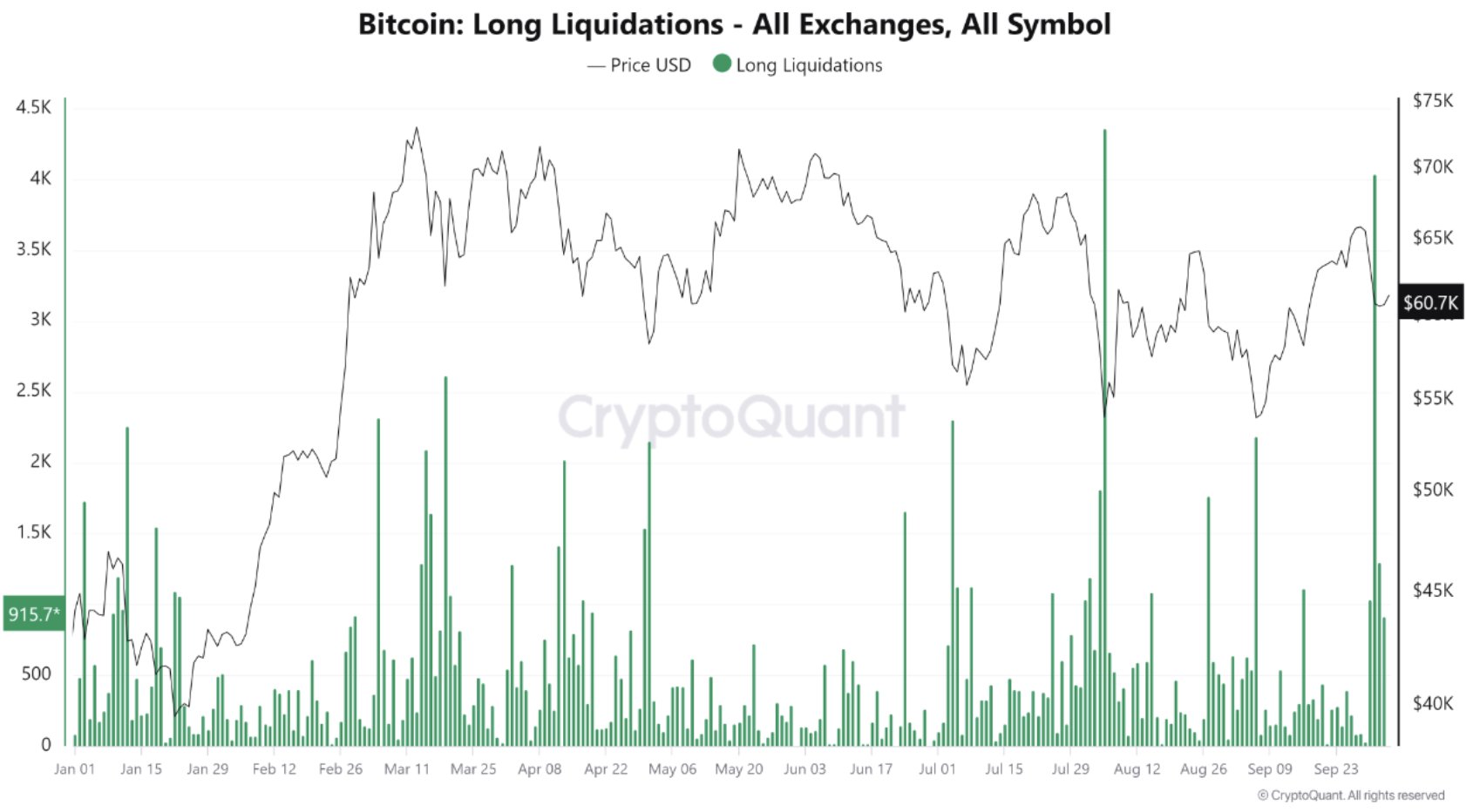

- Bitcoin Long liquidations lead to formation of local bottom.

- Short-term price increase for Bitcoin seems to be imminent.

As a seasoned researcher who has witnessed Bitcoin’s rollercoaster ride over the years, I find myself optimistic about its current trajectory. The recent liquidation of long positions seems to have established a local bottom, potentially paving the way for an imminent short-term price surge.

After a significant drop due to geopolitical conflicts between Israel and Iran, Bitcoin [BTC] has demonstrated its strength by bouncing back. At the moment, it’s trading near $62,000, and it appears to be attempting to regain the $63,000 mark.

Closing out long-term Bitcoin investments might signal a temporary price floor (or “bottom”), suggesting potential future price increases. If so, this low would represent the minimum price point for the current month.

In times of substantial drops, lengthy contracts tend to fall steeply because they’re being liquidated, thereby lessening the demand to sell.

The key liquidity points held steady, ranging from approximately $68,900 to $69,300 higher than the current price, and from around $56,800 to $57,400 lower.

A significant grouping of funds was forming around the $66,500 to $66,800 range, indicating a potential upcoming focus on this price region.

For more than 200 days, the value of Bitcoin (BTC) has fluctuated between approximately $55,000 and $75,000, but it consistently held its ground, maintaining a stable position.

On its weekly chart, it had moved beyond the 100-week moving average (100MA), indicating robust performance in broader market conditions.

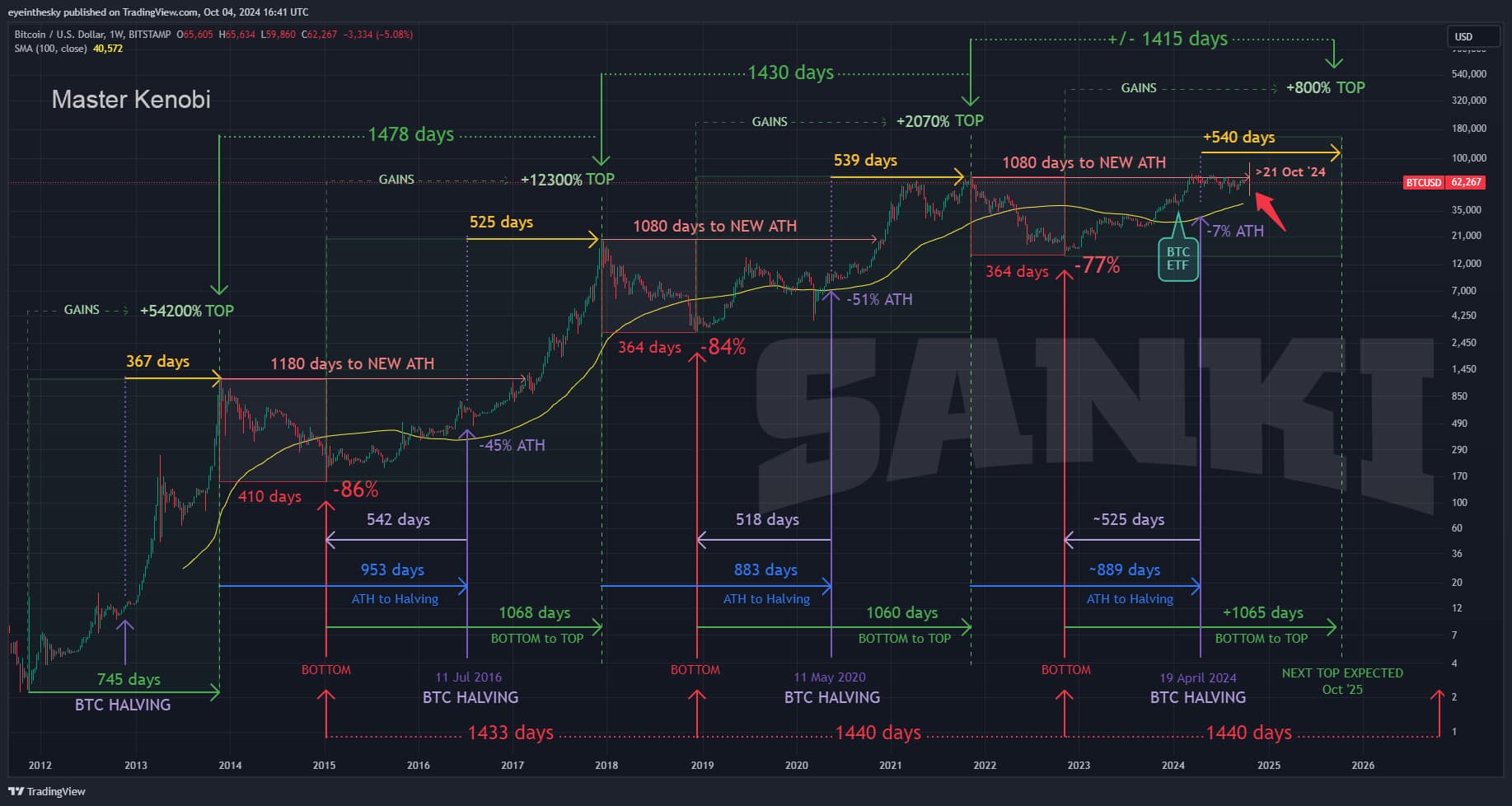

170 days have passed since the last Bitcoin halving, and based on past trends, new record highs (peak prices) typically appear around 1080 days following the top of the previous cycle.

This implies that, based on historical patterns, it’s possible that Bitcoin could increase from its current value, assuming history continues to repeat itself.

Coinbase Premium indicator

Enhancing this optimistic perspective is the Coinbase Premium feature on CryptoQuant, indicating a brief uptick in Bitcoin’s price.

Forming a golden cross in Bitcoin’s past trends typically triggers a temporary increase. This technical pattern provides additional proof that Bitcoin might surge from its current local low.

US Bitcoin spot ETFs demand

The interest in buying Bitcoin through U.S.-based exchange-traded funds (ETFs) has been growing recently. Initially in September, these ETFs were selling more Bitcoin than they were buying, but by the end of the month, their purchases reached 7,000 Bitcoins, which is the highest level since last July.

During the initial three months of the year 2024, exchange-traded funds focusing on Bitcoin (Spot ETFs) purchased approximately 9,000 Bitcoins daily, causing prices to reach record highs. If this pattern of buying persists, the value of Bitcoin could potentially increase even more in the last quarter of 2024.

Whales holding steady

Moreover, it’s worth noting that big Bitcoin owners, often referred to as “whales,” have displayed a relatively low tendency to sell their holdings for profits recently. This behavior suggests a strong belief among them about the potential increase in Bitcoin’s value in the future.

It’s been observed that whales (significant Bitcoin holders) are spreading their BTC wealth across numerous accounts. Currently, approximately 1,975 wallets contain between 1,000 and 10,000 Bitcoins each.

In contrast to past trends, these ‘whales’ have been cashing out only moderately following recent drops in Bitcoin’s price. This action suggests that they anticipate continued growth in the value of BTC, aiming to reap maximum profits.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The blend of asset liquidations, growing interest from Exchange-Traded Funds (ETFs), and significant trading by large investors (whales) indicates that Bitcoin could potentially experience more growth starting from its present low point in the market.

All these factors point towards a likely upward trend for BTC in the near term.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-06 10:16