- Bitcoin’s bearish cross historically precedes significant price rallies.

- Current market indicators hinted at possible short-term volatility, followed by a potential uptrend.

As a seasoned analyst with over two decades of market observation under my belt, I’ve seen more than a few market cycles that made even the most experienced traders question their convictions. The current state of Bitcoin [BTC] is no exception to this rule.

As a researcher observing the cryptocurrency landscape, I’ve noticed that Bitcoin (BTC) seems to be finding it challenging to maintain a steady upward trend lately.

Regardless of Bitcoin’s recent highs near $62,000 and lows at approximately $56,000 over the past fortnight, these price swings have left investors pondering where the cryptocurrency might be heading next.

As I write this, the cryptocurrency is being exchanged for around $58,550. Over the last 24 hours, it has experienced a slight 0.7% rise. The highest point in this period was $59,833, while the lowest was $57,812.

Bitcoin: Indicators of a possible downturn

In the midst of this volatile market trend, a striking pattern seems to be unfolding which may provide clues about future price fluctuations.

In simpler terms, the “bearish cross” pattern has appeared on Bitcoin’s daily graph, which is a technical signal that could potentially predict an upcoming drop in value.

As a crypto investor, I’m referring to a significant occurrence known as the crossover of Bitcoin’s 50-day Simple Moving Average (SMA) dipping below its 200-day SMA. Right now, the 50-day SMA is at $61,749, while the 200-day SMA stands firm at $62,485.

In simpler terms, this specific setup, which is frequently interpreted as a sign of temporary market vulnerability, was highlighted by the anonymous trader known as Mags on the social networking site X, previously called Twitter.

Although the pattern on the graph might initially appear ominous, it doesn’t automatically mean things are grim at present.

Mag noted that historically, when a bearish cross pattern appears on Bitcoin’s price chart, it tends to be preceded by substantial market uptrends.

In September 2023, Bitcoin’s price climbed around 50% within four months following a bearish crossover. Likewise, back in July 2021, there was a similar surge of 54% within the same four-month period after a cross.

In simpler terms, Mag proposes that if the current trend continues, Bitcoin might go through a phase of price volatility first. After this, it could regain its average values and trigger a positive crossover, which could then lead to another powerful surge in its value.

The underlying fundamentals

Despite the focus on chart patterns, it’s worth considering Bitcoin’s fundamental metrics, which offer insights into the broader market stance and investor behavior.

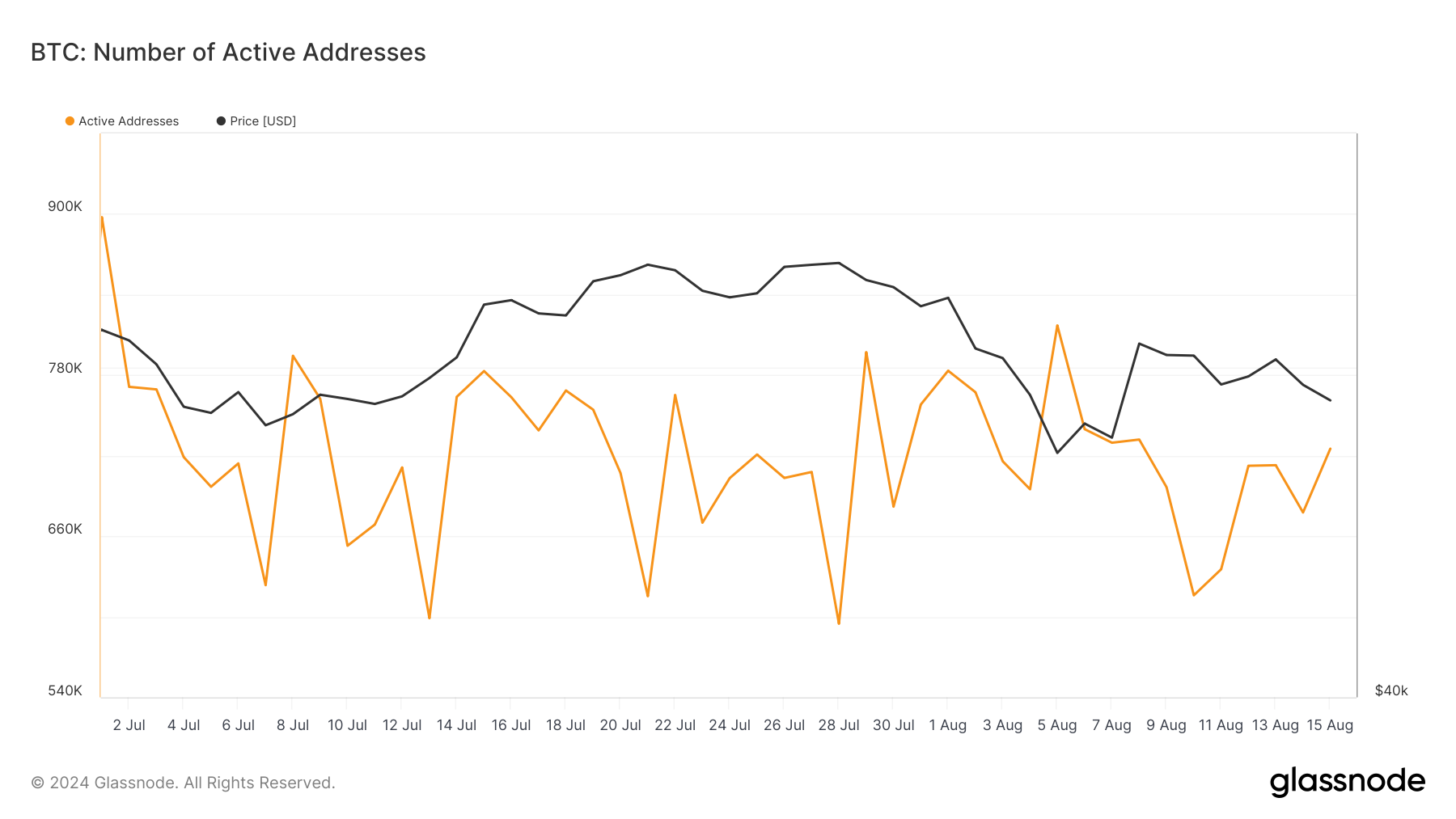

In the first half of July, there were approximately 897,000 actively used Bitcoin addresses, but by mid-August, this number had dropped to around 615,000, according to data from Glassnode.

On the contrary, we’ve seen a significant increase lately, with more than 725,000 addresses now recorded, which represents an approximately 17.89% rise.

An uptick in active Bitcoin addresses may hint at an expanding involvement in the network, possibly indicating a favorable change in investor attitudes towards the market.

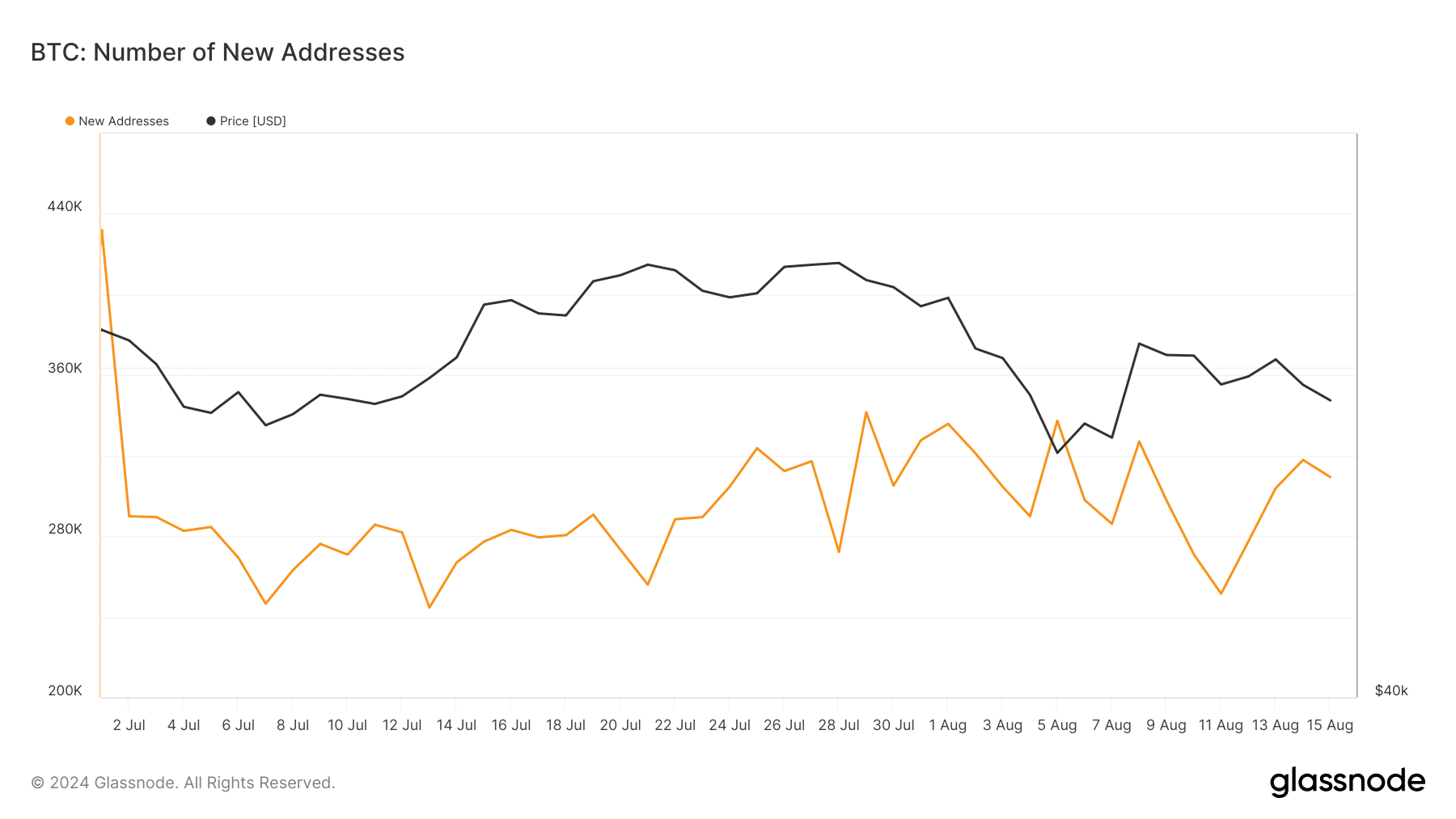

Additionally, there’s been a hint of revival in the creation of new Bitcoin wallets, which often reflects renewed enthusiasm from new investors.

Following a decrease to approximately 251,000 new Bitcoin addresses in early August, there’s been a surge exceeding 300,000, suggesting a rekindled curiosity and possibly increased financial investment in Bitcoin.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-08-16 20:24