- The scent of hope and fear drove traders stampeding into Bitcoin, their pockets itching and hearts pounding, right before the government weighed in with tales of honest labor. Binance? The cash registers nearly burst—$100 million rung up in a flash, like a gold rush with less dust and more Wi-Fi.

- Some mysterious breed called “analysts” claimed altcoins are limbering up backstage, and maybe—just maybe—a wild crypto breakout’s about to crash through the barn doors. (Cue dramatic prairie wind.)

The herd ran for Bitcoin, faster than a coyote spotting a rabbit, all because they caught wind of that sacred American ritual—the jobs report. Stakes high, palms sweaty, traders threw their chips onto the green table, betting the rally would outlast their coffee.

Over at Binance, if you listened close, you could hear a thundering—a hundred million bucks in net taker volume, not from the timid but the hungry, the bold, each one outbidding a neighbor for a little slice of hope before the government flashed its numbers. Classic human nature: just before the dawn, someone’s always buying candles.

Binance: Where The Bulls Stampede 🐂

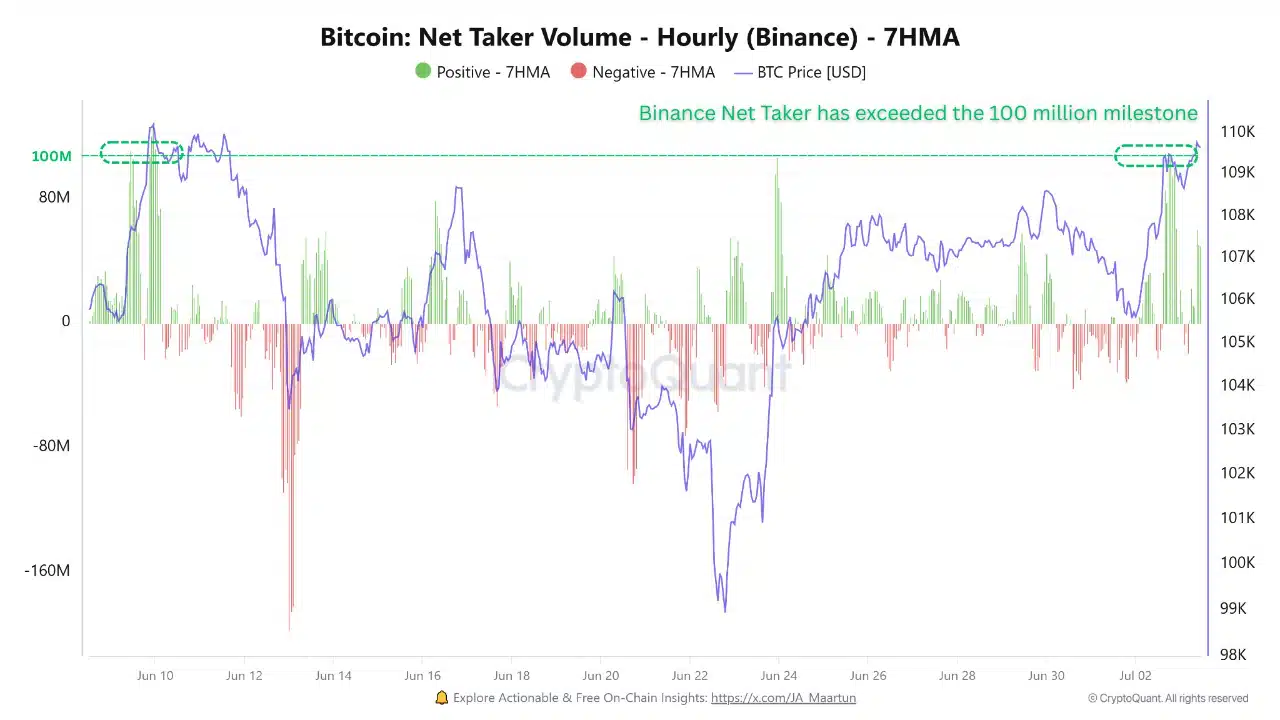

Net Taker Volume on Binance didn’t just rise—it leapt, like a salmon hell-bent for its mountain stream, crossing the fabled $100 million mark. The chart below says it in green bars you could measure with a rancher’s stick.

If you squint a little, Net Taker Volume is just the difference between buyers tripping over themselves and sellers leaning back. This surge? It’s the sound of folks grabbing fistfuls without a care for tomorrow’s dip. No dippers in this saloon, only high-rollers and FOMO-ridden desperados.

And the timing—always watch the timing—just before the official government report. It’s as suspenseful as a dust storm at noon: will the crops survive or flatten flat? Folks speculated harder than a parlor-room philosopher on payday.

The chart was all green and climbing; FOMO had moved in, set up camp, started roasting marshmallows.

Matt Mena, a man who studies waking dreams—also known as markets—at 21Shares, took the scene in with the eyes of one who’s seen a few cycles and maybe a crash or three. He figured risk hung in the air, thick as barnyard dust.

Mena commented, with all the calm of a farmer reading the sky, that the S&P 500 Futures were milling near their own moonlit peaks, and Bitcoin was fenced in between $108,000 and $110,000, snorting and pawing at the boards for a breakout.

He opined,

“Maybe the most telling thing—a 3% drop in Bitcoin’s dominance (now sitting at 62%)—signals the altcoins out back are showing signs of life. Or mischief.”

The Jobs Report: Sunshine or Snake Oil? 👷♂️☀️

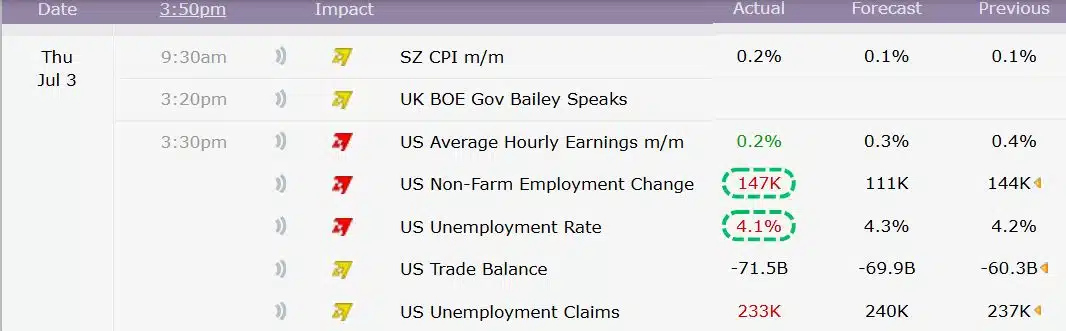

July third, and the American job machine clanked and groaned, but managed to hurl 147,000 new jobs onto the field—well north of what the soothsayers (110,000-118,000) had conjured. Folks hired, pockets jingling, and unemployment slunk down to 4.1%. Call it February nostalgia.

This was optimism, wrapped in government data and tied with a bow—enough to give the Fed pause before fiddling with interest rates.

The betting tables (Fed funds futures, for you city folk) winked and odds jumped: now 95% certain the money men would keep rates where they were. Some called it caution, some called it wisdom—but most just knew the party wasn’t over yet.

Mena, eyeing greener pastures and the smell of regulation in the wind, mused that digital assets were about to get a spring rain.

He added,

“Wouldn’t surprise me if Bitcoin makes for $200,000 and forgets to look back—though if you’re waiting for congratulations from your altcoin bags, maybe keep waiting.”

Rumor also says, if the capital ever gets the urge, altcoins could dance even faster, outpacing everyone with two left feet.

Bulls and the Dollar: A Bar Fight in Slow Motion 🥊💵

Before the jobs report, the Bitcoin bulls loaded their wagons, sure the trail ahead was clear. But now? The numbers tell a different tale.

A brawny labor market means the Fed’s more likely to keep interest rates tall and firm—good for the dollar, bad for Bitcoin. These two, dollar and BTC, have about as much affection for each other as a snake and a mongoose.

History says when jobs go up and rate cuts go missing, crypto prices start coughing and looking for an exit. But sure enough, there’s always a gambler who thinks this time is different, maybe luck’ll cut them a break.

Matt Mena sums it up, scenery fading into dusk over the plains,

“Labor’s steady, inflation’s dozing, and somewhere down the road is fresh liquidity—both the kind that comes from big banks and the kind that comes from people who just want to double their money before breakfast.”

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- 10 Best Superhero Movie Sequels Ranked

2025-07-04 14:49