- Bitcoin holders have to be wary in the short term due to increased selling pressure surrounding the halving.

The halving event was probably not priced in, but that does not guarantee the same returns from this BTC cycle as earlier ones.

The expected massive selling off of Bitcoin (BTC) following its halving did not occur right away, contrary to some investors’ concerns. Instead, efforts were made to protect the $60,000 support level on April 19th. However, it is important to note that conditions could shift later in the week.

Since the dip to $59.6k, prices have climbed by 9% at press time.

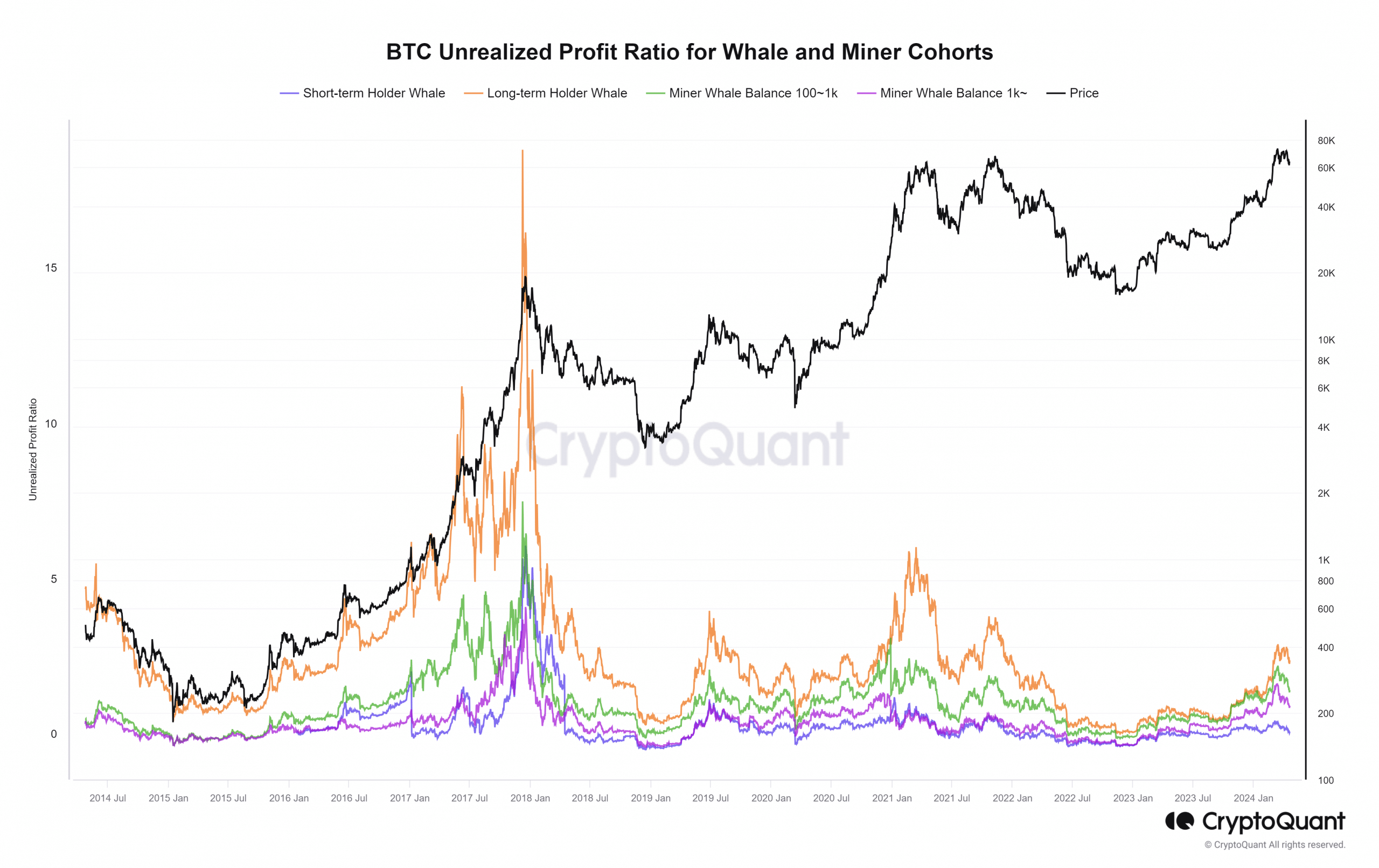

On his X platform post, previously known as Twitter, CryptoQuant CEO Ki Young Ju shared an insight: We haven’t reached the peak yet in this market cycle. Based on the Unrealized Profit Ratio indicator, long-term investors had realized profits amounting to just 234%.

In February 2021, long-term investors in Bitcoin (BTC) saw their profits soar to a stunning 599% during the 2021 market run. Despite BTC reaching new highs later that year, these investors were unable to replicate those record-breaking unrealized gains.

Playing the long game

In the 2017-18 market cycle, the long-term investors saw a profit of over 1700%. This is significantly more than the 599% gain experienced during the 2020-21 period.

Does the possibility of lower earnings for whales during this peak stage cause doubt about the expectation of Bitcoin reaching $200,000? However, it’s important to remember that predictions can only go so far – ultimately, the future holds the answer.

With a reading at 286% in mid-March, bulls are eagerly anticipating that the halving will amplify these figures even more. Yet, according to Ki Young Ju, these gains might not mark the end of the price trend.)

Crypto expert Ali Martinez pointed out that Bitcoin’s sentiment hasn’t fully turned euphoric despite hitting a peak. According to the NUPT metric, we haven’t experienced the typical excessive excitement that precedes a Bitcoin market peak.

Threats in the short-term

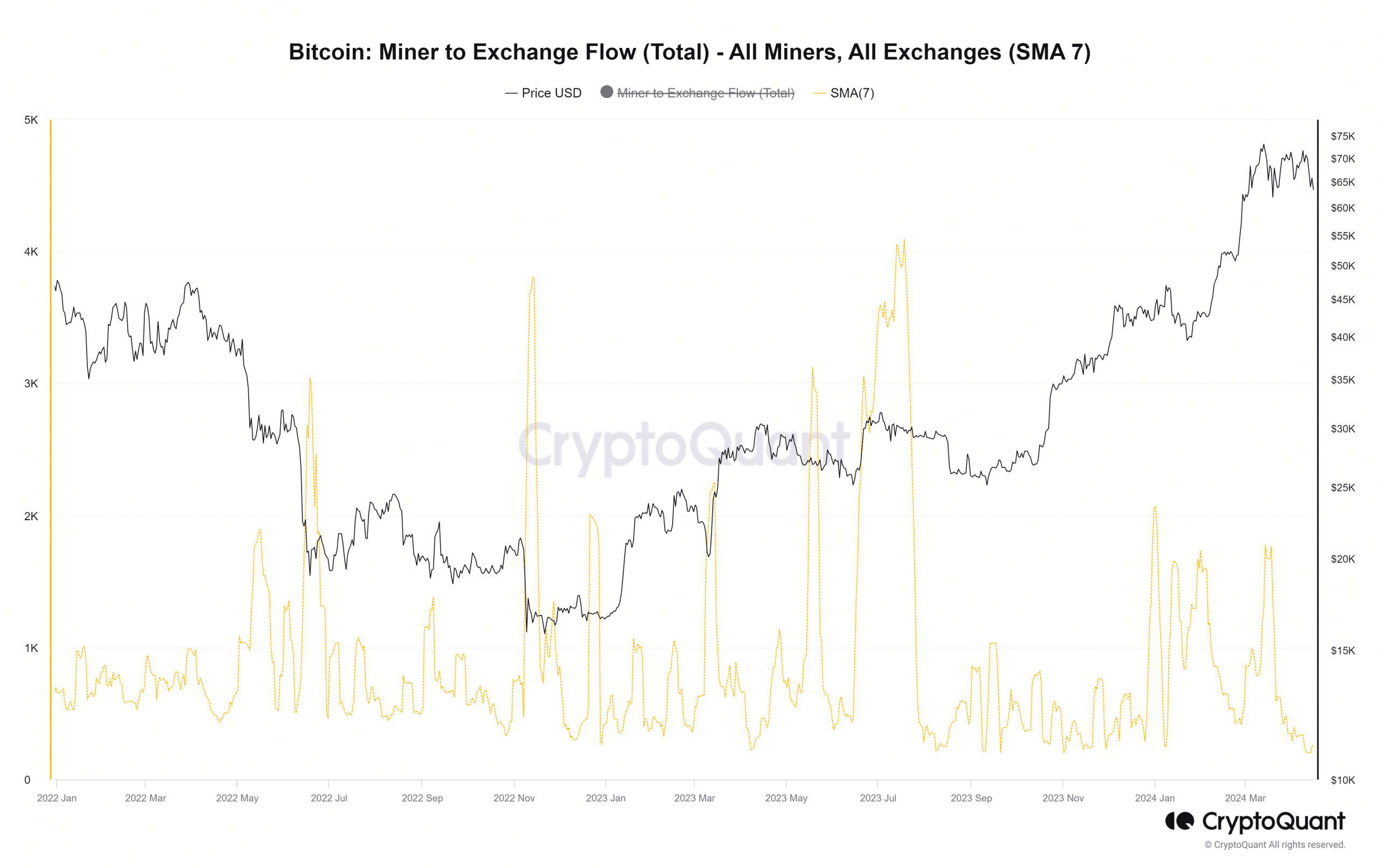

In the longer perspective, it’s expected that Bitcoin prices will rise. However, the near future could bring price fluctuations. According to CryptoQuant’s data, miners have been transferring fewer Bitcoins to exchanges over the last month.

The falling 7-day simple moving average of miner flow to exchanges was evidence for the same.

An alternative interpretation is that miners were saving up Bitcoins, intending to sell them following the halving event. Consequently, an oversupply of Bitcoin for sale might negatively impact the market price.

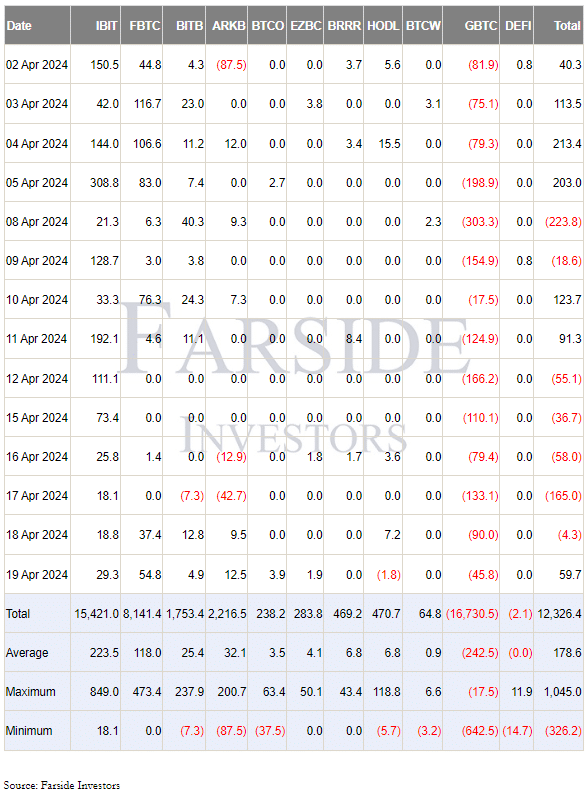

An extra indicator of decreased interest in Bitcoin over the past few weeks was uncovered by the data. The peak inflow of liquidity occurred on March 12th, but since then, the flow has noticeably reduced.

Over the past two weeks, Bitcoin prices dropped by 10-15%. Despite this decline, there was no significant increase in inflows to U.S.-listed Bitcoin ETFs, suggesting that the current demand may have reached its limit.

The halving event must be priced in, says common sense

For years, the market has been aware of the scheduled halving of cryptocurrency supply around the 19th of April (or the beginning of the 20th for those in Eastern time zones).

The aftermath is not as simple as rewards dropping to 3.125 BTC per block mined.

The heart of the issue lies in the complex interplay of various elements, each influenced by supply and demand and public opinion towards Bitcoin.

According to Willy Woo, a Bitcoin market analyst who works on-chain, it may be unnecessary to make the case that the market has already factored in the event due to its long-standing awareness of it.

In simpler terms, the public often becomes interested in Bitcoin near the end of its price growth cycle, which is around the time of the NUPL (Network Value to Realized Value Ratio) euphoria phase.

This cycle might be different due to the ETFs, but the argument against pricing is still valid.

In simpler terms, Bitcoin’s true value has not been fully realized yet due to insufficient investment. However, its long-term worth seems significantly underestimated based on current market prices.

Read Bitcoin’s [BTC] Price Prediction 2024-25

With a more pessimistic perspective, one might argue that this cycle will be less prolonged and not as dramatically curved as previous ones.

In both cases, the roller coaster ride still hasn’t reached its required duration in the air. So get ready and hang on tight.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-21 19:04