-

BTC accumulation climbs ahead of the halving event.

The past few days have seen an uptick in market volatility.

Reaching a new achievement, the amassing of Bitcoins (BTC) is nearing a significant point before the upcoming halving occurs in just a few hours.

A recent analysis conducted by an anonymous expert at CryptoQuant under the alias IT Tech revealed that over 27,000 Bitcoin were transferred into storage wallets on April 16th, according to a newly released report.

An analyst referred to an accumulation address as one that hasn’t sent any transactions but has a bitcoin balance over 10 units, isn’t associated with any centralized trading platforms or miners, and has received at least two deposits.

Its most recent transaction had occurred within the last seven years.

The report indicates that the peak inflows of 25,100 Bitcoin to these addresses occurred on March 22nd.

Traders remain steadfast

The cryptocurrency market, with Bitcoin currently valued at $61,234 as reported, has experienced a downturn over the last few weeks. Based on information from CoinMarketCap, Bitcoin’s price has seen a decrease of approximately 13% within the past week.

Despite the recent decrease in price, people in the market are still buying more cryptocurrency in preparation for the upcoming halving event on April 19th.

With recent challenges, there’s been an increase in Bitcoin hoarding, driven by expectations of a price surge following the upcoming halving event.

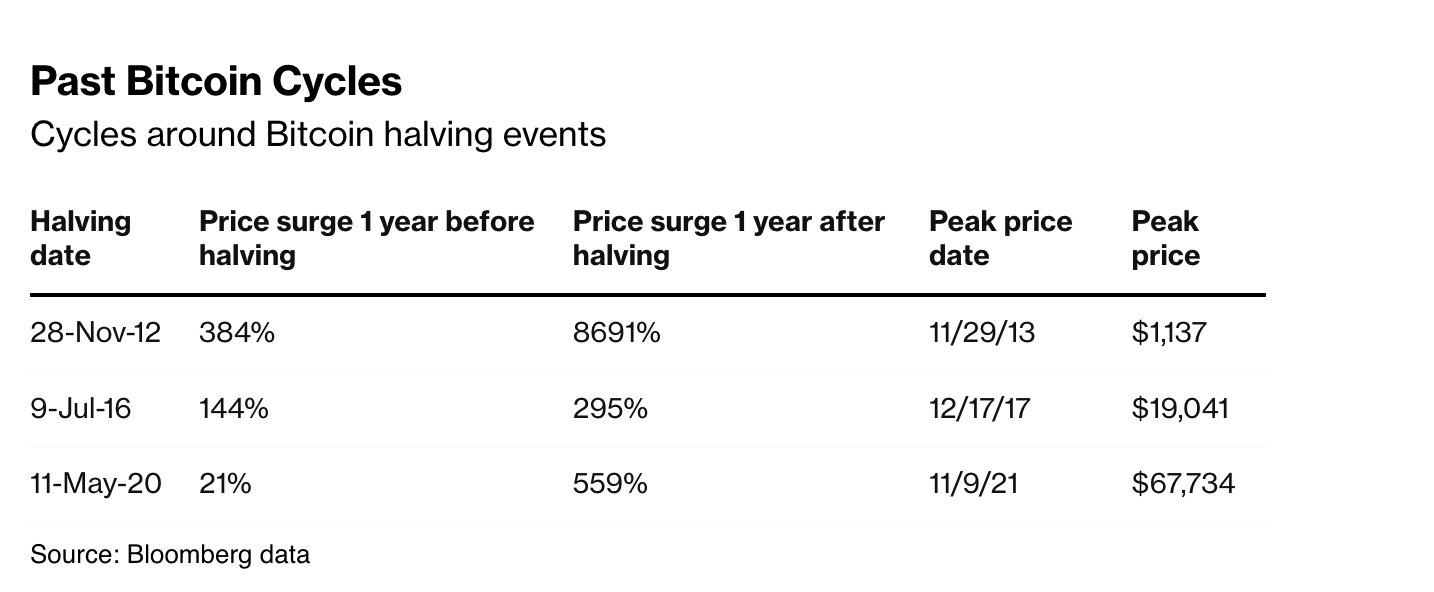

In the past, the value of a coin has significantly increased after halving occurrences, as indicated by Bloomberg’s figures. For instance, within a year following the 2012 halving event, Bitcoin’s price soared above 8,000%.

Approximately one year following the 2016 occurrence, the coin’s worth increased by a factor of 2.95, while it saw a gain of 5.59 times its original value one year after the 2020 incident.

The coin’s exchange reserve has been gradually shrinking, indicating a decrease in demand for selling the coin at present.

According to CryptoQuant’s statistics, there was a 1% decrease in the quantity of Bitcoin stored in cryptocurrency exchanges over the past week.

At the present moment, approximately 1.94 million Bitcoins valued around $119 billion based on current exchange prices are kept in cryptocurrency exchanges.

Remain on the lookout

With a few hours till the halving event, market volatility is climbing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

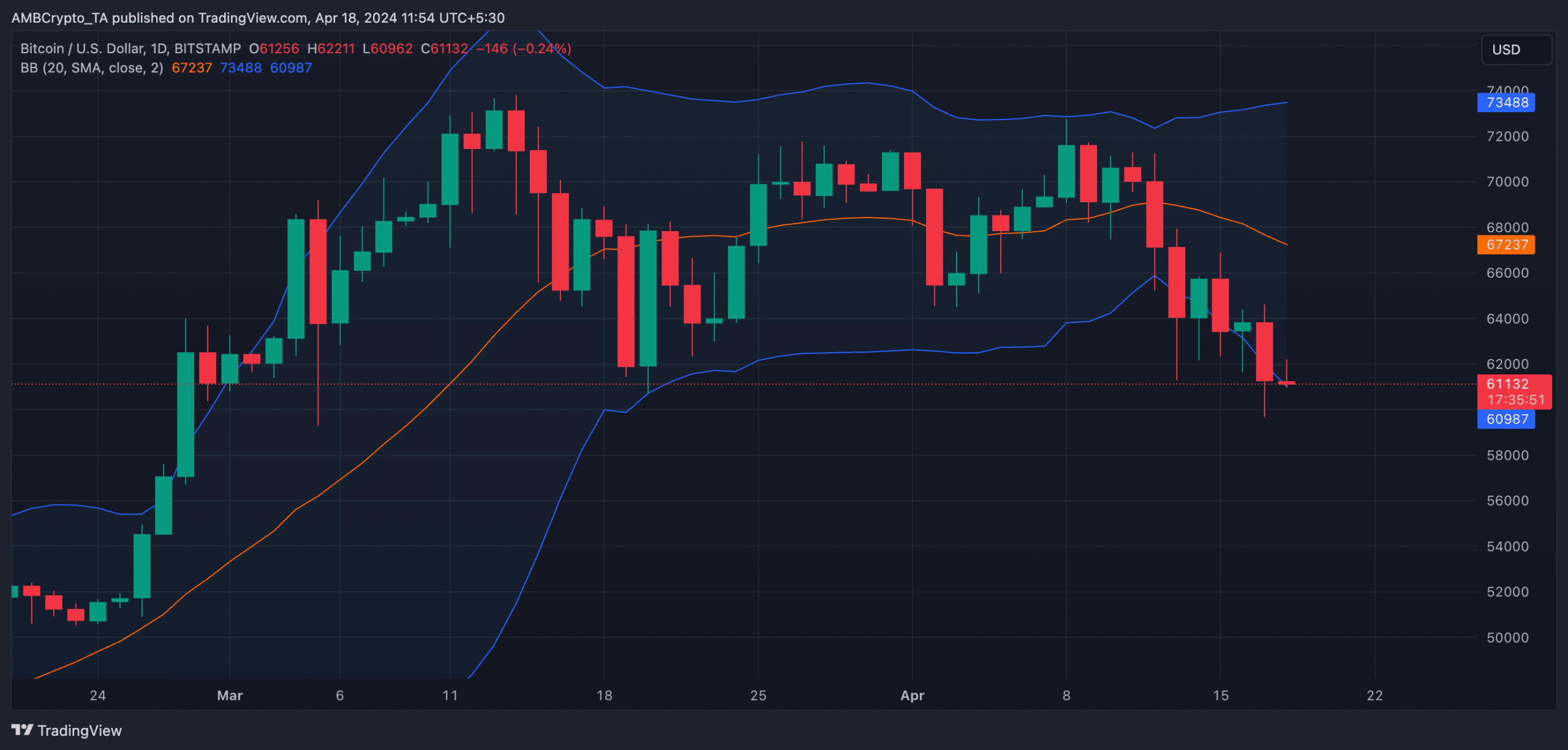

Over the past few days, the distance between BTC‘s upper and lower Bollinger Band lines on its daily chart has been expanding noticeably.

Expanding distance between these two bands signifies heightened market fluctuations. This implies the asset’s value experiences more intense swings, increasing the likelihood of significant price movements or breakouts.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-04-18 18:15