-

Bitcoin’s hash rate has risen sharply since the halving

BTC’s price decline adversely affected mining profitability too

As a researcher with extensive experience in the cryptocurrency industry, I have closely observed the recent developments in Bitcoin (BTC) mining following the latest halving. The sharp rise in hash rate was indeed an expected outcome, but the consequences for miners have been more profound than anticipated.

It’s no surprise that the expense of Bitcoin [BTC] mining has significantly increased following last week’s halving, posing challenges for an industry grappling with shrinking profitability.

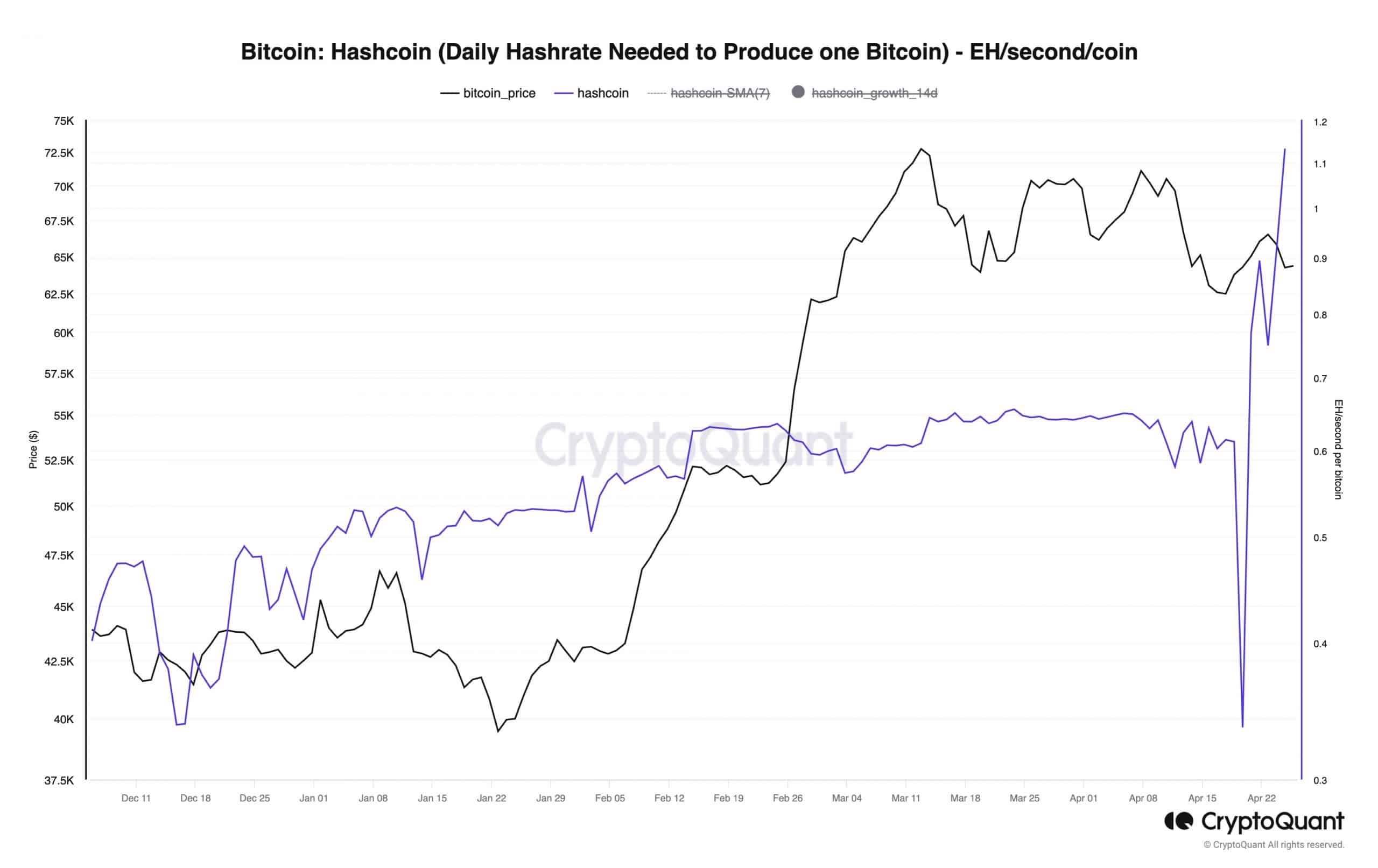

For the first time ever, the computing power needed daily to mine a single Bitcoin has exceeded one exahash per second (EH/s), as stated by Julio Moreno, the Head of Research at CryptoQuant.

Halving increases miners’ expenses

Mining rewards from fixed blocks, a significant source of income for miners, are being reduced through the process called halvings. The most recent reduction brought the incentives down from 6.25 Bitcoins to 3.125 Bitcoins per block. In simpler terms, after each halving event, miners must invest twice as much to maintain their previous profit levels.

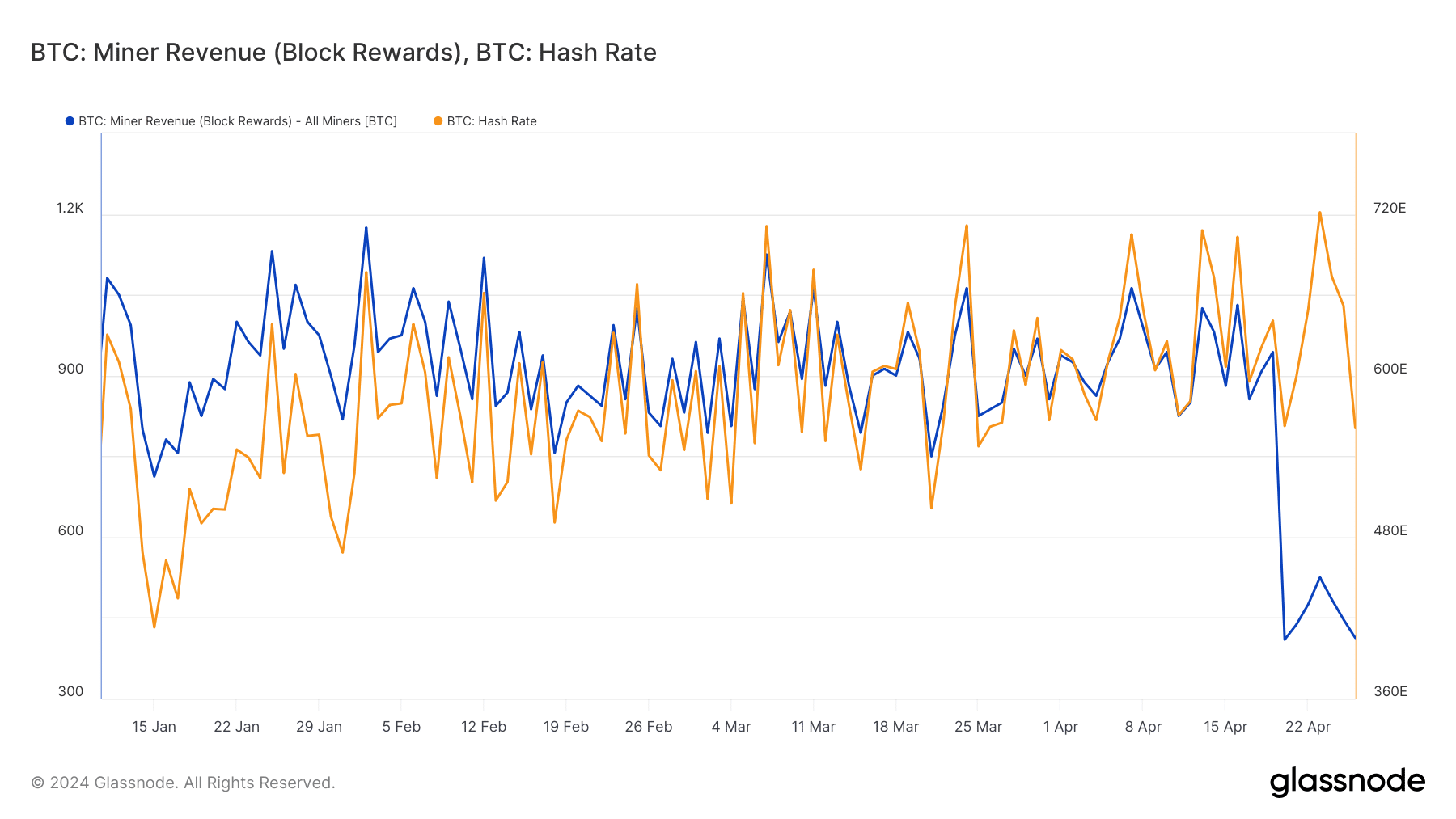

After the halving, AMBCrypto in collaboration with Glassnode data closely examined this phenomenon. On average, around 900 Bitcoins were being generated daily prior to the event. However, following the halving, the production of new Bitcoins decreased and now ranges between 400 and 500 per day.

At the same time, the computing power required to generate new blocks for the Bitcoin blockchain, known as the hash rate, experienced a substantial increase, peaking at 721 exahashes per second (EH/s) during the early part of the week.

Bitcoin’s price decline has a bearing

As a crypto investor, I’ve been facing some challenges lately. The disappointing performance of Bitcoin on the price charts hasn’t helped matters. After a brief surge in bullish sentiment, Bitcoin took a turn for the worse and slipped by 1.63% at the time of reporting, as indicated by CoinMarketCap.

As a crypto investor, I’ve noticed that due to the recent market downturn, the hashprice – a crucial indicator reflecting Bitcoin mining profitability – plummeted by an alarming 72% within just a week.

Will fees come to the rescue?

As a researcher studying the cryptocurrency mining landscape, I’ve noticed that block rewards are increasingly becoming less profitable for miners. However, it’s essential not to overlook the potential of transaction fees as an alternative revenue source.

As a researcher studying cryptocurrency trends, I’ve come across an intriguing finding regarding the Runes protocol and Bitcoin’s halving event. Previously reported by AMBCrypto, this protocol resulted in dramatically increased transaction fees following the halving. These heightened fees accounted for approximately three-quarters of the total miner earnings on that day.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-04-27 19:03