- Miners have been investing in more efficient machines to tackle post-halving financial stress.

- Miners’ sell-offs increased in recent months.

As the Bitcoin [BTC] halving approaches within the next three days, attention has turned towards the miners and their financial viability post-event.

What next for miners after halving?

In the past, miners have experienced a significant decrease in income right after a halving event due to the reduction of block rewards by half. This trend was clearly shown by data from cryptocurrency analysis company IntoTheBlock.

Despite the discomfort, which proved to be short-lived, the value of Bitcoin, referred to as the king coin, continued to climb after the quadrennial event had passed.

After the Bitcoin halving in July 2016, its value increased three-fold over the next twelve months. Likewise, according to AMBCrypto’s analysis based on CoinMarketCap data, Bitcoin experienced a remarkable surge of 500% following its most recent halving in May 2020.

In simpler terms, when the cost of Bitcoin increases, so does the income miners earn. Historically, this income has reached record levels approximately one year after a Bitcoin halving event.

Miners’ preparations before halving

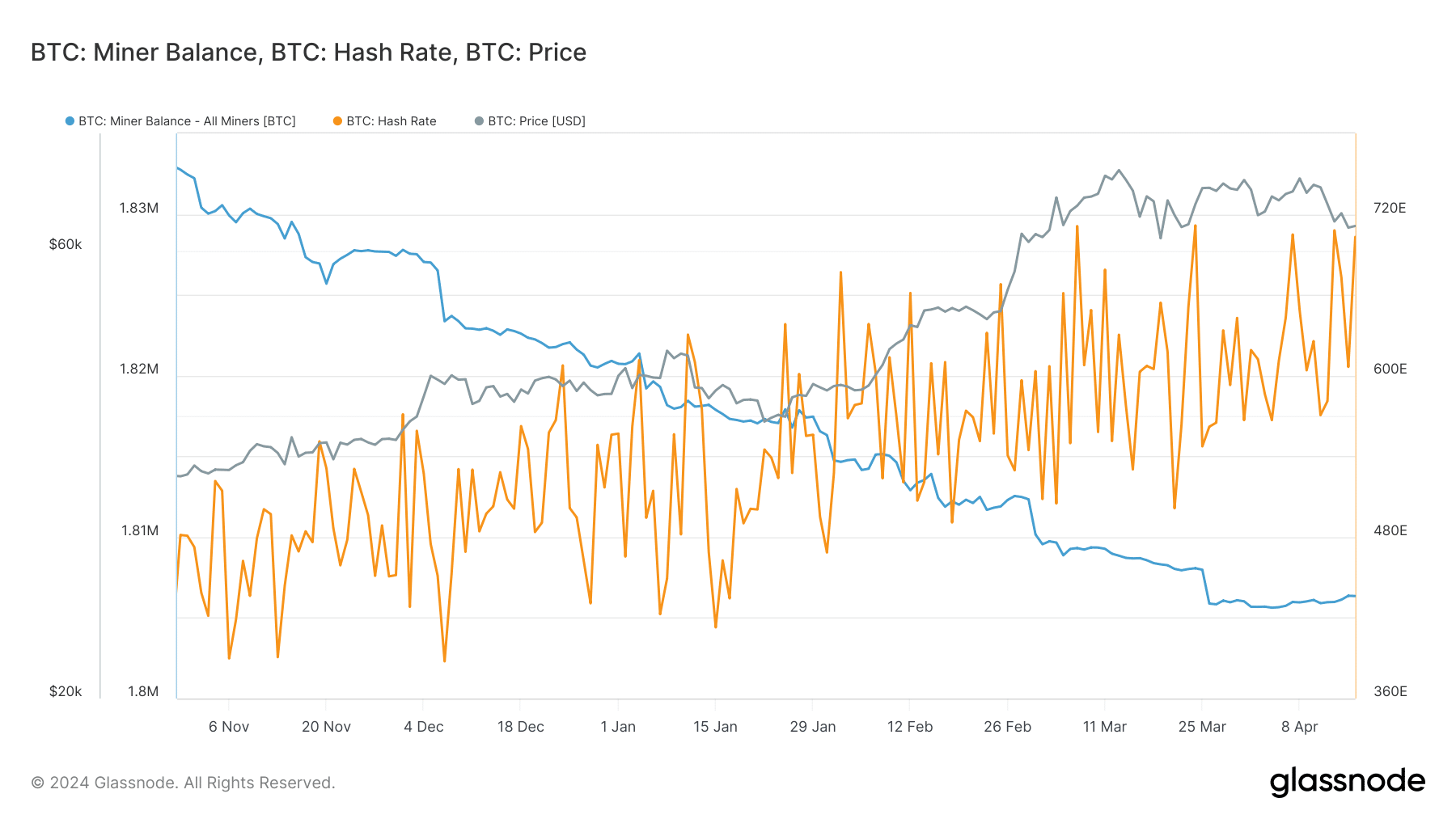

In the past several months, the computing power committed by Bitcoin miners, represented by its hash rate, has been increasing, according to an observation made by AMBCrypto utilizing data from Santiment.

An possible explanation is that miners may be purchasing advanced machinery which produces a greater number of hashes while using less electricity.

Such steps become imperative, as the halving would double the cost to miners to break even.

In the past few months, miners have been selling off their Bitcoin at a consistent rate. This is believed to be so they can acquire funds to purchase advanced mining equipment. The decreasing quantity of Bitcoin in miner wallets serves as an indicator supporting this hypothesis.

At the present moment, according to CoinMarketCap, Bitcoin was priced around $63,000. Before the halving event, it underwent noticeable price declines.

In simple terms, unexpected events affecting Bitcoin’s supply could potentially boost its worth over the long run if there is continued strong interest in the asset.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-17 13:11