- History called attention to a related decline as volatility increased

A higher number of BTC is being spent, indicating a potential slip below $60,000

Bitcoin (BTC) is currently facing a significant turning point as the upcoming halving event approaches within a few hours. Yet, approximately 10% of Bitcoin owners are experiencing losses at present, based on statistics from IntoTheBlock.

The rise in numbers could be attributed to Bitcoin’s recent price decrease from around $70,000 to $62,324 as of press time. However, it’s important to note that this was just one potential factor threatening Bitcoin.

Can bulls defend BTC?

According to the given information, Bitcoin’s price might drop significantly and may land between $56,000 and $60,000. This could occur if the profitability decreases, causing more than 10% of Bitcoin holders to experience a loss.

It’s important to mention that AMBCrypto isn’t making this prediction without backing it up with historical evidence. For example, in January 2021, Bitcoin’s price dropped from $40,000 to $31,000 when a larger number of holders saw losses relative to the given ratio.

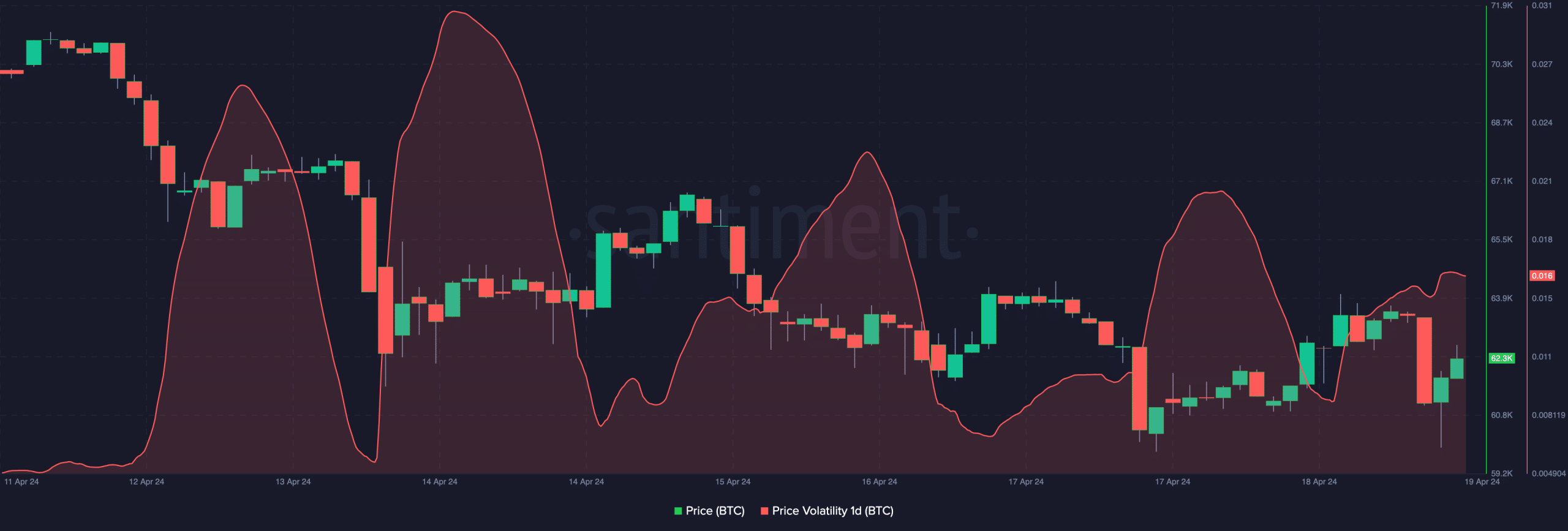

To find out if this was a possibility, we looked up the coin’s price instability using the analytical tool Santiment. The coin’s one-day volatility was currently at 0.016.

With greater volatility comes the chance for larger gains, but this increase can also lead to sizeable price drops.

Currently, Bitcoin’s volatility is less extreme than it was on April 14th and 16th. If this volatility measure reaches those levels again, however, we can expect significant price fluctuations for Bitcoin.

If the demand to buy bitcoin decreases, it may drop to around $56,000. But if the desire to buy increases significantly, bitcoin could instead head upwards.

Trouble ahead? Traders take cover

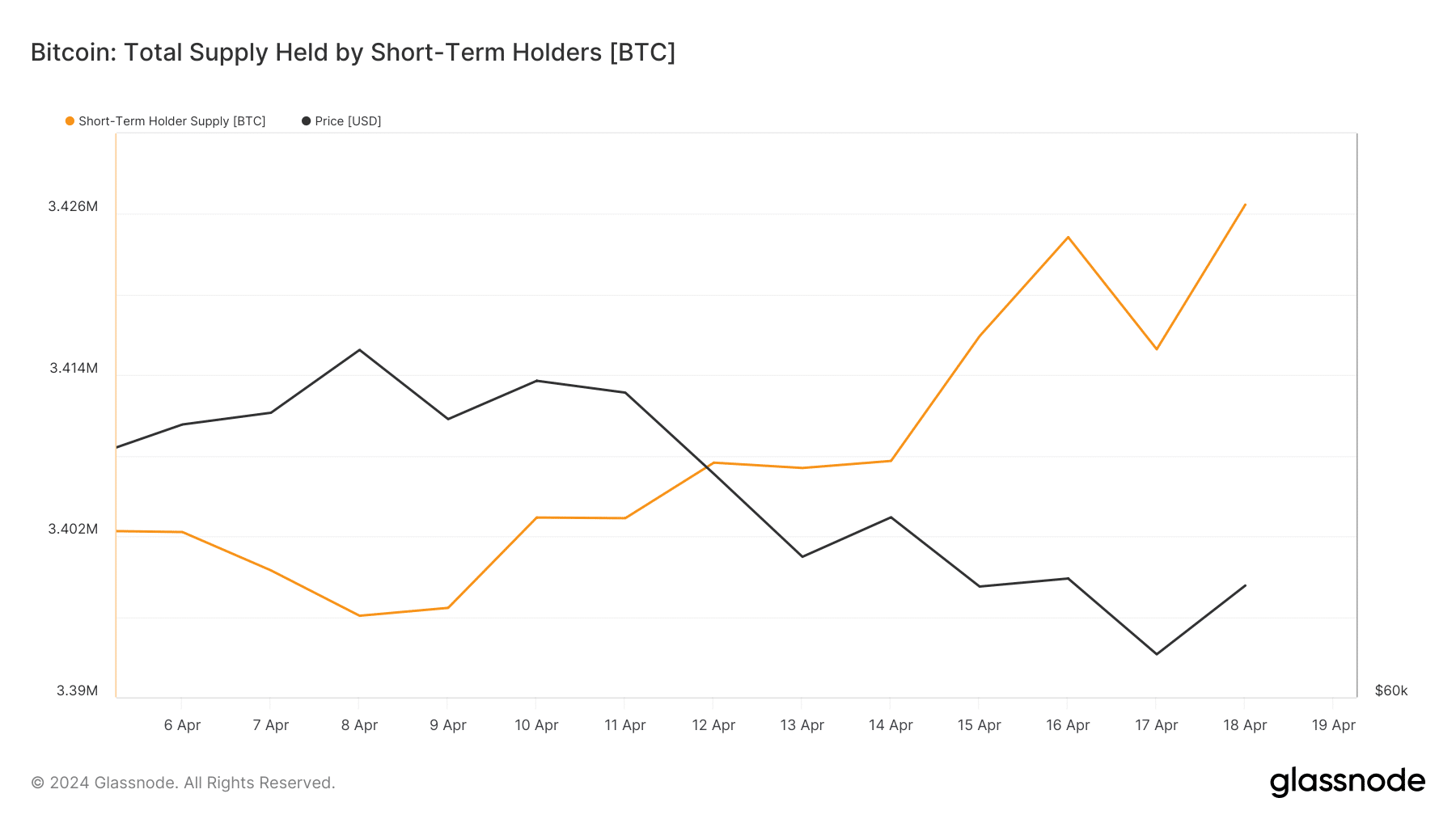

During this period, it was discovered that the amount of Bitcoin held by short-term investors (STHs) has risen. As reported by Glassnode, Bitcoin’s STH supply grew from 3.40 million to 3.42 million between April 14th and the present.

Short-term investors’ holdings make up the metric, representing the overall volume. A decrease in this metric means fewer supplies are accessible for spending or trading. This situation often signals a bullish market trend.

If the situation were different for BTC, a decrease in STH supply might not significantly affect its price, which currently hovers around $62,000. However, this is not a given, as such an event could potentially negatively impact Bitcoin’s price.

From another perspective, a rise in supply might lead to a price decrease, potentially dropping the value down to $56,000.

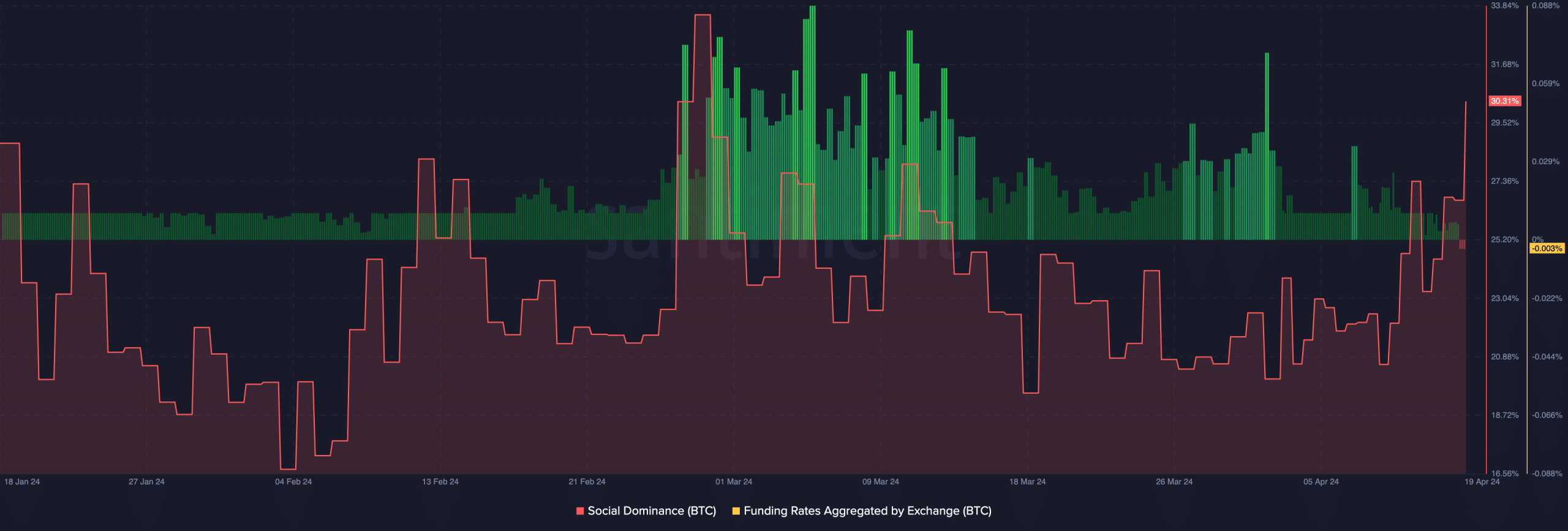

Although there is a prevailing pessimistic outlook, the percentage of social dominance rose to 30.31%. This rise might be attributed to the upcoming halving event, which some anticipate will significantly alter Bitcoin’s dynamics during this market cycle. Conversely, the combined Funding Rate demonstrated a decrease, suggesting that traders are reducing their bullish wagers.

Is your portfolio green? Check the Bitcoin Profit Calculator

if the cost continues to drop and large sellers are less active, Bitcoin may lack the power necessary to reverse the potential downtrend. Should this trend persist during the upcoming halving event, a decrease in price is likely to occur.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-19 14:15