- Bitcoin’s hashprice has hit a record low, stroking fears of another round of miner crisis.

- Network Difficulty was up 10%, and daily miner revenue has tanked by 50%.

As a seasoned crypto investor with battle scars from the 2018 crypto winter and the 2020 halving miner crisis, these recent developments in Bitcoin (BTC) are giving me a sense of déjà vu. The record low hashprice, coupled with a surge in network difficulty and dwindling miner revenue, paints a grim picture for smaller miners who may be struggling to stay afloat.

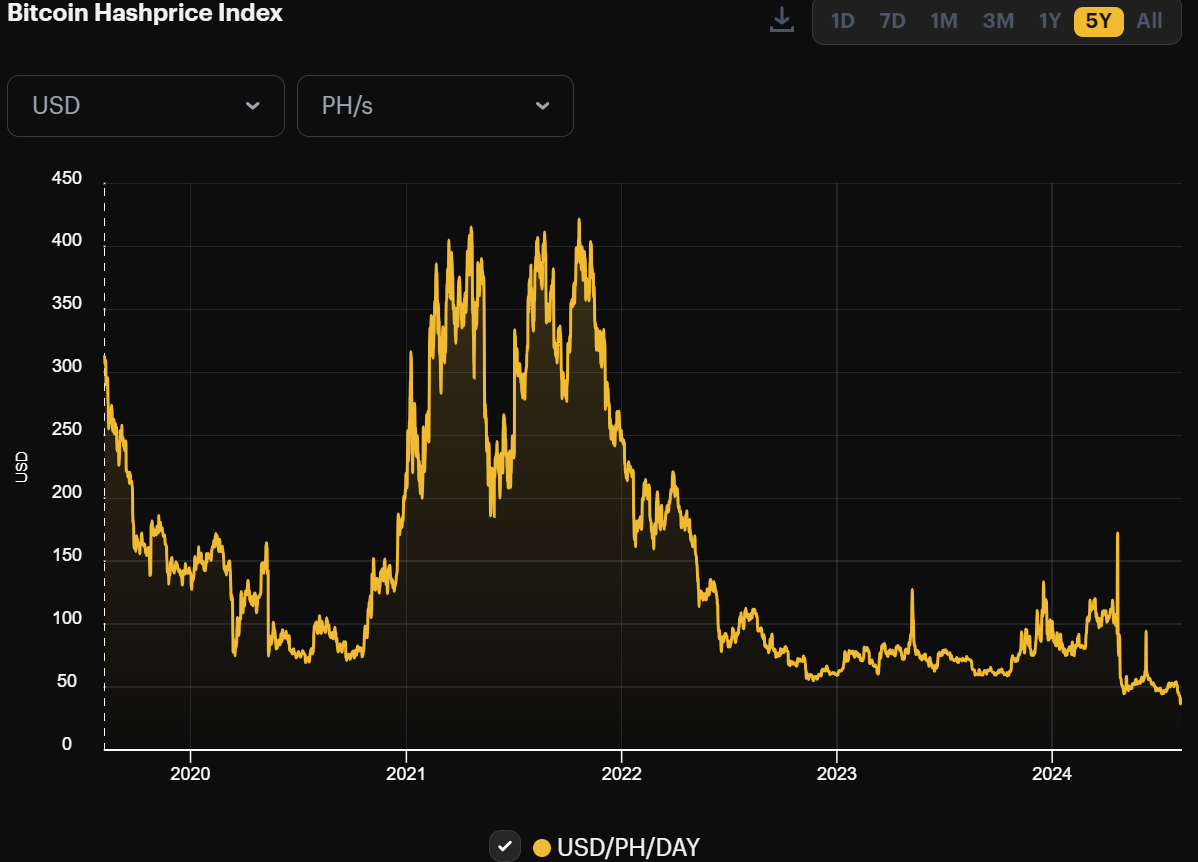

The cost-per-hash of Bitcoin (BTC), a metric that reflects miner earnings, has plummeted to an all-time low, sparking concerns that Bitcoin miners may once again be confronted with a crisis related to profitability.

Based on the information from the Hashrate Index, the cost for a single day’s worth of computing power decreased to approximately $40 on August 8th.

In terms of low points, this situation dropped lower than the 2022 crypto winter, which reached an all-time low of $60 per unit during a significant Bitcoin miner crisis.

As an analyst, I’ve observed a significant drop in Bitcoin miner revenue per day. Initially, on the 29th of July, it stood at approximately $40 million. However, by the 7th of August, this figure had diminished to around $24 million, according to data from YCharts.

Bitcoin network difficulty increases

The struggles faced by miners have been exacerbated by an increase in the difficulty level of the Bitcoin network, reaching a new peak of 90 trillion in August, an uptick from 80 trillion in mid-July.

In simpler terms, it takes approximately 10% more computational resources to mine Bitcoin or discover a new block compared to before.

As a former miner who has faced the harsh realities of the bitcoin mining industry, I can attest that subscale miners are often operating on razor-thin margins. The volatility in cryptocurrency prices and the high cost of electricity for running mining rigs make it difficult for these operators to stay afloat without significant external support or a lucky break.

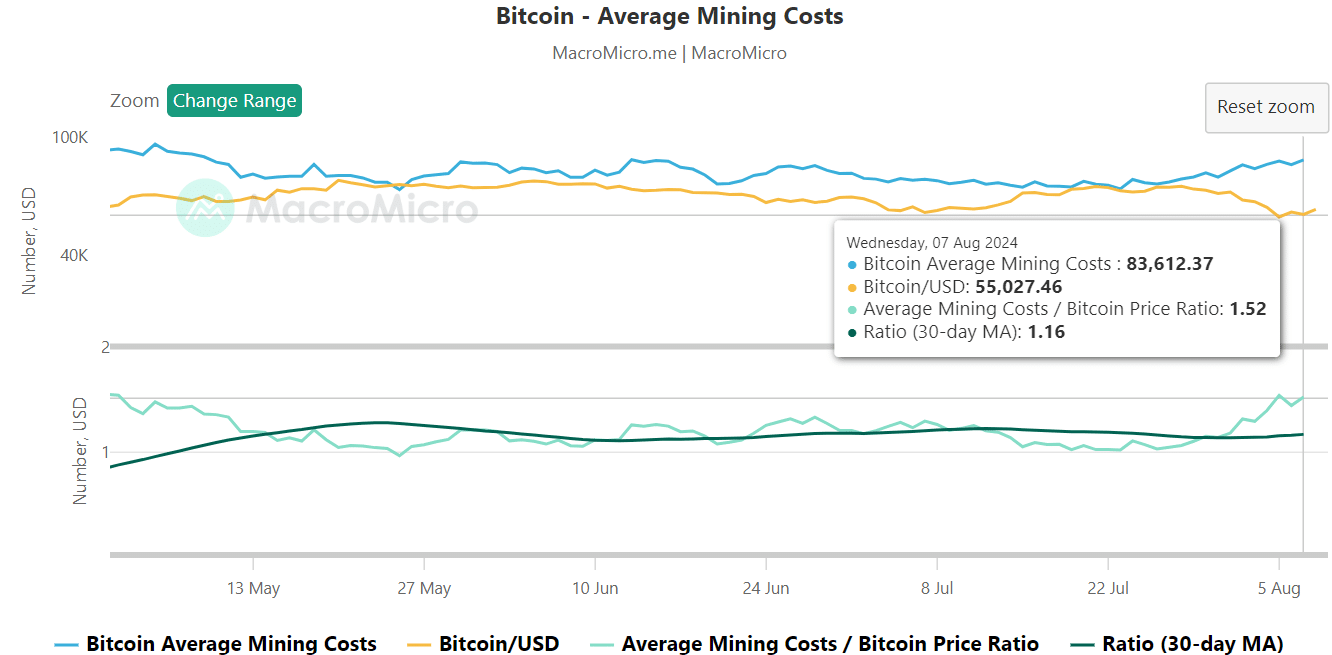

On August 7th, according to MacroMicro data, the average mining cost stood at approximately $83,600, while the Bitcoin price was around $55,000. This means miners were facing a significant gap of about $23,000 between their costs and the market price.

On the other hand, efficiently sized and optimized mining operations, such as Marathon Digital, typically have an average mining expense of around $43,000.

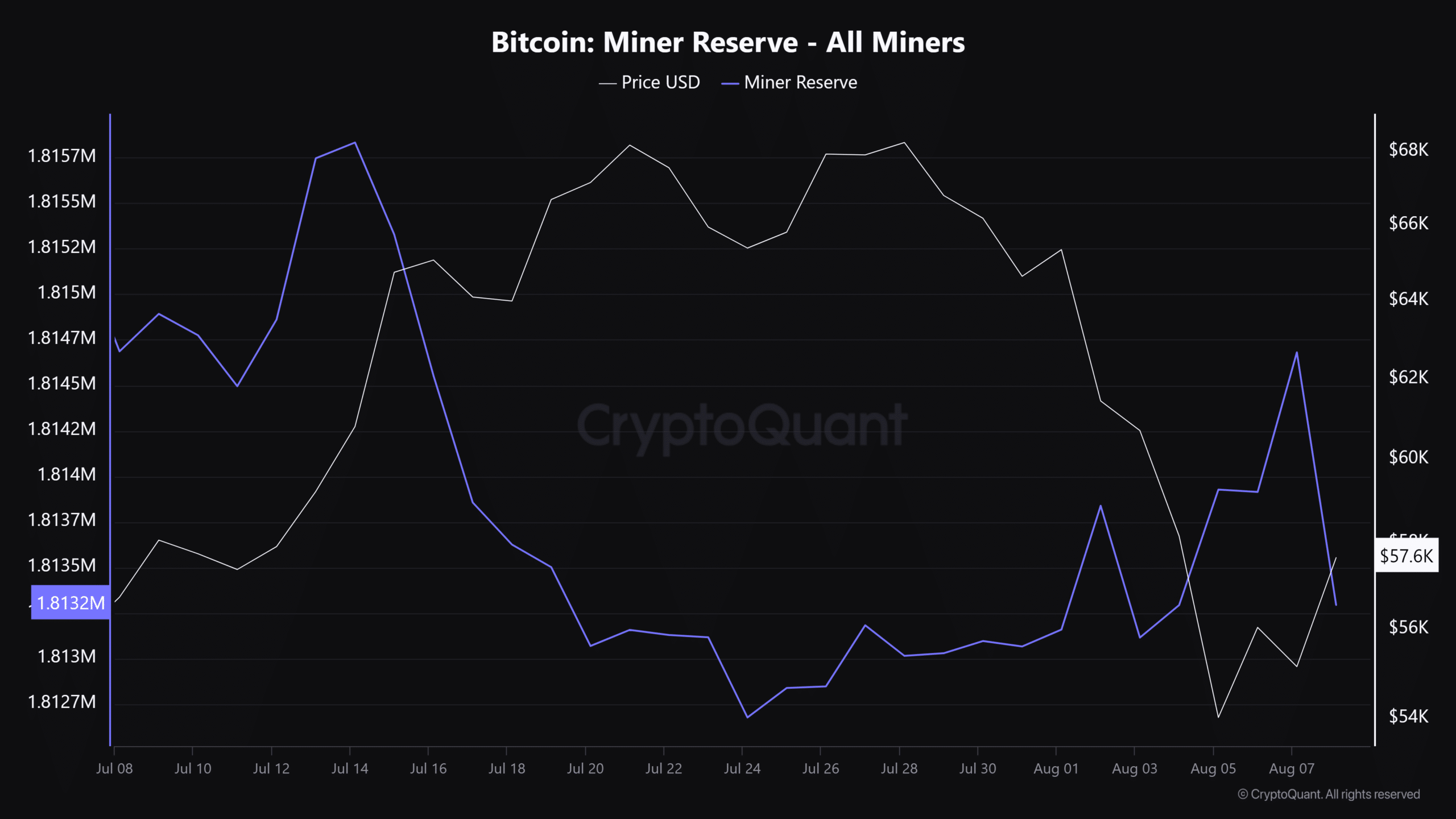

Ki Young Ju, founder of CryptoQuant, suggests that prolonged drops in Bitcoin’s price should cause concern, but otherwise, there is no need for excessive worry.

On the 7th of August, reserves of Bitcoin miners fell by more than 1,100 Bitcoins, indicating that some miners decided to sell a portion of their assets.

As a seasoned cryptocurrency investor with several years of experience under my belt, I have seen countless market fluctuations and trends. Over the past few months, I’ve noticed an interesting development in the Bitcoin mining sector – the total miner holdings have been steadily increasing since late July. This indicates that miners were holding onto their BTC even during last week’s dip, which is a strong sign of confidence in the long-term potential of the cryptocurrency market.

Although miners selling Bitcoin might increase price pressure, as of the latest update, Bitcoin was trading above $58K and potentially aiming for the prior range-low at $60K. Nevertheless, continuous miner sell-offs could disrupt the ongoing recovery process.

Read More

2024-08-09 09:11