- The Bitcoin miners’ reserve has declined significantly.

- Revenue has also plummeted to one of its lowest levels in history.

As a seasoned researcher with a background in cryptocurrency and blockchain technology, I have witnessed the ebb and flow of the Bitcoin market for quite some time now. The recent turn of events, however, has left me somewhat concerned. The significant decline in the Bitcoin miners’ reserve, coupled with the plummeting revenue to one of its lowest levels in history, paints a grim picture for these hardworking individuals who keep the network running.

Bitcoin miners have encountered considerable difficulties due to the Bitcoin’s hashrate reaching unprecedented highs.

The ongoing challenges we face are further complicated by the latest halving and Bitcoin’s significant price drops over the last few weeks.

Bitcoin hashrate spikes

Last week, analysis found that the Bitcoin hash rate profit, or the amount earned for each unit of computational power, reached a record low.

On August 4th, miners received approximately $35 for every petahash they mined each day, which was the lowest daily rate ever recorded in history.

Furthermore, the processing power of Bitcoin (or Bitcoin’s hashrate) reached a record high, hitting approximately 673 quintillion calculations per second.

An increase in the hashrate indicates a rise in mining complexity, which makes it harder for miners to efficiently mine new blocks.

The challenge faced by miners intensifies due to the recent decrease in transaction fees, putting more financial strain on them as a result. (Paraphrased)

Miners sell holdings as Bitcoin hashrate climbs

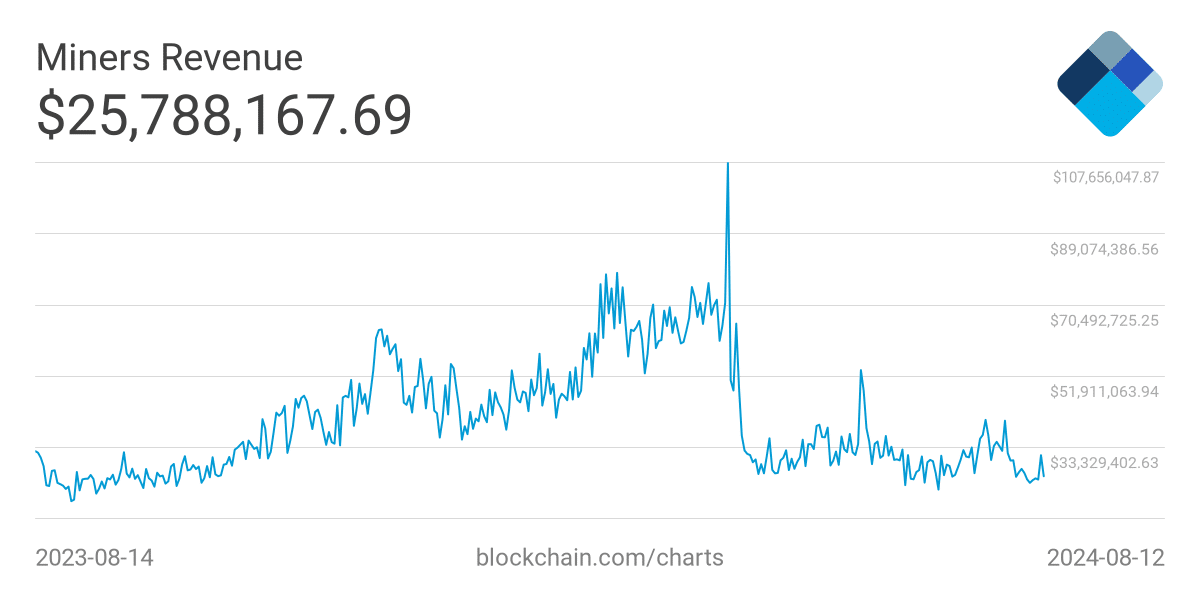

According to AMBCrypto’s examination, miner income saw a substantial decrease after the Bitcoin halving occurred.

According to data from Blockchain.com, the graph indicated a decrease in daily income from around $50,000 to about $30,000 on a day-to-day basis.

The fall worsened significantly due to a recent spike in Bitcoin’s mining difficulty, which drove earnings down to approximately $25,000 – a nearly record-low for miners.

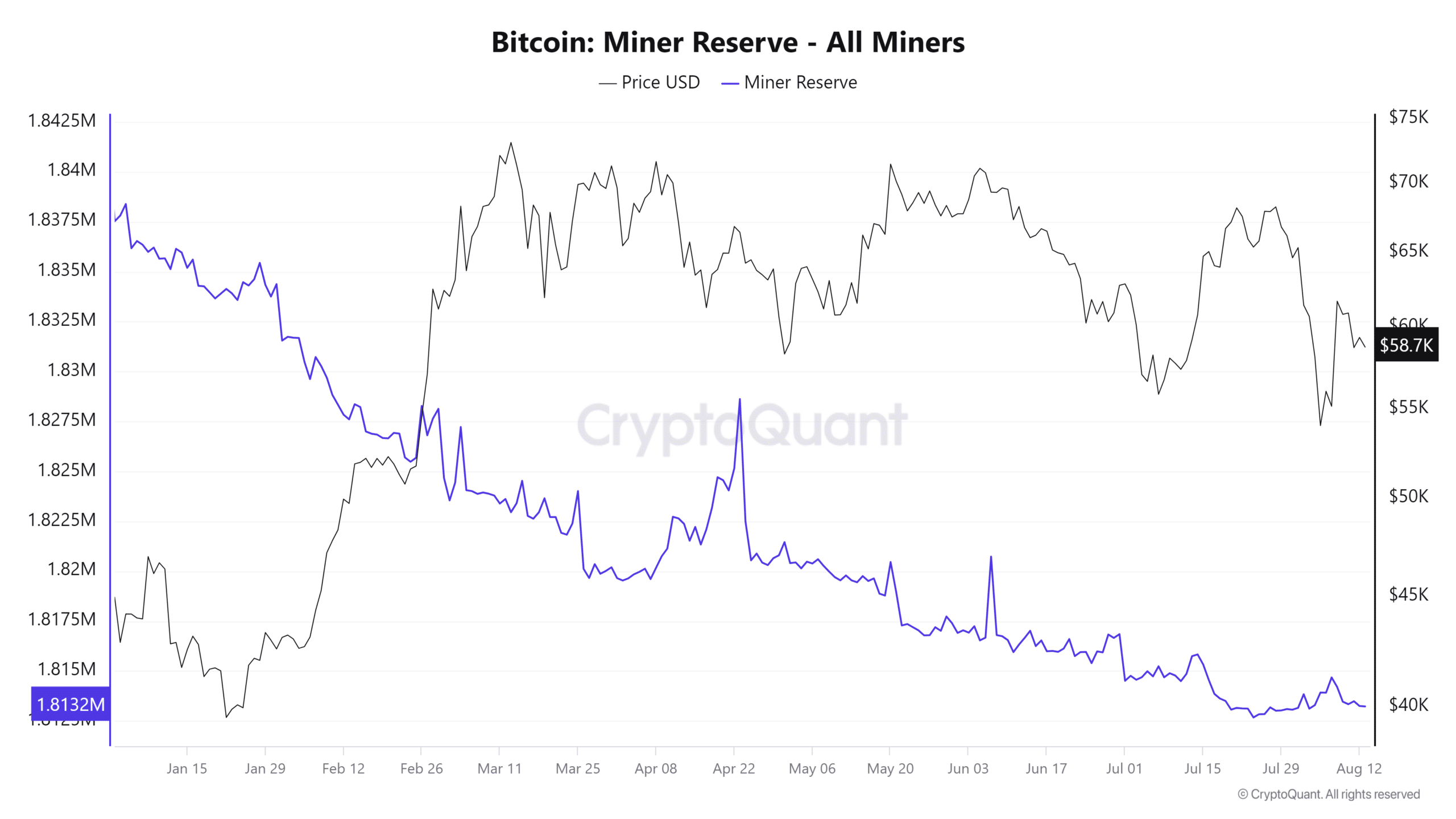

The decrease in income, along with the persistent drop in Bitcoin’s value, has similarly affected the miner’s savings or reserves.

According to data from CryptoQuant, there has been a significant drop in Bitcoin reserves since April, with the current figure standing at around 1.813 million Bitcoins as of now.

If the hashrate remains elevated, miner reserves will likely diminish in the forthcoming months.

Bitcoin’s feeble climb challenged

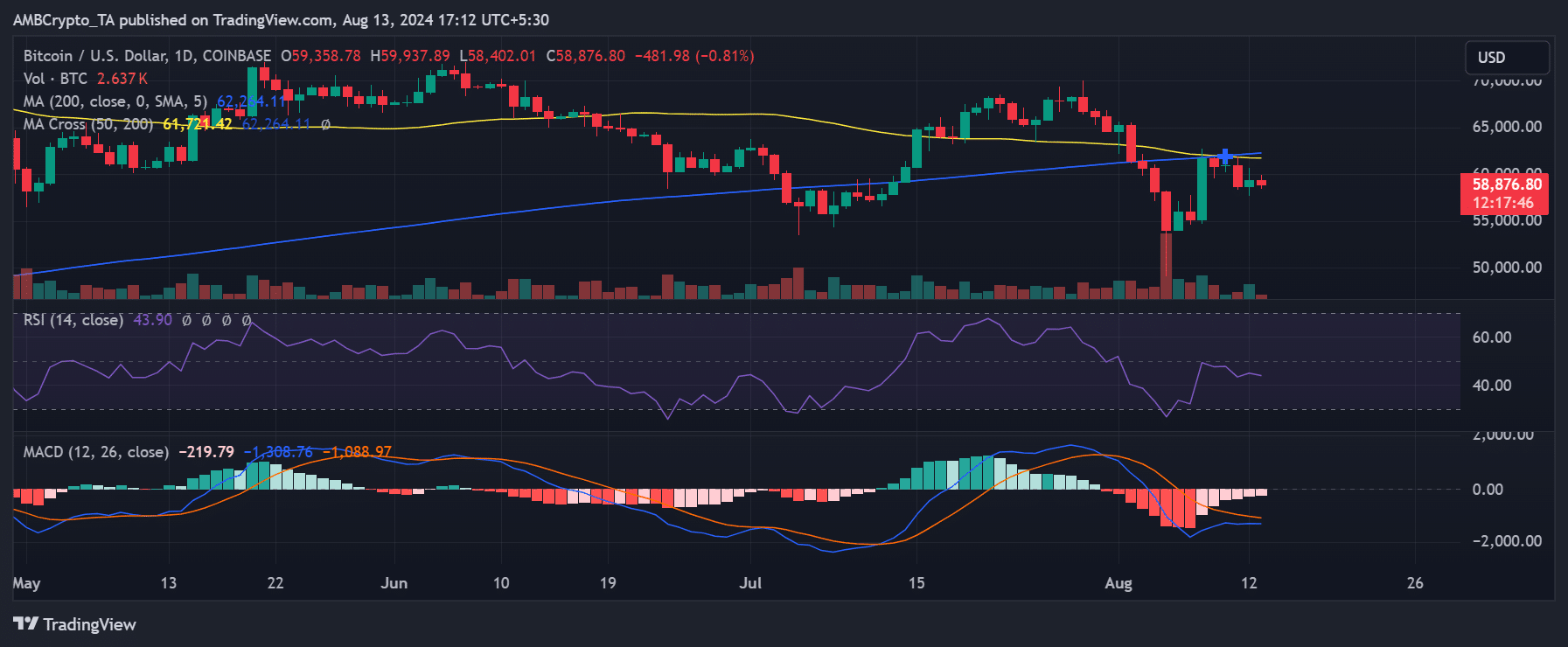

In the recent trading period, Bitcoin showed a minor recovery, increasing by about 1% to reach roughly $59,358. Yet, it has subsequently lost almost 1% of these gains and is currently trading around $58,800.

This recent price action extends the pattern of volatility seen in recent weeks.

According to AMBCrypto’s analysis, the technical signs like MACD and RSI suggest that Bitcoin’s overall trend remains bearish.

As of this moment, my analysis reveals that the Relative Strength Index (RSI) is still falling short of the neutral mark, indicating a continued downward trend. Additionally, the Moving Average Convergence Divergence (MACD) lines and histogram are currently situated below zero, signaling persistent bearish momentum.

Moving toward an upward trend in Bitcoin prices can assist miners in overcoming difficulties caused by the current high level of Bitcoin’s computational power (Hashrate).

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- ANKR PREDICTION. ANKR cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Tainted Grail: The Fall of Avalon Review

2024-08-13 17:13