- Despite corrections, Bitcoin’s price has remained firmly around the $90,000 zone

- Crypto’s price could hike well beyond this level soon

As a seasoned analyst with over two decades of market observation under my belt, I’ve seen enough bull and bear cycles to know that Bitcoin’s current market dynamics are reminiscent of the pre-2017 bull run. The decline in exchange reserves, the rising Open Interest, consistent net outflows, and a bullish NVT Golden Cross – it all points towards a strong accumulation trend among long-term holders.

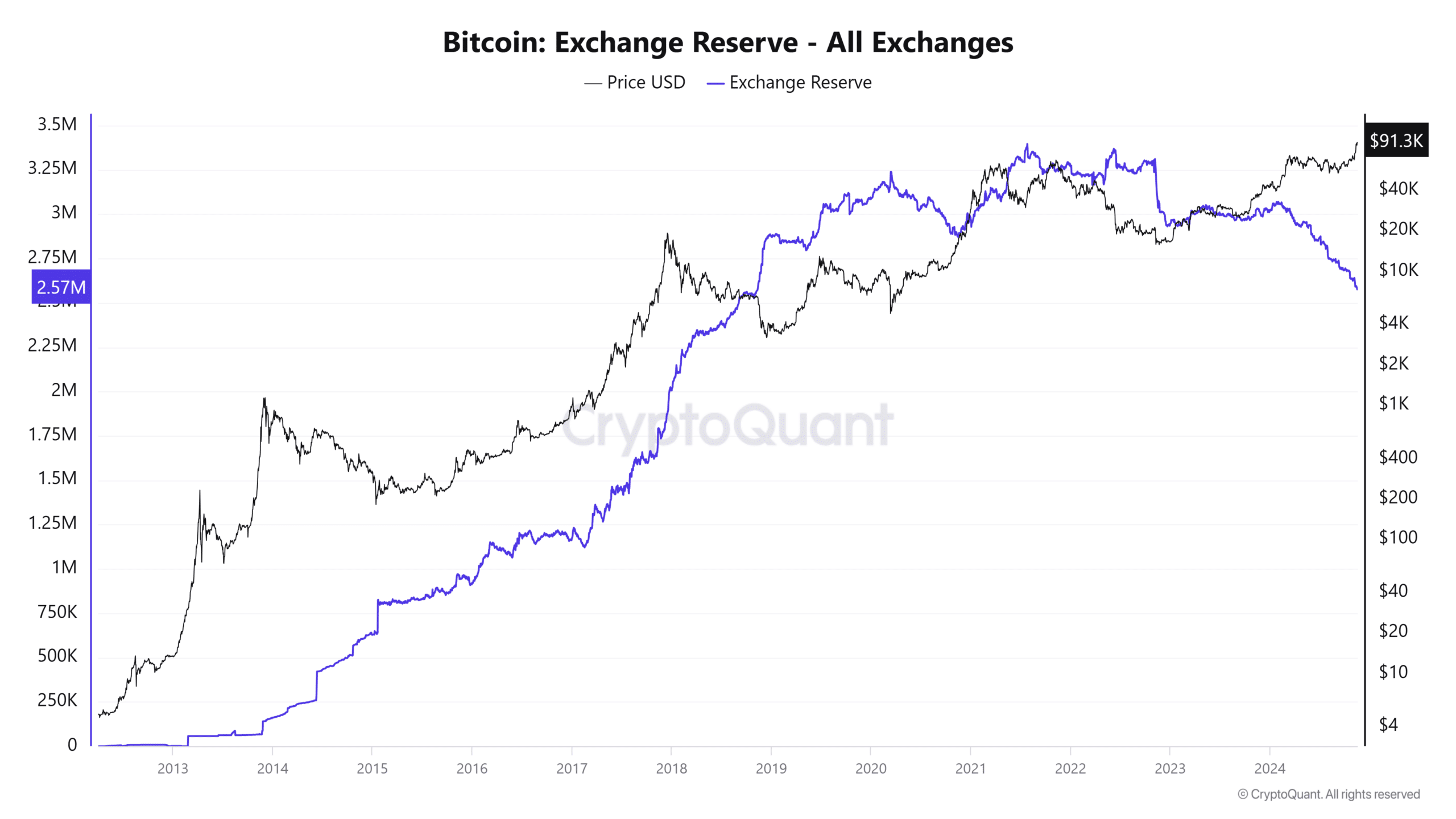

As a crypto investor, I’ve noticed an intriguing development: Bitcoin’s (BTC) reserves on exchanges have plunged to levels not seen since November 2018, indicating a substantial change in market dynamics. This notable achievement comes hot on the heels of Bitcoin crossing the $91,000 mark, which seems to be driven by increasing demand.

Clearly, the combination of these elements triggers important queries concerning the market’s ability to trade freely (liquidity) and hints at potential implications for Bitcoin’s future trajectory.

Bitcoin exchange reserves and liquidity dynamics

The amount of Bitcoin held in exchanges dropped to approximately 2.57 million Bitcoins, according to a graph from CryptoQuant. This amount is similar to what was observed during the collection period prior to the 2020-2021 market surge.

Historically, when Bitcoin (BTC) exchange reserves decrease, it suggests that fewer Bitcoins are being sold on exchanges because more of them are being transferred to personal wallets. This could imply a significant buying trend by long-term investors.

As the value of Bitcoin soared to $91,000, this decrease in exchange reserves highlighted a limited supply amidst increasing market demand.

Should reserves keep dwindling, liquidity might tighten even more, possibly causing increased price fluctuations in the short run. Yet, this could also pave the way for an extended surge, particularly since the amount of Bitcoin available for trading is decreasing.

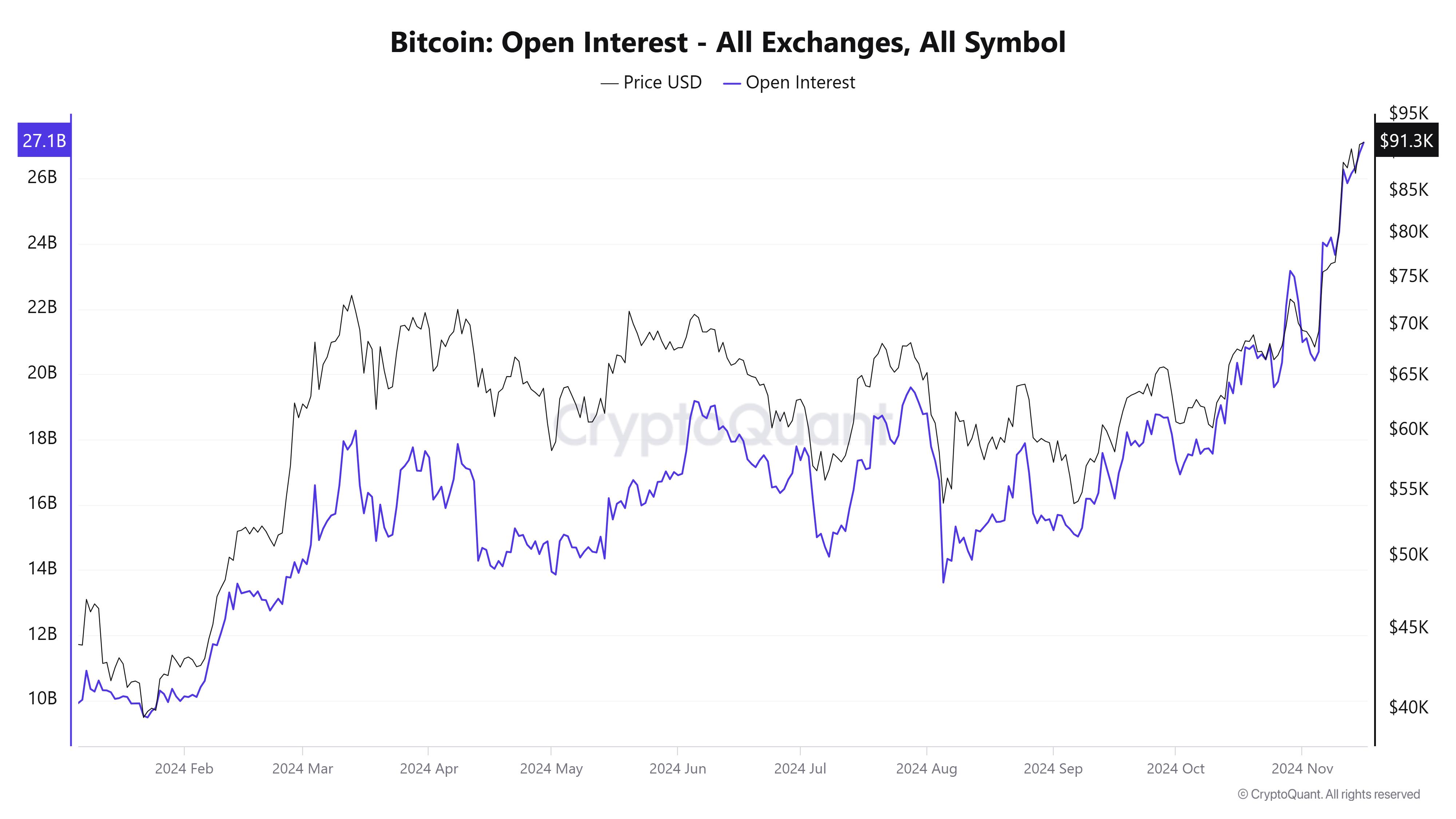

Derivatives data – Bitcoin Open Interest hits new highs

According to CryptoQuant’s data, the total open interest on all cryptocurrency exchanges reached $26.8 billion, indicating a significant increase in speculative trading. This rise is particularly notable as Bitcoin’s price nears unfamiliar heights.

An increase in Open Interest that coincides with an escalating price is usually a positive signal, suggesting heightened market involvement and enthusiasm.

On the other hand, high Open Interest levels call for careful consideration. Over time, significant changes in prices have frequently resulted in liquidations, especially when there is a buildup of leverage.

Keeping an eye on both funding rates and open interest will be crucial in determining if the market is still excessively hot or preparing for more positive movement ahead.

Accumulation over distribution

As an analyst, I observed a persistent outflow of Bitcoin from cryptocurrency exchanges, with approximately 7,500 Bitcoins leaving compared to just 4,200 entering. This consistent net outflow aligns with the broader narrative that investors are accumulating Bitcoin, as they move their digital assets to cold storage or other secure custody solutions.

During past market phases, extended periods of Bitcoin moving out of exchanges often paved the way for significant price increases. This pattern indicates a market behavior where the availability of Bitcoin on exchanges decreases over time. Such trends imply that investors are accumulating Bitcoin in expectation of rising prices, which is a positive sign for the market.

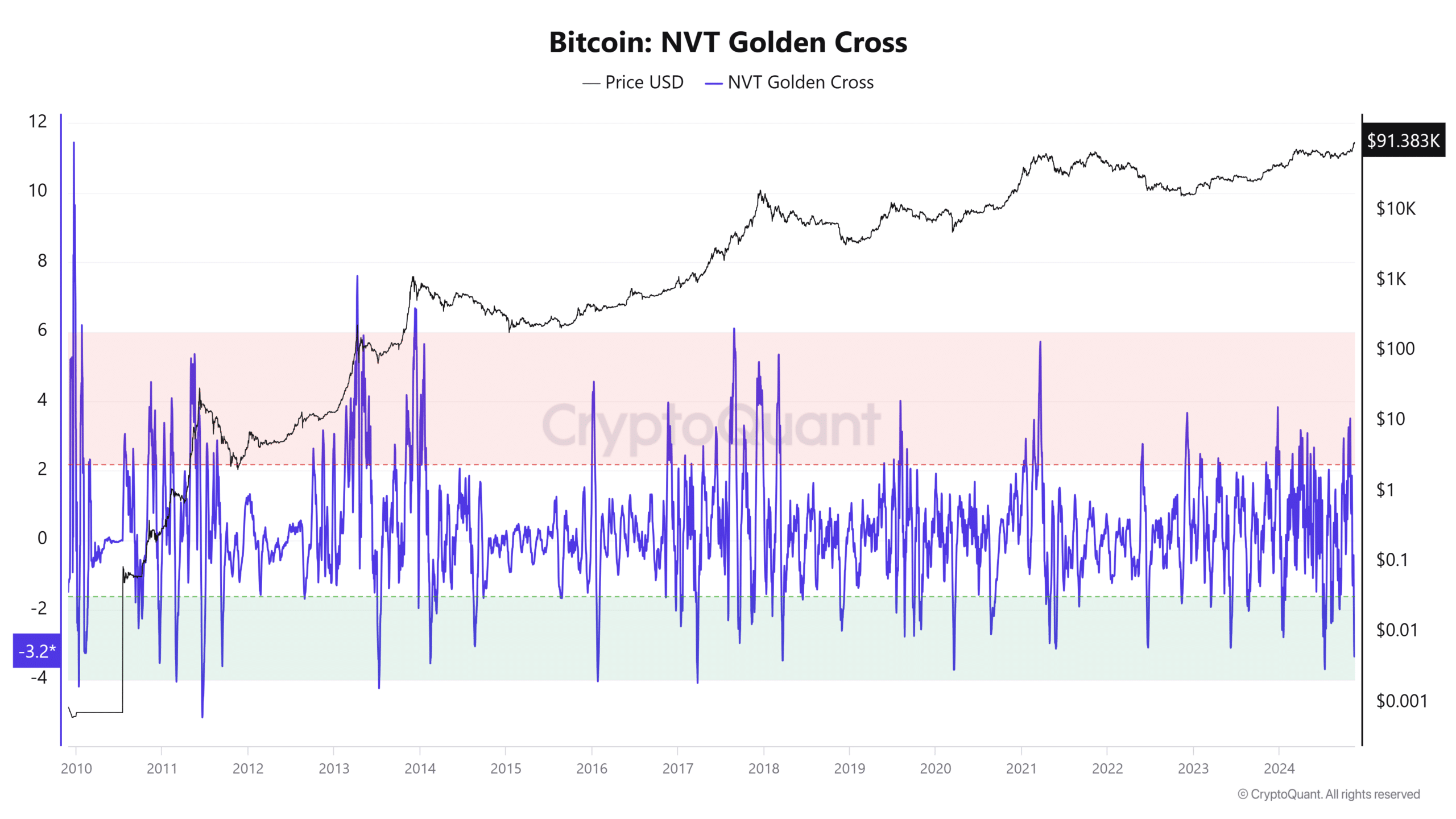

Bitcoin NVT Golden Cross – A signal of market strength

The Network Value to Transactions (NVT) ratio for Bitcoin has moved into a bullish zone, as indicated by graphs from CryptoQuant, suggesting an optimistic trend in the market.

In other words, here we’re pointing out that this measure examines Bitcoin’s market value relative to its transaction amount. Essentially, it helps us understand if the network’s worth is backed by its usage.

Previously, when the NVT Golden Cross moves up into the ‘green zone’, this usually indicates increased trading activities compared to Bitcoin’s value – a signal suggesting robust network utilization and favorable market trends.

Instead of moving into the “red zone,” this suggests an overvaluation or decrease in network activity. At the present moment, its placement within the “bullish zone” supports the idea of increasing adoption and network confidence. This seems to align with the decreasing exchange reserves and escalating Open Interest trends.

– Read Bitcoin (BTC) Price Prediction 2024-25

A decrease in the amount of Bitcoins held on exchanges combined with increasing Open Interest, persistent withdrawals, and a favorable NVT Golden Cross pattern suggest a robust market configuration is developing.

As I delved into the market trends, it appeared that the potential decrease in exchange liquidity might foster increased volatility. However, the data hinted at a strategic move by market players, suggesting they were preparing for a prolonged bullish trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-16 23:04