-

Bitcoin has declined by over 7% over the last 7 days.

Analysts believe a significant correction could be due if BTC drops below $56k

As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of market fluctuations and corrections. The recent 7% decline in Bitcoin over the last week has raised some eyebrows, and the potential for a significant correction if BTC drops below $56k is certainly concerning.

Currently, Bitcoin (BTC), the top digital currency in terms of market size, has experienced a notable drop in value during the past week. At this moment, BTC is trading at a decrease of more than 7%, with a value of approximately $59,129 on the price charts.

Overall, August has seen significant fluctuations in the cryptocurrency market. For example, Bitcoin plummeted down to around $49,500 on the graphs earlier this month, only to bounce back quickly afterward. Interestingly, it reached a local peak of over $65,000 later, but subsequently lost those gains and fell below $60,000 again.

That’s the reason why many are still uncertain about the scale of the next wave of corrections.

As suggested by cryptocurrency analyst Julio Moreno, if the price of Bitcoin falls below $56,000, it could potentially experience a significant drop in value.

What does the market sentiment say?

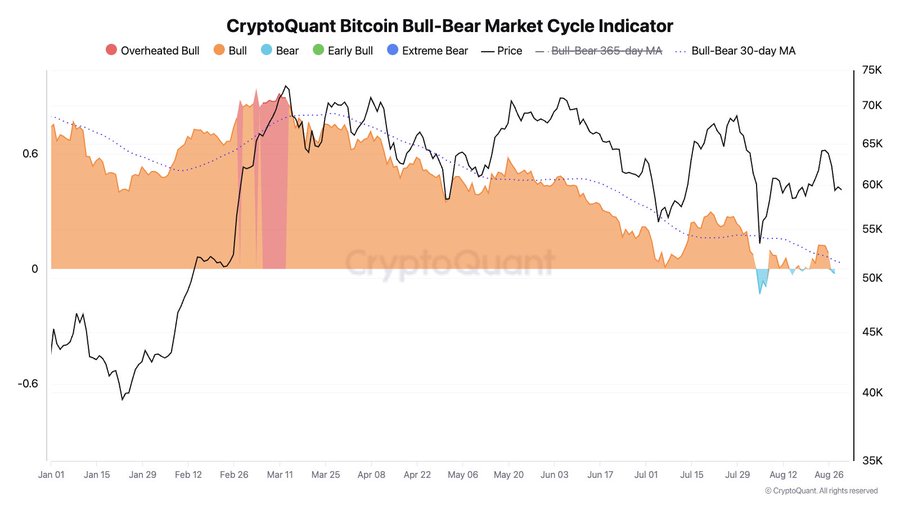

As an analyst, I’ve identified a critical support level for the crypto market at $56k based on my analysis using the market cycle indicator. If the price drops beneath this point, the cryptocurrency could exhibit considerable weakness. Given that the Bitcoin market cycle indicator has once again turned bearish, there’s a risk of further correction below the demand zone.

The analyst shared the analysis on X, noting that,

The Bitcoin market cycle is currently in its bearish phase, represented by the light blue section. If the price drops below $56K, the possibility of a more substantial correction becomes higher from a value standpoint.

According to this study, the Bear phase looks strong and could continue if the buyers (bulls) fail to regain control over the market.

What do BTC’s charts say?

It’s crucial to consider what other market signals may be pointing towards as well, beyond the predictions indicated by Moreno’s metrics.

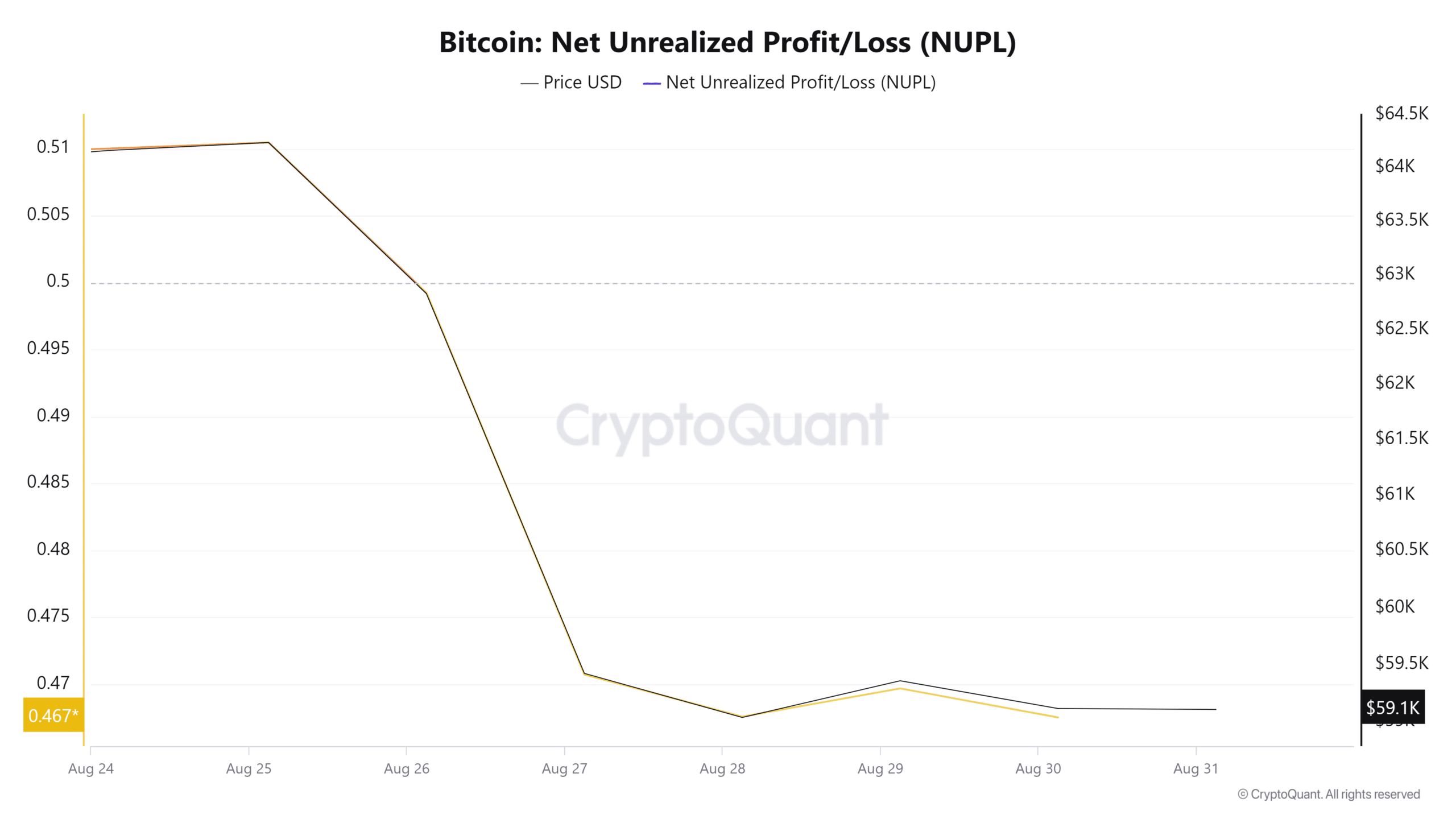

Initially, it’s worth noting that the Network Value to Transactions Ratio (NUPL) of Bitcoin has decreased over the last week. This ratio, which measures net unrealized profit/loss, dropped from 0.5 to 0.4. This indicates a shift among investors from holding unrealized profits to unrealized losses.

This signal suggests the market could be tilting towards a downward trend (bearish). Consequently, it indicates that investors might be concerned about the durability of the present price levels, potentially leading to increased selling activity.

Additionally, BTC is reporting a negative adjusted price DAA divergence of -44.31.

This indicates a drop in on-chain transaction levels, given the present price range. This type of market scenario often leads to corrections, as prices tend to realign with the reduced level of on-chain activity.

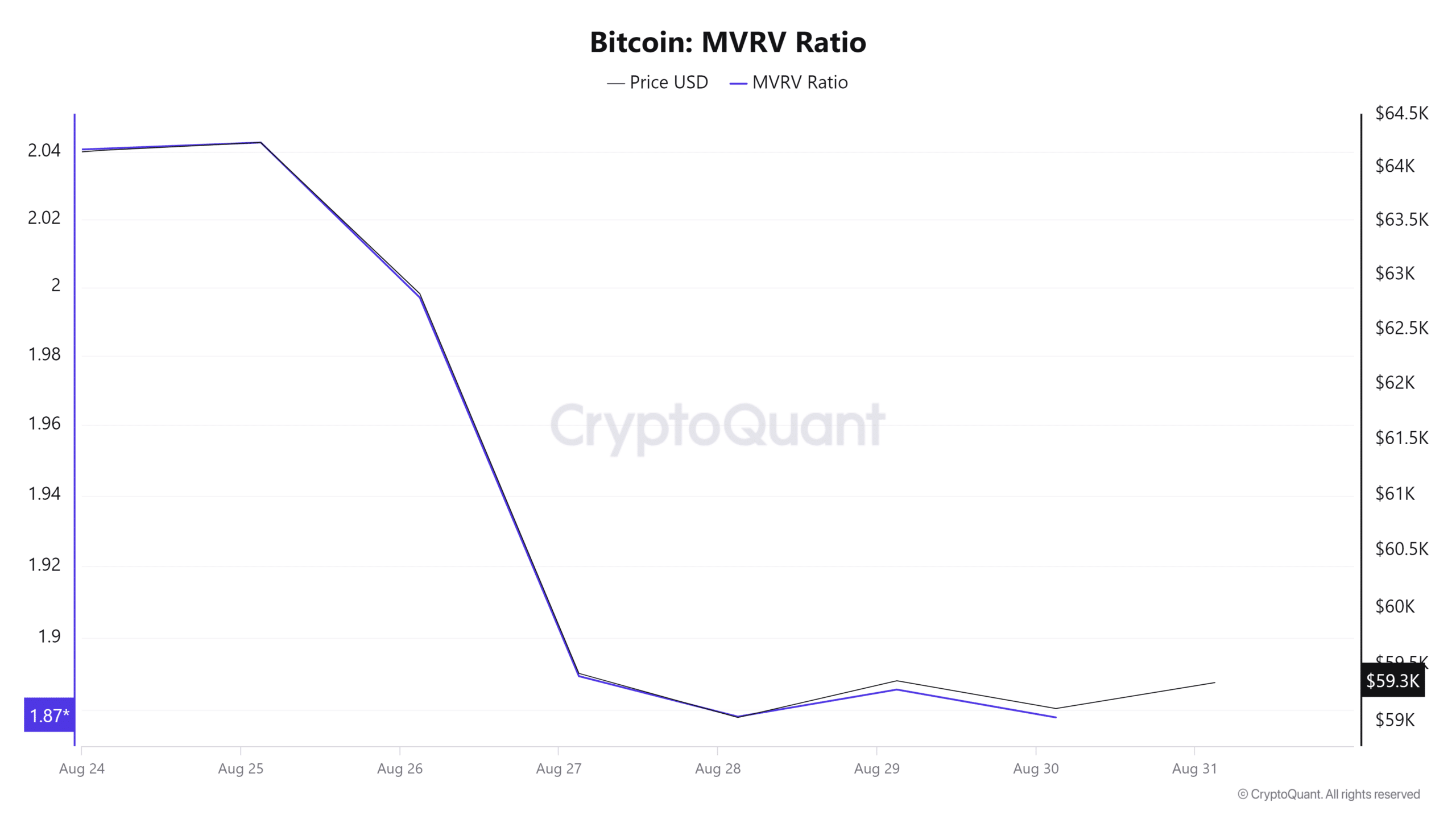

Over the last seven days, I’ve noticed that the MVRV ratio for Bitcoin has consistently hovered around 1.8. This suggests that many investors are currently in profit, which might result in increased selling pressure as they look to cash out their earnings. Consequently, if these Bitcoin holders decide to sell at this rate to lock in their profits, it could potentially trigger further price corrections.

If selling pressure increases, the market will experience a pullback.

Consequently, following the analysis by Cryptoquant expert Julio, it appears that Bitcoin is in a bearish phase. If the present market trends persist, there’s a possibility of a more significant downturn. A decline below the $56 mark could push Bitcoin prices under the crucial support level of $50,000 down to $49,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-01 06:16