- Sentiment index at 69 signals optimism, but caution is advised

- Historical patterns pointed to correction risks near market highs

2025 finds the market buzzing with investor excitement, driven by increased optimism and a fresh outlook on possibilities. Although enthusiasm isn’t yet reaching the heights of past market frenzies, it’s climbing steadily. However, experts advise that the chances of a correction, notably in Bitcoin [BTC] and significant cryptocurrencies, are growing as the market gathers speed.

Keeping these thoughts in perspective, it’s essential for investors to remain attentive, closely observing significant markers and staying attuned to subtle hints that might suggest a change in market trends.

Fear and greed index – What happens at 95?

Currently, the index is at 69 – an indication of confidence, though it’s yet to reach the “red zone.” Analysts suggest that once the index hits 95, the market often shows signs of overheating, characterized by excessive speculation and enthusiasm. In the past, this level has functioned as a warning sign, implying that a potential correction or decline could be on the horizon.

These levels typically come before changes in investors’ actions, as tentative optimism transforms into overly enthusiastic sentiment that can’t be maintained.

Key indicators to watch for a potential correction

In response to signs of an impending market bubble, Adler identified some crucial markers that might signal a potential market correction well in advance.

Long-term holder sales

Historically, when long-term investors start selling more often, it’s been a sign that a market correction might be beginning. In December 2024, there was a slight increase in sales by these long-term holders, similar to the pattern seen before the high points of the markets in 2021 and 2017. If this selling activity spikes significantly, it could mean that seasoned investors are unloading their investments ahead of a possible market decline, which could shake investor confidence.

BTC ETF outflows

Following unprecedented investments in the last months of 2024, Bitcoin Exchange-Traded Funds experienced minor withdrawals at the beginning of January 2025. Such a trend might signal a decrease in interest from institutional investors, which historically tends to reduce the level of buying demand.

MicroStrategy share movements

As a barometer of institutional interest in Bitcoin, MicroStrategy’s (MSTR) shares act as a crucial indicator. If there is a prolonged drop in its stock performance, especially after a robust Q4 2024 demand, it might suggest that large-scale investors are losing their appetite for Bitcoin investments. Historically, such shifts have occurred around market downturns.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Bitcoin – Historical patterns and price analysis

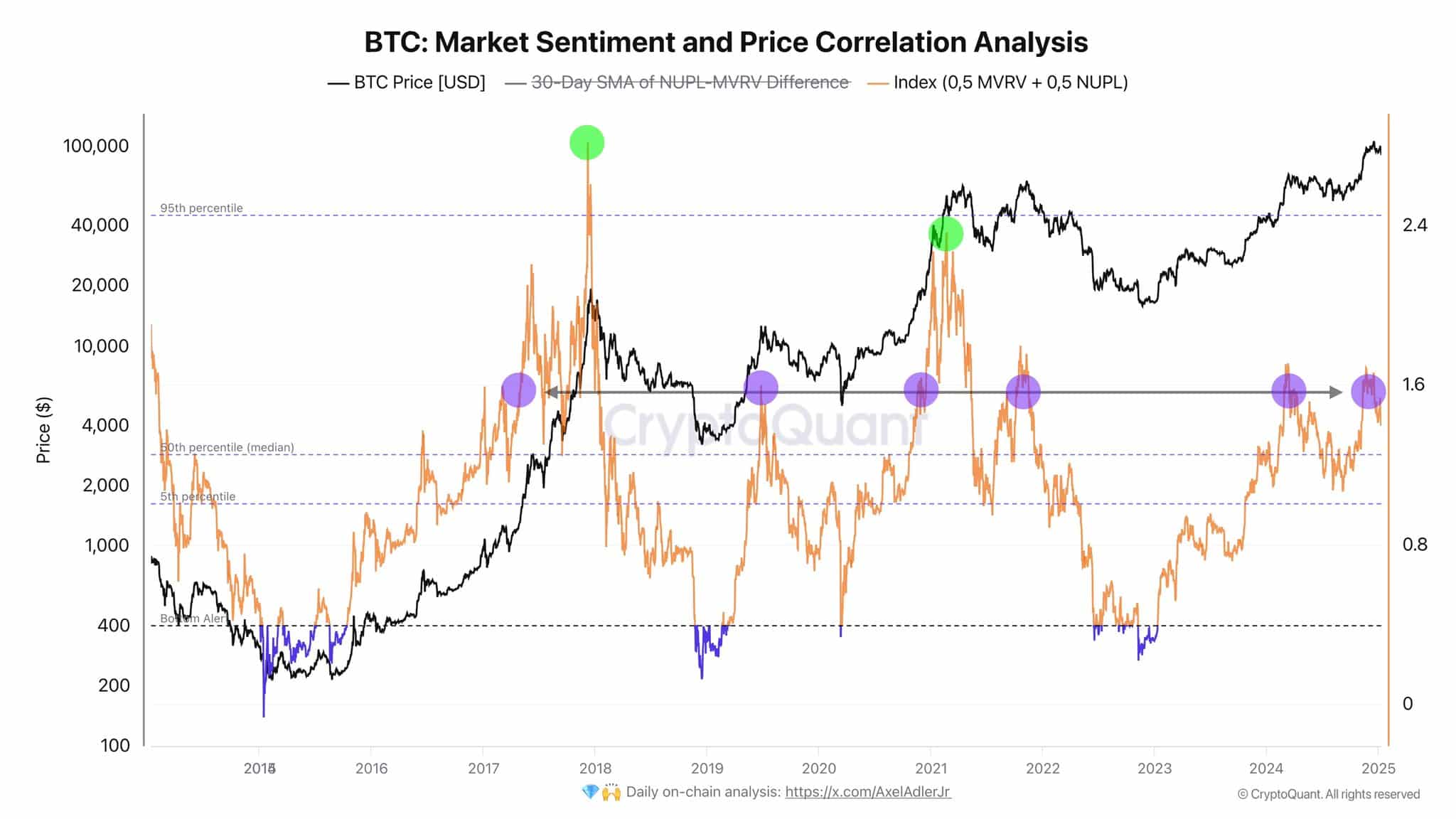

Historically, the relationship between market sentiment and price has been a dependable indicator for forecasting market trends. Currently, the NUPL-MVRV index appears to be moving towards levels that, in the past, have signaled market tops in 2017, 2021, and mid-2024.

These boundaries signal areas with increased danger, as price adjustments typically occur after periods of intense heating or inflation.

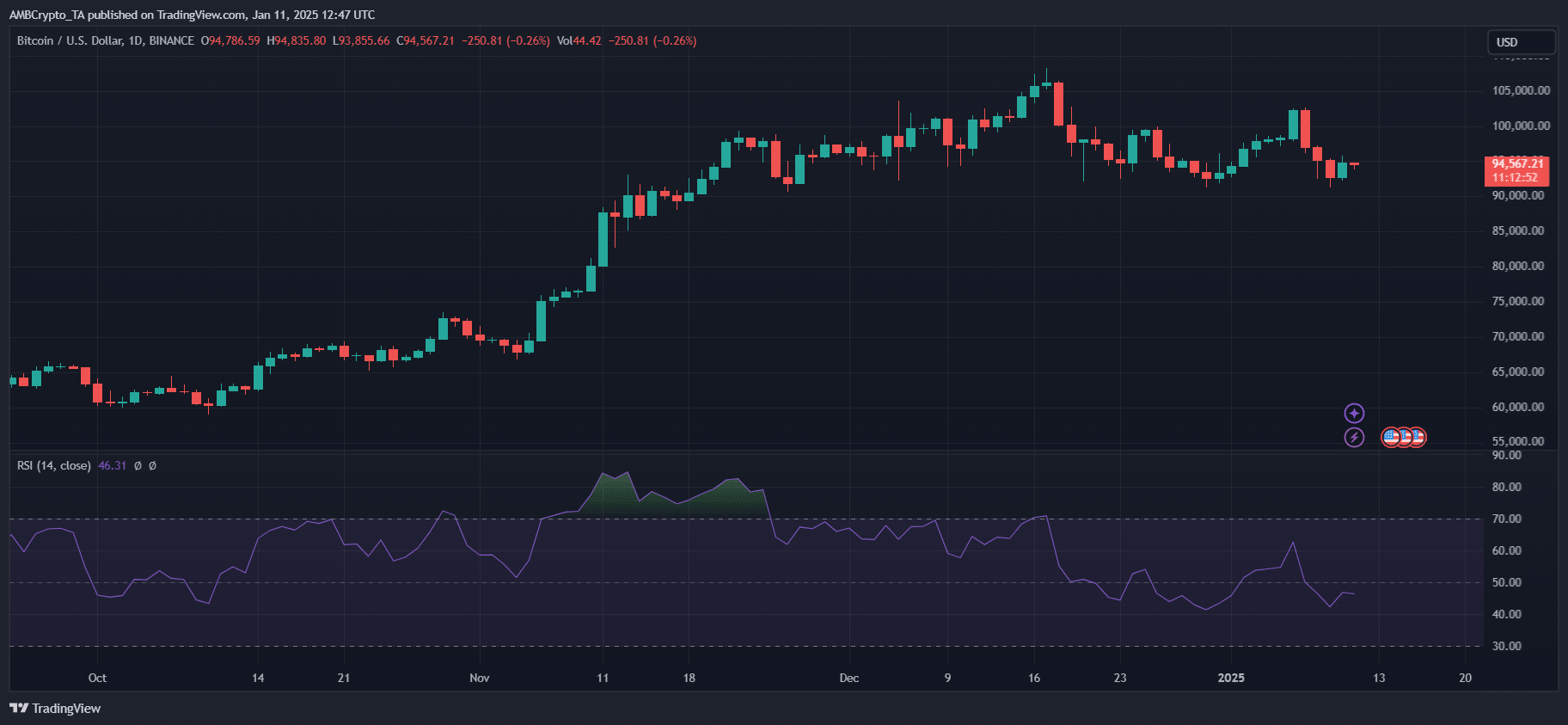

In a similar fashion, following December’s excessive highs, Bitcoin’s Relative Strength Index (RSI) dropped to around 46 on its daily chart, indicating a possible transition towards consolidation or a decrease.

As an analyst, I’ve observed that the price action hovering around $95,000 indicates a significant resistance zone. Previously, our upward trajectories have stalled following similar Relative Strength Index (RSI) decreases. If we don’t manage to regain momentum at this point, it might trigger a pullback towards support zones ranging from $88,000 to $90,000. This potential downturn aligns with broader market trends of profit-taking and declining Exchange Traded Fund (ETF) inflows.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-01-12 11:03