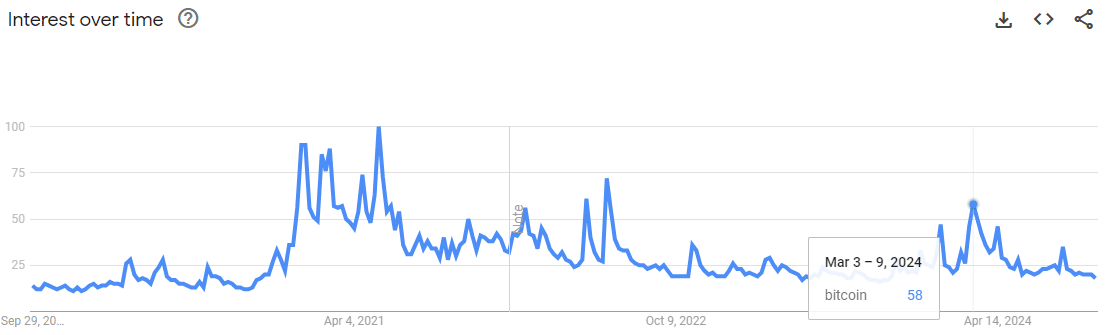

- Bitcoin popularity is a small fraction of what it was in March 2024.

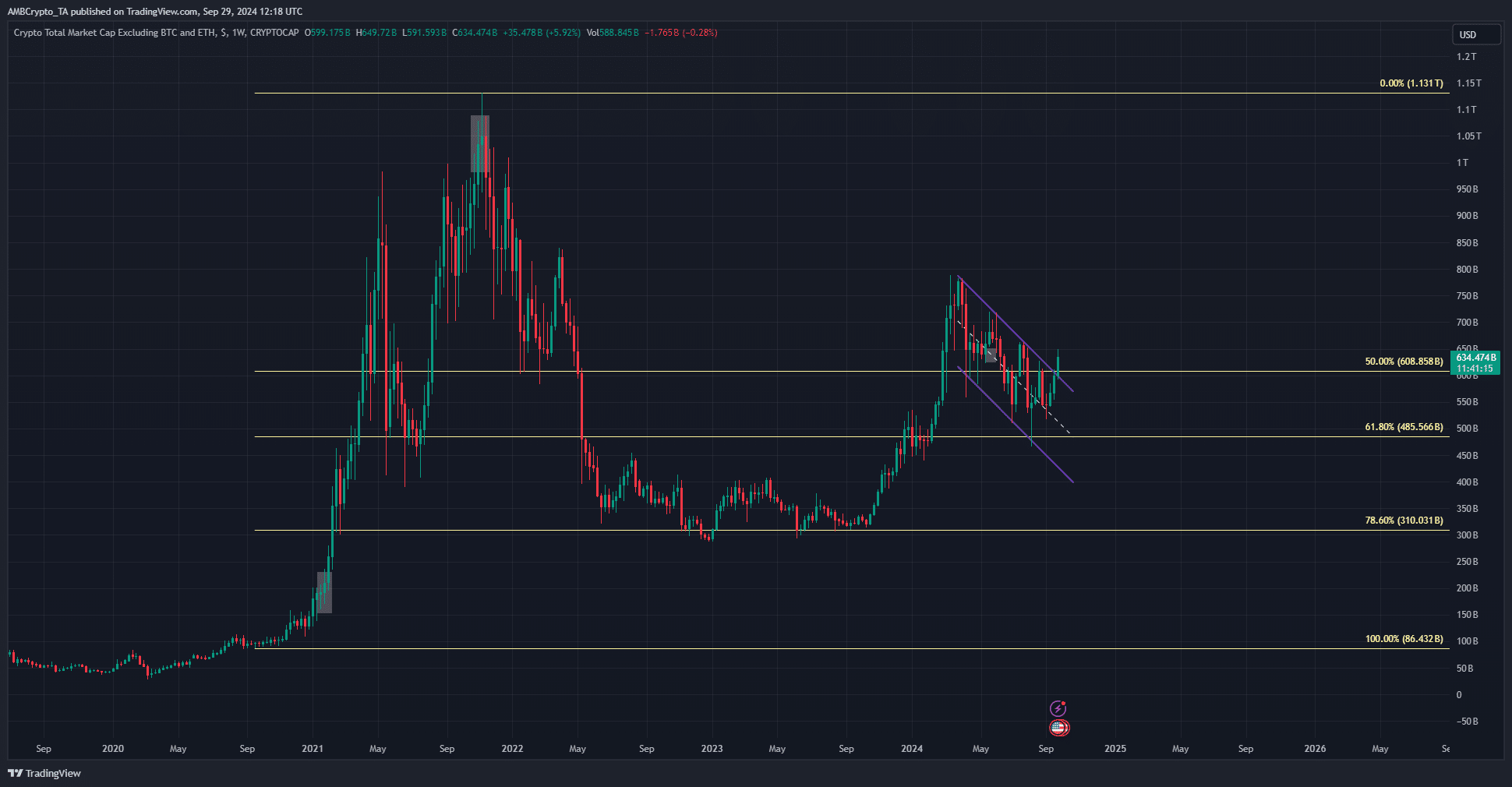

- The market capitalization charts gave bullish signals for the long-term.

As a seasoned researcher with a decade of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by the current state of the market. The Bitcoin [BTC] bullish sentiment is undeniably present, yet the wider market’s interest remains a fraction of what it was during the 2020 run.

The Bitcoin (BTC) market mood began leaning towards optimism. The Cryptocurrency Fear and Greed Index read 63, indicating that market participants were primarily exhibiting greed following Bitcoin surpassing the significant $64k barrier.

On X’s latest post, user Alex Becker pointed out that, although there’s a lot of buzz in the cryptocurrency world, the broader market’s engagement has been relatively low. The enthusiasm pales in comparison to the mania that occurred during the 2020 surge.

A look at the popularity of the term “Bitcoin” on Google Trends underlines this point. It reached the zenith of its popularity in the first half of 2021. The rally from last October to March 2024 saw BTC popularity reach a score of 58.

Conversely, the record high was established a week ago at 20. That implies that the number of Bitcoin searches is currently about one-third of what it was at the beginning of this year, despite the fact that the leading cryptocurrency is trading only 11% below its peak value.

To gain insights about potential implications for the broader cryptocurrency market, AMBCrypto examined various charts more thoroughly.

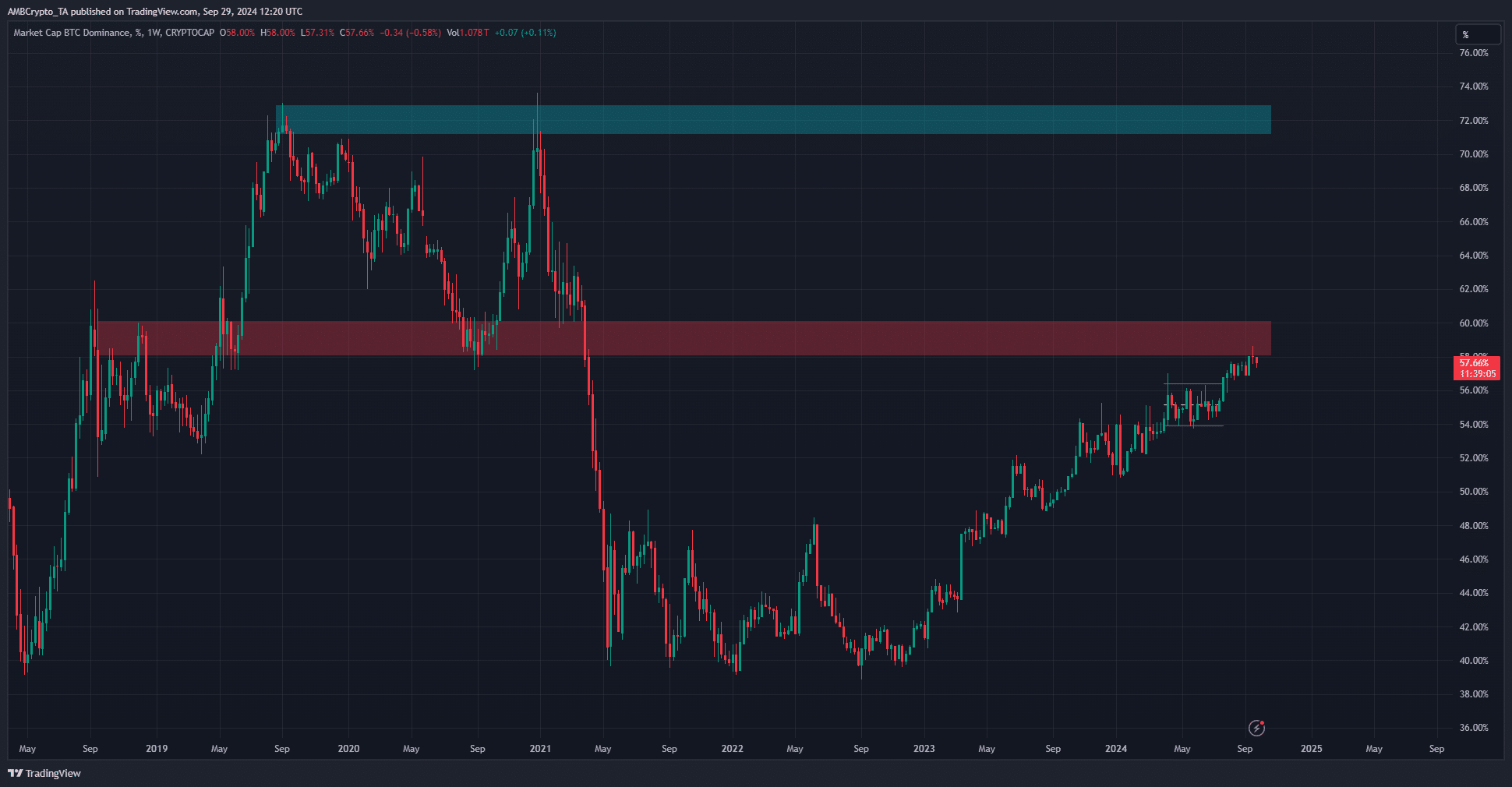

Bitcoin Dominance is key for understanding capital flow

As I type this, the overall value of all cryptocurrencies amounts to approximately $2.3 trillion. Bitcoin, making up about 57.66%, holds the majority share of this total market cap. On a weekly scale, the 60% region is indicated as a potential resistance point.

In simple terms, when the BTC.D chart shows a decrease, it suggests that the total value of alternative cryptocurrencies (altcoins) is growing at a faster rate than Bitcoin’s, which could be good news for the altcoin market.

As a crypto investor, I’m keenly aware that the 2020 cycle serves as a benchmark. Ideally, I’d like to see Bitcoin embark on a sustained upward trajectory, attracting capital towards the cryptocurrency market. This influx of capital can then circulate, or “rotate,” into various altcoin sectors. As a savvy trader or investor, this rotation presents an opportunity for potential profits.

Long-term investors can utilize this dominance graph as a tool to determine if Bitcoin or other digital currencies (altcoins) are currently driving the market’s attention.

Another positive sign for alt season

On the displayed graph, you’ll find the market capitalizations of the leading cryptocurrencies other than Bitcoin and Ethereum [ETH]. It has surpassed the downward trendline pattern, known as a descending channel.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In doing so, it also breached the 50% Fibonacci retracement level from the 2020 bull run.

Preparing the scene effectively, we anticipate an impressive showcase of growth among the alternative cryptocurrencies within the upcoming months. Based on both historical patterns and technical analysis, it seems that the crypto market will likely trend upwards for the next 3 to 6 months.

Read More

2024-09-30 08:07