- Bitcoin’s greed has slowed, with a noticeable lack of risk-taking among investors.

- However, a dip could soon incentivize investors to HODL.

As a seasoned analyst with years of market observation under my belt, I have witnessed the ebb and flow of countless bull runs. The recent Bitcoin price action has been nothing short of thrilling, but it also brings forth a sense of déjà vu.

Over the last 24 hours, I’ve found myself on a rollercoaster ride within the crypto sphere. Just earlier today, I witnessed Bitcoin [BTC] surpassing the $100K mark – an exhilarating moment for any crypto investor. However, the excitement was short-lived as the market took a dip later in the day, with Bitcoin plummeting by over 5%.

Generally speaking, these price drops often lure bargain shoppers, yet the dampened sentiment among investors suggests a decreasing interest in holding on to their investments.

In simpler terms, many people have become incredibly wealthy from this recent surge in cryptocurrency prices, especially Bitcoin. Now, attention is turning towards individuals who are anticipating Bitcoin’s future high point as a wise long-term investment choice.

It’s essential to maintain a delicate equilibrium between these conflicting elements. Will it be the ones seeking profits who take control, or those ready to pursue significant gains who prevail?

Lack of risk appetite is holding Bitcoin back

On a one-day basis, Bitcoin’s price graph presents conflicting indications. The Moving Average Convergence Divergence (MACD) is bearishly aligned, while the Relative Strength Index (RSI) remains in a neutral state. Interestingly, Bitcoin has managed to hit $100K despite these signals.

As long as there’s potential for expansion, the key question is if investors are willing to tolerate the ups and downs in exchange for potentially increased earnings.

Instead of surpassing 90 as it did in March, the Greed Index has stayed below that level in the current situation. Such a situation suggests cautious behavior rather than risk-taking, which has resulted in Bitcoin returning to the area where fear, uncertainty, and doubt (FUD) prevail.

Psychologically speaking, such a move may induce considerable reluctance among both novice and experienced investors, potentially leading many to choose short-term profit over long-term investment.

Consequently, the $100K milestone barely persisted for a day, as profit-taking activities were prevalent across the exchange. Both short-term and long-term investors seized opportunities to cash out on profits from prior market dips, while potential risk-takers hesitated to intervene and counteract the selling wave.

Should this pattern persist whenever Bitcoin reaches $100K, it might lead to a perpetual cycle, as diminished greed among investors increases the opportunity for those cashing out to exit the market before prices can consistently maintain elevated levels – thereby setting up circumstances ripe for a short squeeze.

So, should you cash out too when BTC hits $100K?

After hitting an all-time high of $103,629, Bitcoin’s closing price for the day dropped to $92,285 – its lowest point during the day. This dip presents an attractive opportunity for short-term traders who are hoping to profit from a potential rebound in the market.

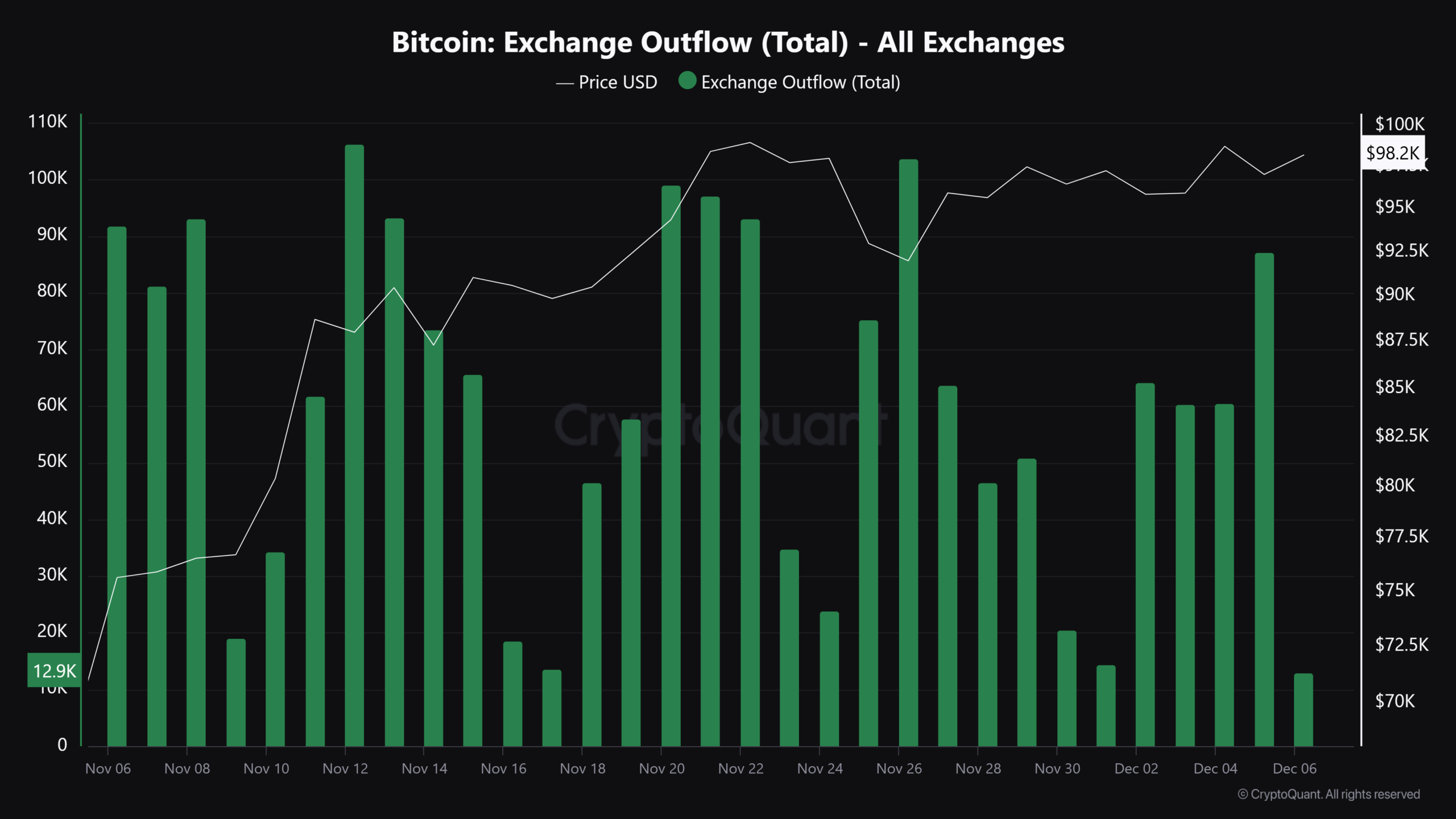

Consequently, the trading volume of Bitcoin increased by approximately 5% to about $124 billion. Moreover, it was observed that withdrawals of coins from exchanges were prevalent on these trading platforms, suggesting a high level of confidence among investors.

Source : CryptoQuant

Whales have also seized the opportunity, scooping up 600 Bitcoins at a bargain price of $98,083.

Combined, these elements seem to indicate a possible formation of a base near $96K. This area might draw in both investors and traders, potentially leading to a stronger rebound.

This development is beneficial for Bitcoin investors (bulls). If a confirmed price floor of $96,000 holds steady and more funds flow into the market, Bitcoin could climb approximately 4% closer to its $100,000 target, realizing profits along the way.

This small profit might not lead to a substantial selling spree since most investors are unlikely to recoup their initial investment, instead opting to continue holding onto their assets.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Consequently, we should keep an eye on the price range between $96,000 and $98,000, as significant activity is expected there. If there’s increased optimism within this range, it could propel further growth.

It could be an ideal moment to make a purchase given the potential for a significant $103K leap ahead. But keep a close eye on the market’s liquidity within this range over the next few days, as it may play a critical role.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-06 20:08