- Ethereum is closely mirroring Bitcoin’s movements, making it increasingly susceptible to a potential correction.

- With whales continuing to dominate, keeping a close eye on their daily actions will be crucial.

As a seasoned researcher with over two decades of market analysis under my belt, I can’t help but feel a sense of deja vu when observing Ethereum’s recent performance. The parallels between its current trajectory and Bitcoin’s movements are unmistakable, and as history has shown us, such mimicry often precedes a correction.

In the last day, Bitcoin (BTC) has climbed approximately 3%, hitting a new record peak of $106,488. With the start of the New Year, it’s evident that positive energy is gathering pace.

Without being left behind, Ethereum [ETH] is taking its own steps forward, edging closer to its annual peak of $4,000. Historically, ETH has tended to follow Bitcoin’s [BTC] lead, but with uncertain market conditions and overextended positions, some are wondering if Bitcoin’s recent spike might indicate a forthcoming peak.

Could this be the time when Ethereum finally steps out of Bitcoin’s long shadow? As the market grows and matures, could we be witnessing an increasing separation between these two cryptocurrencies – a division that has never been more plausible?

Bitcoin is still in charge of Ethereum

2024 is drawing to a close, and as we reflect on the past year, it’s clear that Bitcoin has reached significant achievements. In just a month during the first quarter, Bitcoin’s value soared from $49,710 to an unprecedented peak of $73,000.

During that same timeframe, Ethereum didn’t just watch from the sidelines. Similarly to Bitcoin, ETH surpassed $4,000, reaching levels not seen since 2021. However, it’s important to note that when Bitcoin reached its maximum value, Ethereum mirrored this trend.

In just one week, ETH plunged to around $3,100, with daily drops reaching up to 10%.

Source : TradingView

Currently, a notable occurrence has piqued the interest of AMBCrypto. On a day-to-day basis, Ethereum’s price trend seems to mimic that of Bitcoin. However, what stands out is the heightened volatility in Ethereum’s price fluctuations, whether they are increases or decreases.

Consequently, regaining $4K is looking like a difficult proposition for Ethereum. Initially, the boost might originate from Bitcoin, but maintaining this level and converting it into robust support seems to be quite a struggle.

In this situation, it looks probable that a ‘healthy’ retreat will occur, which may force out hesitant investors. Furthermore, the demand for higher priced Bitcoins has not significantly increased, indicating that either Bitcoin is attracting more money or fear of missing out hasn’t reached its peak just yet.

As a crypto investor, I’ve noticed that Ethereum’s daily price movements remain volatile, with significant fluctuations making it challenging to foresee a consistent trend in the near future.

Whales are pulling the strings on ETH

It’s been discovered by AMBCrypto that a substantial change might influence Ethereum, not just in the immediate future but also long-term. The amount of Ethereum controlled by ‘whales’ has climbed up to approximately 44%. This is nearly touching the 47% owned by regular investors.

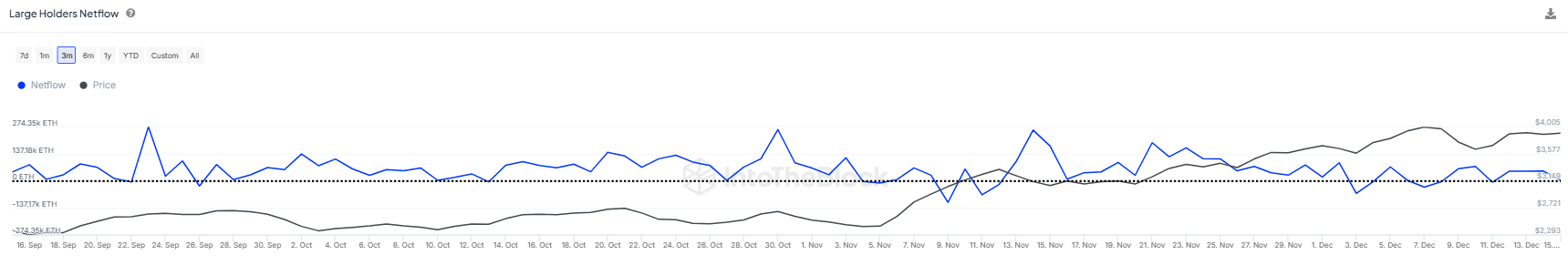

Over the last three months, I’ve noticed an unusual pattern in whale behavior that deviates from their usual strategy. While they typically buy low and sell high, their order book activity has exhibited a growing lack of consistency.

Source : IntoTheBlock

It was clear that Ethereum felt the effects: For two consecutive days, these massive investors (whales) transferred 40,000 ETH to exchanges when Ethereum’s price reached $4,000 on December 6th – the exact day Bitcoin hit a new milestone by going above $100,000 for the first time.

The decrease in ETH was substantial (7%) the next day as a result of this. These ‘whales’ have been cleverly buying ETH and capitalizing on price drops, selling it right before Ethereum approached important mental resistance levels, effectively employing a well-crafted manipulation tactic reminiscent of a textbook strategy.

Read Ethereum (ETH) Price Prediction 2024-25

Considering the current circumstances, it appears increasingly probable that we might witness a retreat or pullback. Financial experts are forecasting a potential adjustment in Bitcoin’s value, and if this happens, Ethereum is expected to follow suit as well.

In contrast, if fear of missing out (FOMO) arises once more, both retail investors and large players might capitalize on the situation by purchasing at the $3,700 price point, a location where approximately 4.6 million tokens were earlier acquired.

Read More

2024-12-17 01:12