What to know:

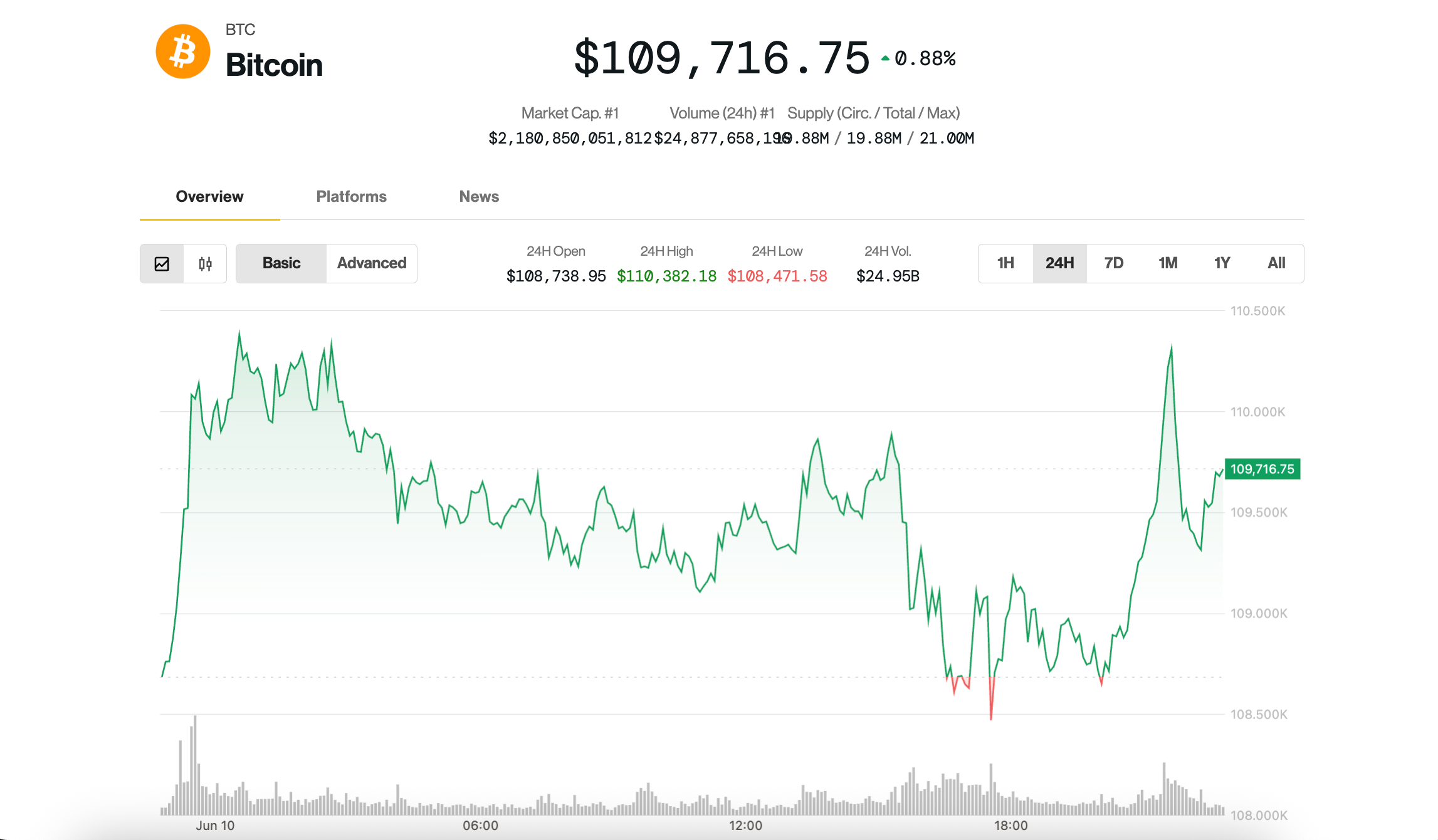

- Bitcoin is again testing the $110,000 level and just below a record, while altcoins like UNI and AAVE have surged due to positive DeFi comments from the SEC Chair.

- Despite gains, crypto market signals remain cautious, with negative funding rates suggesting potential for a future rally.

- Experts remain skeptical about a sustainable breakout, citing volatility and potential for sharp drops.

For the second day straight, Bitcoin surpassed the $110,000 mark, potentially boosted by significant growth in the value of alternative cryptocurrencies as well.

Bitcoin experienced a rise of approximately 0.9% more than 1%, reaching close to $110,000 shortly following the closure of U.S. stock markets on Tuesday. Notably, the CoinDesk 20, a collection of the top 20 cryptocurrencies by market capitalization excluding stablecoins, exchange coins, and memecoins, increased by around 3.3% within the same timeframe. This surge can primarily be attributed to ether.

, solana , chainlink all gaining 5%-7%.

The standout performances, however, were put on by uniswap

and aave , which soared a whooping 24% and 13%, respectively. The move was prompted by optimistic comments on the topic of DeFi by Securities and Exchange Commission (SEC) Chair Paul Atkins on Monday.

On the stocks side, there’s been a general tranquility, while most crypto-related shares have remained steady. However, Semler Scientific (SMLR) stands out as an exception. This company is aiming to replicate Strategy’s (MSTR) strategy and accumulate as much bitcoin as they can. Today, its shares dropped by another 10%, causing the stock to trade below the actual value of the bitcoin listed on its balance sheet.

Despite the day’s gains, positioning across crypto markets still reflects a largely defensive tone.

As a crypto investor, I’ve noticed that funding rates and other indicators suggest a gradually cautious mood in the market. This observation was made by Vetle Lunde, head of research at K33 Research, in his recent report. It’s interesting to note that despite Bitcoin trading near its previous record highs, the overall risk appetite appears surprisingly subdued.

Last week, daily funding rates for Binance‘s Bitcoin perpetual swaps turned negative, and the current average annualized funding rate is only 1.3%. This low rate is usually connected to local market bottoms instead of market peaks, as pointed out by Lunde.

In most cases, Bitcoin doesn’t tend to reach its highest point when there are negative funding rates, a fact worth noting because historical data shows that these conditions are usually followed by price increases rather than decreases.

The flow into Bitcoin ETFs like the ProShares 2x Bitcoin ETF (BITX) is showing a comparable trend. At present, BITX holds an exposure equivalent to approximately 52,435 Bitcoins – noticeably lower than its December 2023 high of 76,755 Bitcoins – and the inflows continue to be modest. As per Lunde’s analysis, this cautious stance opens up the possibility for a potential significant rise in Bitcoin prices.

While some market analysts believe the recent price movements could be indicative of a lasting uptrend, others remain uncertain if this is indeed the beginning of a durable surge in prices.

According to Kirill Kretov, a senior automation expert at CoinPanel, this might not be a genuine breakout that will persist. Instead, it appears more likely to be just another phase in the usual volatility cycle. This includes an uptrend now, which could be followed by a significant decline caused by unfavorable news or a change in the storyline.

Kretov believes that the present market conditions are advantageous for seasoned traders who can skillfully maneuver through a market structure influenced by volatility. In his technical analysis, he predicts the potential support levels for Bitcoin (BTC) to be at $105,000 and $100,000. These areas could be tested if there’s increased selling pressure in the future.

Read More

2025-06-11 00:24