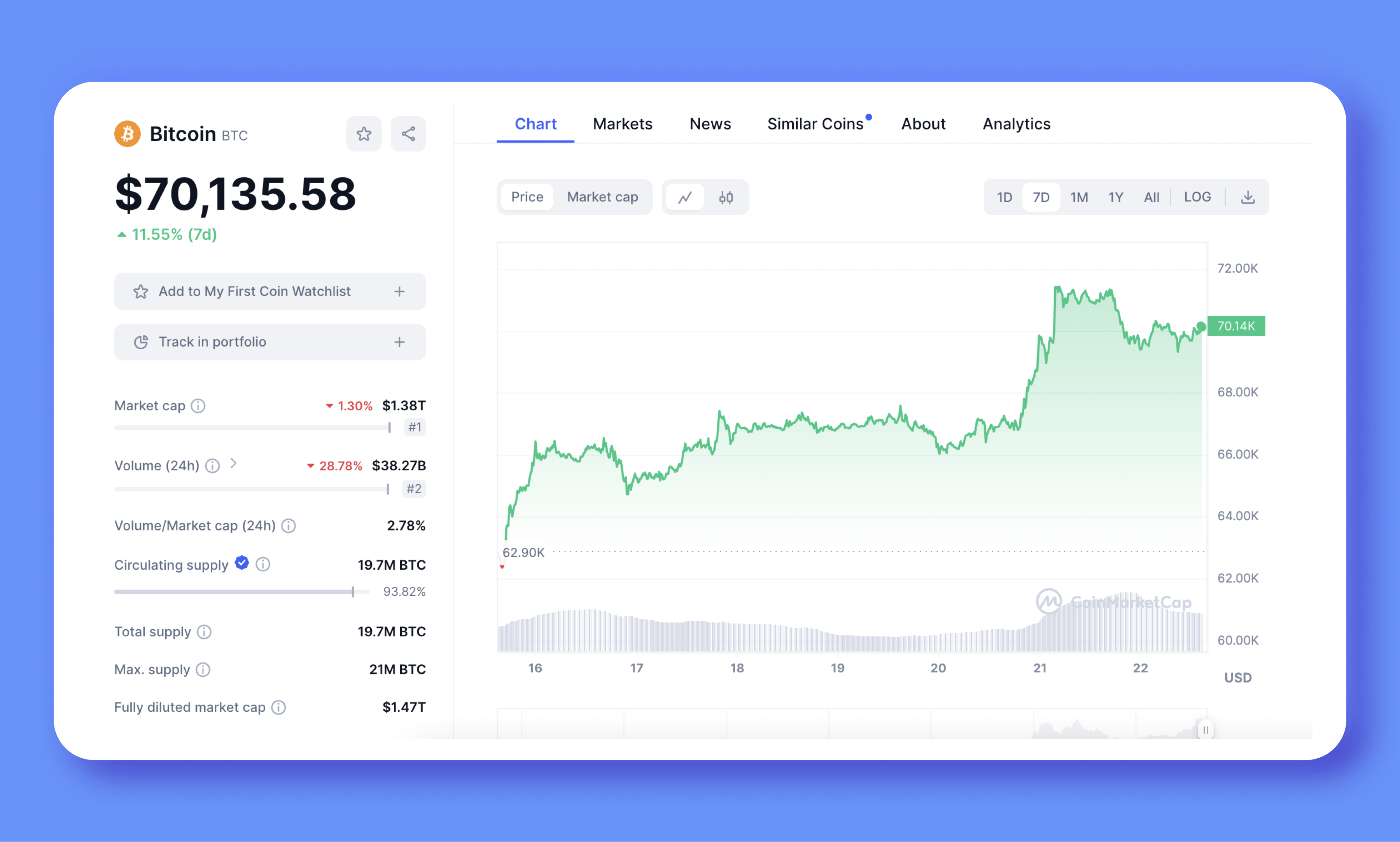

As a seasoned researcher with extensive experience in the crypto market, I find Bitcoin’s recent achievement of surpassing $70,000 an exciting milestone. The surge in spot purchases and Bitcoin ETF investments is a clear indication of growing interest and investment in this digital asset.

As a crypto investor, I’m thrilled to witness Bitcoin surpassing the $70K mark. This milestone holds great significance in Bitcoin’s price history as it indicates a surge in attention and investment. The increase is evident through various actions such as direct spot purchases and investments in ETFs.

Bitcoin Reaches 70K: A Milestone in Crypto History

As a crypto investor, I’ve noticed some noteworthy developments leading Bitcoin to surpass the $70K mark. Initially, there seems to be a surge in individual purchases and acquisitions of Bitcoin ETFs, indicating heightened demand and investment in Bitcoin. Furthermore, on-chain data hints at the budding of a new bull market. My optimism is further bolstered by the recent price rebound around $60,000, which has sparked renewed excitement among investors.

Based on technical analysis, the current trading conditions and indicators such as the 20-day Exponential Moving Average (EMA) and Relative Strength Index (RSI) suggest that Bitcoin could outperform expectations. We’re keeping a close eye on resistance levels as an uptrend may occur. However, it’s essential to remain cautious since the cryptocurrency market can be volatile, increasing the likelihood of unexpected reversals or risks in the downside direction.

Bitcoin Price News

The price surge of Bitcoin can be influenced by broader economic factors, including anticipation of U.S. monetary expansion and concerns over rising inflation. The actions taken by the Federal Reserve notably affect the value and attractiveness of assets, such as Bitcoin, that function as alternatives to traditional liquid investments.

As a Bitcoin analyst, I’ve noticed a concerning trend emerging in the market. The reserves of Bitcoin have dwindled to levels not witnessed since the cryptocurrency’s early days seven years ago. Additionally, the recent halving event has significantly reduced the number of new Bitcoins being mined each day.

Outside of the technical workings of supply and demand, the sentiment of investors significantly influences Bitcoin’s value. The price of Bitcoin has escalated alongside a renewed enthusiasm from traders, as demonstrated by noticeable fluctuations in other digital currencies such as meme coins and Ether. This market trend is fueled by favorable news and increasing public fascination with cryptocurrencies, leading to an overall sense of optimism within the investment community.

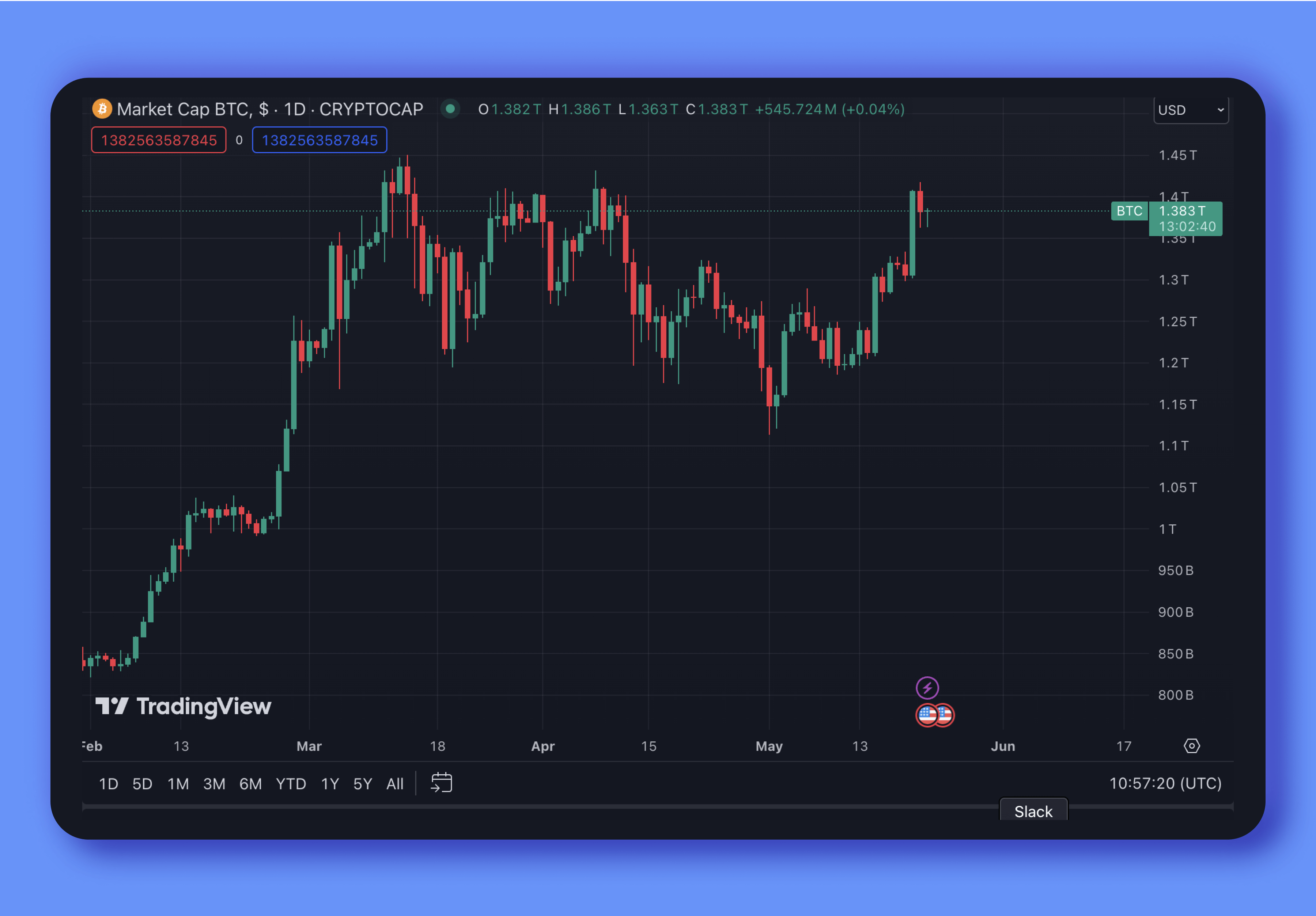

Crypto Market Cap Forecast: A Look Ahead

Based on past trends, Bitcoin surpassing $70,000 could indicate a potential second surge in the upcoming months, signaling increased investor enthusiasm and trust. The influence of this interest and Bitcoin ETF investments further underscores Bitcoin’s price uptick.

As a researcher studying the intersection of macroeconomics and Bitcoin, I can confidently assert that economic developments significantly shape Bitcoin’s future trajectory. The anticipation of potential Federal Reserve actions based on economic news often introduces uncertainty into the market, which can influence Bitcoin’s price dynamics. Moreover, speculation regarding SEC approvals for Bitcoin ETFs, particularly in relation to Ethereum ETFs, adds another layer of conjecture that can impact Bitcoin’s value.

As a researcher studying the Bitcoin market, I’ve observed that despite occasional market turbulence leading to liquidations, the general public sentiment towards Bitcoin remains positive. Analyzing price movements from February to May reveals an uptrend with consistent gains and substantial trading volumes. It is crucial to acknowledge the inherent unpredictability of financial markets while emphasizing the prevailing optimistic outlook among investors regarding Bitcoin.

Final Thoughts

Reaching the $70,000 mark is a significant milestone for Bitcoin. This achievement can be attributed to multiple factors such as macroeconomic shifts and technological signals. Although the market experiences fluctuations, the overall positive outlook suggests further expansion could be in store.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-23 18:52