- Bitcoin has climbed to a 20-week high above $71,000 amid positive market sentiment.

- With 98% of holders in profits, FOMO could propel BTC to a new ATH before the end of Uptober.

As a researcher with a keen eye for market trends and a heart full of cryptocurrency enthusiasm, I find myself positively electrified by the recent surge of Bitcoin (BTC) to a 20-week high above $71,000! With 98% of holders in profits, FOMO could propel BTC to a new ATH before the end of Uptober.

This month, the value of Bitcoin (BTC) has been rising significantly and it recently surpassed a 20-week peak, reaching over $71,500. At this moment, one Bitcoin is being traded at approximately $70,900, which is just about 3.7% away from its record highs.

Multiple positive signals indicate that Bitcoin might reach a new all-time high before October concludes, given the optimistic atmosphere in the market.

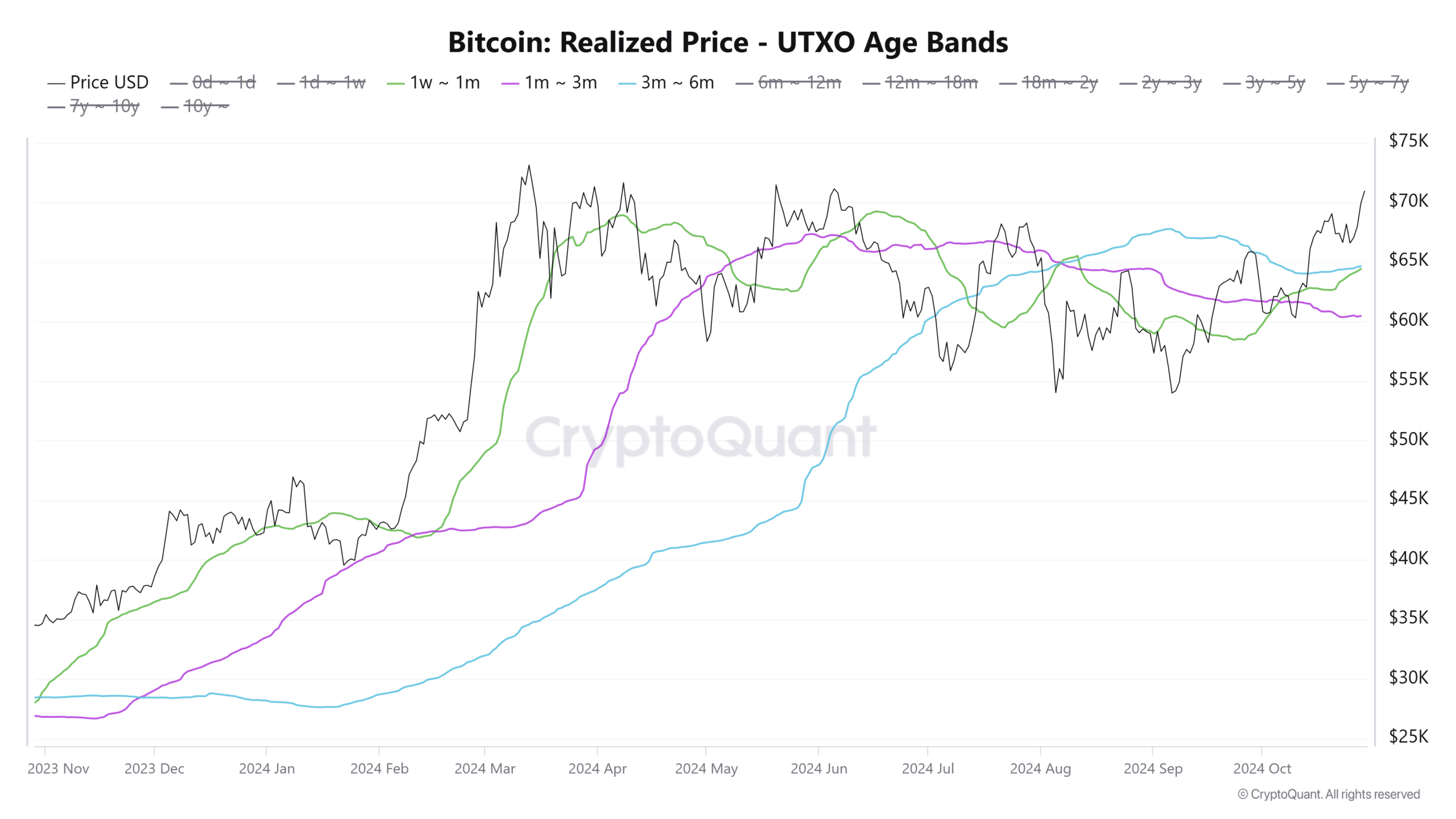

Bitcoin UTXO Realized Price

A look at the Bitcoin UTXO Realized Price for short-term holders suggests that prices could continue to rise in the short term.

According to CryptoQuant, the average price at which Bitcoin held by wallets for less than a month is nearly reaching the level set by wallets that have owned Bitcoin for a period of three to six months.

Previous occurrences of a specific event have typically been followed by substantial price growth. A comparable event seems imminent, potentially bolstering the bullish case for Bitcoin.

In simpler terms, frequent buyers at increasing prices often help maintain a rally’s momentum. This influx of new purchases can enhance market optimism and potentially lead to a new All-Time High (ATH).

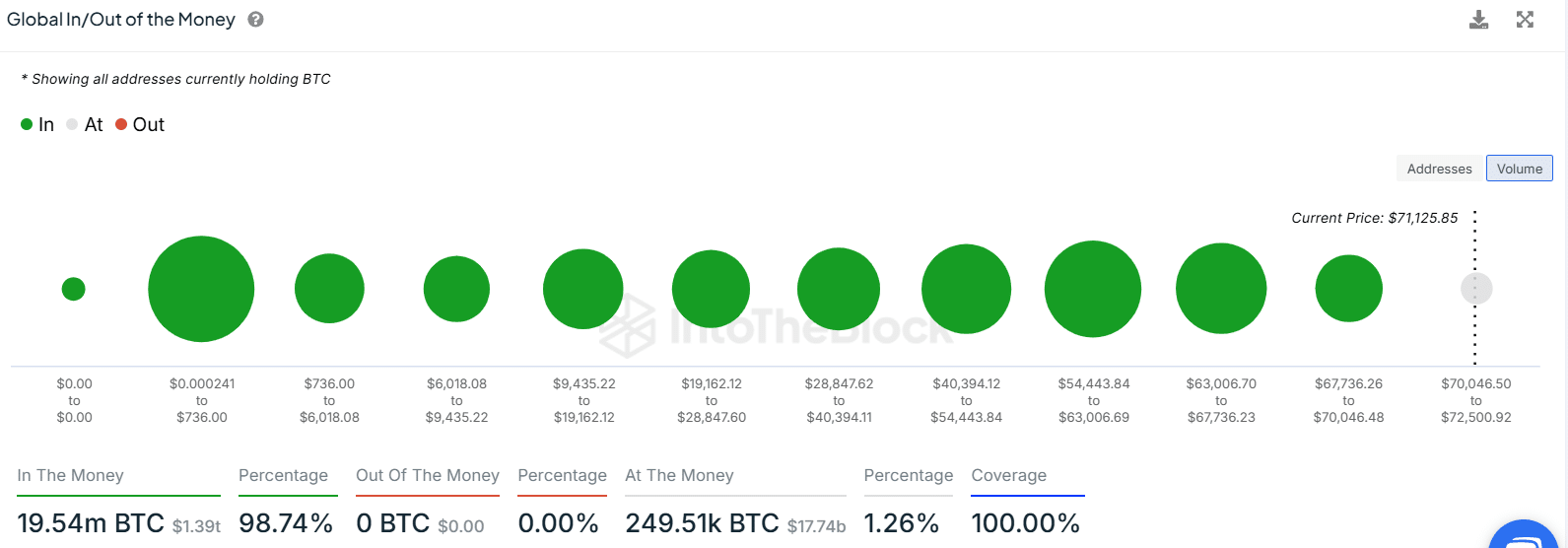

98% of holders are in profits

According to data from IntoTheBlock, nearly all Bitcoin owners (98%) currently have more money than they initially invested, with just over 1% being at the point where their investment has broken even.

As the profitability of wallets grows, it encourages investors by making them more likely to keep their investments instead of selling off. Such a situation might also spark feelings of FOMO (Fear of Missing Out), leading potential new buyers to jump into the market. This influx can further strengthen the upward trend.

It’s clear that fear of missing out (FOMO) is present, as the Fear and Greed Index currently reads 72. This suggests that the current market mood is primarily driven by greed.

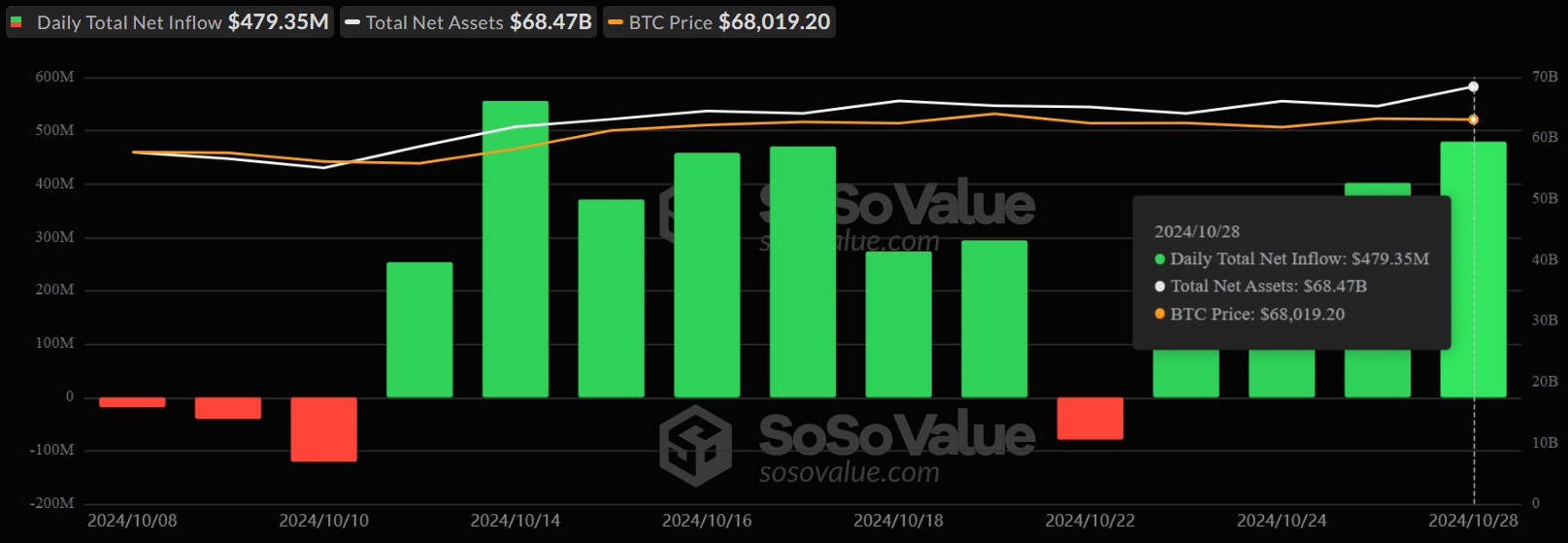

Rising demand for BTC ETFs

As an analyst, I observed a significant surge in investments on October 28th in US spot Bitcoin exchange-traded funds (ETFs). According to SoSoValue, these inflows amounted to approximately $479 million for the day. Notably, Blackrock accounted for the largest portion of these investments with an inflow of around $315 million.

According to a report from AMBCrypto, BlackRock now owns more than 400,000 Bitcoins, putting them on pace to surpass the original creator of Bitcoin (Satoshi Nakamoto) and become the largest Bitcoin holder.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Approximately $68.47 billion in total assets are managed by U.S.-based Bitcoin Exchange Traded Funds (ETFs), representing 4.9% of the entire Bitcoin supply. Over the past two weeks, these ETFs have attracted a combined inflow of approximately $3 billion.

With growing attention from individual and large-scale investors, Bitcoin’s control in the cryptocurrency market remains strong. Currently, Bitcoin controls approximately 60% of the market, while the Altcoin Season Index has dipped to 27%.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-29 14:48