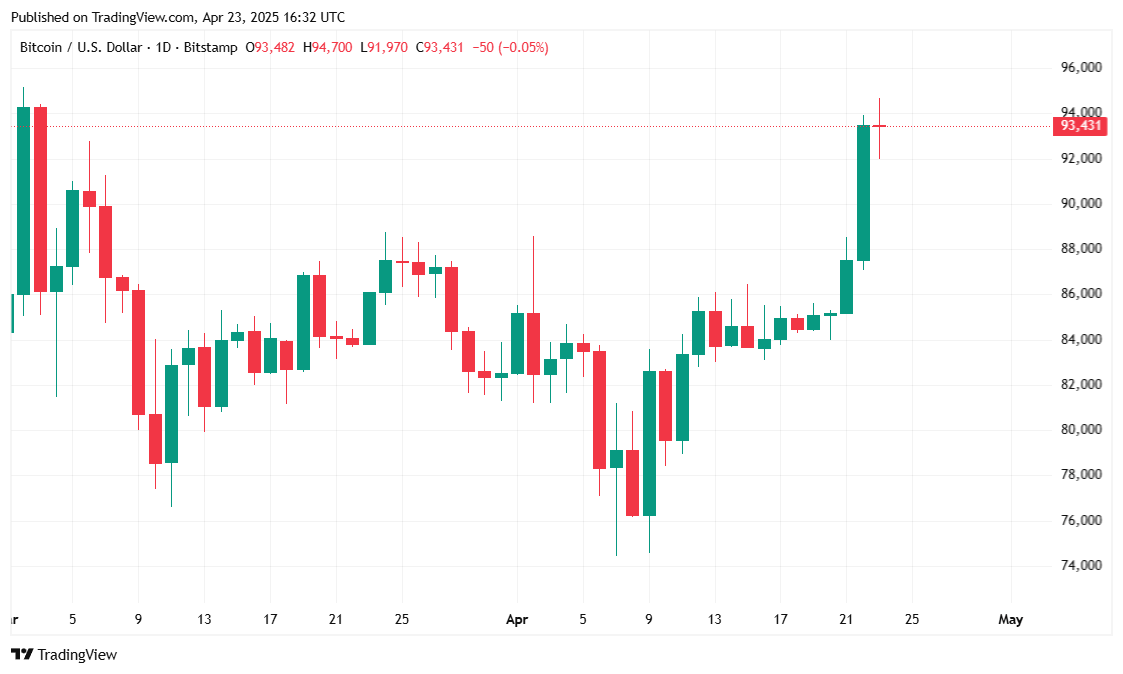

Bitcoin, ever the diva, surged past the magnificent $94K on a crisp Wednesday morning, only to retreat slightly to $93K. Meanwhile, traditional stock indices? Well, they’re just there, like background noise. The digital darling seems to be finally growing up—detaching itself from the comforting embrace of the stock market.

BTC Breaks $94K, And Stocks Are Just… Over There

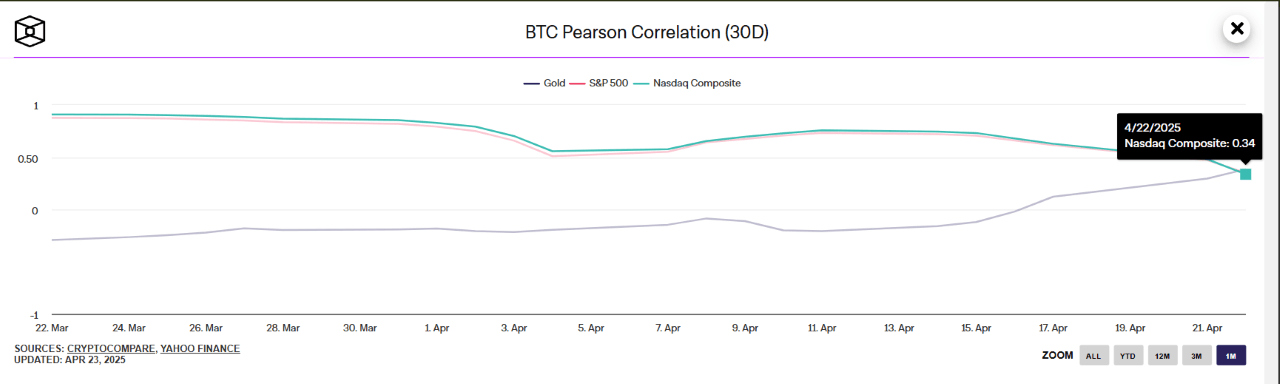

Despite an economy in the throes of confusion, fueled by the capricious trade policies of President Donald Trump (yes, that one), Bitcoin has remained steadfast on its upward journey. The crypto world watches in awe as the correlation between Bitcoin and traditional indices like the Nasdaq and the S&P 500 steadily plummets like an awkwardly timed dad joke.

Market Metrics: The Beautiful Numbers We Love to Obsess Over

At the moment of writing, Bitcoin’s price danced between $94,535.73 and $90,455.69 before settling at $93,406.06. A comfortable 2.97% increase from yesterday, and a solid 10.09% gain over the last seven days. Sure, that sounds nice, doesn’t it?

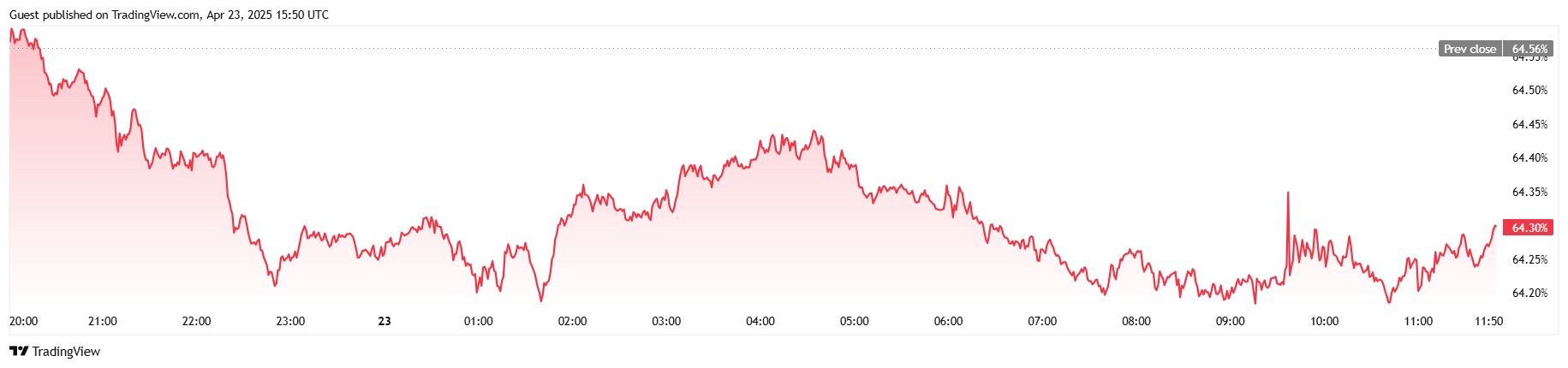

Trading volume, never one to be outdone, leaped by 19.93% to $52.74 billion. Oh, and the market cap? A neat $1.83 trillion, up 2.16% from the day before. But, just to keep us all grounded, Bitcoin’s dominance slid a little, down to 64.30%, which hints that altcoins might be doing a little dance of their own.

Futures activity, however, presents a bit of a mixed bag. Total open interest in Bitcoin futures fell by 6.03% to $63.94 billion, showing some traders wisely trimming their leverage. In the past 24 hours, a curious $10.33 million in positions got liquidated, with long traders bearing the brunt of it—because who doesn’t love a good liquidation story? Shorts, however, faced a gentler fate with a mere $1.59 million in losses.

The Great Decoupling: The Breakup We Didn’t See Coming

Once upon a time, Bitcoin, the rebellious cryptocurrency, was glued to the stock market, showing an uncanny 30-day Pearson correlation coefficient above 0.80 with the Nasdaq and the S&P 500. But like any good soap opera, this relationship has had its twists and turns. By April’s end, the numbers started to fade away, like the last episode of a once-popular TV series.

By the time we hit report hour, the correlation coefficient dropped to a modest 0.34 and 0.35 with the Nasdaq and S&P 500, respectively. This signals the grand decoupling, with Bitcoin looking less like a stock market sidekick and more like a solo artist, ready to head its own show.

It’s still early days, but this could very well be the dawn of a new era—an era where Bitcoin, not stocks, might become the safe haven asset when the world decides to throw a tantrum. Stay tuned. The drama is far from over.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-23 20:02