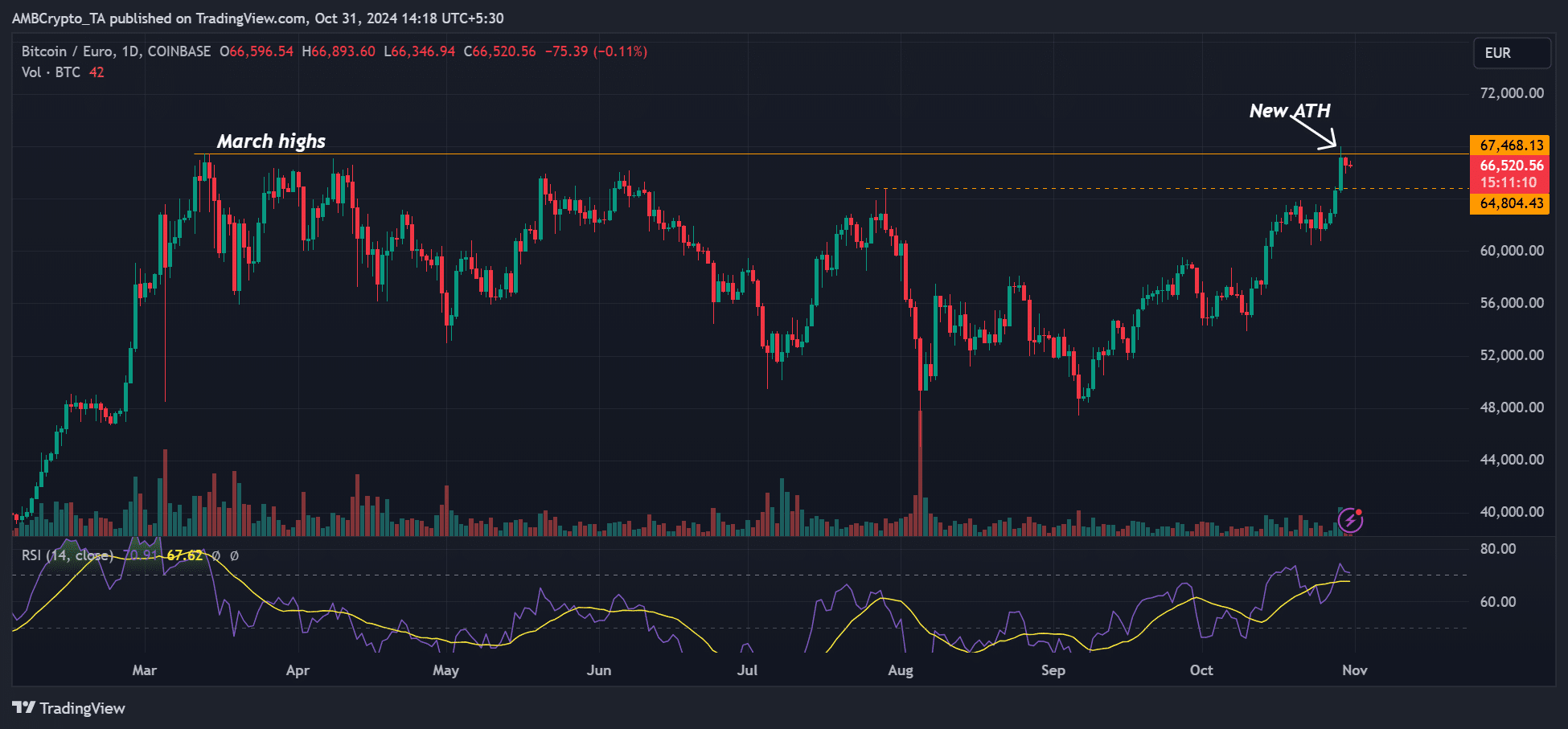

- Bitcoin printed a new ATH against the Euro on Tuesday.

- BTCUSDT pair was yet to hit fresh new highs above the March ATH.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I can’t help but feel a sense of exhilaration and cautious optimism as I observe Bitcoin setting new milestones against the Euro while remaining relatively stagnant against the US dollar.

29th October marked a significant milestone for Bitcoin [BTC], reaching an unprecedented peak in value against the Euro. The digital currency soared to a maximum of approximately 68,000 Euros on Coinbase and just shy of that at 67,900 Euros on Binance.

At the moment of reporting, we haven’t seen a repeat of the situation where the price surpassed its previous high from March, as it has with other assets, but not with Bitcoin against the U.S. Dollar (BTC/USD) or Tether (BTC/USDT).

BTC sets new milestone against Euro

In recent times, the latest exchange rate between the U.S. Dollar (USD) and the Euro has significantly influenced its increase.

In October, the U.S. Dollar (USD) to Euro (EUR) exchange rate increased by approximately 4%. This rise took the rate from 0.8918 EUR per USD on the first day, up to around 0.9300 EUR per USD at its highest point. At the peak, one U.S. dollar was equivalent to 0.93 Euros, which is roughly the value of €68,000 when compared to the record high for Bitcoin (BTC) against the U.S. dollar of $73,600.

Generally speaking, when the U.S. Dollar is getting stronger, there may be chances for profit known as arbitrage. This involves buying Bitcoin from markets where its price against the Euro (BTCEUR) is lower, and selling it in markets where its price against the U.S. Dollar (BTCUSD) is higher. The difference in exchange rates and any price discrepancies between markets serve as the profit.

Despite the BTC’s new ATH against Euro, the asset failed to front a fresh high against the USD.

On the same day, BTC/USD hit a high of $73.6K, about $100 from the March ATH of $73.7K.

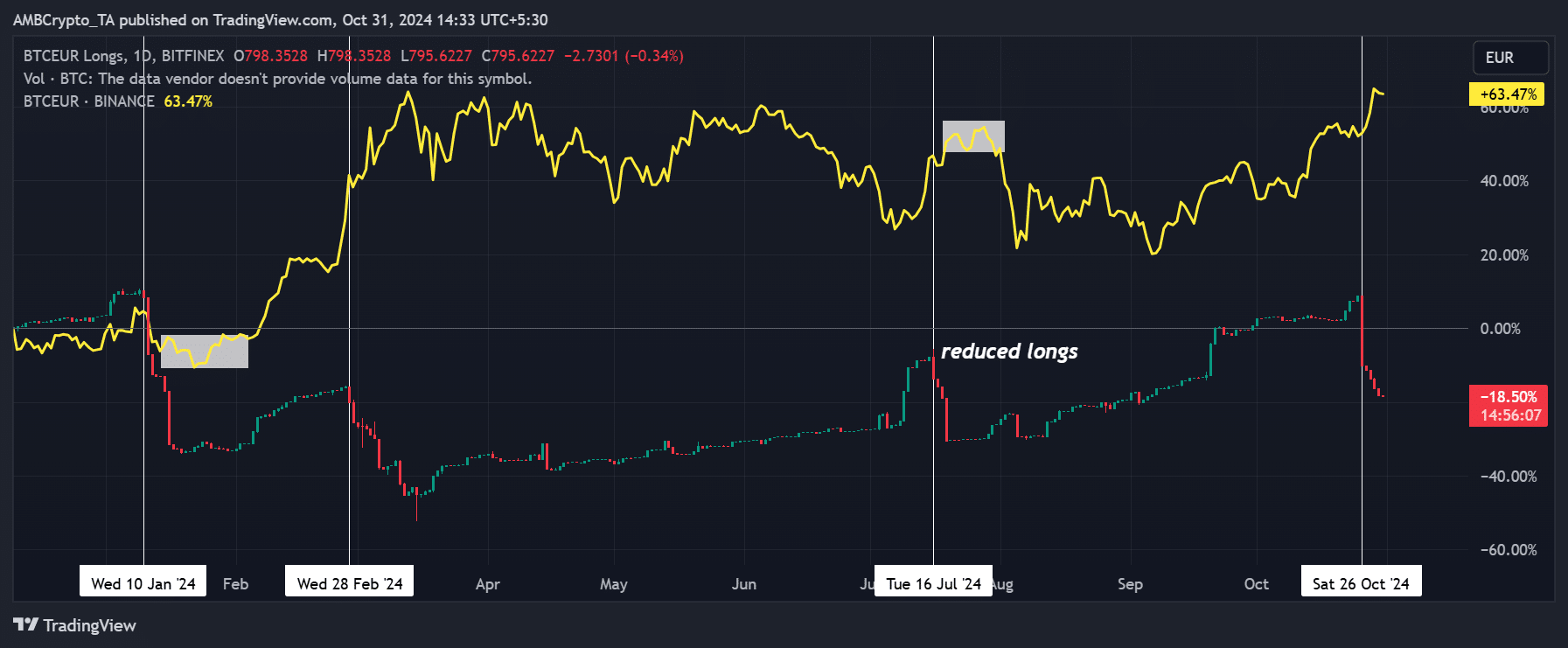

At the current moment, I’ve noticed a significant increase in the closing of BTCEUR long positions on the Bitfinex exchange, as indicated by the red candles. Historically, similar long position unwinds have been associated with local Bitcoin peaks in July and February.

After the trading platform showed an increase in long positions, there was a recovery of Bitcoin prices in our area. It’s uncertain if this pattern will reoccur, potentially causing Bitcoin to dip slightly first, followed by another rise. We’ll have to wait and see.

For now, the upward trend in Bitcoin’s price remained robust, as suggested by an approaching golden cross prediction from CryptoQuant. This observation was made by the blockchain analytics company.

Historically, when the short-term average (30 days) surpasses the long-term average (365 days), often referred to as the “Golden Cross,” it signifies a positive trend or growth in the market’s prices.

currently, the value of BTCEUR is approximately $66,500 USD ($72,300 USD), which represents a decrease of around 2% compared to its latest all-time high of €68,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-11-01 01:11