- Analysts highlighted growing spot demand while futures activity cooled, sustaining Bitcoin’s upward momentum.

- Bitcoin’s MVRV ratio at 2.69 and rising Open Interest suggested further potential for price growth.

As a seasoned researcher with a keen eye for market trends and an even keener sense of humor, I find myself both astounded and amused by Bitcoin’s recent performance. The ongoing bull run has been nothing short of spectacular, with spot demand playing a pivotal role in its momentum.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastBitcoin (BTC) is capturing the spotlight with its persistent rise, hitting a fresh record peak of $107,822.

At the current moment, this recent achievement serves as a testament to Bitcoin’s remarkable growth this year, surpassing a staggering increase of 150%.

Following the summit touch, the value of the asset showed a minor adjustment, trading at around $107,064. This slight adjustment represented a decrease of 0.6% from its peak, yet it still indicated an increase of 2% over the last 24 hours.

Through a recent examination by CryptoQuant, we’ve gained insights into the hidden factors propelling the ongoing rally, with special attention drawn to the escalating influence of demand from the traditional trading markets, which is playing a key role in Bitcoin’s continuous price surge.

Spot market demand drives Bitcoin’s momentum

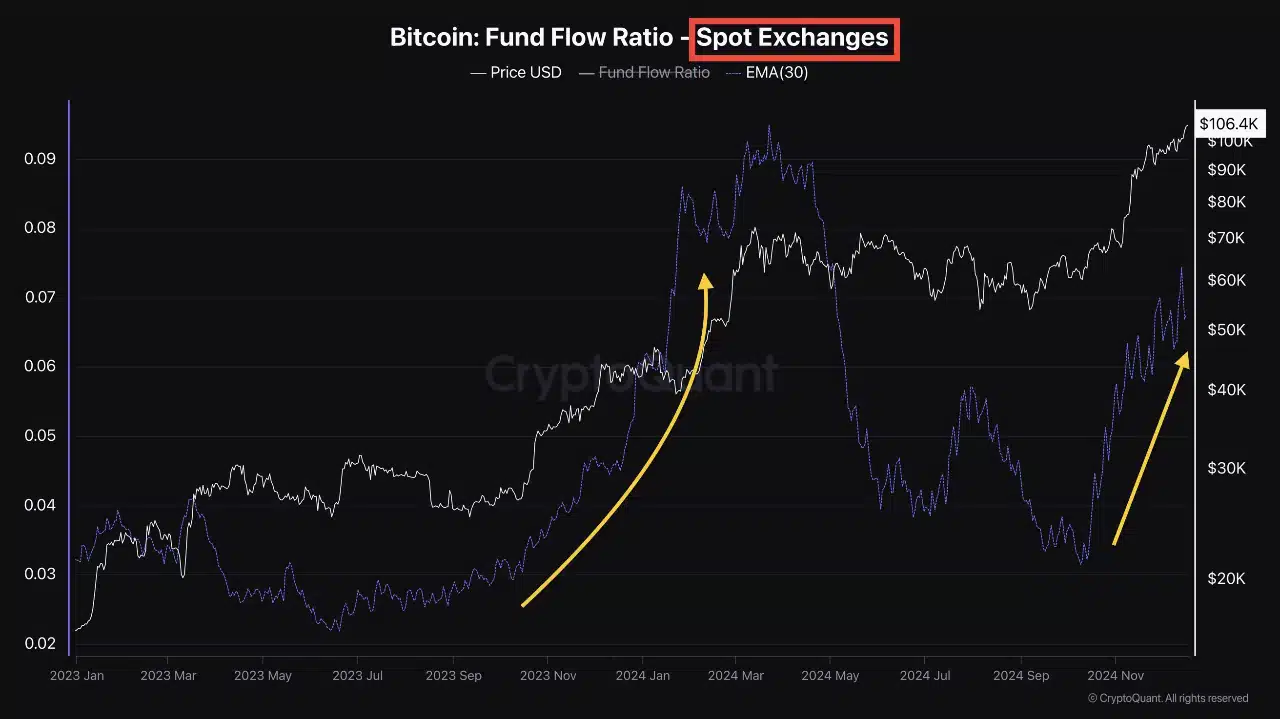

Based on an analysis by a CryptoQuant expert, it’s believed that the current uptrend in Bitcoin, starting in early 2023, was primarily ignited by speculative actions within the Futures market.

Starting from October 2024 onwards, there’s been a change in direction, with increased trading activity being observed in both the spot and futures markets for Bitcoin. This surge in trading volume has fueled a continued rise in Bitcoin’s price due to the resulting upward trend.

Lately, as futures market action slows down, the importance of the spot market is increasing.

As a researcher, I’m noticing an uptick in purchasing activity from long-term investors and retail participants, which appears to be curbing excessive speculation. This pattern seems to be laying a more robust base for consistent price expansion over the long term.

The analyst additionally noted that the funding rate, studied through a 30-day exponential moving average (EMA), gives no indications of approaching overheating in the final stages of a cycle.

This suggests that Bitcoin’s upward trend still has potential for growth, with no clear indications of an impending reversal at this point.

The report proposes that the Futures market might undergo periods of heightened action and settlements. However, this price fluctuation may draw extra investments towards the cash or spot market.

Growing optimism

As a researcher delving into the realm of cryptocurrencies, I’ve noticed that the spike in spot market demand isn’t the only factor pointing towards a promising future for Bitcoin. Other essential metrics also underscore its optimistic outlook.

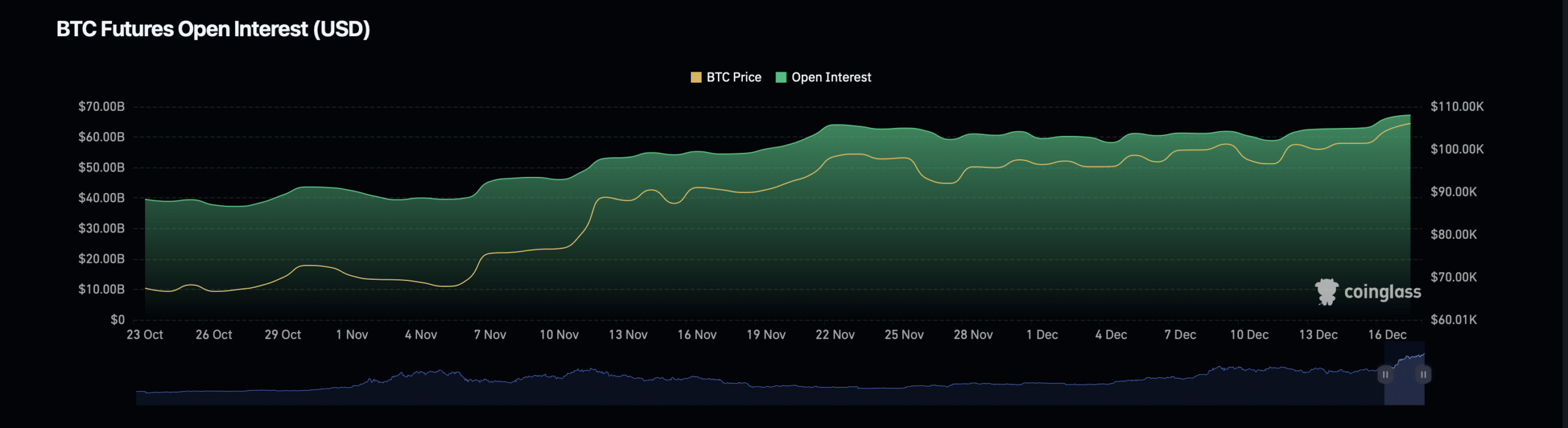

According to data from Coinglass, it was found that as Bitcoin’s price went up, so did the Open Interest, which refers to the combined value of all active Future contracts for Bitcoin.

To put it simply, the open interest in Bitcoin (BTC) has climbed up by approximately 2.56%, amounting to around $68.82 billion. Over the long term, this figure has experienced a significant boost of nearly 19.13%, resulting in a total of approximately $100.63 billion.

An increase in Open Interest usually indicates a surge in market action and investor faith regarding Bitcoin’s potential price trend.

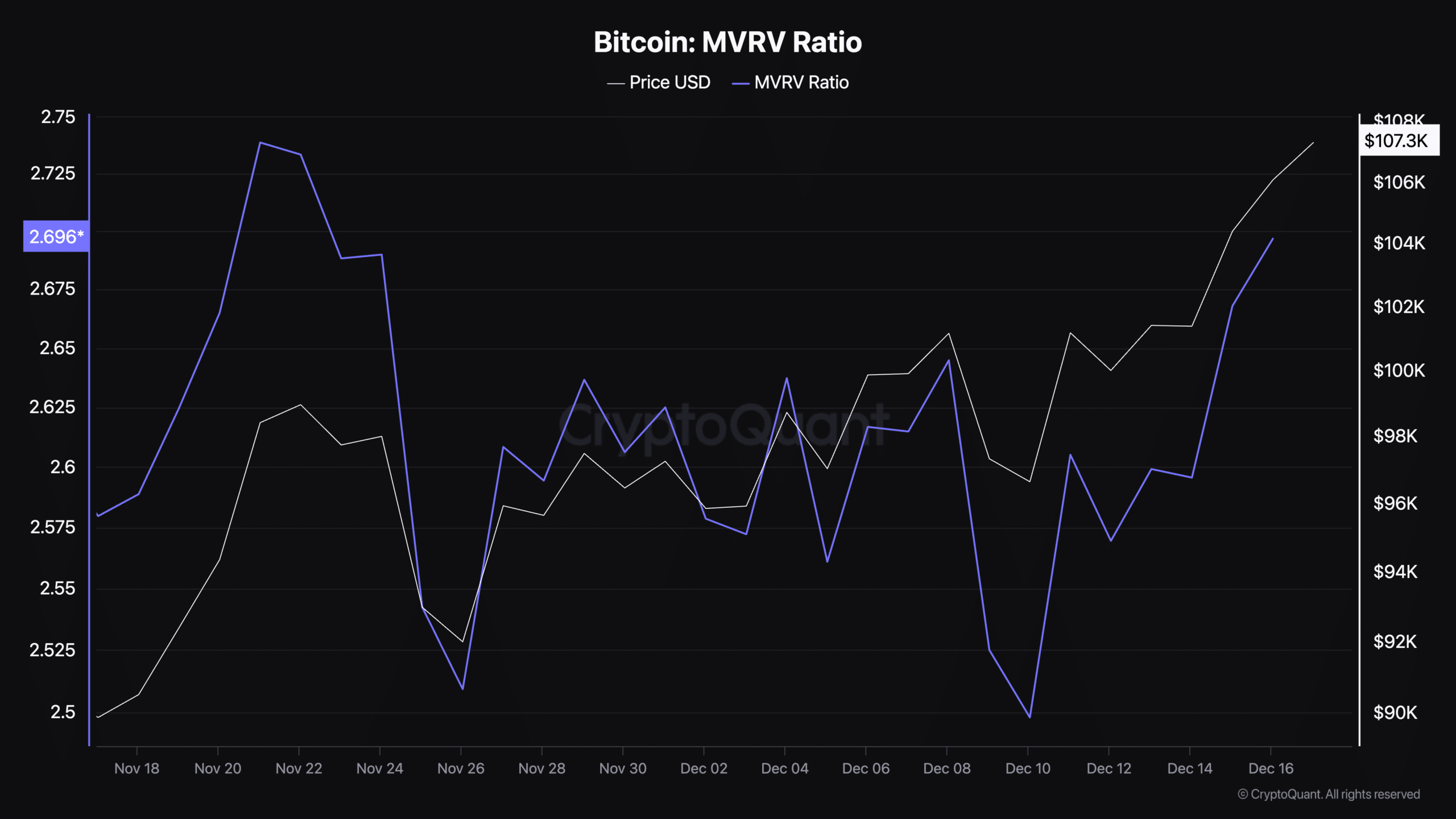

As a crypto investor, I’ve been closely watching the Market Value to Realized Value (MVRV) ratio for Bitcoin, and according to CryptoQuant data, it stood at 2.69 by the 16th of December. This suggests that the price might be overvalued compared to the actual money spent by investors on purchasing Bitcoin, which could indicate a potential correction or consolidation in the near future.

“The MVRV ratio, which is a critical measurement derived from blockchain data, helps determine if an asset’s current market price is higher or lower than its true worth based on past transactions.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A MVRV ratio exceeding 2.5 implies that Bitcoin is experiencing a robust bull market, yet it could signal that investors might be preparing to cash out their earnings soon.

From my perspective as a crypto investor, historically, an MVRV value above 3 has indicated market tops. Given that we’re currently at 2.69, it seems there might be potential for Bitcoin to continue its upward trajectory. However, this also underscores the importance of staying vigilant and exercising caution when trading.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-12-17 15:36