-

The net position change for long-term holders has switched to positive.

BTC has flipped its previous immediate resistance to support.

As a seasoned financial analyst with extensive experience in the cryptocurrency market, I have witnessed numerous trends and price movements over the years. The recent developments in Bitcoin (BTC) have caught my attention due to their significance and potential impact on the market.

Bitcoin‘s value rose above $60,000 for the first time, fueled by growing trust from investors and an overall optimistic atmosphere in the financial world.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing trend emerging. Not only are we seeing an influx of new buyers entering the market, but long-term holders are also re-engaging with their investments in Bitcoin. This signals a potential resurgence for the leading digital asset, often referred to as the “king coin,” as both types of investors return to form.

Buy Bitcoin!

As a data analyst, I’ve examined the latest information from Santiment, and it appears that Bitcoin traders are showing renewed optimism based on social volume trends, specifically in terms of buying behavior.

As a crypto investor, I’ve noticed an intriguing surge in buying activity on social media platforms. This spike in social volume suggests that a large number of investors are jumping into the market, fueled by heightened interest and enthusiasm for potential gains.

On July 15th, the buying attitude indicator recorded a score of roughly 117, exceeding the social media volume for selling, which was approximately 92 around the same time.

The difference in buying and selling Bitcoin volumes indicates a prevailing market bias toward purchasing, as more traders are choosing to buy Bitcoin over selling it.

I’ve noticed a significant surge in market activity recently, with many traders and investors scrambling to get a piece of the action as they fear missing out on potential gains from Bitcoin’s rising value. This phenomenon is commonly referred to as FOMO (Fear of Missing Out).

These patterns can help maintain and even boost price growth due to higher demand compared to available supply.

Bitcoin welcomes back long-term holders

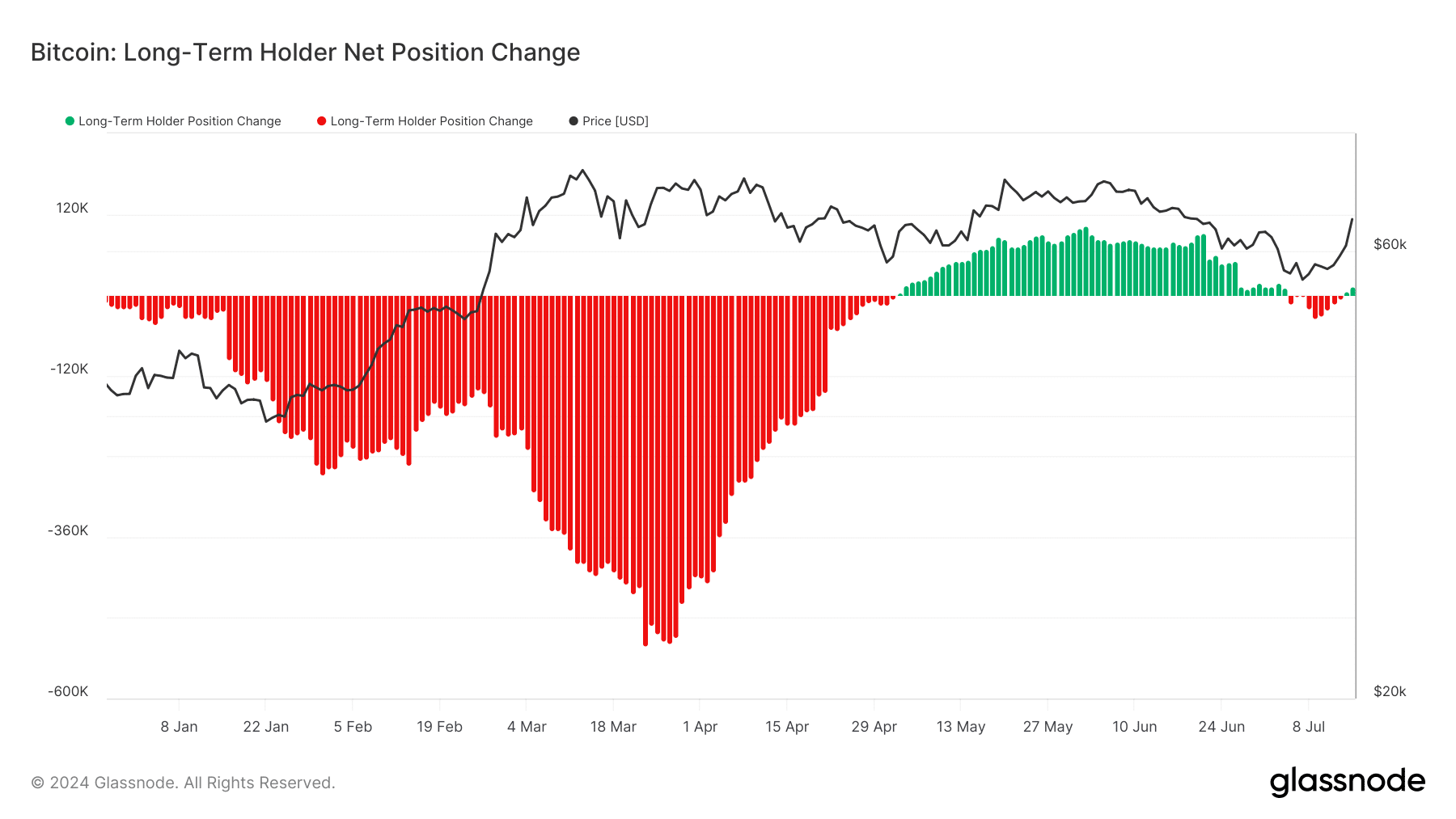

The latest information from Glassnode about Bitcoin’s net position change for long-term investors provides valuable clues regarding the ongoing bull market in Bitcoin.

In the past, this metric had a negative value, signaling that long-term investors were indeed disposing of more assets than they were acquiring – in other words, they were offloading their holdings rather than adding to them.

For the majority of the month, this downward trend in net sales continued strongly, leading many experienced investors to adopt a pessimistic outlook.

As a researcher observing this phenomenon, I’ve noticed an intriguing reversal of trends lately. Whereas before we saw a negative value in our metric, it now displays a positive figure.

Based on recent examination, the net change in position stands at approximately 13,000 units. This uptick suggests that long-term investors have resumed buying Bitcoin.

Seasoned investors’ collective buying indicates a growing belief in an asset’s future value increase, signaling a bullish market trend.

BTC breaks $60,000

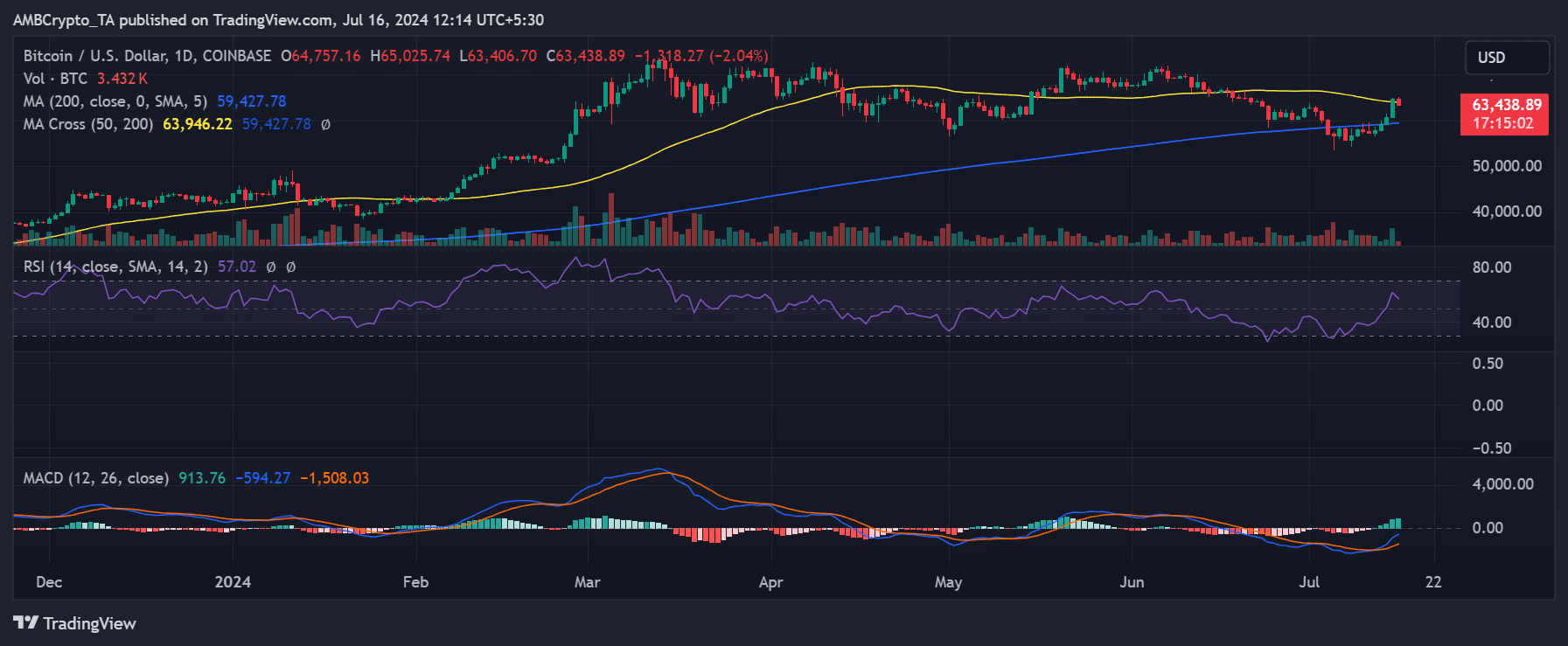

Based on AMBCrypto’s examination of Bitcoin’s daily chart, there was a notable surge in its value on July 15th. The cryptocurrency rose by approximately 7% and settled around $64,757. Moreover, this was the initial time in July that Bitcoin hit this particular price point.

In the past month, Bitcoin had barely managed to exceed its yellow moving average for the first time. Previously, this line had served as a barrier to its price advancement within this particular price range.

At the current moment, Bitcoin’s price stood approximately at $63,400 in the market, representing a drop of more than 2% compared to its previous peak.

Read Bitcoin (BTC) Price Prediction 2024-25

Even though there’s been a minor dip, the yellow line continues to hover above its recent average. This indicates that the yellow line could potentially function as a level of support moving forward.

A move from opposition to backing up of Bitcoin at this crucial level might signal the possibility of stabilization or even more growth if Bitcoin continues to hold above this significant mark.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-07-17 03:03