-

Most addresses continued to hold Bitcoin despite the market drawdown.

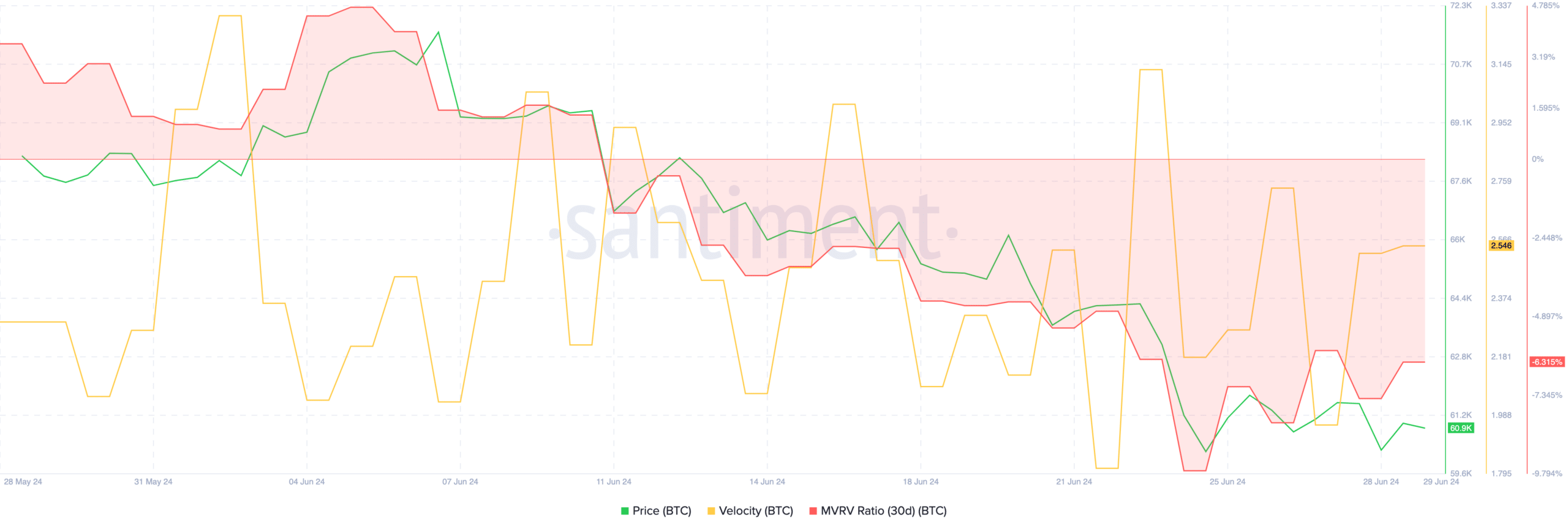

The velocity at which BTC was trading had surged materially.

As a long-term Bitcoin investor, I’ve seen my fair share of market volatility and price fluctuations. The recent decline in Bitcoin’s price has undoubtedly brought about uncertainty and anxiety for many in the crypto community. However, based on the latest data and trends, I remain optimistic.

The drop in Bitcoin’s [BTC] value lately has caused ripples of concern throughout the cryptocurrency market. Yet, in spite of this price decrease, dedicated Bitcoin holders have maintained optimistic attitudes.

Will HODLers stay put?

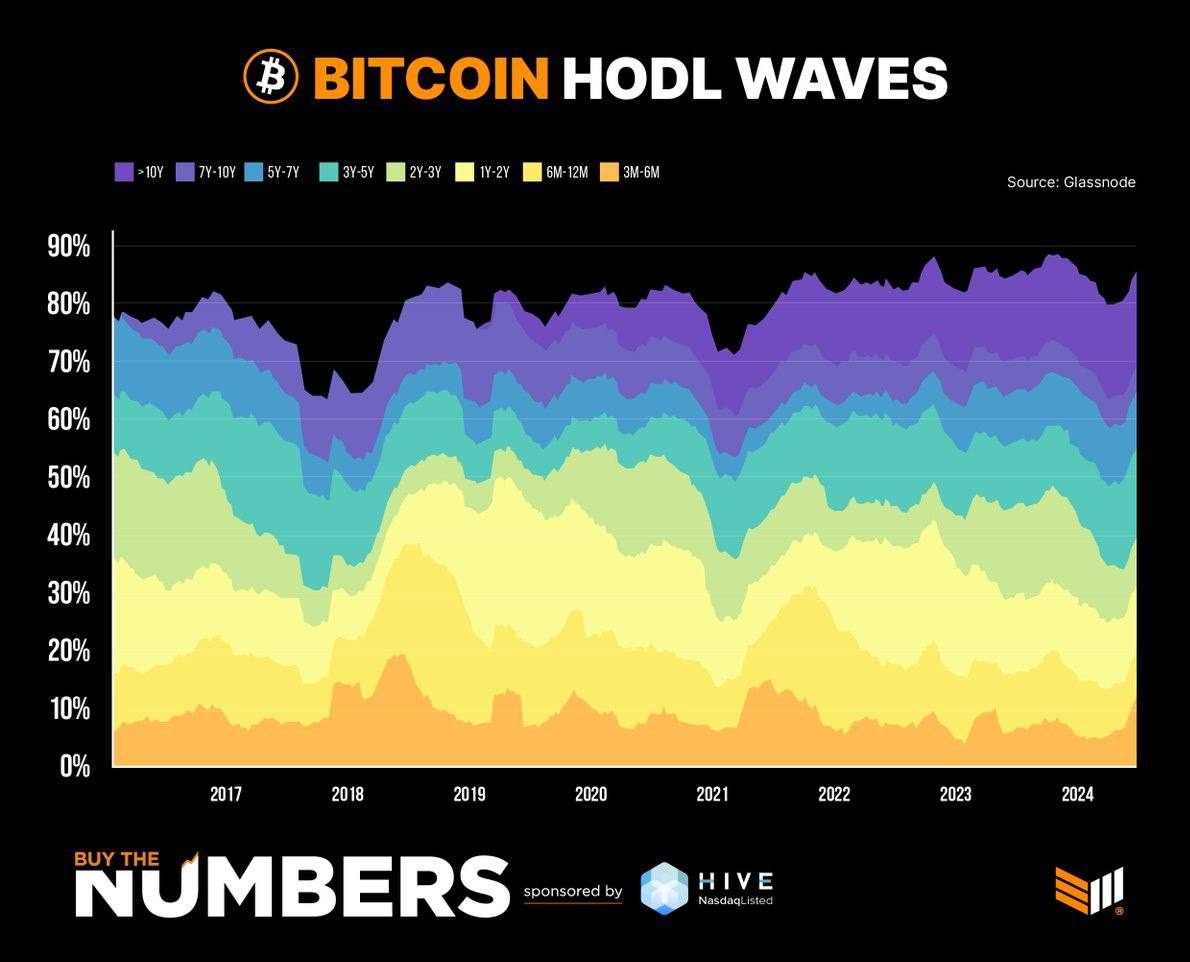

Approximately 90% of Bitcoins have remained stationary in the past few months according to HODL waves analysis, with the majority being held by their owners rather than being transferred.

From my perspective as an analyst, this situation could be viewed through different lenses. One interpretation is that the unwavering tone of these addresses signifies a strong belief among holders that the cryptocurrency’s dip is only temporary. They may be confident that the price of Bitcoin, being the king coin, will rebound in the long term.

From a research perspective, another interpretation is that investors might be hesitant to part with their Bitcoins if the current market price falls below their initial purchase cost, unwilling to recognize a loss on their investment.

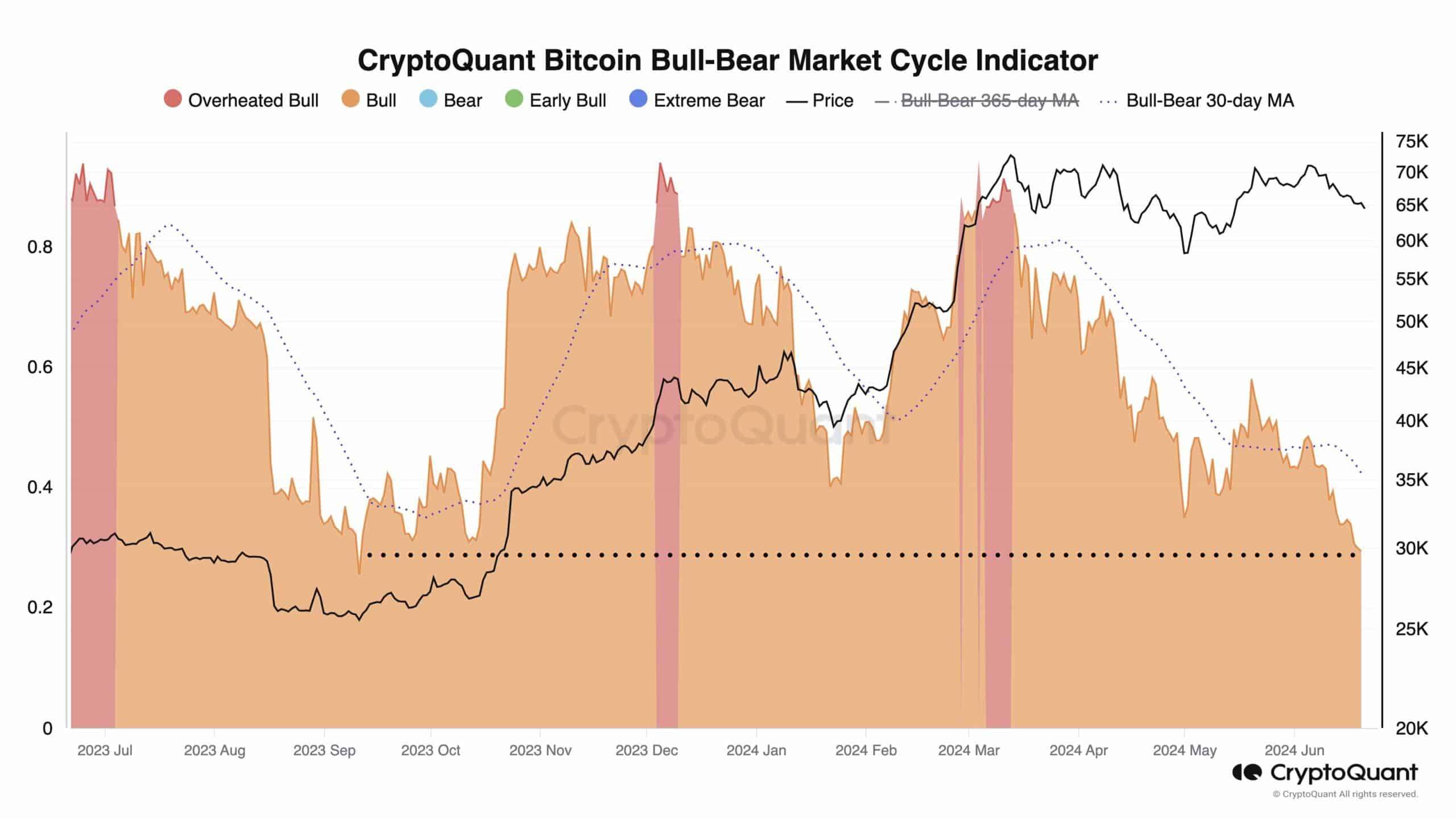

Based on the Bitcoin cycle indicator’s analysis, the market is currently exhibiting the least bullish sentiment it has shown since September 2023.

Based on the signal, it seems we could be approaching the final phases of a bull market, where prices begin to drop, signaling a shift towards a bear market.

Another interpretation could be that this might signify a decline in investors’ confidence or expectation for Bitcoin’s price growth in the upcoming period.

How are Bitcoin miners holding up?

Another factor that can impact Bitcoin’s price in the long run, would be the state of miners.

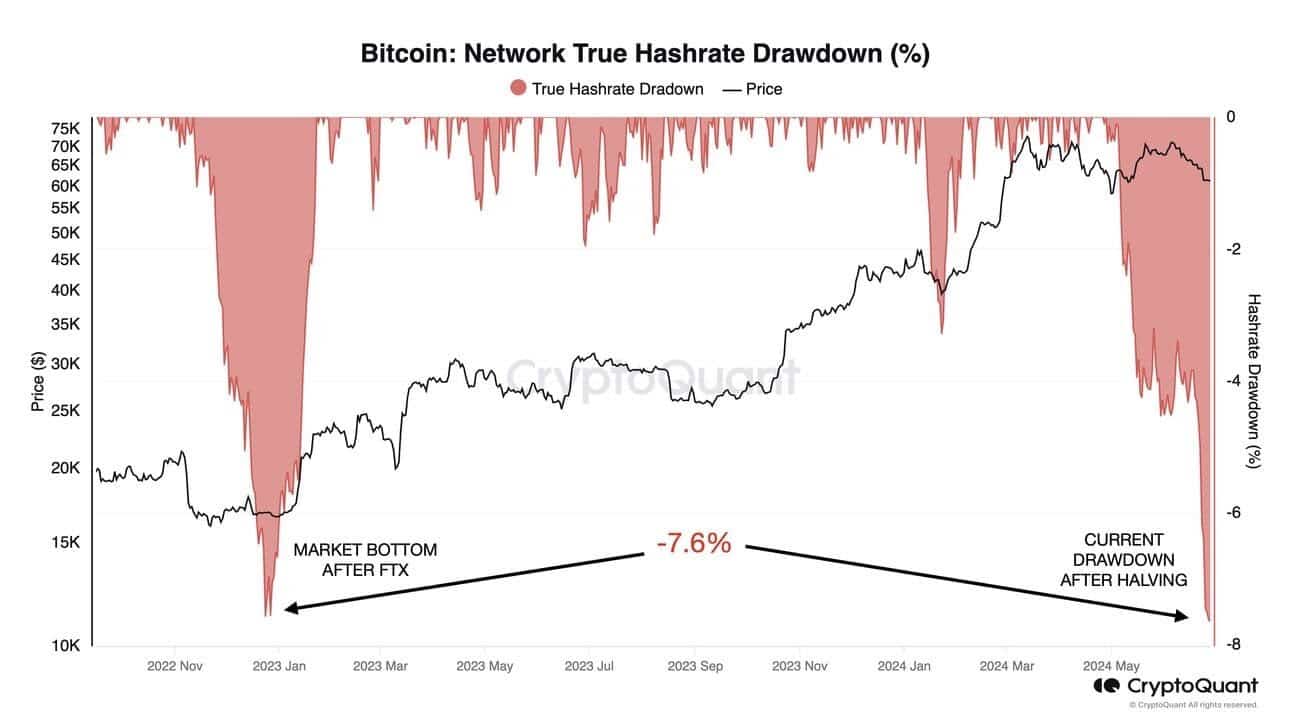

The current drop in hash rate is almost as drastic as the one witnessed during the FTX exchange crash in late 2023, according to recent data.

A substantial decrease in Bitcoin’s mining hash rate might reduce the network’s security, leading it to become more controlled by a smaller number of miners.

Additionally, if miners are forced to sell a significant amount of Bitcoin due to unprofitability, this could exacerbate the downward trend in price.

A decrease in the hashrate of a cryptocurrency network, such as Bitcoin, may signal a market bottom. Based on historical trends, a price increase could follow.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’m observing the current market situation, and at this moment, Bitcoin is being transacted for around $61,596.57. In the past day, its value has experienced a growth of approximately 1.79%.

The significant increase in Bitcoin’s trading speed suggests that the number of Bitcoin transactions per unit time has significantly risen.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-06-30 17:11