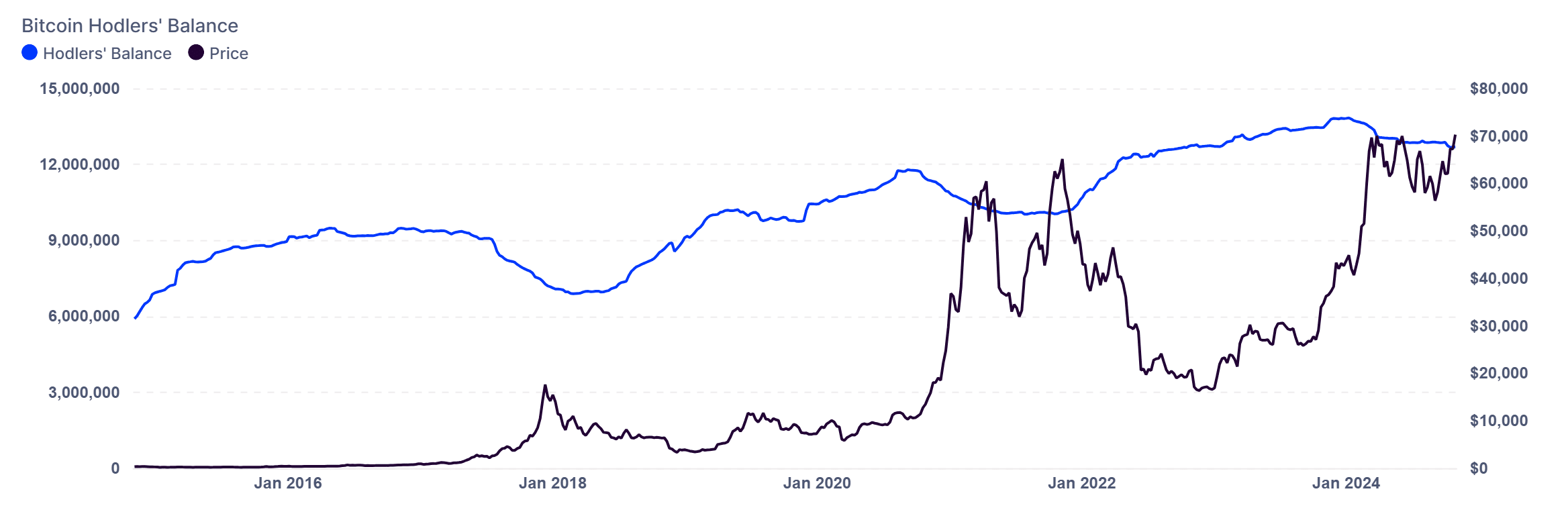

- The BTC Hodler’s balance has seen a slight drop recently.

- BTC’s price has maintained a strong trend despite this drop.

As a seasoned analyst with over two decades of experience in the ever-changing world of cryptocurrencies, I find the recent market dynamics of Bitcoin particularly intriguing. Long-term holders, or “Hodlers,” have traditionally been known for their aggressive selling during bull runs, but this time around, they seem to be taking a more calculated approach. The gradual decline in Hodlers’ balances suggests a shift in strategy that could signal a maturing market.

In the ongoing Bitcoin market, there’s an interesting change in the trading patterns as long-term investors (referred to as “Hodlers”) are becoming less inclined to sell their Bitcoins during this particular market phase.

Contrary to past Bitcoin price surges characterized by frenzied selling, recent data indicates a more subtle decrease in the amount held by investors. This cautious approach towards trading could indicate a shift in Bitcoin’s market dynamics, as rising prices are met with less aggressive buying or selling.

Bitcoin hodlers’ balance shows gradual decline

As per the latest figures from IntoTheBlock, Bitcoin holders have been gradually, if slightly, reducing their Bitcoin holdings over the past few weeks.

On the 4th of November, the total amount of Bitcoin held by Hodlers was roughly 12,681,159 BTC, marking a slight decrease compared to the 12,686,790 BTC they held on the 28th of October.

Instead of previous market cycles, which frequently saw major sell-offs at price peaks, this gradual decrease indicates a change in approach among investors, or “Hodlers,” suggesting they are adopting a more cautious stance and aiming to maintain their positions during the current price growth phase.

In this case, the current measured strategy differs from past actions, where swift price hikes prompted excessive selling.

Currently, with Bitcoin’s price going up, its owners (Hodlers) appear to be exhibiting greater patience. Instead of quickly selling off their holdings in large quantities and flooding the market, they are slowly letting go, which could suggest a more thoughtful strategy for capitalizing on gains within a dynamic market environment.

Bitcoin price dynamics amid moderate selling pressure

Bitcoin’s recent market behavior demonstrates a degree of steadiness amidst modest selling from its long-term investors. With Bitcoin trading at approximately $68,789, this suggests that it maintains its strength even during these minor periods of selling.

In simpler terms, the technical indicators we’re looking at suggest a well-balanced market situation. One of these indicators, called the Relative Strength Index (RSI), currently reads 54.66. This number indicates a neutral-to-slightly positive outlook since it’s above 50, which means that more traders are buying than selling at the moment.

As an analyst, I observe that the Relative Strength Index (RSI) continues to linger beneath the overbought level of 70. This suggests that there’s potential for further growth in the asset before it encounters significant selling pressure.

The Choppiness Index (CHOP), currently at 49.90, suggests a generally stable market trend with minimal extreme fluctuations. A CHOP value close to 50 often means the market isn’t experiencing a dominant trend or excessive volatility.

This follows a trend of decreasing Hodler balances, implying that selling actions are consistently matched by strong buying demand, thus preventing significant price fluctuations.

As a seasoned investor with years of experience under my belt, I understand the value of stability when it comes to investment opportunities. In my journey, I have learned that less volatile entry points can provide a sense of security and predictability in an otherwise chaotic market. Therefore, I believe that this stability could be an appealing factor for both retail and institutional investors who are constantly seeking such less volatile options.

A new market cycle dynamic?

Based on the current actions of Bitcoin holders, it appears that we might be witnessing a shift in the cyclical pattern. Their unwillingness to cash out, even when market conditions are advantageous, could indicate a belief that the price will keep rising or potentially increase even more.

A careful strategy might also signal a measured hopefulness, as cryptocurrency holders seem to be assessing the market by gradually offloading modest portions of their assets instead of cashing out large amounts immediately.

Read Bitcoin (BTC) Price Prediction 2024-25

With Bitcoin’s market becoming more established, the tendency towards gradual sales instead of sudden drops might indicate a move towards a more consistent and steady market scenario.

Such conduct could potentially lessen the severe price swings usually experienced during Bitcoin’s market fluctuations, enhancing the digital currency’s robustness. If this pattern persists, it may signify a lasting change in the way Bitcoin investors interact with the market.

Read More

2024-11-06 02:16