-

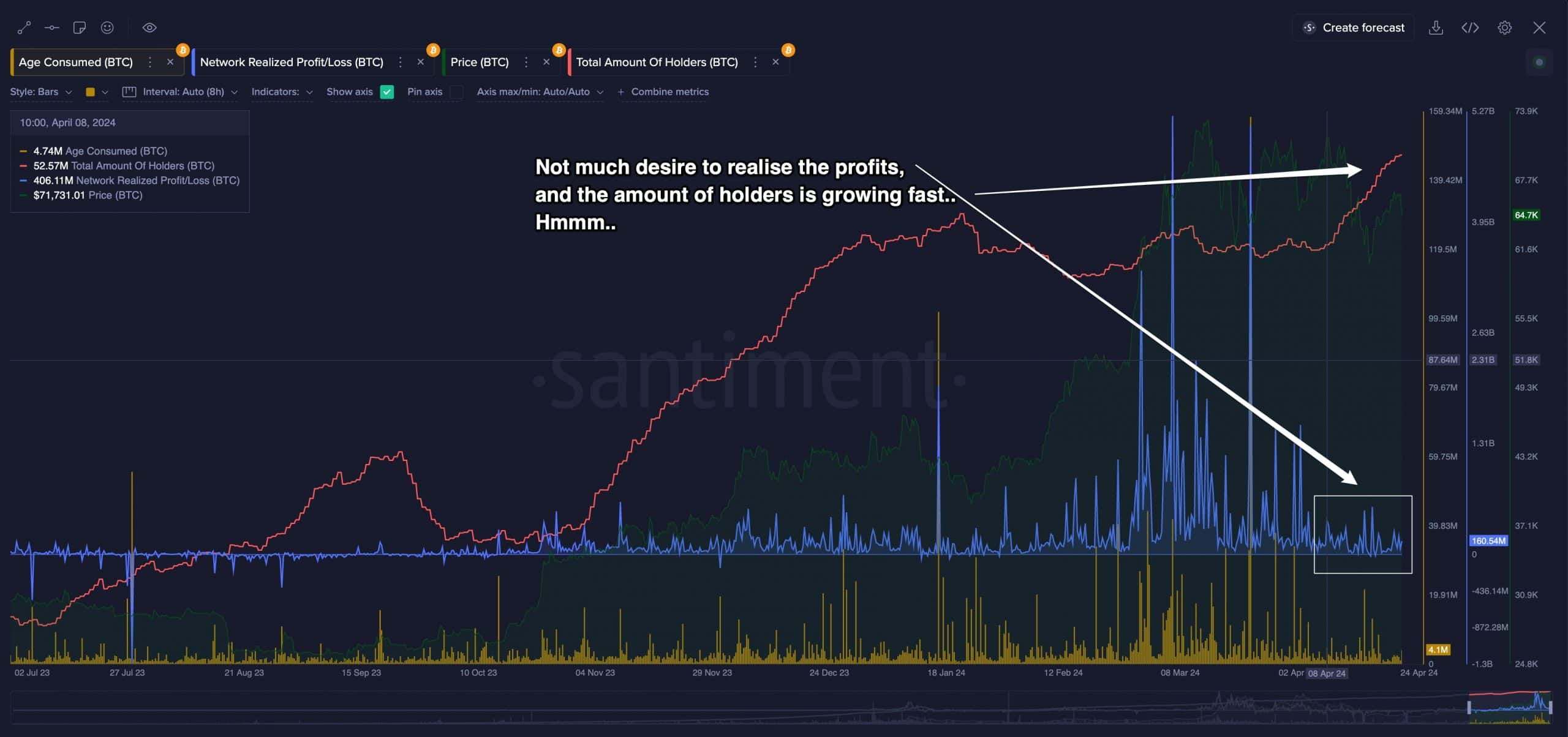

There appeared a reluctance among BTC traders to cash their profits.

Early HODLers were distributing to newer entrants.

As a researcher with a background in cryptocurrency and blockchain analysis, I find the current state of Bitcoin (BTC) after its recent halving to be an intriguing subject. Based on the available data from on-chain analytics firms like Santiment, there are some interesting trends emerging.

It has been a roller coaster ride for Bitcoin [BTC] after its most recent halving.

Three days following a significant event, Bitcoin (BTC) experienced a strong rally, reaching a peak of $67,000 according to CoinMarketCap. Yet, the subsequent day brought a reversal, with BTC dipping by 4%, returning to its previous price levels before the halving event.

It’s important to know to what extent does the world’s largest digital asset have been affected by the halving event, and what predictions can be made about its future actions in the short to mid-term period.

Profit-taking still on the lower side

Based on data from cryptanalysis firm Santiment, there seems to be a hesitance among Bitcoin traders to realize their gains. The Network Realized Profit/Loss (NRPL) indicator has remained low, and this trend mirrors past peak periods in 2017 and 2021.

The number of BTC holders was also seen to be increasing alongside.

During this stage, Santiment labeled the market behavior as “an irrational discrepancy,” where selling seemed reluctant despite escalating prices.

As an analyst looking at Bitcoin’s (BTC) price action, I’ve noticed that this current phase of strong growth has historically been followed by significant market peaks. While I believe in BTC’s long-term potential, this pattern may suggest a potential bearish trend ahead.

HODLers were redistributing

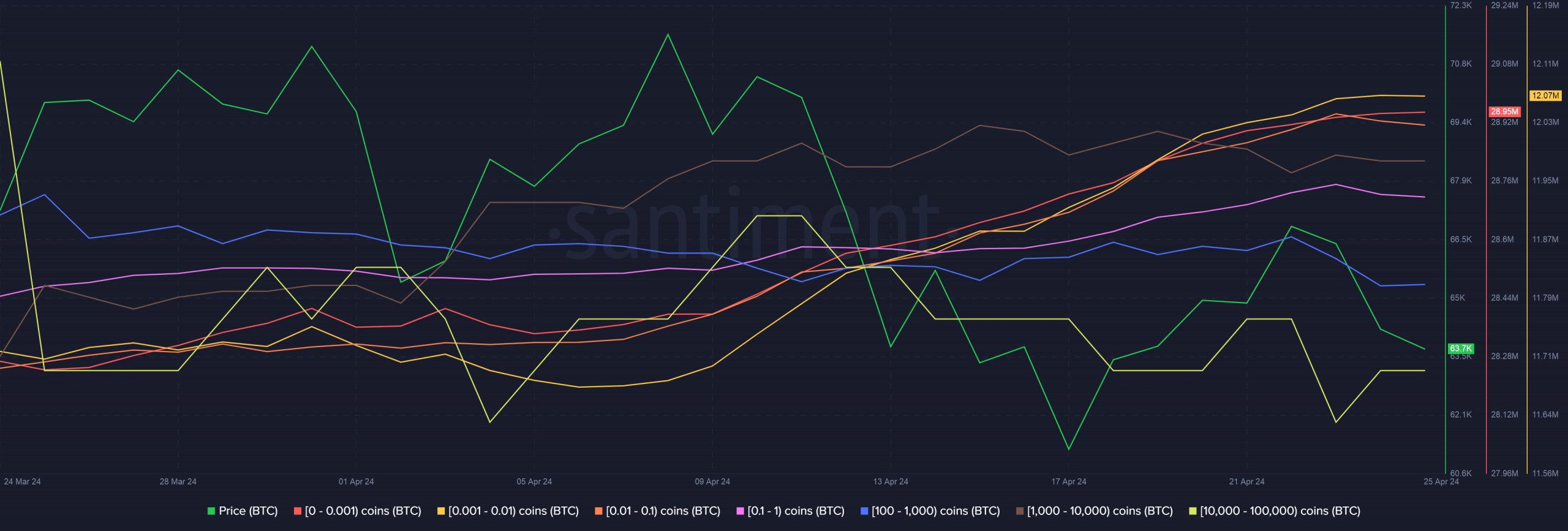

I’ve noticed a significant decrease in the Mean Dollar Invested Age (MDIA) figure lately, indicating an increasingly active period of asset reallocation.

In the process of redistribution, earlier cryptocurrency investors pass on their wealth to more recent market entrants. Following a redistribution cycle lasting twelve months, the market typically reverts back to an accumulation stage. This trend fuels optimism that the bull market is set to persist further.

As an analyst, I’ve observed some intriguing patterns in the distribution of Bitcoin supply among various cohorts following the latest halving event. Specifically, the smaller holders, representing individuals who own less than one whole Bitcoin, have been actively purchasing the cryptocurrency post-halving.

Instead of this: “To the contrary, sharks and whales, with coin reserves ranging from 100 to 100,000 coins, were giving out coins.”

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

2024-04-26 01:11